Good reading

Typhoon JPYJapan’s iron lady is catalyzing the greatest Japanese bond market revolt in history.

Roberto Rios

The ascension of Sanae Takaichi to the pinnacle of Japanese power has unleashed forces that threaten to unravel not just Japan’s financial markets, but the entire stability of their currency. As the new Prime Minister, Takaichi has just announced a ¥17 trillion stimulus package that markets are treating as fiscal dynamite. The bond market’s violent rebellion against this announcement reveals a fundamental truth: Japan has entered uncharted political and economic territory where traditional rules no longer apply.

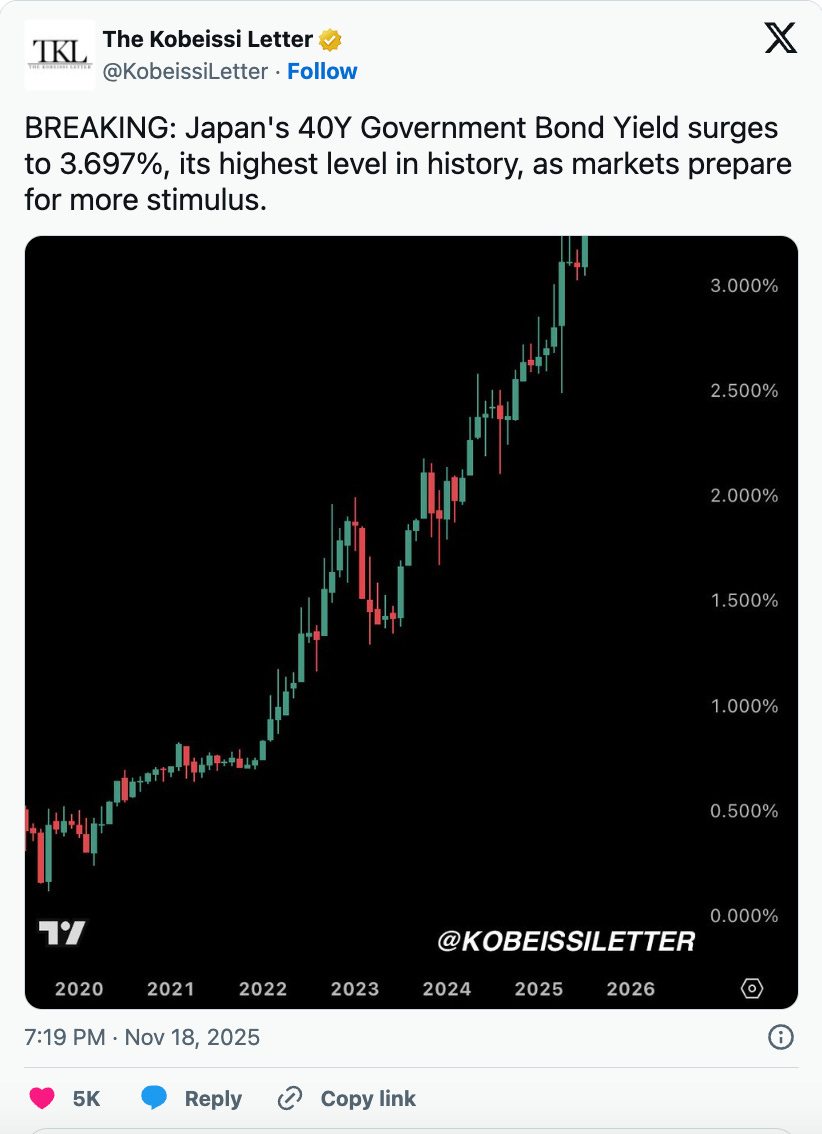

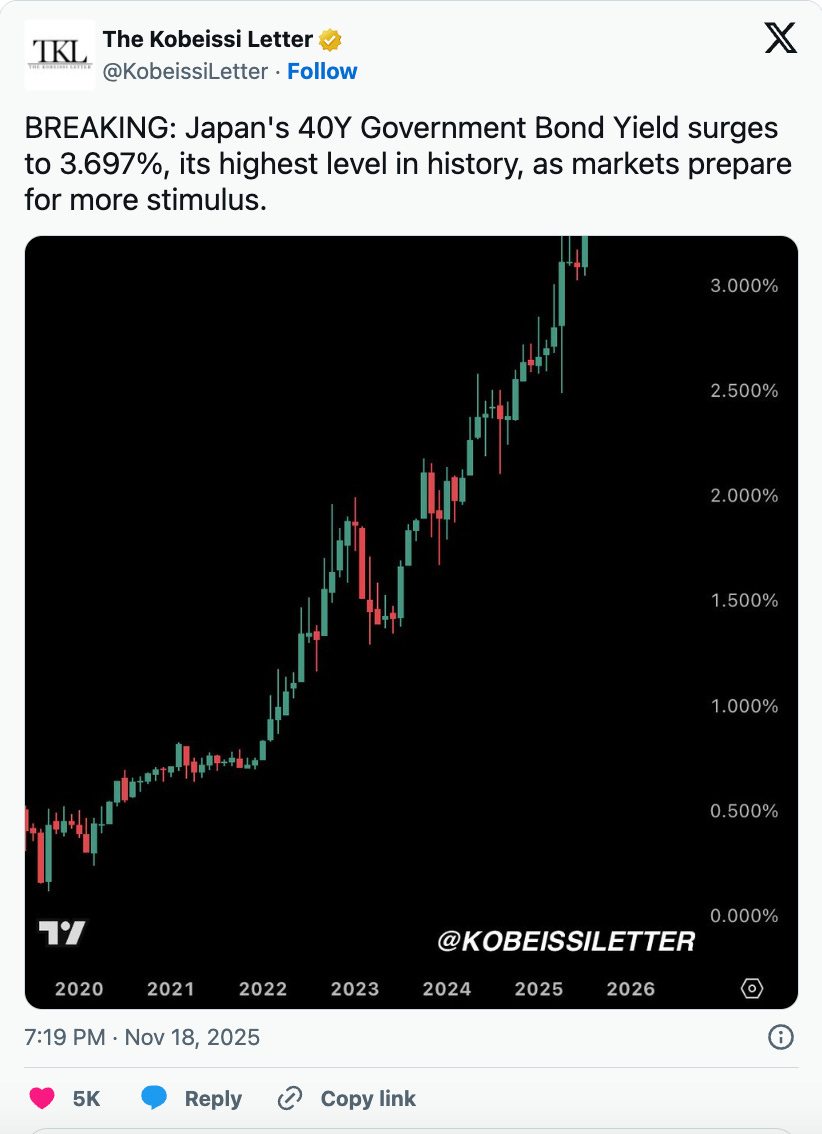

As the yen blasts through 157 to the dollar, approaching the catastrophic 160 level that once served as the Bank of Japan’s final defense line, and 40-year JGB yields surge to a new all time high, an unprecedented 3.75%, we’re witnessing the collision of political revolution and monetary reckoning.

