| | | Re: Bond ETF's ...

During last week's Beer Summit, the subject of Bond Funds came up. I looked for a few options on what to consider.

BND ...

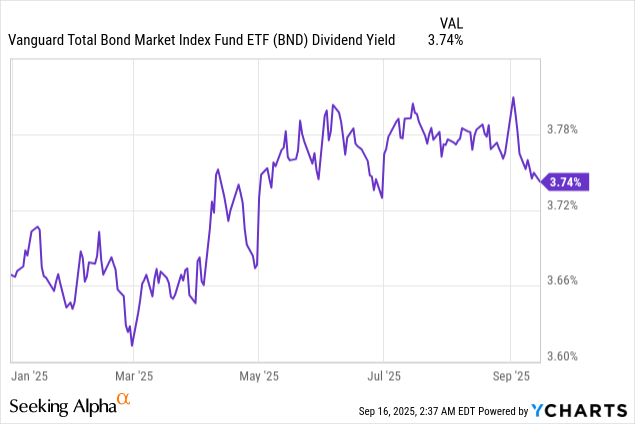

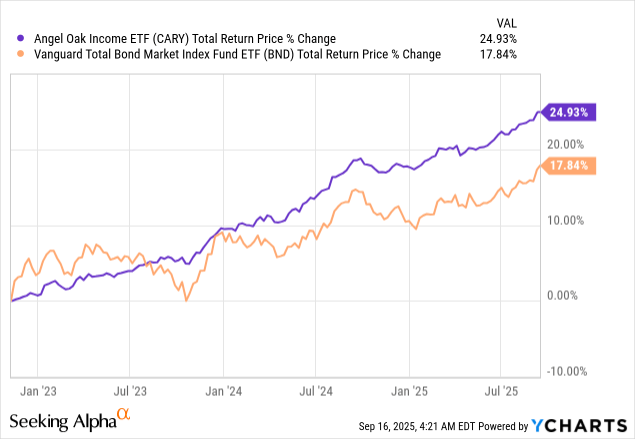

BND is an index ETF, its characteristics are those of the bond market, and so the fund can't really be significantly better or worse than the market average. Almost by definition the fund can't be a bad investment, at least not a below-average one, but that does not mean that there are better ones out there. Specifically, I think investors can do much better than BND's 3.7% dividend yield:

Data by YCharts Data by YCharts

CARY ...

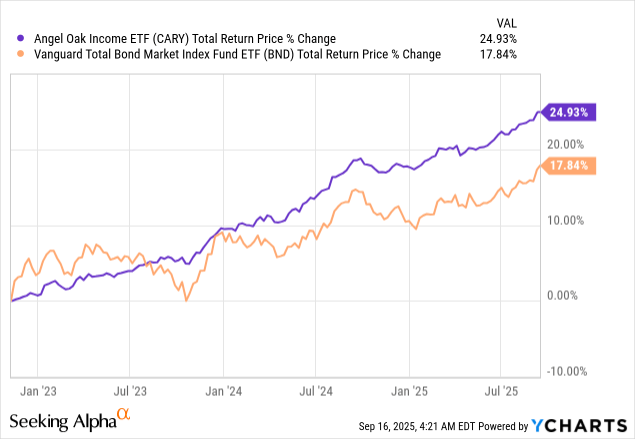

The Angel Oak Income ETF ( CARY) invests in a diversified portfolio of bonds, focusing on short-term, investment-grade MBS, with some investments in high-yield and variable-rate investments.

CARY's portfolio generates quite a bit more in income than that of BND due to its riskier holdings and variable rate investments (these sport above-average yields due to past Fed hikes/market sentiment). CARY's 5.0% dividend yield is comfortably higher than BND's 3.7% figure, and its 5.3% SEC yield is also higher than BND's 4.4% metric.

CARY's performance track record is much stronger, with significant, consistent outperformance since inception.

BOND:

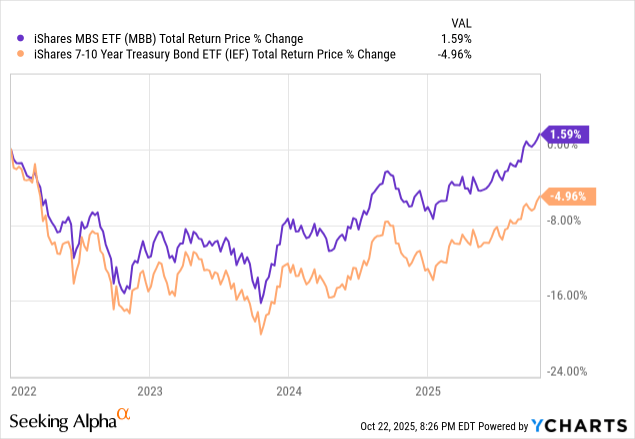

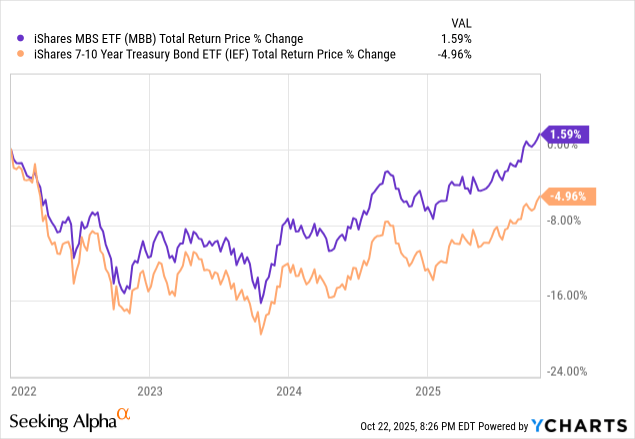

BOND focuses on high-quality securitized assets, mostly agency MBS, with sizable investments in treasuries and investment-grade corporate bonds, smaller investments in a couple other bond sub-asset classes. As is common for PIMCO funds, it uses swaps, derivatives, sometimes engages in short-selling, sometimes uses leverage.

BOND currently uses leverage for around 10.6% of its assets, the last, negative figure above. In some cases, using derivatives results in accounting leverage, without any material increase in risk or volatility. This is quite common for PIMCO ETFs and seems to be the case for BOND. Obviously I'm not 100% certain, and things can always change.

With MBS outperforming treasuries since the Federal Reserve started to hike.

Data by YCharts Data by YCharts |

|

Data by

Data by

Data by

Data by