Verizon Is Getting an Amazon Data Center Boost. Should You Buy the High-Yield Dividend Stock Here?

Sristi Suman Jayaswal - Barchart - Thu Nov 6, 6:30PM CST Columnist

Verizon Communications Inc wireless store by-RiverNorthPhotography via iStock

In the age of generative AI, data is the new electricity, and the power lines running it are high-capacity fiber routes. These fiber networks form the backbone of modern computing, enabling lightning-fast data transfers between sprawling data centers that fuel everything from real-time analytics to massive artificial intelligence (AI) model training. Without them, the AI revolution simply cannot run.

That’s where Verizon Communications ( VZ) has stepped in. Recently, the telecom company announced a new partnership with Amazon Web Services to build high-capacity fiber routes linking AWS data centers across key regions. Under the “Verizon AI Connect” initiative, the company will lay down long-haul, low-latency pathways designed to handle the heavy traffic of next-gen AI workloads. It’s a timely move that strengthens Verizon’s deep relationship with AWS, and underscores how telcos are quietly becoming the muscle behind the AI boom.

But with VZ stock still treading cautiously, should investors plug in now while it’s trading at an attractive valuation?

About Verizon Stock New York-based Verizon Communications is one of the world’s leading names in connectivity – powering how people, businesses, and governments communicate. With a market capitalization of about $166.4 billion, Verizon is best known for its rock-solid network, dependable coverage, and lightning-fast data speeds. The company’s backbone lies in its wireless business, which drives roughly 75% of its service revenue, serving millions of postpaid and prepaid phone users across the U.S.

Beyond mobile, Verizon extends its reach through fixed-line telecom services, connecting millions of homes and businesses, many powered by its ultra-fast Fios fiber technology. Constantly evolving, the company continues to invest heavily in 5G and fiber technologies – cementing its role as among the nation's leaders in performance and quality in an increasingly connected world.

Yet, shares of the wireless carrier have been treading a choppy path – down about 3.81% over the past 52 weeks and off 9.06% just this past month. But after a mixed Q3 and some upbeat analyst chatter, VZ is showing flickers of life. Trading volume has been ticking higher, hinting at renewed investor interest as the company’s new CEO, Daniel Schulman, in the Q3 earnings call last week, signals a major strategic reset.

Technically, the setup looks mildly encouraging. The 14-day RSI is hovering near neutral around 43.87, suggesting the stock is not overbought or oversold. More notably, the MACD line (orange) has just crossed above the blue signal line – a bullish sign that momentum may be shifting upward. The histogram turning positive reinforces that sentiment, showing buying strength building beneath the surface.

With Schulman steering a turnaround and Verizon teaming up with tech giants like Amazon (AMZN) to bolster its data and fiber backbone, the stock could be setting up for a more connected and confident rebound.

www.barchart.com VZ stock looks like a bargain. Trading at just 8.4 times forward earnings and 1.2 times forward sales, it is priced below both its sector peers and its own history, making it a quietly compelling pick for value hunters in telecom. www.barchart.com VZ stock looks like a bargain. Trading at just 8.4 times forward earnings and 1.2 times forward sales, it is priced below both its sector peers and its own history, making it a quietly compelling pick for value hunters in telecom.

Meanwhile, for income investors, Verizon has long been the quiet heavyweight that consistently pays out dividends. The company has raised its dividend for two decades, a streak built on discipline and shareholder loyalty. On Nov. 3, it handed out its latest quarterly dividend of $0.69 per share, translating to an annualized dividend of $2.76.

That gives Verizon a handsome 6.95% yield, one of the richest in the telecom space. With a forward payout ratio hovering around 57.3%, the company strikes a smart balance between rewarding investors and keeping enough cash to reinvest in its network and manage debt. In a volatile market, Verizon remains the steady income engine investors can count on, quarter after quarter.

Verizon’s Shares Surge After Its Q3 Results On Oct. 29, Verizon released its earnings report for the third quarter of 2025, and the stock rose 2.3%. Revenue came in at $33.8 billion, up 1.5% year-over-year (YOY), with adjusted EPS climbing 1.7% annually to $1.21. While earnings beat expectations, revenue fell just shy of estimates – a minor miss in an otherwise solid showing. Driving top-line growth was a 2.1% rise in wireless service revenue to $21 billion, alongside a 5.2% jump in wireless equipment sales to $5.6 billion.

Verizon’s broadband engine continued to hum, adding 261,000 fixed wireless access customers, lifting its base to nearly 5.4 million – well on track toward its 8 million to 9 million goal by 2028. The company also saw 61,000 new Fios Internet customers, pushing total broadband additions to 306,000, though traditional Fios Video subscriptions slipped by 70,000 as streaming alternatives gain traction.