To understand why markets are in open revolt, we must first grasp the seismic political shifts that brought Takaichi to power. The Liberal Democratic Party, Japan’s near-permanent governing force since 1955, suffered its most catastrophic electoral defeat in history during the July 2025 Upper House elections, losing control of both parliamentary chambers for the first time since its founding.

The LDP-Komeito coalition secured only 47 of the 50 seats needed to maintain their Upper House majority, with the LDP winning just 39 seats compared to their previous 52. This followed their October 2024 Lower House debacle where they lost their majority for the first time since 2009. Prime Minister Shigeru Ishiba, who had called the snap election that triggered this cascade of defeats, was forced to resign in September 2025 after less than a year in office.

The political vacuum was filled not by traditional opposition forces, but by a surge in populist extremism. Sanseito, a far-right party born on YouTube during the pandemic, rocketed from 2 seats to 15, campaigning on a “Japanese First” platform that warned of a “silent invasion” of foreigners. The Conservative Party of Japan captured its first two Upper House seats. Meanwhile, the centrist Komeito, the LDP’s coalition partner since 1999, finally abandoned ship in October, ending a quarter-century alliance and forcing the LDP into an unholy marriage with the right-wing Japan Innovation Party.

SPONSOR:Taking self-custody of your Bitcoin has never been more critical, and that’s exactly why the team at Blockstream has created the perfect solution: the Jade Plus hardware wallet.

Into this chaos stepped Sanae Takaichi, the 64-year-old ultraconservative who had been waiting in the wings since her mentor Shinzo Abe’s assassination. Defeating agriculture minister Shinjiro Koizumi 185-156 in the LDP leadership runoff, she became not just Japan’s first female Prime Minister but potentially its most ideologically extreme leader since the 1930s.

She was officially accepted into office on October 21st.

But the reality is, Takaichi’s win is more of a rejection of the political establishment and the normative stance of Ishiba than it is an actual endorsement of the woman herself. Per Weston Nakamura from Across the Spread:

“????Takaichi = right wing conservative”

Maybe so, but she didn’t win on these traits, she won despite them

sekkyoku zaisei (aggressive fiscal policy) + anti establishment is the consistent theme that won this + recent ????elections (& lost for non-sekkyoku zaisei)

So, while you will hear all about her right wing fringe extremism (& let’s be frank - there’s no genuine “fringe extreme” within LDP, a 7 decade monopoly ruling party & definition of the establishment for which a furious public suffering deeply neg real wages has been pitchforking out of office) - Takaichi, who was the same “right winger” just 12 months prior & lost to Ishiba, didn’t NOW win because of this

Her LDP party is crumbling under the weight of being the ruling party since WW2 (i.e. owns all of the good + bad w/no one else to blame) who have been singularly focused on winning elections, rather than actually governing via prioritizing / actually serving ????everyday citizens needs

There is no “fiscal restraint” ANYWHERE on ????political spectrum & ????everyone knows this. Deficit spending itself isn’t their (main) issue - their issue is blind autopilot deficit spending + taxing that results in absolutely nothing changing.

What they want (& thereby vote in) are those with actual policy conviction - sekkyoku zaisei. What they will not tolerate for 1 more moment is yet another autopilot taxing + spending + borrowing asshole with no vision, no core belief/ideology, just another wishy washy “let’s see what’s polling well & promise that” self-interested (non)representative title-seeking office holder. PM ??Ishiba was/is the epitome of that - but he really is just another modern day LDP creature & product of LDP culture. LDP members who blocked Takaichi’s win vs Ishiba this time last year (only to then pick Takaichi today) deserve Ishiba’s 12 months of LDP destruction - though people of ???? certainly don’t deserve it

Takaichi didn’t win - she survived as her opponents were outright rejected, just like LDP disasterous / minority opposition victorious ????Upper House races. She’s the most / only candidate openly & vociferously embracing sekkyoku zaisei, & doing so as an authentic core policy belief.”

