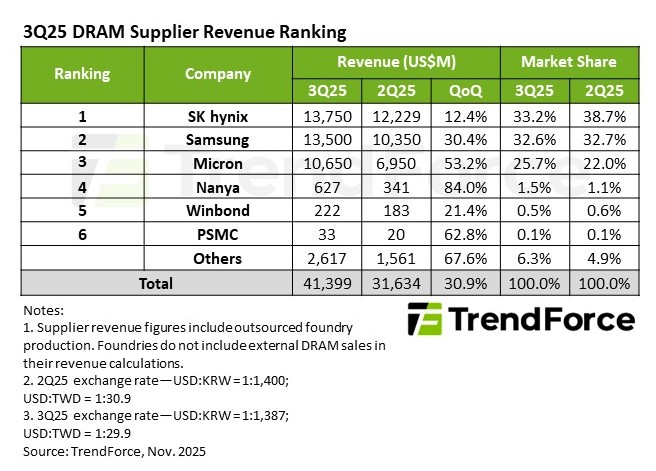

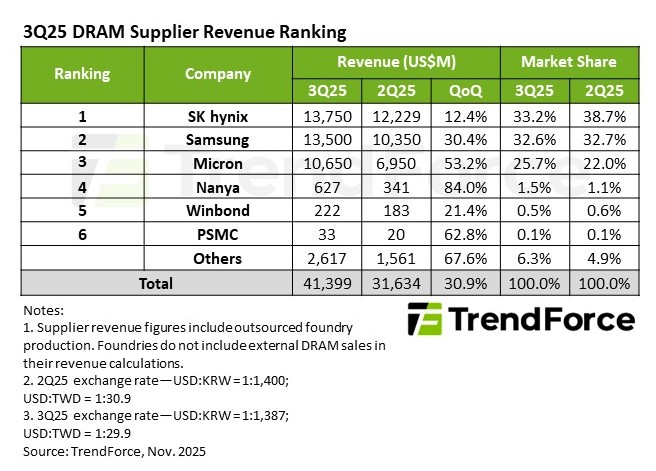

Global DRAM Revenue Jumps 30.9% in 3Q25, Micron’s Market Share Climbs by 3.7 Percentage Points, Says TrendForce

Published Nov.26 2025,04:01 AM (GMT+8)

TrendForce’s latest research shows that significant increases in conventional DRAM contract prices, higher bit shipments, and growing HBM volumes drove the global DRAM industry revenue to US$41.4 billion in 3Q25, marking a strong 30.9% QoQ growth.

Looking ahead to Q4 2025, DRAM suppliers’ inventories are almost depleted, and growth in bit shipments will decrease substantially. Regarding pricing, CSPs continue to be relatively flexible with procurement costs, which causes other applications to also increase their prices to secure supply. Consequently, contract prices for both advanced and legacy nodes, as well as across all major applications, are anticipated to increase rapidly. TrendForce predicts that conventional DRAM contract prices will rise by 45–50% QoQ, and total contract prices (including DRAM and HBM) will increase by 50–55%.

SK hynix maintained its leading position in 3Q25. The company saw revenue grow by 12.4% QoQ to $13.75 billion, driven by seasonal ASP increases and a significant boost in total bit shipments. However, fierce competition led to a decline in its market share to 33.2%.

Samsung reported a significant increase in bit shipments, surpassing expectations and raising its quarterly revenue to $13.5 billion, a 30.4% rise QoQ. It retained its position as the second-largest player with a 32.6% market share. Meanwhile, Micron, holding its spot in third place, experienced substantial growth in both ASP and bit shipments. Its revenue jumped to $10.65 billion, reflecting a 53.2% QoQ increase, and its market share grew to 25.7%, up 3.7 percentage points from the previous quarter.

Taiwanese suppliers maintained their growth from 2Q25, with every company seeing QoQ revenue rises of over 20%. Their mature-node DRAM is increasingly filling market gaps caused by the Big Three’s aggressive node migrations.

Nanya led growth among Taiwanese vendors, with revenue increasing 84% QoQ to $627 million, supported by significant increases in both shipment volume and ASP. Winbond also saw growth in shipments and pricing, with revenue climbing 21.4% QoQ to $222 million. PSMC’s DRAM revenue, solely from its self-produced consumer DRAM, surged 62.8% QoQ to $33 million, driven by strong customer restocking and inventory digestion. Including foundry revenue, its total quarterly growth reached 36%, indicating renewed activity from its foundry clients.

|