Meanwhile, free cash flow – the lifeblood of Verizon’s rich dividend – hit $15.8 billion for the first nine months of 2025, up from $14.5 billion a year ago.

Management reaffirmed full-year guidance, projecting wireless service revenue growth between 2% and 2.8%, EBITDA gains of 2.5% to 3.5%, and FCF between $19.5 and $20.5 billion.

Meanwhile, analysts tracking the stock anticipate the company’s Q4 EPS of $1.08, down 1.8% YOY, on revenue of roughly $36.1 billion. But for fiscal 2025, EPS is anticipated to rise by 2.2% YOY to $4.69, and then rise by another 4.3% annually to $4.89 in fiscal 2026.

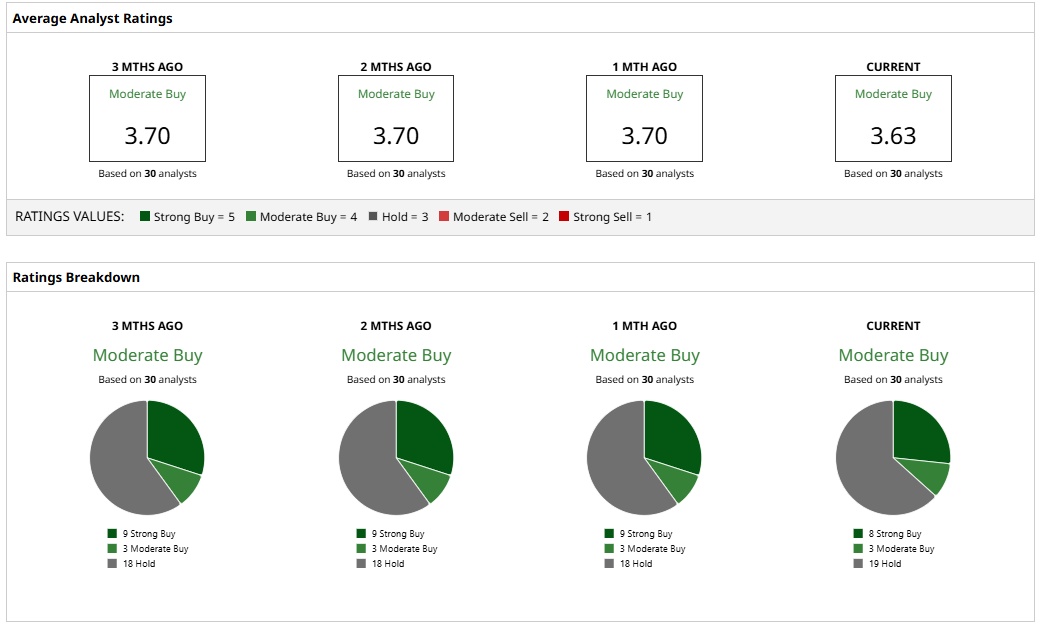

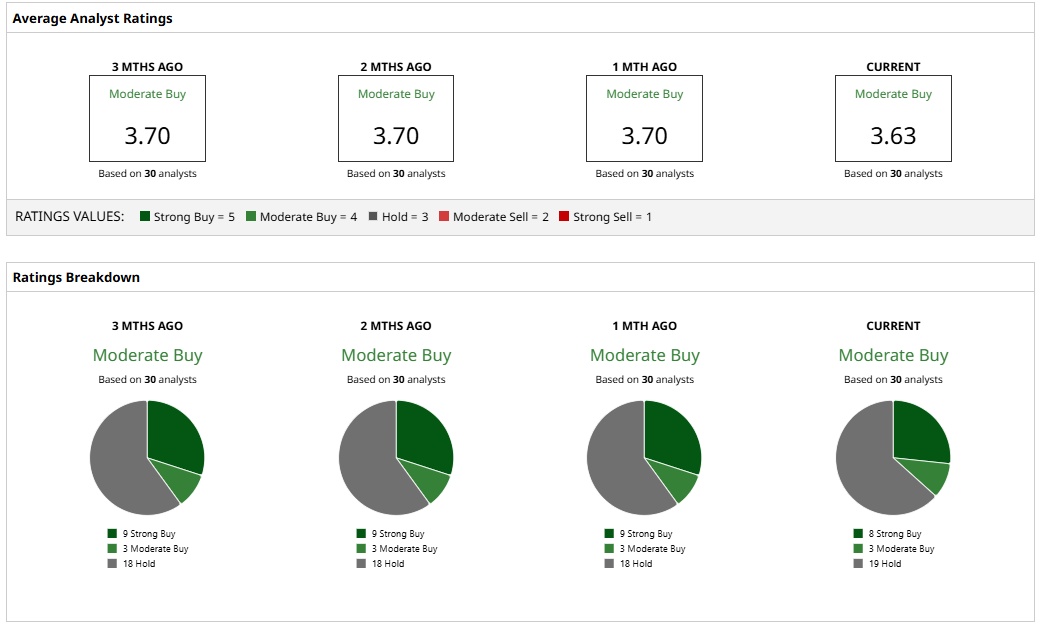

What Do Analysts Expect for Verizon Stock? Verizon’s shares have been on a slow climb out of the red, trying to win back Wall Street’s full confidence – and analysts have plenty to say about its next move.