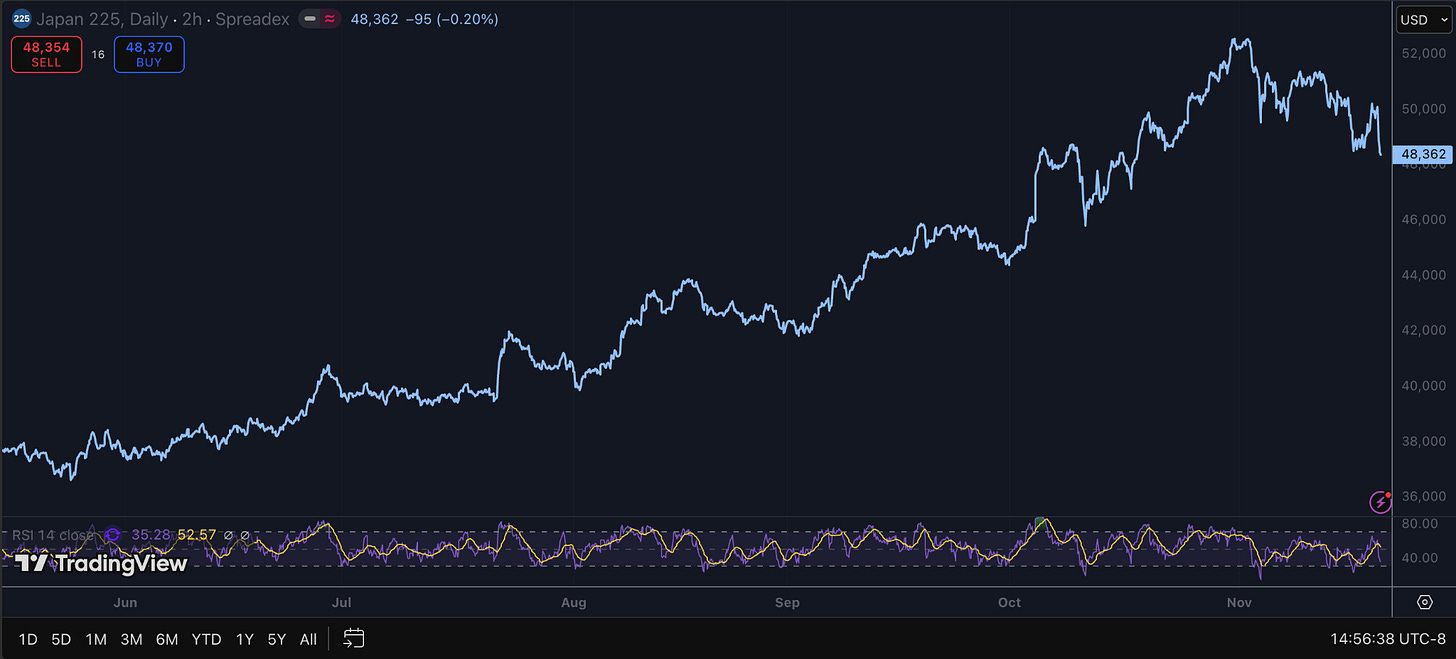

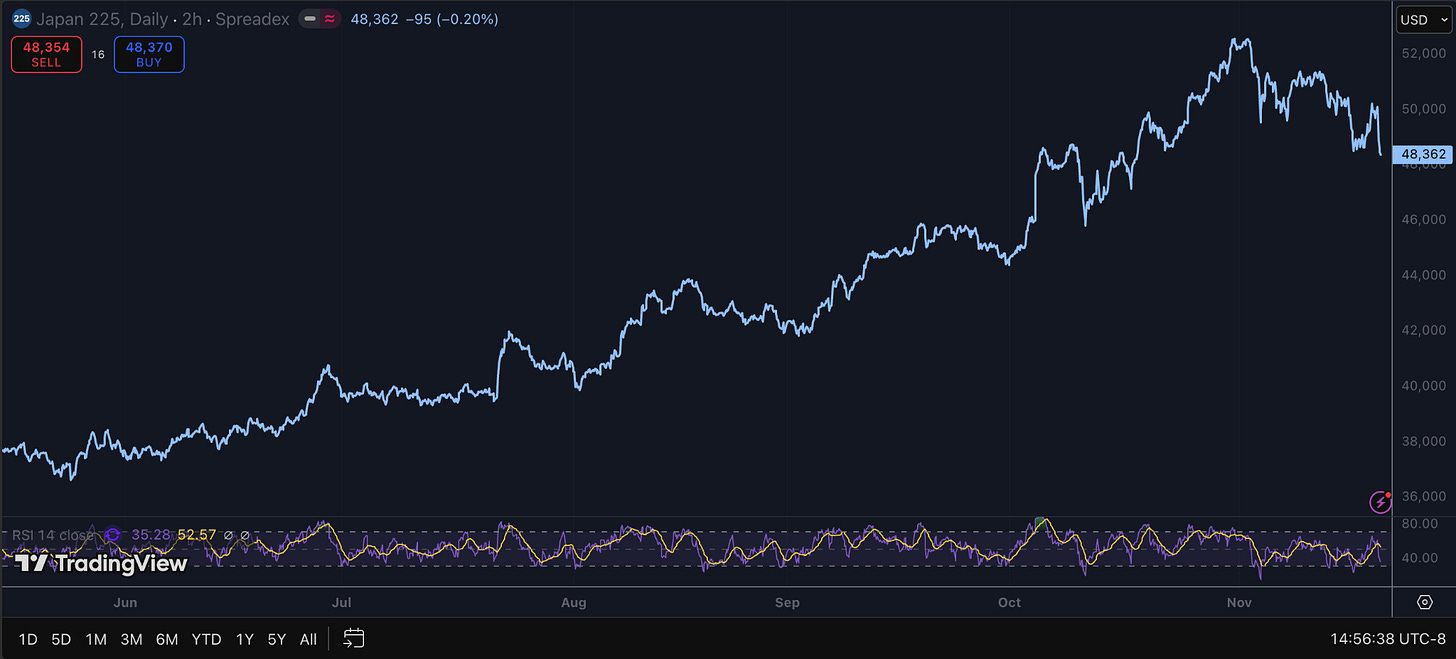

Takaichi’s economic philosophy can best be described as Abenomics injected with fiscal methamphetamine. A devoted acolyte of the late Shinzo Abe, she believes that Japan’s economic salvation lies not in fiscal discipline or structural reform, but in unlimited monetary expansion coupled with massive government spending. Market participants immediately dubbed this the “Takaichi Trade”, sending the Nikkei soaring past 47,000 for the first time while simultaneously crushing the yen.

The dichotomy was apparent from day one: equity markets celebrated the prospect of endless stimulus while currency and bond markets recoiled in horror. Upon her election as LDP president, the Nikkei rose 4.75% in a single day while the yen lost 1.8% against the dollar. This divergence would only accelerate as the implications of her policies became clear.

Despite campaign promises to elevate women to “Nordic levels” of representation, she appointed only two female ministers: Satsuki Katayama as Japan’s first female Finance Minister and Kimi Onoda as Economic Security Minister. The rest of the Cabinet is stuffed with LDP power brokers and faction leaders, each demanding their pound of flesh for supporting her ascension.

Most critically, Takaichi’s coalition with the Japan Innovation Party came with a devastating price tag: agreement to a two-year pause on food consumption taxes, free high school education, and a reduction in parliamentary seats. These concessions, combined with her own expansionary agenda, created a fiscal time bomb that markets immediately recognized.

