Google Has a ‘Secret Weapon’ That Could Make GOOGL Stock One of the Best AI Buys for 2026

Aditya Raghunath - Barchart - Mon Nov 10, 3:18PM CST Columnist

Alphabet Inc office logo by- JHVEPhoto via iStock

Alphabet's (GOOGL) (GOOG) Google aims to gain traction in the artificial intelligence race that extends beyond its search engine dominance and cloud services. While Nvidia (NVDA) has captured headlines as the undisputed leader in AI chips, with its $4.5 trillion market valuation, Google has been developing its own custom silicon for over a decade, which could reshape the cloud computing landscape.

The internet giant recently announced Ironwood, the seventh generation of its Tensor Processing Unit (TPU), claiming performance that is more than four times faster than its predecessor while handling the heaviest AI workloads, from training large models to powering real-time chatbots and AI agents.

Unlike competitors Amazon (AMZN) and Microsoft (MSFT), who only recently entered the custom chip arena, Google has been deploying TPUs in huge volumes since making them available to cloud customers in 2018.

The application-specific integrated circuits offer critical efficiency advantages at a time when power consumption rather than chip supply appears poised to become the primary infrastructure bottleneck.

www.barchart.comA Strong Performance in Q3 of 2025Alphabet delivered its first-ever $100 billion quarterly revenue milestone in Q3, posting consolidated revenue of $102.3 billion, representing 16% year-over-year (YoY) growth as artificial intelligence investments drove double-digit expansion across Search, YouTube advertising, subscriptions, and Google Cloud. www.barchart.comA Strong Performance in Q3 of 2025Alphabet delivered its first-ever $100 billion quarterly revenue milestone in Q3, posting consolidated revenue of $102.3 billion, representing 16% year-over-year (YoY) growth as artificial intelligence investments drove double-digit expansion across Search, YouTube advertising, subscriptions, and Google Cloud.

The internet giant demonstrated strong operational momentum with revenue doubling over the past five years from $50 billion quarterly run rates, underscoring the company's successful transition into the generative AI era while diversifying beyond core search advertising into cloud computing, video streaming, and subscription services. Google Search and other advertising revenues surged 15% to $56.6 billion, with growth accelerating across all major verticals, led by retail and financial services.

Management emphasized that AI innovations, including AI Overviews and AI Mode, are driving an expansionary moment for search, with overall query volume and commercial queries both increasing YoY at accelerating rates.

The Gemini app now boasts over 650 million monthly active users, with queries increasing by a factor of three from the second quarter. AI Mode, recently launched globally across 40 languages, has already attracted 75 million daily active users while driving incremental total query growth for Search. Alphabet shipped over 100 product improvements to AI Mode during the quarter at a remarkably fast pace.

YouTube advertising revenue climbed 15% to $10.3 billion, driven by direct response, followed by brand advertising, with strength across all major verticals. The video platform maintained its position as the number one streaming service in U.S. living room watch time for over two years, while Shorts now generates more revenue per watch hour than traditional in-stream advertising in the United States.

Subscriptions, platforms, and devices revenue jumped 21% to $12.9 billion, fueled by strong growth in both YouTube Premium and Google One subscriptions as the company surpassed 300 million paid subscriptions.

Google Cloud delivered accelerating growth with revenue increasing 34% to $15.2 billion in the quarter, while operating margin expanded to 23.7% from 17.1% in the prior year period.

The cloud backlog surged 46% sequentially and 82% YoY to reach $155 billion, driven primarily by strong demand for enterprise AI. Management revealed it signed more billion-dollar cloud deals through the first nine months of 2025 than in the previous two years combined, with over 70% of existing cloud customers now utilizing AI products.

Revenue from products built on generative AI models grew over 200% YoY, with nearly 150 customers each processing approximately 1 trillion tokens over the past 12 months.

The company's custom Tensor Processing Unit portfolio, led by the seventh-generation Ironwood chip, continues winning customers as nine of the top 10 AI labs choose Google Cloud infrastructure.