With a “Moderate Buy” consensus, Verizon may just be gearing up for a steadier signal ahead. Of the 30 analysts monitoring the telecom stock, eight suggest a “Strong Buy,” three recommend a “Moderate Buy,” and a majority of 19 analysts are playing it safe, advising a “Hold.”

The average analyst price target for VZ is $47.15, indicating potential upside of 20.5%. The Street-high target price of $58 suggests that the stock could rally as much as 49% from here.

www.barchart.com www.barchart.com

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More News from Barchart

Sun Summit Minerals Builds Momentum With Early-Stage Value in a Rising BC Mining Belt

Barchart Impact - Tue Oct 28, 8:58AM CDT Sponsored Content

/Sun%20Summit%20Minerals%E2%80%99%20flagship%20JD%20Project%20is%20located%20in%20British%20Columbia%E2%80%99s%20Toodoggone%20Mining%20District%2C%20where%20the%202025%20exploration%20program%20recently%20concluded%20and%20assay%20results%20are%20pending_.jpg)

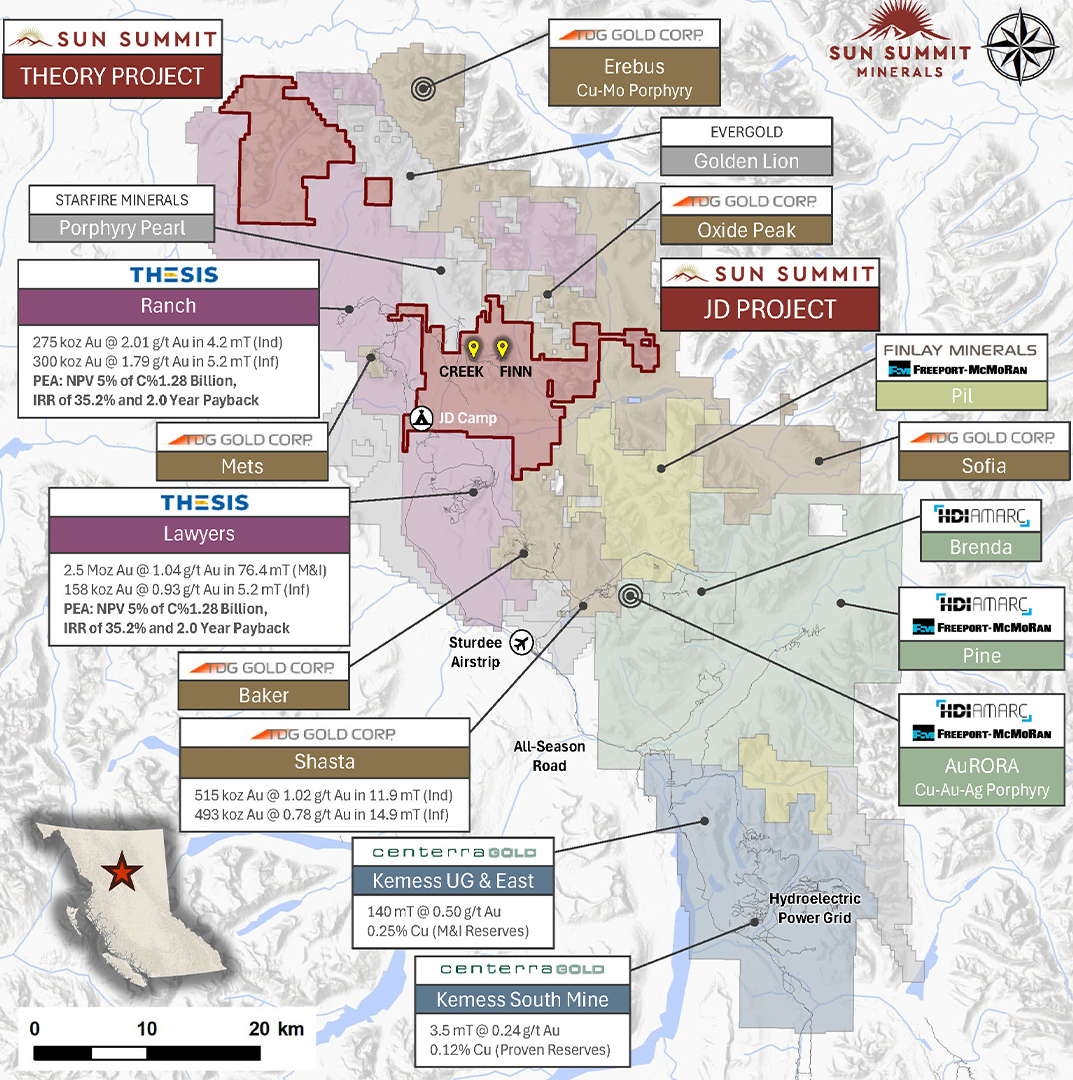

Sun Summit Minerals’ flagship JD Project is located in British Columbia’s Toodoggone Mining District, where the 2025 exploration program recently concluded and assay results are pending_

This is sponsored content. Barchart is not endorsing the websites or products set forth below.