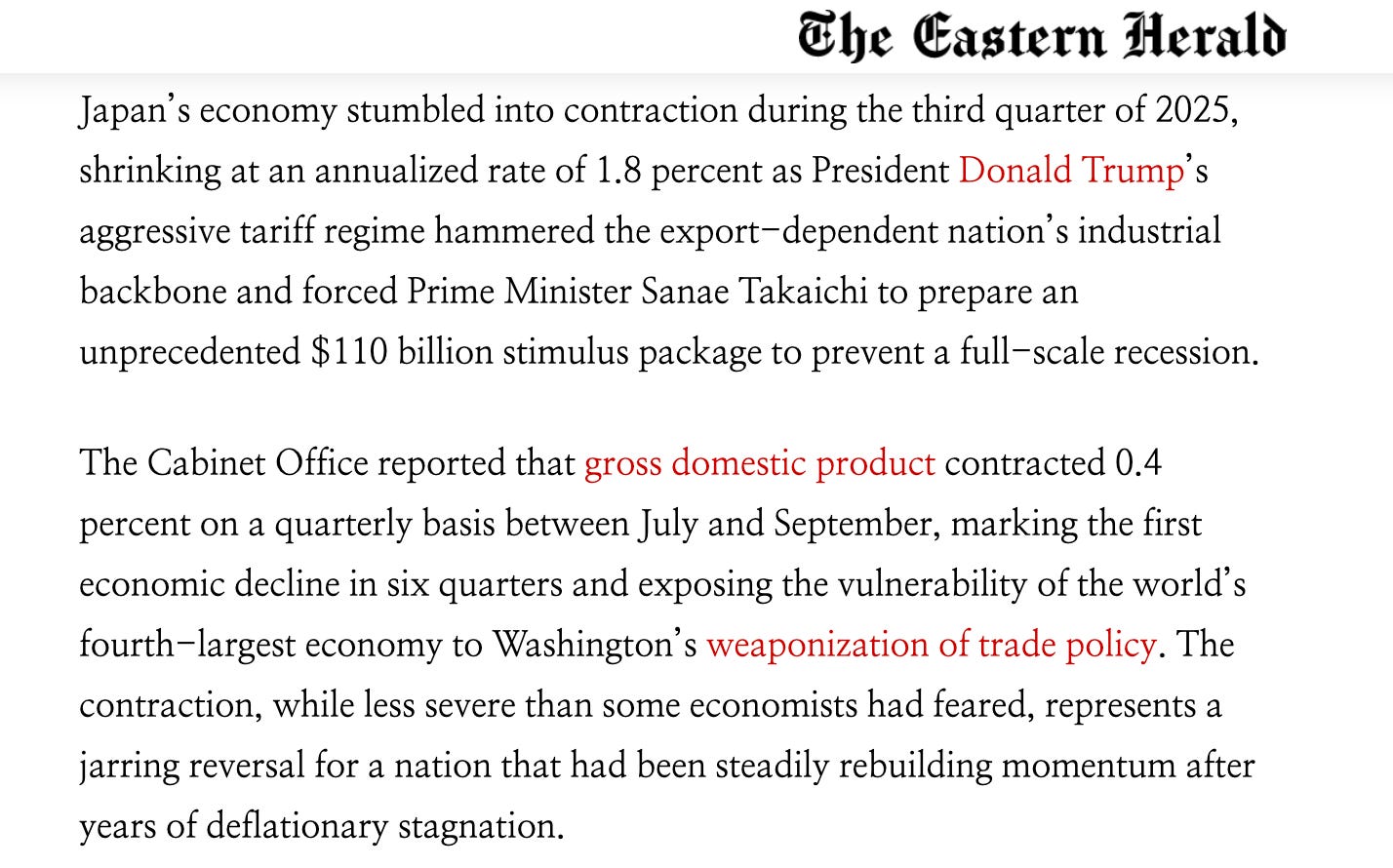

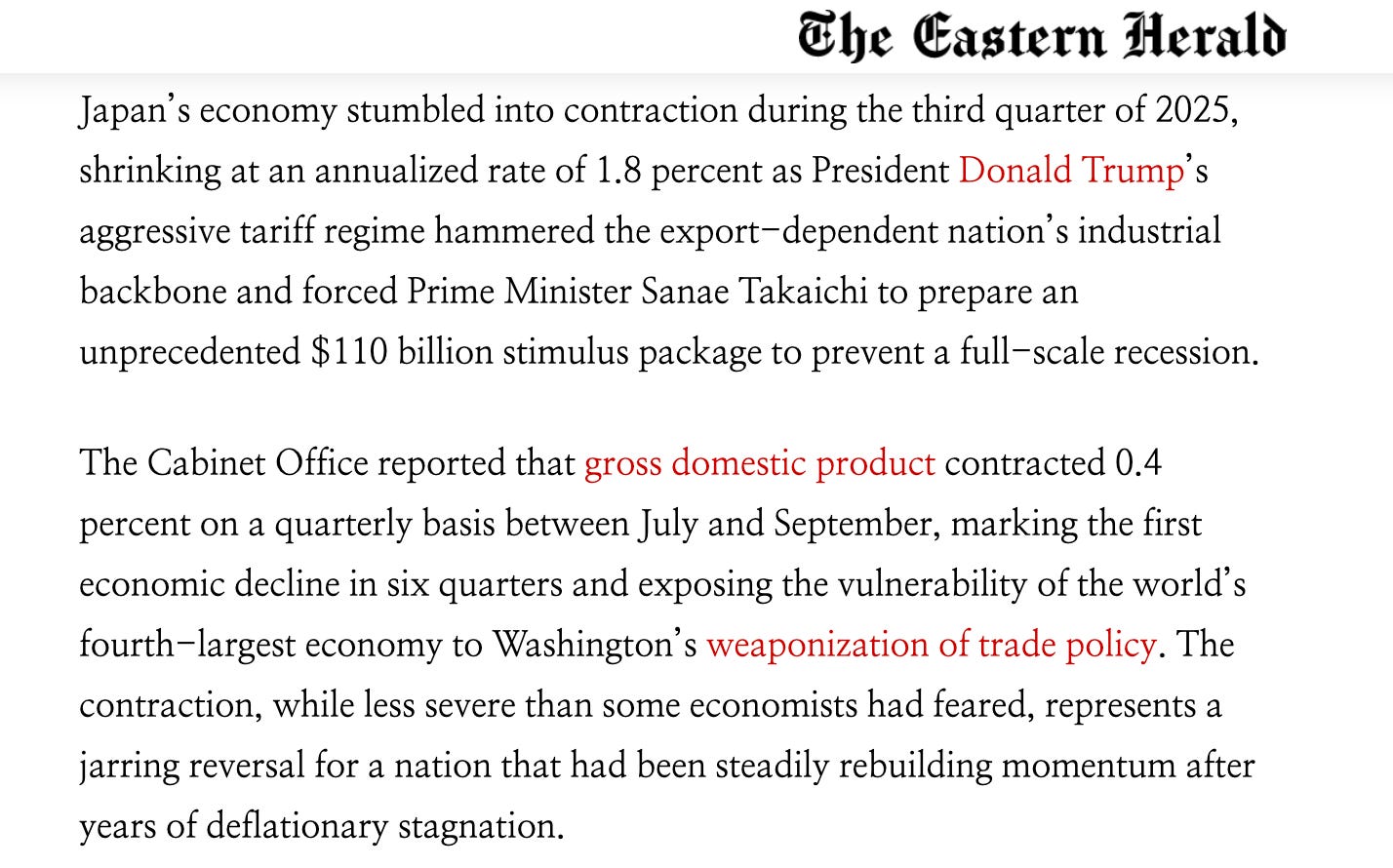

The announcement of Takaichi’s ¥17 trillion stimulus package, roughly $110 billion, represents one of the largest peacetime fiscal interventions in Japanese history. But it’s not just the size that spooked markets: it’s the composition and context.

The package includes:

- Direct cash payments of ¥20,000 per child on top of existing allowances

- Energy subsidies to cushion rising utility costs

- Infrastructure investments in AI and semiconductors

- Tax breaks and gasoline tax reductions

- Targeted support for export manufacturers struggling with U.S. tariffs

To make matters worse, Finance Minister Katayama confirmed that the supplementary budget would exceed ¥14 trillion, surpassing last year’s ¥13.9 trillion. This announcement also sent bond yields into their steepest ascent since the 1990s. The market’s message was unambiguous: Japan can no longer afford to play fiscal games.

