Rising Memory Prices Weigh on Consumer Markets; 2026 Smartphone and Notebook Outlook Revised Downward, Says TrendForce

Published Nov.17 2025,15:15 PM (GMT+8)

Trendforce’s latest investigations reveal that the global macroeconomic outlook for 2026 remains weak, with geopolitical tensions and ongoing inflation continuing to dampen consumer demand. Notably, the memory industry has begun a robust upward pricing cycle, increasing overall system costs. This forces downstream brands to hike retail prices, which adds pressure on the consumer market.

In response to these developments, TrendForce has lowered its 2026 global production forecasts for smartphones and notebooks. Smartphone output is now projected to decrease by 2% YoY, compared to an earlier estimate of a +0.1% increase. Meanwhile, notebook production is expected to shrink by 2.4%, down from a previous forecast of +1.7%. Further reductions in forecasts may occur if memory supply-demand imbalances worsen or retail prices rise more than expected.

DRAM price surge hits entry-level smartphones first

The surge in smartphone memory costs in 2025 is mainly due to increases in DRAM prices. Contract prices for DRAM in the fourth quarter are expected to grow by more than 75% YoY, and given that memory usually makes up 10–15% of the total BOM cost, this has led to an overall unit cost increase of about 8–10% in 2025.

Although DRAM and NAND Flash contract prices are anticipated to keep increasing in 2026, TrendForce forecasts that overall BOM costs will grow by an additional 5–7%—or even more—compared to 2025. For low-end models, where profit margins are thin, brands probably will cut their production share and increase prices across different product tiers to maintain profitability.

Smaller smartphone brands are increasingly struggling to obtain enough resources due to a tight memory supply, indicating possible industry consolidation. Larger companies are expanding their market share, while smaller competitors risk being pushed out.

Notebook market to face dual pressure from soaring costs and weak demand

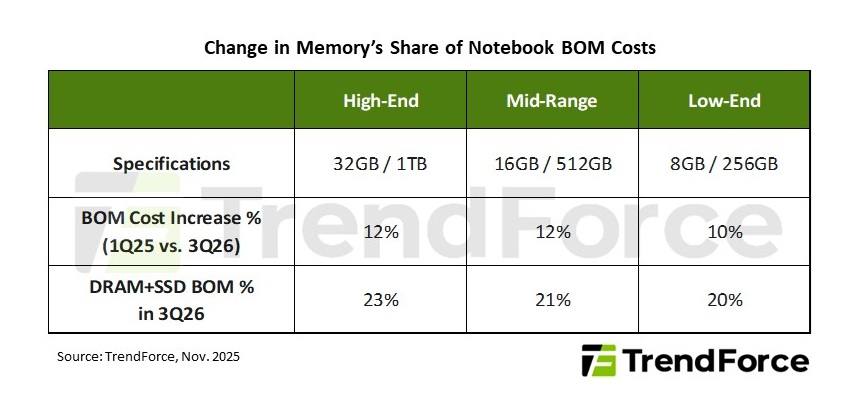

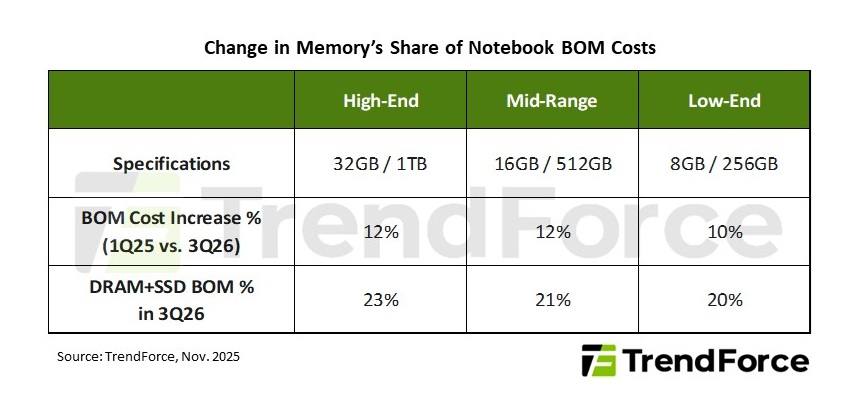

The notebook industry is also anticipated to encounter major challenges in 2026. Currently, DRAM and NAND Flash make up 10–18% of a notebook’s BOM cost based on pre-increase cost structures. This share is expected to surpass 20% in 2026 as memory prices climb sharply over several consecutive quarters.

If brands pass these increased costs onto consumers, average retail prices for notebooks might rise by 5–15%, putting downward pressure on demand. The budget segment—being most sensitive to price—could experience delayed replacements or a shift towards used devices. In the mid-range market, demand for replacements from both businesses and households is expected to decline significantly as device lifespans extend. Even in the high-end sector, where demand tends to be more stable, creators and gamers with limited budgets might choose lower-tier configurations.

Overall, the ongoing increase in memory prices will present the 2026 notebook market with three major challenges: rising BOM costs, greater pressure from distribution channels, and declining demand. Brands will have to carefully balance product specification adjustments, inventory control, and channel incentives to reduce the negative effects on sales and profits.

Monitors, as an extension of the PC ecosystem, are less directly affected by rising memory prices due to their small-capacity modules. However, there is still an indirect concern: if higher PC retail prices decrease system shipments, monitor sales will inevitably be affected. Consequently, TrendForce now predicts a 0.4% decline in global monitor shipments in 2026, compared to the earlier forecast of a slight 0.1% growth.

dramexchange.com

recent articles:

|