- Sun Summit controls key ground in one of British Columbia’s most active emerging exploration belts, surrounded by majors and mid-tiers now investing heavily in new discoveries.

- The company’s high-grade gold–silver JD Project offers potential for a major new discovery, while the Buck Project provides nearly one million gold-equivalent ounces and year-round resource growth.

- A $10 million financing completed in June 2025 fully funded this year’s exploration program and leaves the company well-positioned with a strong treasury heading into 2026.

With gold hitting record highs and copper demand accelerating on the back of AI, electrification, and infrastructure build-outs, investors are turning back to exploration, looking not just for ounces, but for emerging districts with scale. In this environment, new finds in stable jurisdictions are gaining a premium, especially those with the potential to anchor the next wave of development.

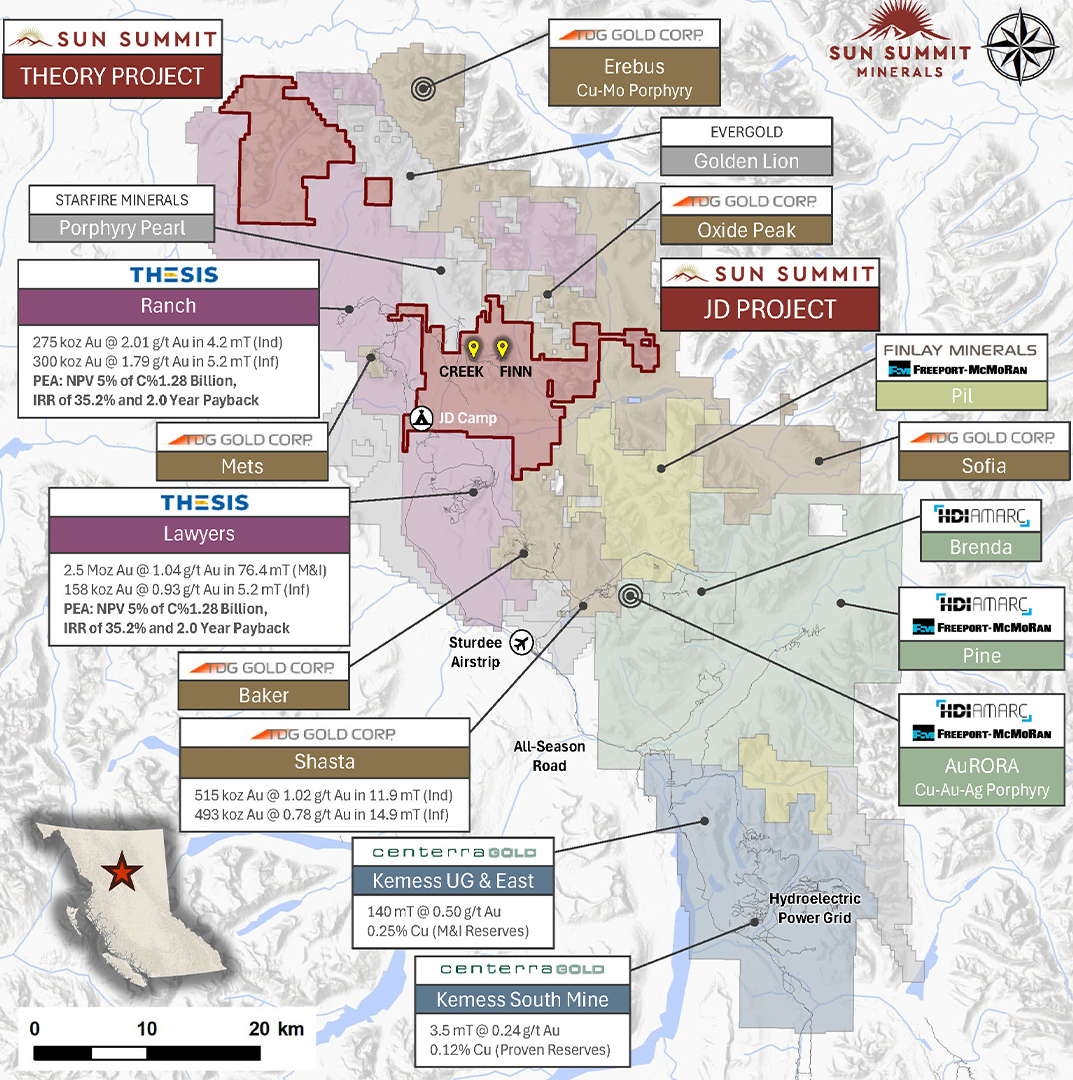

That’s what’s bringing renewed attention to Sun Summit Minerals Corp. (SMN.VN) (SMREF), a well-funded explorer positioned in British Columbia’s most active emerging mining belt, with multiple shots at discovery and room to re-rate. The Vancouver-based explorer controls a portfolio of projects in the heart of BC’s prolific Toodoggone and Skeena Arch mining districts, including its flagship JD Project, a highly prospective property with proven low-sulphidation epithermal Au-Ag mineralized zones that has already returned standout grades, and the established 100%-owned Buck Project, which anchors the company’s valuation and provides additional discovery potential.

The Toodoggone belt is rapidly transforming into Canada’s next exploration hotbed. Once overshadowed by the adjacent Golden Triangle, it now attracts over $100 million in exploration spending from both private and corporate investors in 2025, driven by major and mid-tier companies, including Centerra Gold, Skeena Resources, and Amarc Resources in partnership with Freeport-McMoRan.