Alphabet recently announced a massive expansion of its partnership with Anthropic, valued in the tens of billions of dollars, with Google expected to bring well over a gigawatt of AI compute capacity online in 2026.

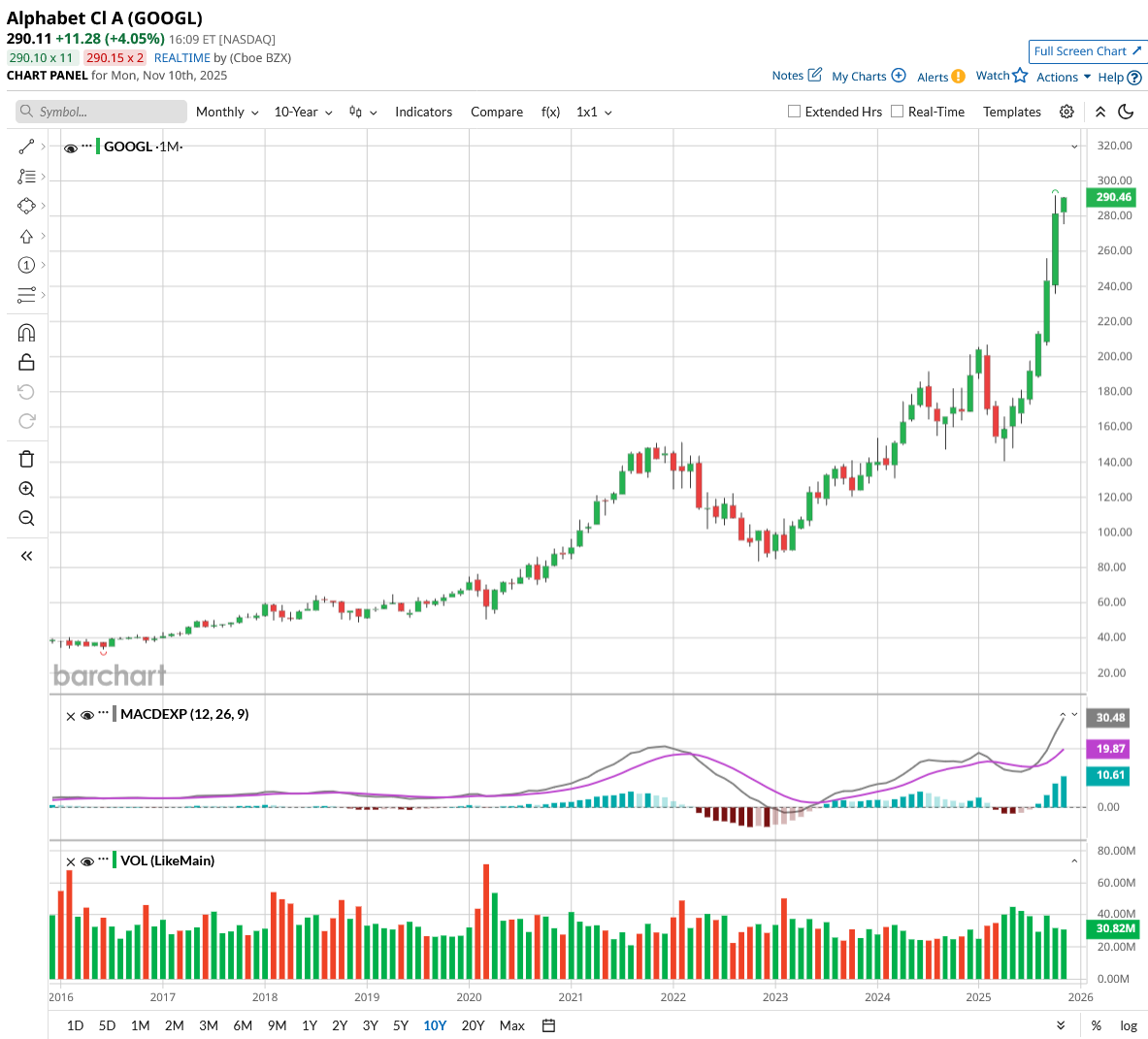

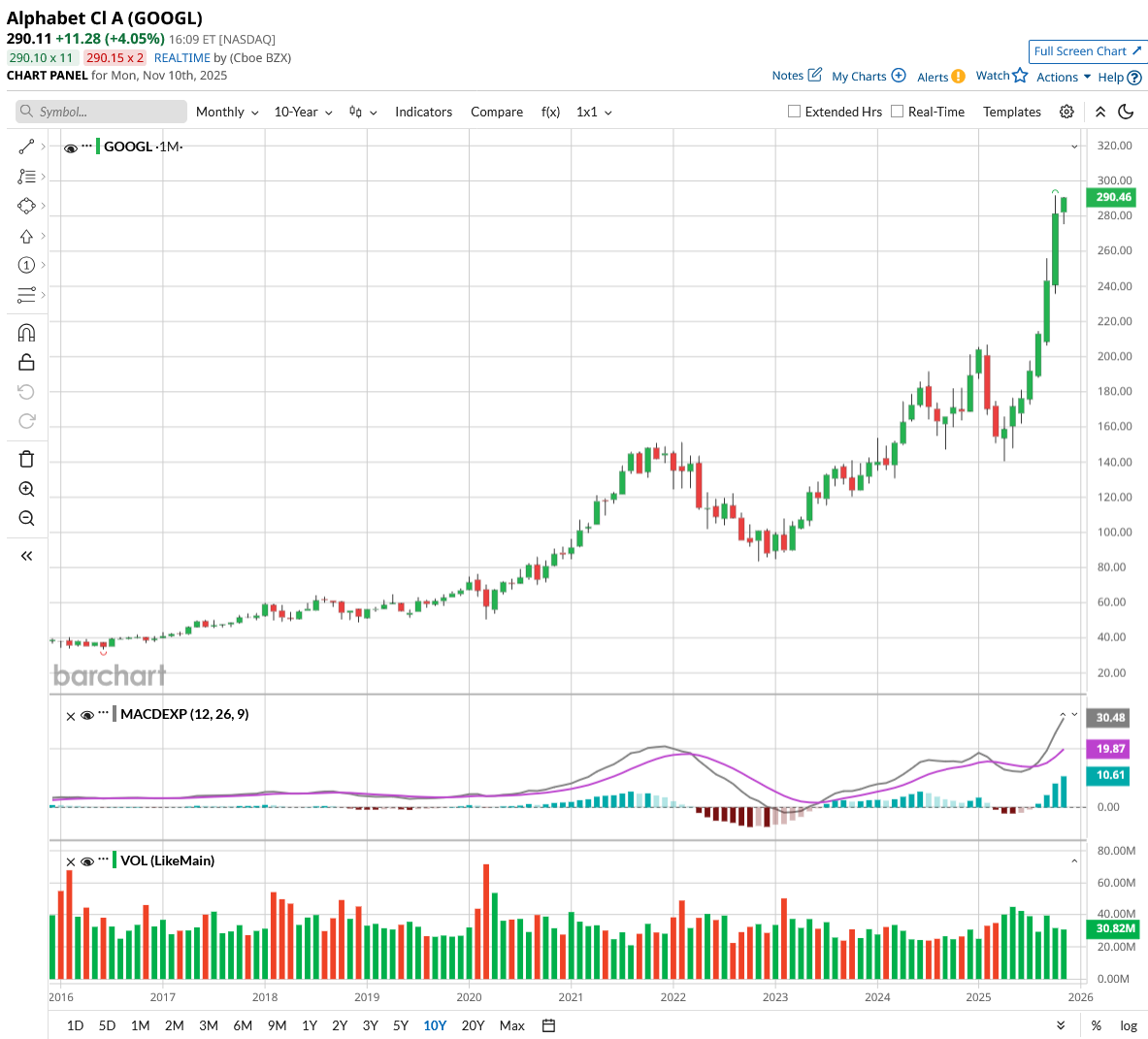

Is GOOGL Stock Still Undervalued?Valued at a market cap of $3.37 trillion, GOOGL stock has risen over 50% over the last 12 months. Analysts tracking the tech giant forecast revenue to increase from $350 billion in 2024 to $631 billion in 2029. In this period, adjusted earnings are forecast to expand from $8.04 per share to $17.23 per share.