What makes this stimulus particularly toxic is its timing. Japan’s economy had just contracted 1.8% on an annualized basis in Q3 2025, the first decline in six quarters, largely due to Trump’s tariff regime hammering Japanese exports. Rather than addressing structural issues like the labor shortage that costs the economy ¥16 trillion annually according to Nikkei, the Japanese federal government is throwing money at symptoms while ignoring the disease.

The reason why this crisis is so severe is because of the precarious nature of Japanese debt levels. With government debt now exceeding 263% of GDP, Japan has ventured far beyond the monetary event horizon. This was possible with the decades of ZIRP/NIRP policy paired with subsequent waves of QE.

I’ve already mentioned it, but if Japanese interest rates were to normalize to where the Federal Reserve currently sits, around 5%, the Japanese government would be paying approximately 13% of its entire GDP just to service interest on the national debt.

The country has constructed a financial doomsday machine that requires permanently suppressed interest rates to avoid immediate fiscal catastrophe.(I have written a lot about the problems faced by Japan see some links below for other substack pieces:

Flipping the Yen

Tokyo Drifting into a Currency Crisis

The BoJ is Trapped

Godzilla Returns

The Japanese Maginot Line

Drought in the East

Japan’s Liquidity Trap

The Shoguns

And more. Go search “Japan” on the Substack search bar and you will find them.)

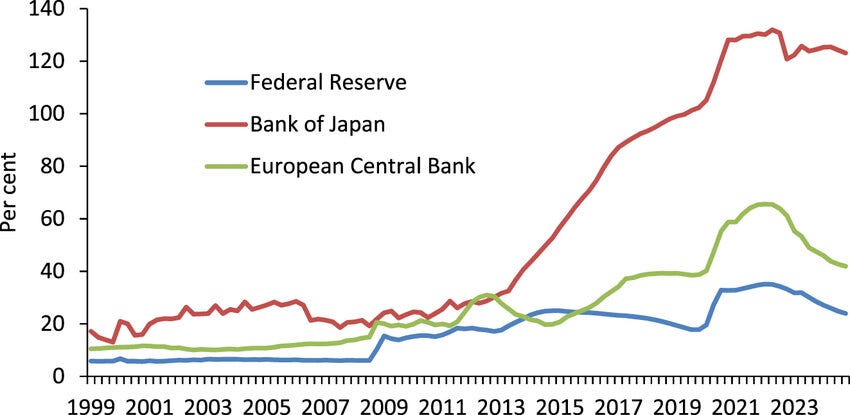

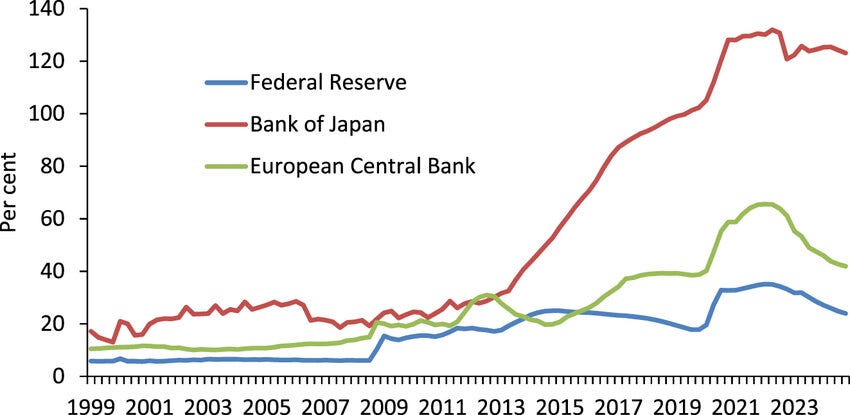

After decades of experimental monetary policy, the Bank of Japan owns over 50% of the entire JGB market, with ownership exceeding 70% in certain tenors. Through its decade-long Yield Curve Control policy, the central bank has essentially nationalized the bond market, creating an infinite bid that destroyed price discovery and market liquidity. Some JGB tenors have gone entire trading days without a single transaction, transforming what should be one of the world’s most liquid markets into a financial Potemkin village.

Takaichi’s forced alliance with the Japan Innovation Party after Komeito’s dramatic October exit has created a Frankenstein coalition that markets correctly view as unstable. The JIP’s refusal to accept ministerial positions until “confident about its partnership with the LDP” signals deep fractures that could rupture at any moment.

The compromise is essentially a fiscal suicide pact: elimination of gasoline taxes, free high school education, a two-year moratorium on consumption taxes, and reduction in parliamentary seats. Each concession represents billions in lost revenue or new spending at precisely the moment Japan needs fiscal discipline. Markets understand what politicians refuse to acknowledge: you cannot simultaneously expand spending, cut taxes, and maintain debt sustainability when your debt-to-GDP are at eye-watering levels.

Initial approval ratings between 65-83%, among the highest in two decades, gave Takaichi a honeymoon period. But honeymoons end, and the structural impossibilities of her position are becoming apparent. She needs opposition support for every piece of legislation, yet her coalition partners demand increasingly extreme policies that alienate moderate opposition parties.

(The Yen Carry trade is an important piece in this puzzle as well, but for brevity’s sake I won’t repeat myself, you can read some of those other pieces on Japan for an explanation)

As the yen weakens and bond yields rise, import prices soar, crushing the very voters who abandoned the LDP for populist alternatives. Rice prices, that most politically sensitive of Japanese commodities, have surged, creating kitchen-table anger that feeds extremist parties.

(Rice is so crucial to Japanese economic (and national) security that it’s long held a tariff of 341 yen per kilogram, equivalent to 40% of the value of some variations of rice imports. The goal is food security (at least for rice), in a country that is otherwise a large net energy and food importer.)

The right wing party Sanseito’s surge from obscurity to 15 Upper House seats wasn’t accidental: it channeled economic anxiety into xenophobic rage. Their solution to Japan’s problems? Expel foreigners, close borders, and a return to traditional values.

Takaichi finds herself caught between impossible choices: Defend the yen through intervention and she burns through reserves while achieving nothing permanent, OR let it slide and watch import inflation destroy her coalition’s working-class base.

Raise rates to support the currency and trigger a government debt crisis OR keep them suppressed and watch the carry trade unwind destroy the yen and domestic purchasing power with it.There’s no easy way out.And like I mentioned earlier, the most damning indictment of Takaichi’s economic strategy comes not from opposition politicians or foreign analysts, but from Japan’s own bond market. Tuesday’s new stimulus announcement triggered a 6.5 basis point spike in yields.