“This is an emerging district play, and we’re right in the middle of it,” said CEO Niel Marotta, a seasoned mining executive with over $1 billion in transactions and deep capital markets experience.

At the centre of a rising discovery belt Unlike its corporate-backed neighbours, Sun Summit still operates independently, a fact Marotta sees as a strategic advantage. Unlike its corporate-backed neighbours, Sun Summit still operates independently, a fact Marotta sees as a strategic advantage.

“We’re a junior explorer with a market cap around $45 million, roughly one-tenth the size of our neighbours … but just as compelling, because we’re earlier-stage and sitting on the same kind of potential,” he said. “We don’t yet have a big corporate partner. That optionality gives us full leverage on discovery and the ability to choose the right partnership when the timing is ideal.”

Covering 15,000 hectares, the JD Project sits adjacent to some of BC’s most advanced exploration-stage gold-silver-copper assets, including Thesis Gold’s Lawyers and Ranch projects, TDG Gold’s Baker-Shasta, and Amarc’s AuRORA deposit.

“The geological setting mirrors the same Stikinia Terrane that hosts multi-million-ounce systems throughout northern BC”, said Ken MacDonald, the company’s VP of Exploration, who was previously a senior permitting official with the mining branch of the B.C. Government. MacDonald, a veteran geologist, sees JD as offering two distinct discovery paths: high-grade gold and silver close to surface, alongside the potential for a much larger copper-gold porphyry system at depth.

“It’s a rare combination, and we’re gearing up for a major push in 2026,” he said. That confidence is rooted in the drill results now coming out of the JD Project.

“We’re a junior explorer with a market cap around $45 million, roughly one-tenth the size of our neighbours … but just as compelling, because we’re earlier-stage and sitting on the same kind of potential.” – Niel Marotta, CEO of Sun Summit Minerals Corp.

