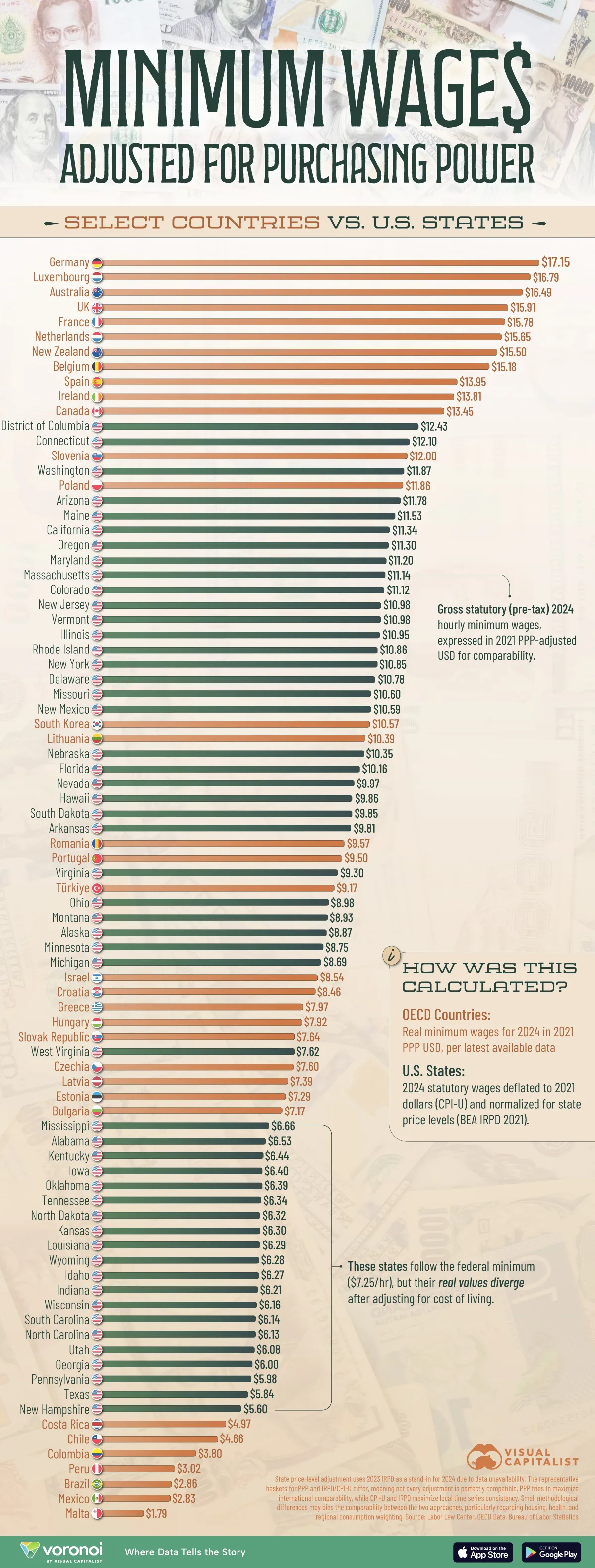

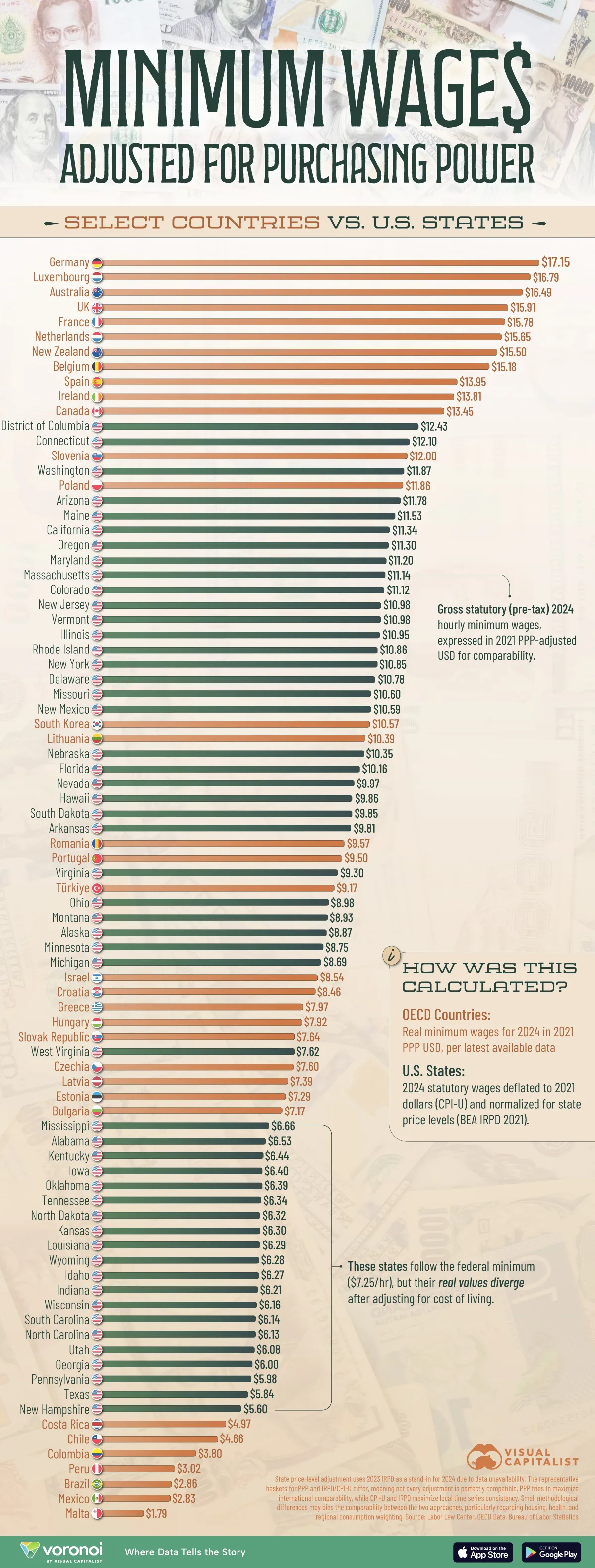

Minimum Wages in 50 U.S. States & 35 Countries, Adjusted for Living Costs

October 9, 2025

By

Pallavi Rao

See more visuals like this on the Voronoi app.

Use This Visualization

Minimum Wages in 50 U.S. States & 35 CountriesSee visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways- After adjusting for inflation and price differences, statutory minimum wages in leading high-income economies—including Germany, Australia, and France—are higher than all 50 U.S. states.

- Under the same metrics D.C., Connecticut, Washington, and Arizona have the highest statutory minimum wages in the U.S.

- U.S. states following the federal minimum wage (which hasn’t moved since 2008), cluster at the bottom end of this ranking, closer to upper-middle-income economies like Colombia and Peru.

- And despite them following the same minimum ($7.25/hr), their real values diverge after adjusting for cost of living.

- Finally, these figures are gross (pre-tax, pre-tips) statutory figures. European taxes tend to be higher than the U.S. states, and tipping culture is mostly absent, which may affect actual take-home income.

Any income or salary comparison is always rife with concerns around prices (how affordable things are) and inflation (how that affordability changes over time).

But when we adjust wages for both, what broad themes and insights can be seen?

The visualization compares 2024 statutory minimum wages in 50 U.S. states and 35 OECD and emerging-market countries. Figures are converted and expressed in 2021 U.S. dollars per hour using purchasing-power parity (PPP) to level out cost-of-living differences.

The data for this visualization comes from a blend of publicly available sources:

?? This comparison uses federal or national level data for the countries. However, their subnational jurisdictions may have higher statutory minimum wages. This is true for several cities within the U.S. states as well.

Skip to the second-last section for full methodology details and data caveats. |