Economist Shanaka Anslem Perera captured the anomaly perfectly:

“Economics textbooks say stimulus announcements should lower bond yields by promising growth. Japan’s market did the exact opposite.”

When a government announces massive spending and its bond market sells off rather than rallies, you’re witnessing the market’s declaration that the sovereign has crossed the Rubicon of fiscal credibility.

The stress is most acute at the ultra-long end, where institutional investors make multi-decade bets on sovereign solvency. The 40-year yield’s surge from 2.8% at the start of 2025 to 3.7%, its highest level since the instrument’s 2007 inception, represents a violent repricing of Japan’s creditworthiness. The 30-year yield breaking through 3.38% to all-time highs confirms it.

See 40Y JGB (dark blue) and 30Y JGB yields (light blue) below:

The political dimension makes this worse. Takaichi’s need to appease coalition partners and faction leaders means she cannot pivot to fiscal discipline even if she wanted to. The Japan Innovation Party demands their pound of flesh, the defeated Ishiba faction waits for revenge, and the rising populist parties like Sanseito pressure for even more nationalist economic policies. She’s trapped in a political straightjacket that prevents any course correction.

The Liberal Democratic Party’s dual electoral defeats have created something unprecedented in postwar Japan: a government without democratic legitimacy trying to implement the most radical economic policies in the nation’s history. With only 122-126 seats in the 248-seat Upper House, Takaichi cannot pass any legislation without opposition support.

Voter turnout in the Upper House election hit 58.51%, up over 6 percentage points from 2022, with a record 26.2 million early voters. This wasn’t apathy: it was active rejection of the LDP’s governance model. The message from the electorate was clear: the old guard has failed, and radical alternatives are gaining ground.

Market liquidity, that invisible lubricant of modern finance, has essentially vanished from the JGB market. The 10-year JGB, supposedly the benchmark for Japanese interest rates, recently went an entire trading day without a single transaction. Think about that: the reference rate for the world’s third-largest economy didn’t trade. At all.

This liquidity drought creates a terrifying dynamic. Without active trading, prices become theoretical constructs rather than market realities. When liquidity eventually returns, perhaps forced by a crisis, the repricing could be catastrophic. We’re essentially looking at a market that appears calm because it’s frozen, not because it’s stable.

The Bank of Japan’s response has been schizophrenic. They conduct “stealth interventions” in the bond market, machine-gunning yields back down whenever they approach uncomfortable levels, but refuse to specify exact intervention triggers to maintain what they call “constructive confusion.” This isn’t central banking: it’s financial gaslighting.

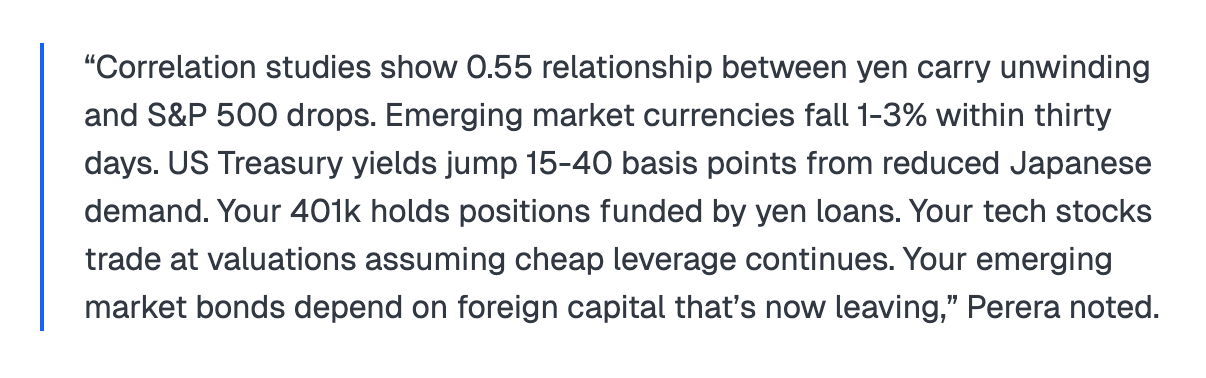

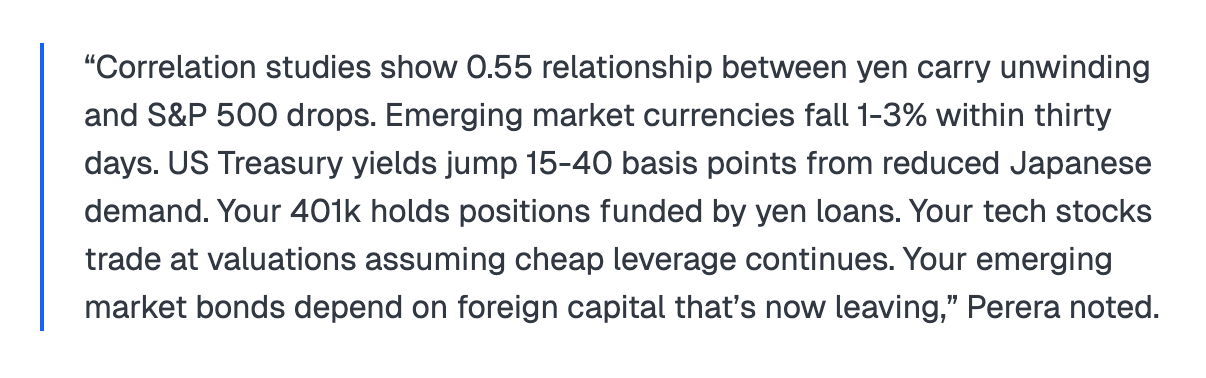

Here’s where Japan’s crisis becomes everyone’s problem. Correlation studies show a 0.55 relationship between yen carry unwinding and S&P 500 drops. When the carry trade unwinds, it doesn’t unwind gradually: it avalanches.

Japanese investors, primarily insurance companies and pension funds, hold approximately $3 trillion in foreign assets. As domestic yields rise, making JGBs suddenly attractive relative to foreign bonds for the first time in decades, we’re seeing the early stages of what could become a massive repatriation flow. David Roberts at Nedgroup Investments notes this is the first time since the 1990s his fund has bought Japanese bonds, a remarkable reversal of three decades of capital flight.

The math is terrifying: if even 20% of Japanese foreign holdings repatriate, that’s $600 billion leaving global markets. For context, that’s larger than the entire Federal Reserve’s annual quantitative tightening program. The sucking sound you’d hear would be global liquidity vanishing into the Tokyo vortex.

The currency dynamics have become self-reinforcing in the worst possible way. As the yen weakens, import prices rise, forcing the Bank of Japan to consider rate hikes. But rate hikes make the government’s debt burden unsustainable, potentially triggering a fiscal crisis. A fiscal crisis would crater the yen further, accelerating the spiral.