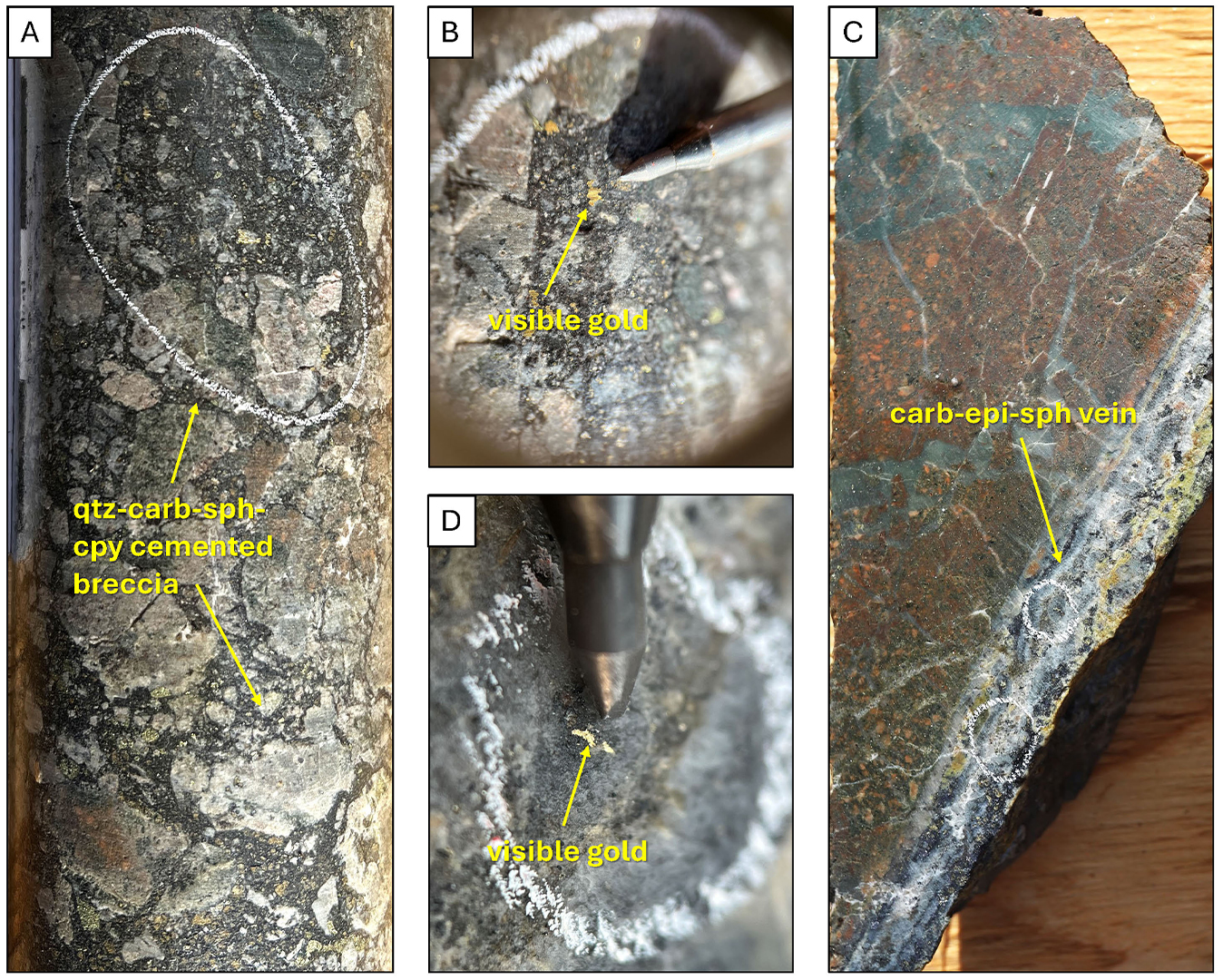

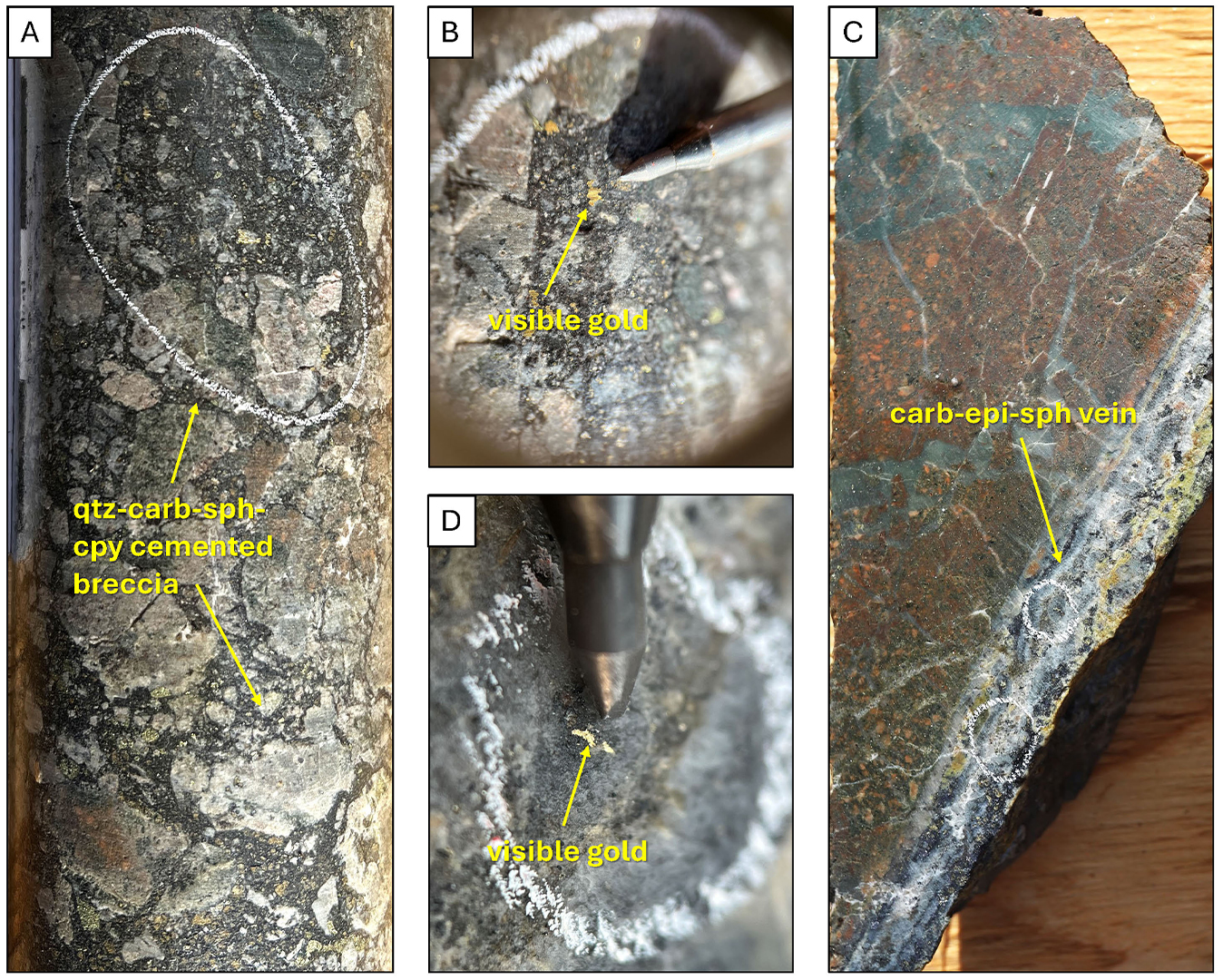

Scale, infrastructure, and year-round strength Recent drilling at the Creek Zone target delivered one of the strongest intercepts reported in the region this year. The hole returned 78.0 metres of 3.72 g/t gold, including 19.1 metres of 7.5 g/t gold, beginning just 30 metres below surface. These results build on earlier drilling from 2024, which delivered 122.5 metres of 2.1 g/t gold and 58.0 metres of 2.7 g/t gold. Together, they suggest the presence of a broad, near-surface zone of high-grade mineralization that remains open in all directions.

The JD program now totals 9,400 metres of total diamond drilling from 2024 and 2025 under a five-year permit. Geophysical surveying has outlined an 8.5-kilometre IP chargeability anomaly, coincident with a high magnetic anomaly, which mirrors the McClair Creek gossan corridor. This is a classic coincident geophysical signal pointing to the potential for a much larger copper-gold porphyry system at depth, adding a second discovery horizon to the project.

While JD fuels the excitement around discovery, Sun Summit also maintains a strong foundation at its Buck Project near Houston, BC. Buck benefits from year-round access and established infrastructure, including local roads, rail-highway access to the Port of Prince Rupert, gas, hydro power, and a skilled local workforce.

Following 35,000 metres of drilling, Buck now hosts an initial mineral resource estimate of nearly one million gold-equivalent ounces at the Buck Main deposit, including 19,100 ounces in the indicated category and 820,000 ounces inferred. Mineralization remains open both laterally and at depth, supporting continued growth.

“The Buck deposit gives us scale and a solid foundation … real ounces in the ground with room to grow,” said MacDonald, noting its position within a proven mining belt that includes Artemis Gold’s Blackwater, Imperial Metals’ Huckleberry, and Newmont’s Equity Silver.

