Seagate's Record Earnings Prove Its Role as a Core AI Player

Written by Jeffrey Neal Johnson | Reviewed by Shannon Tokheim

November 5, 2025

Image Licensed from DepositPhotos. License #351875130

Key Points- The company delivered a landmark quarterly earnings report that decisively surpassed Wall Street's expectations for revenue and profitability.

- Demand from cloud and data center customers building AI infrastructure is now the primary driver of Seagate's business, accounting for the vast majority of its total revenue.

- Management provided solid forward guidance for continued growth and increased the shareholder dividend, signaling confidence in future cash flow generation.

- MarketBeat previews top five stocks to own in December.

Seagate Technology Today

STX

Seagate Technology

$278.47 +2.70 (+0.98%)

As of 04:00 PM Eastern

52-Week Range$63.19

?

$284.42

Dividend Yield1.06%

P/E Ratio35.75

Price Target$268.64

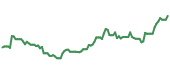

Shares of data storage leader Seagate Technology NASDAQ: STX surged over 12% in the first week of November, pushing the stock to a new 52-week high and extending a remarkable year-to-date run of over 213%. The immediate catalyst for the jump was a newly announced strategic debt exchange, a move investors are interpreting as a clear sign of financial strength and prudent management.

This news landed on fertile ground, amplifying the powerful momentum still building from the company's recent first-quarter 2026 earnings report, which re-formatted the expectations of Seagate’s analyst community. That report provided definitive proof that the growing demand for artificial intelligence (AI) is fueling record-setting growth, transforming a long-standing market thesis that Seagate is Wall Street’s favorite new AI infrastructure player into a present-day reality.

Get Seagate Technology SMS alerts:

Seagate's Earnings Crush ExpectationsOn Oct. 28, Seagate reported fiscal first-quarter 2026 results that decisively beat Wall Street estimates in a classic beat-and-raise scenario, energizing investors. The performance was a powerful confirmation that the company is not just meeting but significantly exceeding the market's high expectations, providing tangible proof that its business is accelerating.

The standout metrics from the quarter paint a clear picture of a business that is optimizing while running at full tilt:

- Revenue Outperformance: The company delivered $2.63 billion in revenue, handily beating the $2.54 billion consensus estimate and marking a healthy 21% year-over-year increase.

- Record Profitability: Seagate achieved a record non-GAAP gross margin of 40.1%. This figure is especially significant as it reflects strong pricing power in a supply-constrained market and the financial benefits of selling higher-value, high-capacity drives.

- Earnings Power: It posted a non-GAAP earnings per share (EPS) of $2.61, crushing the $2.40 analyst forecast. This level of earnings beat demonstrates that revenue and margin performance are flowing directly to the bottom line, a key indicator of a healthy business model.

How a Niche Became Seagate's Core BusinessThe source of this exceptional strength is the explosive demand for mass-capacity data storage driven by the AI revolution. During Seagate’s earnings call, management explicitly credited robust customer demand for its high-capacity products, directly linking it to new AI applications and the shift from AI model training to inferencing workloads.

The numbers fully support this narrative. Revenue from the Data Center segment, which supplies the high-capacity drives used to build AI infrastructure, surged 34% year-over-year to $2.1 billion. Crucially, this segment now constitutes a commanding 80% of Seagate's total business, cementing the company's identity as a primary AI infrastructure provider rather than a diversified hardware company.

Further solidifying this position, the company reported key adoption milestones for its next-generation HAMR (Heat-Assisted Magnetic Recording) technology. It shipped over one million of these cutting-edge drives in the quarter and, most importantly, has now secured qualifications with five of the world's largest cloud customers. This is a critical step, as it paves the way for broader adoption and confirms the technology is ready for deployment at a massive scale.

Seagate Technology Holdings PLC (STX) Price Chart for Thursday, November, 6, 2025

Seagate Signals Sustained GrowthSeagate's management made it clear they believe this strong performance is not a one-time event. The company's guidance for the second quarter projects continued momentum, with a revenue target of $2.70 billion and a non-GAAP EPS target of $2.75 at the midpoint. This forecast for accelerating profitability suggests the best is yet to come. Furthermore, the company expects its non-GAAP operating margin to expand to an impressive 30%, signaling even greater efficiency and earnings power.

This confidence was backed by a direct commitment to shareholders. The Board of Directors approved an approximate 3% increase in the quarterly dividend to 74 cents per share. For investors, a dividend hike from a company that is also heavily investing in growth is a powerful signal. It reflects the board's belief in the sustainability of its strong cash flow, which stood at a healthy $427 million for the quarter.

Why Seagate's Re-Rating Is Far From OverSeagate has successfully transitioned from a company with a promising AI story to one delivering undeniable, record-breaking results driven by that story. The combination of accelerating demand, a technological lead in next-generation drives, and a strengthening financial position shows that the powerful tailwinds driving the company are stronger than ever. For investors, the recent outperformance and confident outlook suggest that the fundamental re-rating of Seagate as a core AI infrastructure play is still in its rewarding early stages. |