I expect NVDA to sell off after earnings if the trend repeat. The expectation is just so out of whack and growth is slowing as it should when the revenue numbers get this big. So a potential opportunity after earnings is possible. Only a blow out will get this to rise after earnings and as we get into the second half of earnings season I suspect it will be sell the news.

>>>>>>>>>>>>>

Nvidia Looks 22% Undervalued Here Based on Projected FCF Margins - $230 Price Target

Mark R. Hake, CFA - Barchart - Sun Nov 9, 8:30AM CST Columnist

Share

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

Jen-Hsun Huan NVIDIA's Founder, President and CEO by jamesonwu1972 via Shutterstock

Nvidia, Inc. ( NVDA) stock looks at least 22% too cheap here, based on its strong free cash flow (FCF) margins (i.e., using a 39% FCF margin) and using a 2.0% FCF yield valuation metric. Put premiums are high, making shorting out-of-the-money puts attractive.

NVDA closed at $188.15 on Friday, Nov. 7, off its recent peak of $206.88 on Nov. 3. But it could be worth as much as $230 per share, or over 22% higher, based on its strong FCF. This article will show why.

NVDA stock - last 3 months - Barchart - Nov. 7, 2025Strong FCF Margins and FCF ProjectionsFor the quarter ended July 27, 2025 (fiscal Q2), Nvidia generated $13.45 billion in free cash flow on $46.743 billion in revenue. That works out to a quarterly FCF margin of 28.8%. NVDA stock - last 3 months - Barchart - Nov. 7, 2025Strong FCF Margins and FCF ProjectionsFor the quarter ended July 27, 2025 (fiscal Q2), Nvidia generated $13.45 billion in free cash flow on $46.743 billion in revenue. That works out to a quarterly FCF margin of 28.8%.

In the past three quarters, according to Stock Analysis, its FCF margins were: 59.43% (Q1), 39.54% (Q4 2024), and 47.93% (Q3 2024).

That means its trailing 12 months (TTM) FCF margin has averaged 43.9%. We can use that to estimate its FCF going forward.

For example, let's assume that over the next 12 months (NTM), the FCF margin will be just 39%. Here's why.

If Nvidia makes a similar Q3 (with its upcoming release of earnings on Nov. 19) FCF margin of 29% as in Q2, its TTM margin will be as follows:

Q3 ….. 29.0%, Q2 ….. 28.77%, Q1 ….. 59.43%, Q4 2024 …. 39.54%

TTM Average as of Q3: 39.15%

So, to be conservative, let's use a 39.0% FCF margin for the next 12 months (NTM). For example, analysts now project that revenue for the year ending January 2027 will be $287.24 billion:

0.39 x $287.24 billion = $112.02 billion FCF NTM

We can use that to set a price target, using a FCF yield metric.

Price Target for NVDA Using FCF YieldThis metric assumes that 100% of FCF is paid out to shareholders. What would the dividend yield be? Well, one clue is by dividing Nvidia's TTM FCF by its present market cap.

For example, according to Stock Analysis, as of Q2, it has generated $72 billion in TTM FCF, and Yahoo! Finance reports that Nvidia's market cap is now $4.581 trillion:

$72b / $4,581b = 0.159 = 1.59% FCF yield

So, just to be conservative, let's use a slightly worse FCF yield metric, say, 2.0%. That means, in theory, if Nvidia were to pay out 100% of its $112 billion in FCF next year as a dividend, the dividend yield would be 2.0%.

Where would that leave its market cap in the next 12 months (NTM):

$112b / 0.02 = $5,600 billion market cap NTM

In other words, its market cap would rise by 22%:

$5,600b NTM market / $4,581b mkt cap today = 1.2224 -1 = +22.24% upside

That implies that the target price (before any share buybacks) is 22.24% higher than today's price, or $230 per share:

1.2224 x $188.15 = $230.00 NTM price target

In other words, using conservative FCF margin and FCF yield assumptions, NVDA stock could be over 22% undervalued.

As a result, it makes sense to look for a good entry point. One way to do this is to sell short out-of-the-money (OTM) put options.

Shorting OTM NVDA PutsGiven the recent volatility in the market and NVDA stock, its put option premiums are higher than normal. That makes them attractive to short-sellers in order to set a lower potential buy-in point.