Building momentum through discovery With two core projects offering both discovery potential and resource scale, Sun Summit has positioned itself to advance aggressively without relying on outside control. That strategy is reinforced by a strong balance sheet and long-term planning, giving the company freedom to build value on its own terms. With two core projects offering both discovery potential and resource scale, Sun Summit has positioned itself to advance aggressively without relying on outside control. That strategy is reinforced by a strong balance sheet and long-term planning, giving the company freedom to build value on its own terms.

In June 2025, Sun Summit completed a $10 million private placement, fully funding the 2025 exploration program. The financing included long-term warrants, extending the company’s capital runway and supporting the 2026 expansion at JD.

“This financing puts us in control of our timeline,” said Marotta. “If a corporate partner steps in, it will be on our terms and at a point where we’ve demonstrated maximum value.”

With more than $12 million projected in exploration expenditures, Sun Summit maintains a strong treasury and disciplined financial position, despite trading at roughly one-tenth the valuation of nearby operators with comparable assets. That financial discipline is matched by a deliberate approach to partnership. Across northern BC, the company has emphasized collaboration with Indigenous communities, including an active exploration agreement with the Wet’suwet’en First Nation at Buck and advancing agreements at JD involving four First Nations.

“These relationships are foundational to our progress and long-term sustainability,” said MacDonald.

A series of near-term milestonesLooking ahead, Sun Summit’s path to value creation is anchored in a series of near-term milestones. These include the release of remaining drill results from the JD program, continued modelling of the McClair Creek porphyry corridor, and potential interest from strategic investors as the scale of the system becomes clearer. The company is also advancing toward its first formal resource estimate for JD, targeted for 2027–2028.

As Marotta summarized, “We’re earlier-stage than our neighbours, but that’s where the value lies. If we hit what we believe is here, our upside is exponential.”

