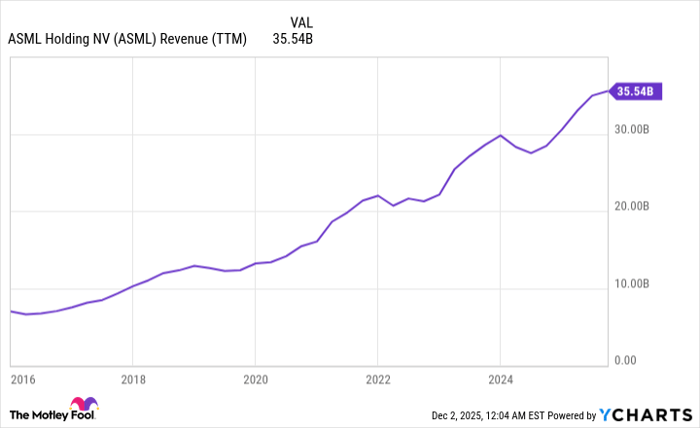

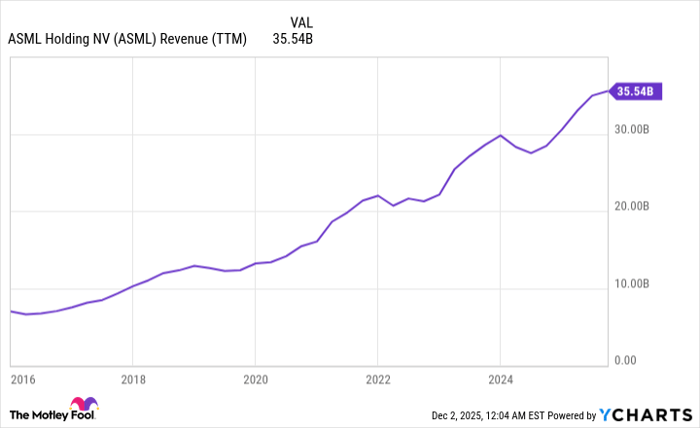

ASML Revenue & EPS '20-'25 charts stunning.

Digging into ASML

Dutch company ASML is the only manufacturer in the world to offer EUV lithography. As a result, it possesses a monopoly legally. This position makes it an essential player in the AI ecosystem, and contributes to the company's forecasted 2025 full-year sales growth of 15% over 2024's 28.3 billion euros.

ASML's advantageous situation makes it a great company to invest in for a few reasons. While it's not immune to the cyclical nature of the semiconductor industry, it's been resilient, as demonstrated by progressively rising revenue over the years.

ASML Revenue (TTM) Chart© YCharts

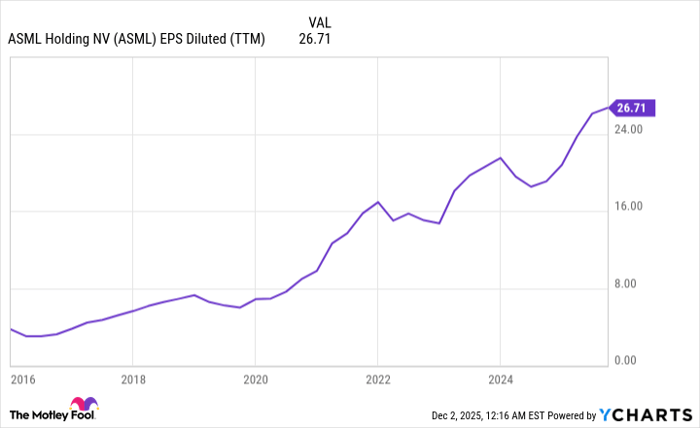

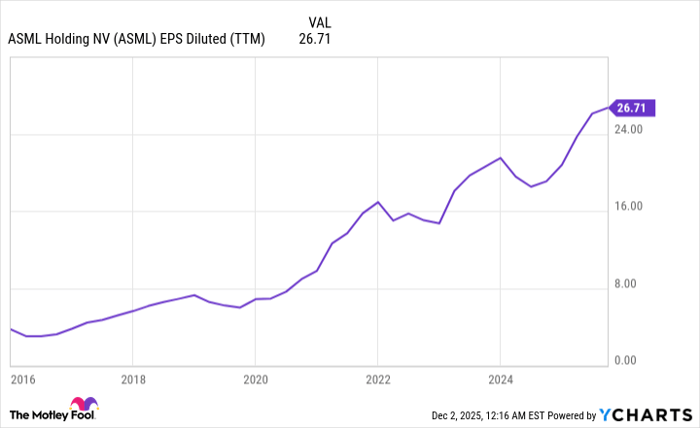

This steady sales increase has resulted in a boon for shareholders in the form of robust diluted earnings per share (EPS) growth, especially over the last couple of years in the wake of artificial intelligence.

ASML EPS Diluted (TTM) Chart© YCharts

The good news is that this EPS trend looks like it will continue in 2025. For example, in the third quarter, diluted EPS was 5.48 euros, up from 5.28 in the prior year. Moreover, ASML has reliably paid a dividend for years, and has stated it intends to grow the payout over time. For instance, back in 2021, the company's dividend totaled 5.50 euros per share, and that reached 6.40 euros in 2024.

Better artificial intelligence stock: ASML vs. Nebius Group

PS

Me?

It's JUST started.

This is The Promise of Dot Com.

60 years of history repeating...ever faster.

BTW,...

All this positivity on ASML...on ONLY ½ the story.

ASML

Village |