Markets

Battery boost needed to solve India’s energy gridlock

India has made significant strides toward its goal of achieving 500 GW of non-fossil fuel generation capacity by 2030. However, this progress could be undermined if more focus is not placed on the integration of renewables. Rystad Energy analyst Uttamarani Pati examines India’s progress on storage and transmission upgrades.

By

Uttamarani Pati

Nov 07, 2025

Markets

Opinion & Analysis

Image: Rystad Energy

India’s power grid relies heavily on fossil fuels and is not adequately prepared to manage the variability of solar and wind energy. Without an increase in battery storage capacity, much of India’s expanding renewable energy potential may go to waste.

Despite growth in clean energy, fossil fuels still supply 75% to 80% of India’s power. This highlights the urgency of scaling up battery energy storage systems (BESS) as a bridge to a cleaner grid. BESS balances intermittent renewables and ensures round-the-clock reliability, keeping power flowing when the sun isn’t shining. But progress lags ambition. Rystad Energy estimates India will have just 2.56 GW of installed battery capacity by the end of 2025, a fraction of what is needed to meet its clean energy goals.

Storage incentives

To address the shortfall, the Indian government has begun accelerating initiatives. Policies such as production-linked incentives for battery manufacturers and viability gap funding (VGF) for 30 GWh of BESS capacity, intended initially to support 13.2 GWh of projects, are now in effect. Auction frequency is also on the rise. In the first half of 2025, India allocated 2.8 GW of standalone BESS capacity alongside 9 GW of solar-plus-BESS projects. As annual renewable auctions push toward the 50 GW target needed to stay on track for 2030, the market is clearly moving in a new direction. Solar-only projects are starting to take a back seat, particularly as developers struggle to secure timely power purchase agreements (PPAs) from distribution companies, often delaying commissioning and cutting into revenue potential.

Deployment alone will not suffice. India’s transmission infrastructure requires significant upgrades before the true benefits of BESS, such as balancing peak loads, storing excess generation and improving grid reliability, can be fully realized.

Green energy corridor (GEC) transmission works have begun, including GEC-I and GEC-II projects for both state and interstate transmission. The total planned transmission (57 GW as of 2025) accounts for only 11% of the national target of 500 GW of renewable energy capacity installations by 2030.

Transmission bottleneck

This gap is more than just a logistical hiccup, it’s a structural bottleneck. States like Rajasthan, Gujarat and Tamil Nadu, which are major renewable energy generators, are already nearing grid saturation. This means their power grids are nearing instability in terms of frequency and voltage due to the high influx of renewable energy. These grids were not designed to accommodate the intermittent and variable nature of renewable sources. During peak generation periods such as midday for solar power, excess electricity often cannot be transmitted because there is insufficient transmission capacity to deliver it to consumers. The resulting curtailment represents a significant waste of clean energy that is becoming increasingly frequent.

This makes the strategic placement of BESS not just valuable, but vital. Locating storage systems near demand centers rather than generation hotspots can significantly ease transmission congestion during peak hours. For state-controlled distribution companies, it also provides a powerful tool to handle peak demand by utilizing stored renewable power, particularly in states where local renewable energy generation is limited.

Gradual growth

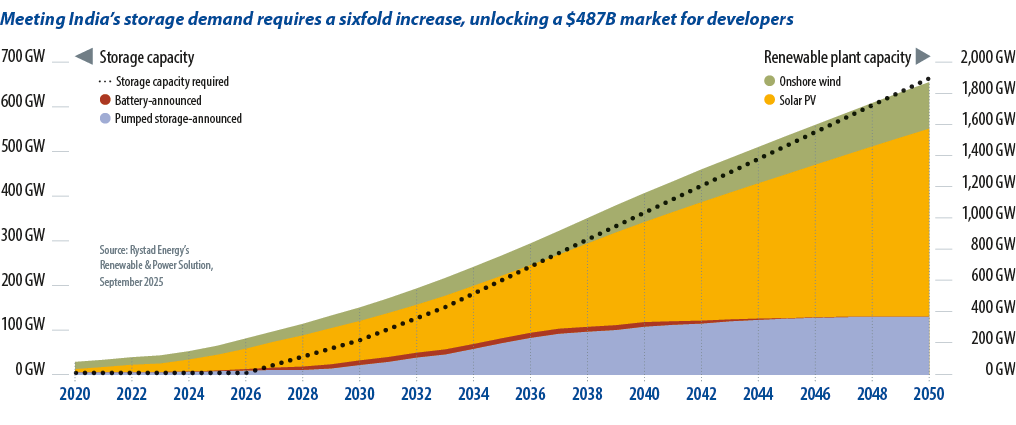

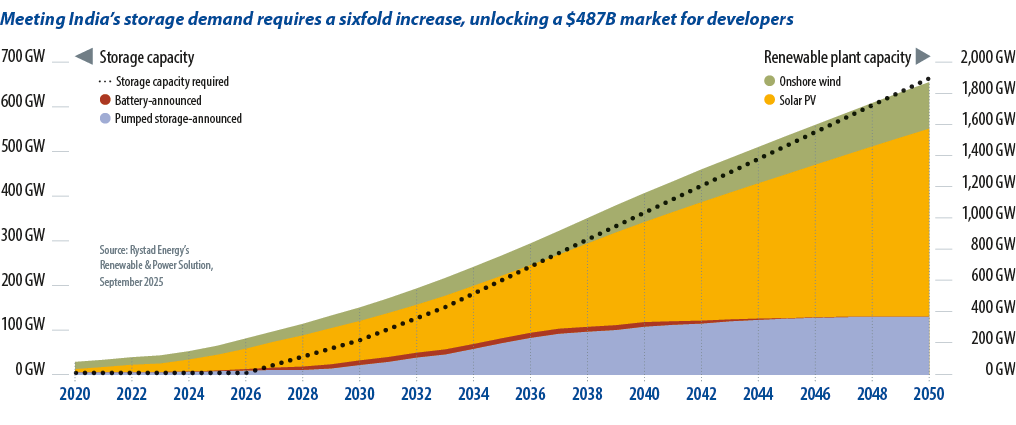

India’s BESS story is as much a question of financing as it is about technology and ambition. The nation’s investment ecosystem is still in its infancy, but there are numerous growth opportunities. Energy storage presents an estimated $487 billion investment opportunity in India between 2025 and 2050, according to research from Rystad Energy. This is driven by declining battery prices, positioning the country as one of the most attractive markets for storage developers globally. Early movers stand to gain the most, not only by capturing market share, but also through the government’s VGF support, which can cover up to 40% of capital expenditure and boost long-term margins.

Beyond utility-scale projects, interest is also building in the merchant market, where players sell power directly to commercial and industrial consumers at higher tariffs than those offered by distribution companies. Without clear frameworks for merchant deployment, developers are reluctant to invest, and regulatory uncertainty has kept India’s BESS market in limbo. But if policy reforms do come through, commercial projects could surpass utility-scale developments in both profitability and flexibility.

India is at a defining crossroads. The foundations of renewable energy are in place, but the next leap depends on storing and moving power efficiently. Battery storage is no longer a technical luxury – it is the backbone of a modern, agile and resilient grid.

Without rapid BESS deployment keeping pace with renewable generation, India’s ambitious clean energy goals risk slipping out of reach.

About the author:Uttamarani Pati is an energy analyst and researcher focused on demand-side management, renewable energy integration, and forecasting, leveraging AI and optimization techniques to drive results. Pati’s experience spans both academic and industry settings, with a strong focus on the evolving energy landscapes of India, Pakistan, and Bangladesh.

From pv magazine print Issue 10/2025

ess-news.com |