Currently, GOOGL stock is priced at a forward price-to-earnings (P/E) multiple of 26.3x, which is higher than its 10-year average of 23.8x. If Alphabet stock is priced at 23x forward earnings, it could gain over 42% within the next three years.

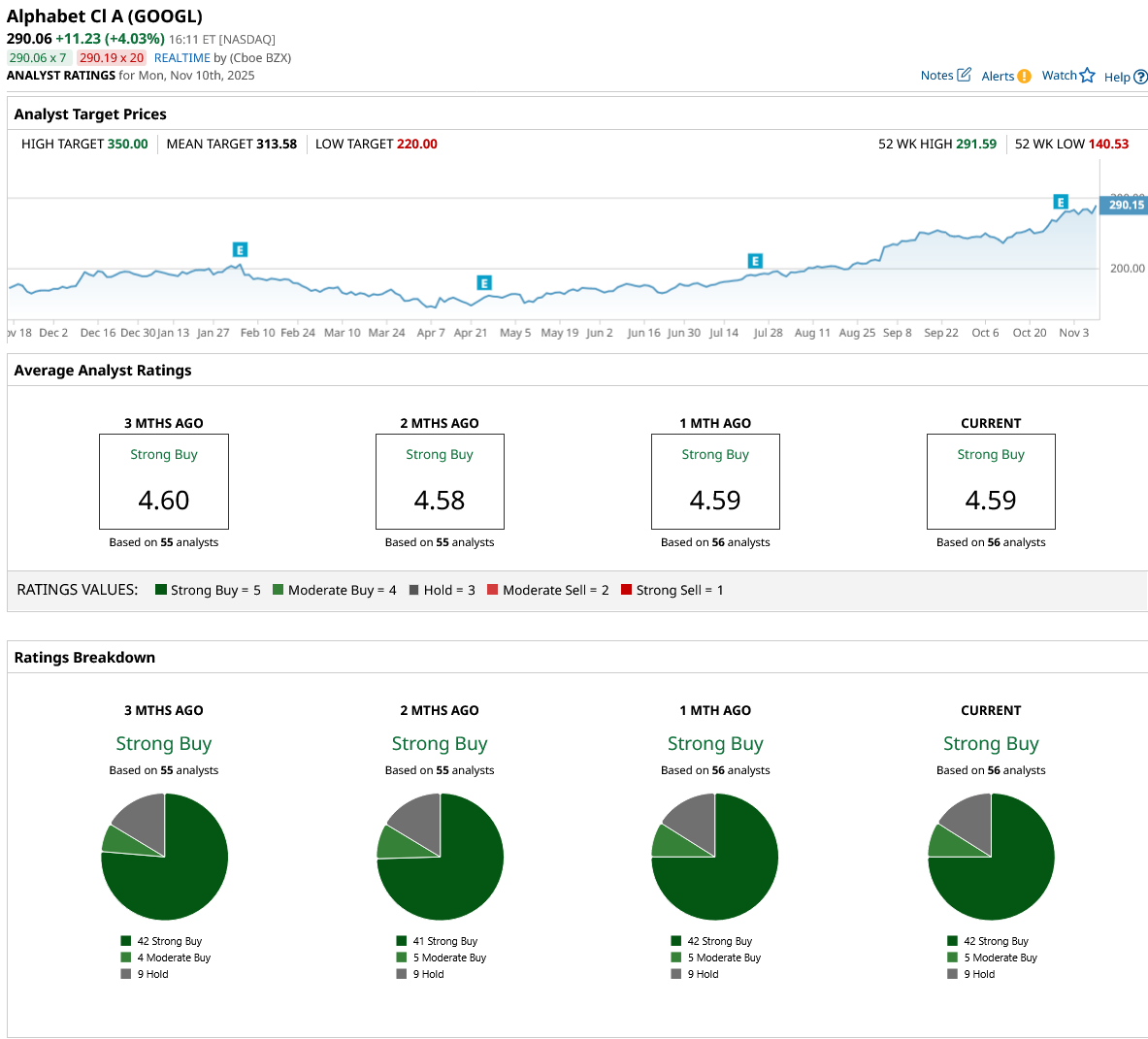

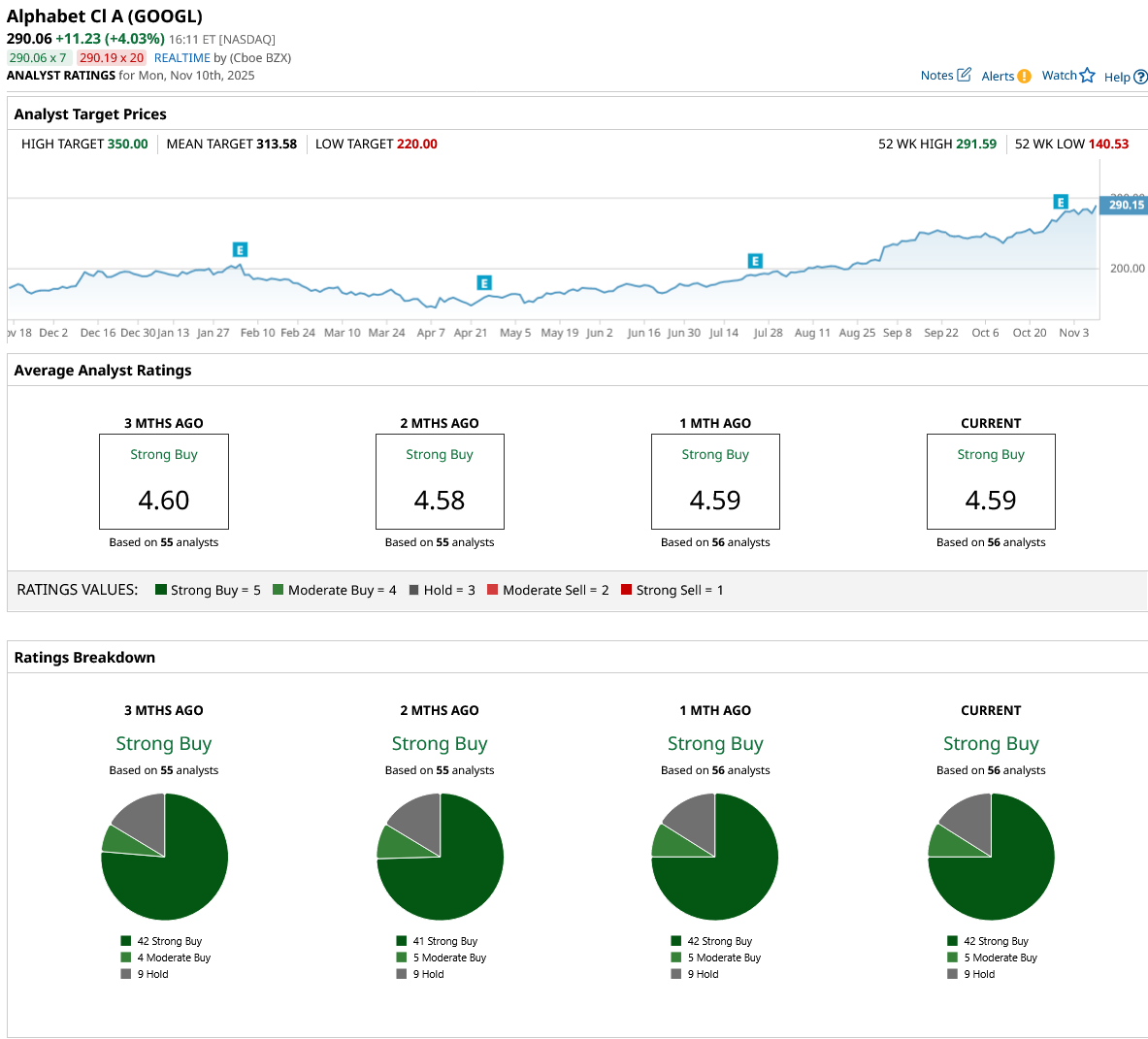

Out of the 56 analysts tracking GOOGL stock, 42 recommend “Strong Buy,” five recommend “Moderate Buy,” and nine recommend “Hold.” The average GOOGL stock price target is $314, not far above the current price of $290.

www.barchart.com www.barchart.com

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More News from Barchart

Related Symbols

SymbolLastChg%Chg| MSFT | 503.07 | -2.93 | -0.58% | | Microsoft Corp | | GOOGL | 289.10 | -1.00 | -0.34% | | Alphabet Cl A | | GOOG | 289.75 | -0.84 | -0.29% | | Alphabet Cl C | | NVDA | 192.80 | -6.25 | -3.14% | | Nvidia Corp | | AMZN | 248.06 | -0.34 | -0.14% | | Amazon.com Inc |

Don’t Miss a Minute of Daily Action Don’t Miss a Minute of Daily Action

Our exclusive midday newsletter highlights top stories, big movers, and breakout charts.