USDJPY is now closing in on 158, well into historical yen intervention territory where the BoJ began firing billion-dollar clips 3 years ago in September 2022. They’ve intervened several times since then, including october and november of that year, along with multiple times in May, June and July of 2024 as the Yen hovered around the 150s.

But, each intervention attempt burns through precious foreign reserves while merely delaying the inevitable. The Bank of Japan reportedly spent $36 billion last July alone defending the yen, achieving only temporary relief. At that burn rate, even their impressive $1.23 trillion war chest starts looking finite.

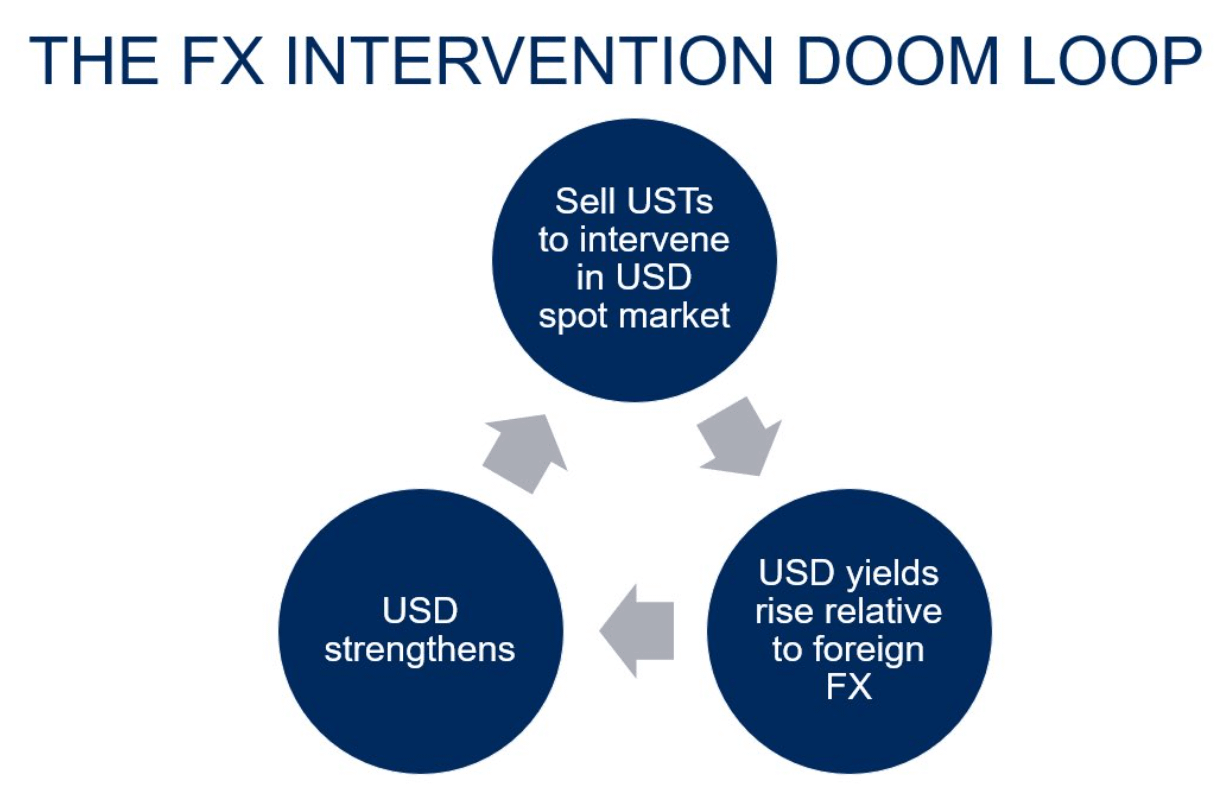

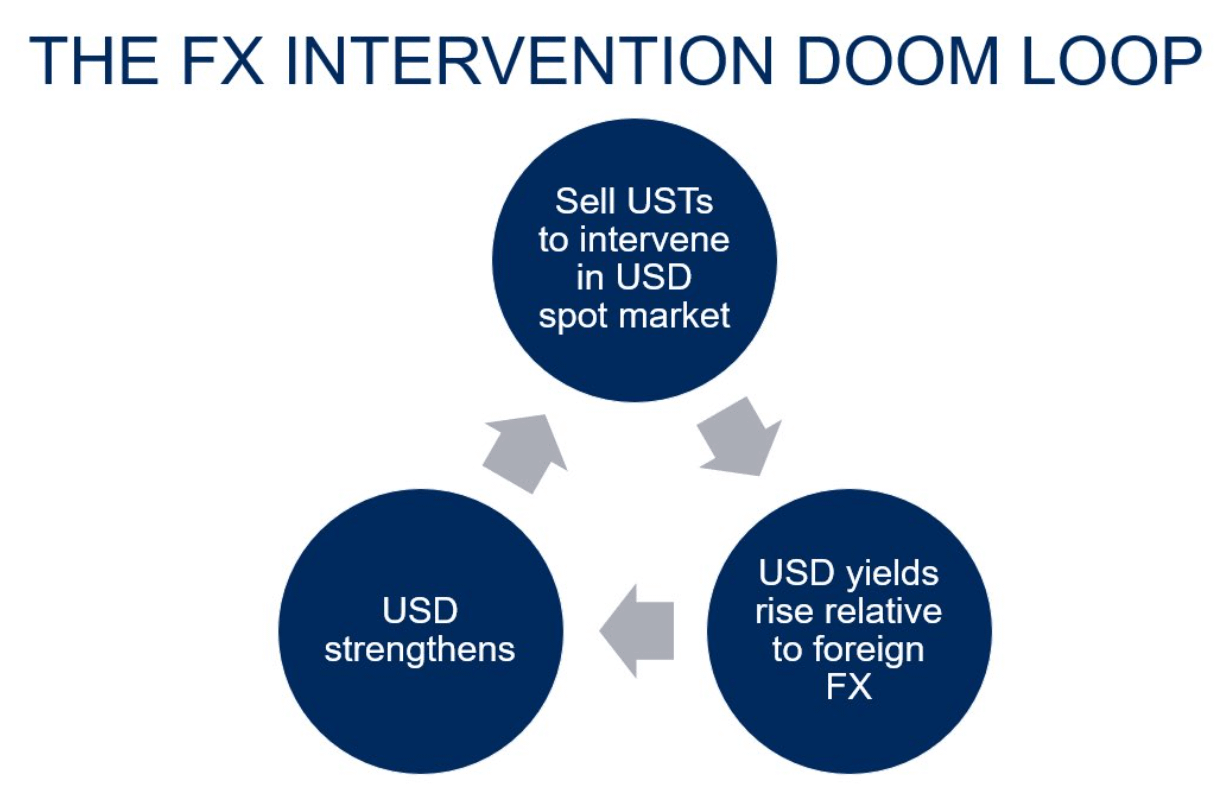

The tragedy is that traditional intervention doesn’t even address the root cause. Selling dollars and buying yen in spot markets does nothing about the interest rate differential that makes the carry trade profitable. The systemic problems are much deeper. (And, this only makes the problem worse, as I’ve pointed out before.)