For investors looking for exposure to gold’s strength and copper’s long-term growth, Sun Summit stands out as a well-financed explorer with high-impact drill targets, district-scale potential, and full leverage to discovery in one of North America’s fastest-emerging mining regions.

To learn more about Sun Summit Minerals, visit their website.

For the latest updates, follow Sun Summit Minerals on social media and other online platforms: Facebook, X, LinkedIn, and YouTube.

The above is sponsored content. Barchart was paid up to two thousand dollars for placement and promotion of the content on this site and other forms of public distribution covering the period of October 2025. For more information please view the Barchart Disclosure Policy here.

Related Symbols

| VZ | 39.97 | +0.15 | +0.38% | | Verizon Communications Inc | | AMZN | 240.12 | -2.92 | -1.20% | | Amazon.com Inc | Symbol Last Chg %Chg

Don’t Miss a Minute of Daily Action Don’t Miss a Minute of Daily Action

Our exclusive midday newsletter highlights top stories, big movers, and breakout charts.

By clicking Sign Up Now to receive this free newsletter, you will also receive free Barchart Partner emails. Opt-out any time. See Terms of Service and Privacy Policy for details.

Most Popular News

/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg) 1 1

Dear AMD Stock Fans, Mark Your Calendars for November 11

/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg) 2 2

Michael Burry Abandons UnitedHealth Stock With Shares Down 35% YTD. Should You Sell UNH or Buy the Dip?

/Apple%20products%20on%20desk%20by%20Ake%20Ngiamsanguan%20via%20iStock.jpg) 3 3

Apple’s Record Quarter Hints at Something Huge Coming: Is AAPL Stock a Buy Now?

4 4

Dutch Bros Beat Earnings But the Real Story Behind BROS Stock is the Hidden Arbitrage Trade

/AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg) 5 5

This AI Stock Surpassed Nvidia’s Rally and Still Looks Cheap

Log Out

Market:

HOME

Stocks

Options

ETFs

Futures

Currencies

Investing

News

Barchart

Markets Today Barchart News Exclusives Contributors Chart of the Day News Feeds

Featured Authors

Andrew Hecht Austin Schroeder Caleb Naysmith Darin Newsom Don Dawson Elizabeth H. Volk Gavin McMaster Jim Van Meerten Josh Enomoto Mark Hake Oleksandr Pylypenko Rich Asplund Rick Orford Sarah Holzmann All Authors

Commodity News

All Commodities Energy Grains Livestock Metals Softs

Financial News

All Financials Crypto Dividends ETFs FX Interest Rates Options Stock Market

Press Releases

All Press Releases ACCESS Newswire Business Wire GlobeNewswire Newsfile PR Newswire

Tools

Learn

Site News 2

B2B SOLUTIONS

Contact Barchart

Site Map

Back to top

Change to Dark mode

Membership Barchart Premier Barchart Plus Barchart for Excel

Resources Site Map Site Education Newsletters Advertise

Barchart App Business Solutions Market Data APIs Real-Time Futures

Stocks: 15 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered by Barchart Solutions. Fundamental data provided by Zacks and Morningstar.

Barchart is committed to ensuring digital accessibility for individuals with disabilities. We encourage users to Contact Us with feedback and accommodation requests.

© 2025 Barchart.com, Inc. All Rights Reserved.

About Barchart | Affiliate Program | Terms of Service | Privacy Policy | Do Not Sell or Share My Personal Information | Cookie Settings

×

Terms of Content Use |

/Sun%20Summit%20Minerals%E2%80%99%20flagship%20JD%20Project%20is%20located%20in%20British%20Columbia%E2%80%99s%20Toodoggone%20Mining%20District%2C%20where%20the%202025%20exploration%20program%20recently%20concluded%20and%20assay%20results%20are%20pending_.jpg)

Unlike its corporate-backed neighbours, Sun Summit still operates independently, a fact Marotta sees as a strategic advantage.

Unlike its corporate-backed neighbours, Sun Summit still operates independently, a fact Marotta sees as a strategic advantage. With two core projects offering both discovery potential and resource scale, Sun Summit has positioned itself to advance aggressively without relying on outside control. That strategy is reinforced by a strong balance sheet and long-term planning, giving the company freedom to build value on its own terms.

With two core projects offering both discovery potential and resource scale, Sun Summit has positioned itself to advance aggressively without relying on outside control. That strategy is reinforced by a strong balance sheet and long-term planning, giving the company freedom to build value on its own terms. Don’t Miss a Minute of Daily Action

Don’t Miss a Minute of Daily Action /Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg) 1

1 /Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg) 2

2 /Apple%20products%20on%20desk%20by%20Ake%20Ngiamsanguan%20via%20iStock.jpg) 3

3  4

4 /AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg) 5

5