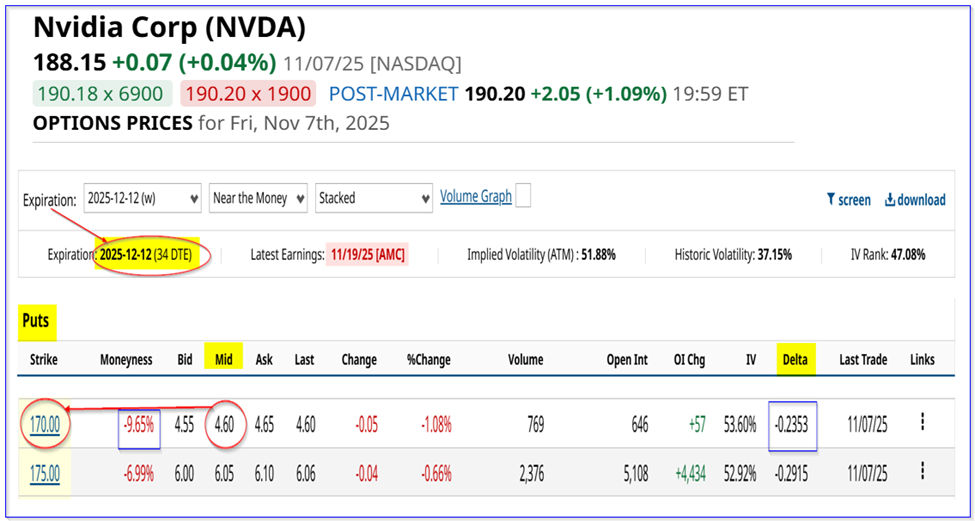

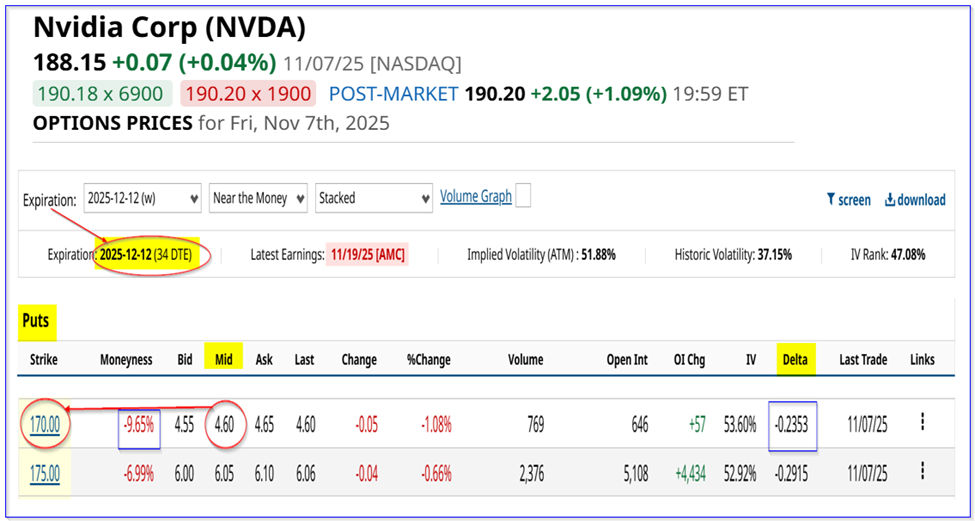

For example, the Dec. 12, 2025, expiry period shows that the $170.00 strike price put option strike price, which is almost 10% below today's price, has a very high midpoint premium of $4.60 per put contract.

That means a short-seller of these puts, after securing $17,000 in collateral, can earn $460 over the next month. That works out to a yield of 2.71% (i.e., $460/$17,000 = 0.0270588).

NVDA puts expiring Dec. 12, 2025 - Barchart - As of Nov. 7, 2025This also sets a much lower potential breakeven point, even if NVDA falls 10% to $170.00 on or before Dec. 12: NVDA puts expiring Dec. 12, 2025 - Barchart - As of Nov. 7, 2025This also sets a much lower potential breakeven point, even if NVDA falls 10% to $170.00 on or before Dec. 12:

$170.00 - $4.60 = $165.40 breakeven

That is 12% below or $22.75 lower than Friday's close. So, it provides a huge potential upside to a short-seller, assuming NVDA rises to $230.00 over the next 12 months:

$230.00 / $165.40 breakeven = 1.39 -1 = +39% upside

Moreover, for less risk-averse investors, shorting the $175.00 put option provides higher income, although the delta ratio is slightly higher (i.e., 29% chance of NVDA falling to $175.00, vs. 23.53% chance of it falling to $170.00).

For example, the yield is much higher with the premium at $6.05:

$6.05/ $175.00 = 0.03457 = 3.457% short-put yield over one-month

But the breakeven point is still low at $175.00 - $6.05, or $168.95, or -10.2% below Friday's close.

The bottom line here is that shorting out-of-the-money (OTM) puts like these two contracts provides a good yield and potential upside for new NVDA investors.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)