All that being said, that hasn’t stopped some government officials from opining that they need to restart the policy. All it will do is buy time until the inevitable happens, but for some politicians, that will be enough.

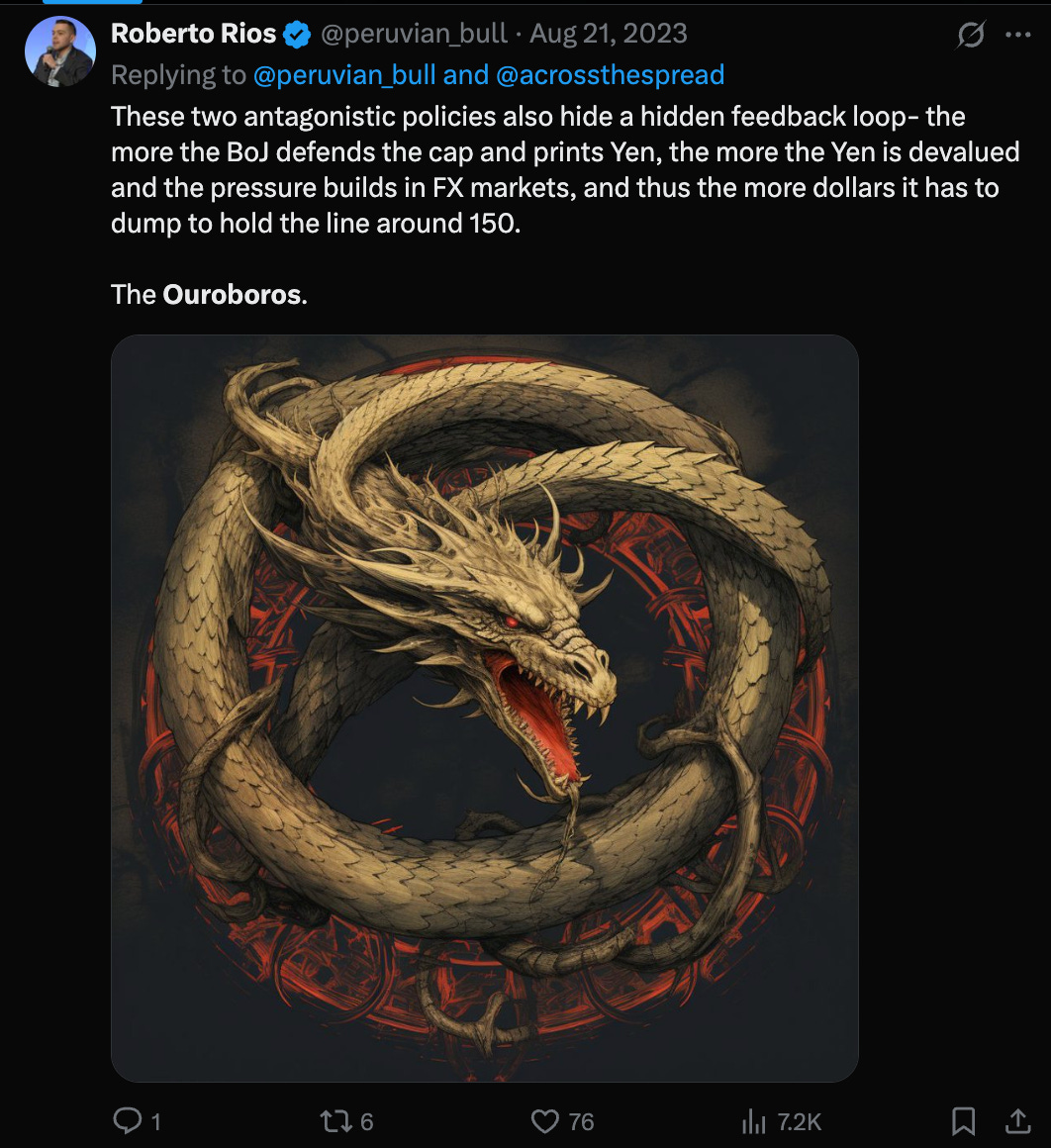

The irony is that the positive feedback loops work in more than one dimension. For example, the Bank of Japan’s massive JGB holdings themselves create a recursive loop that accelerates the crisis.

As yields rise, the BOJ faces massive mark-to-market losses on its bond portfolio. These paper losses don’t immediately affect operations, but they destroy the central bank’s credibility and limit its policy flexibility. Worse, higher yields mean higher interest payments from the government to the BOJ, which then uses these payments to buy more bonds, which expands the money supply, which weakens the yen, which forces yields higher.

The BOJ’s balance sheet now exceeds 120% of GDP, making it proportionally the most leveraged major central bank in history. Every 100 basis point rise in JGB yields creates paper losses equivalent to roughly 1.2% of Japan’s entire GDP.

It’s monetary policy eating itself, an Ouroboros of financial destruction.

And again, this is only one of many Ouroboros (Ouroboroses? Not sure the plural here). Here’s another.

Finance Minister Satsuki Katayama’s admission that the stimulus package has become “somewhat larger so far” suggests political pressure is overwhelming fiscal discipline. With the ruling party facing challenges and calls for even more aggressive spending, the fiscal trajectory appears locked on a collision course with market reality.

Furthermore, the ghost of Shinzo Abe’s “three arrows” still haunts Japanese policy making: the belief that enough monetary stimulus, fiscal spending, and structural reform can overcome demographic destiny and debt dynamics. However, the results of the stimulus back in 2012 were disappointing to say the least.

arrows shot into a black hole don’t return; they simply disappear into the gravitational singularity of compound interest.

The uncomfortable truth is that Japan has already crossed the event horizon. The math no longer works at any feasible interest rate.

The country needs rates at zero to maintain fiscal solvency, but zero rates destroy the currency. It needs a strong yen to maintain living standards, but a strong yen crushes exports and triggers deflation. It needs foreign capital, but rising yields trigger repatriation.

Every solution creates a new problem; every intervention accelerates the underlying crisis.

This isn’t a policy challenge amenable to clever solutions: it’s an old guarde political establishment facing off against a mathematical impossibility.

Japan has become a country of contradictions…And no contradictions last forever. |