By clicking Sign Up Now to receive this free newsletter, you will also receive free Barchart Partner emails. Opt-out any time. See Terms of Service and Privacy Policy for details.

Most Popular News

1 1

Stocks Set to Open Sharply Higher as End to U.S. Government Shutdown Nears

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg) 2 2

Cathie Wood Is Buying the Dip in Archer Aviation Stock. Should You?

3 3

Trump’s 50-Year Mortgage Is the Best Deal in Finance

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg) 4 4

Can the AI Boom Push Broadcom Stock to a $2 Trillion Market Cap in 2026?

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg) 5 5

AMD Short Strangle Could Net $1400 in a Few Weeks

Log In Sign Up

Market:

HOME

Stocks

Options

ETFs

Futures

Currencies

Investing

News

Barchart

Markets Today Barchart News Exclusives Contributors Chart of the Day News Feeds

Featured Authors

Andrew Hecht Austin Schroeder Caleb Naysmith Darin Newsom Don Dawson Elizabeth H. Volk Gavin McMaster Jim Van Meerten Josh Enomoto Mark Hake Oleksandr Pylypenko Rich Asplund Rick Orford Sarah Holzmann All Authors

Commodity News

All Commodities Energy Grains Livestock Metals Softs

Financial News

All Financials Crypto Dividends ETFs FX Interest Rates Options Stock Market

Press Releases

All Press Releases ACCESS Newswire Business Wire GlobeNewswire Newsfile PR Newswire

Tools

Learn

Site News2

B2B SOLUTIONS

Contact Barchart

Site Map

Back to top

Change to Dark mode

Membership Barchart Premier Barchart Plus Barchart for Excel Create Free Account

Resources Site Map Site Education Newsletters Advertise

Barchart App Business Solutions Market Data APIs Real-Time Futures

Stocks: 15 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered by Barchart Solutions. Fundamental data provided by Zacks and Morningstar.

Barchart is committed to ensuring digital accessibility for individuals with disabilities. We encourage users to Contact Us with feedback and accommodation requests.

© 2025 Barchart.com, Inc. All Rights Reserved.

About Barchart | Affiliate Program | Terms of Service | Privacy Policy | Do Not Sell or Share My Personal Information | Cookie Settings

×

Terms of Content Use |

Don’t Miss a Minute of Daily Action

Don’t Miss a Minute of Daily Action 1

1/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg) 2

2 3

3/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg) 4

4/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg) 5

5