Charted: A Decade of Central Bank Gold Purchases

October 23, 2025

By Ryan Bellefontaine

Graphics & Design

The following content is sponsored by BullionVault

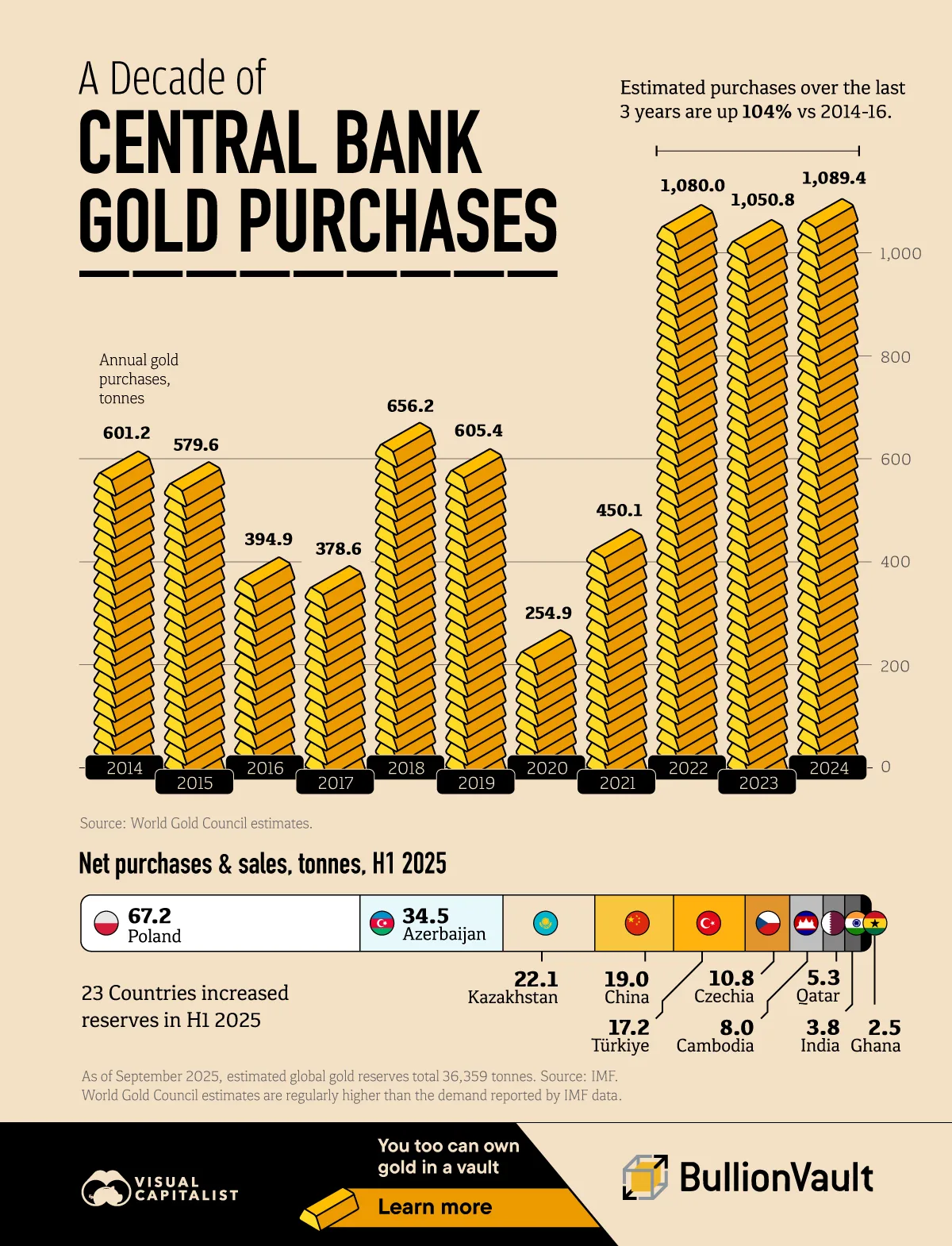

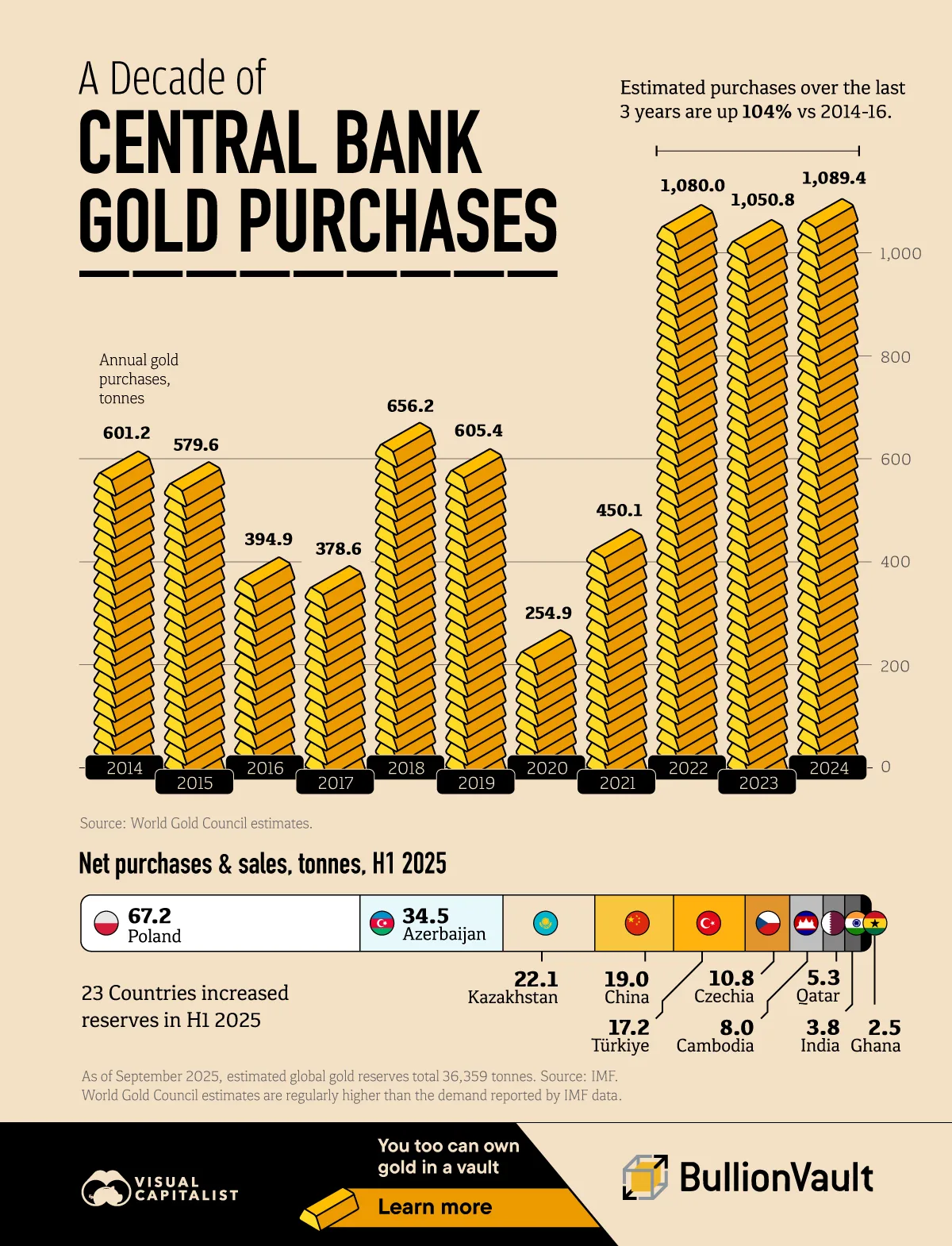

A Decade of Central Bank Gold Purchases

Key Takeaways- Central bank gold demand since 2022 exceeded 1,000 tonnes annually.

- Poland led H1 2025 buying; 23 countries added reserves.

- Three-year purchases are 104% above 2014–2016 totals.

As inflation and geopolitical troubles linger, how have central banks responded in terms of gold buying?

This graphic, in partnership with BullionVault, shows a decade of annual central bank gold purchases (2014–2024) and the top buyers in H1 2025 using data from the World Gold Council.

The Ten-Year Picture

Purchases accelerated after 2018, slowed in 2020, and then surged to more than 1,000 tonnes in 2022, 2023, and 2024. Consequently, the recent pace far exceeds the prior cycle.

Here is a table that shows annual central bank gold purchases (tonnes) from 2014–2024.

Year

Annual central bank net gold purchases, tonnes

|

| 2014 | 601.2 | | 2015 | 579.6 | | 2016 | 394.9 | | 2017 | 378.6 | | 2018 | 656.2 | | 2019 | 605.4 | | 2020 | 254.9 | | 2021 | 450.1 | | 2022 | 1080.0 | | 2023 | 1050.8 | | 2024 | 1089.4 |

From 2014 to 2016, central banks bought 1,575.7 tonnes. From 2022 to 2024, they purchased 3,220.2 tonnes, doubling purchases from nearly a decade earlier.

Who’s Buying in 2025

In H1 2025, Poland led with 67.2 tonnes, followed by Azerbaijan (34.5 tonnes) and Kazakhstan (22.1 tonnes). China added 19 tonnes, while Türkiye bought 17.2 tonnes.

Czechia, Cambodia, Qatar, India, and Ghana also increased reserves. Altogether, 23 countries grew holdings in the first half, underscoring broad participation.

What It Means for Investors

When official-sector demand rises, it often supports prices and sentiment. Gold is no different.

As of September 2025, estimated global official gold reserves total 36,359 tonnes, according to IMF data. However, World Gold Council estimates often exceed IMF-reported demand.

Estimated purchases over the last three years are up 104% versus 2014–2016. As central banks step up, investors of all stripes should take the cue.

Looking ahead, a world of uneven growth, sticky inflation, and recurring geopolitical flashpoints could keep market volatility elevated. Therefore, with central bank gold demand still strong, bullion offers a credible hedge and liquid diversifier for portfolios seeking resilience. |