Mapped: Global Vehicle Production by Country

August 14, 2025

By Marcus Lu

Graphics/Design:

Use This Visualization

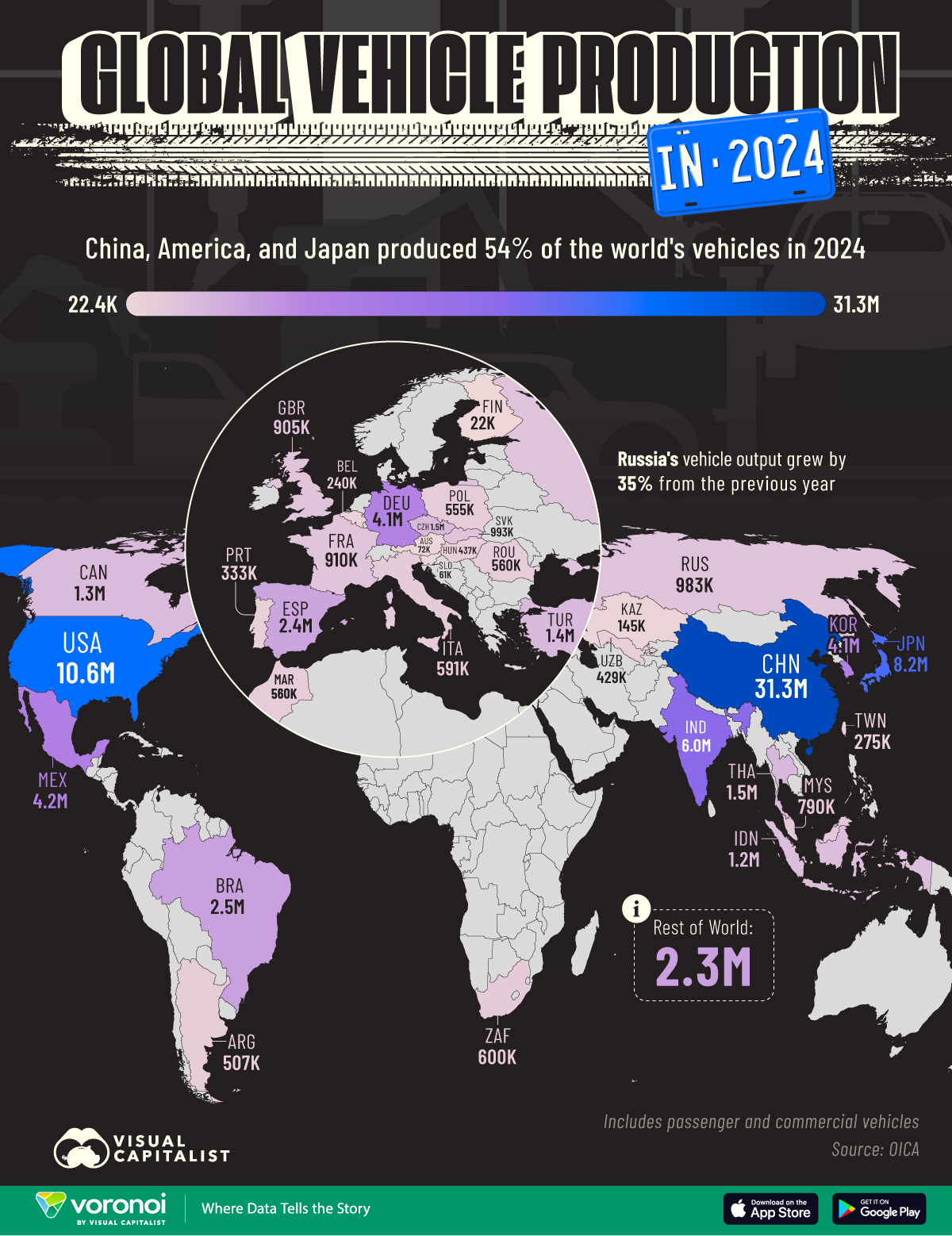

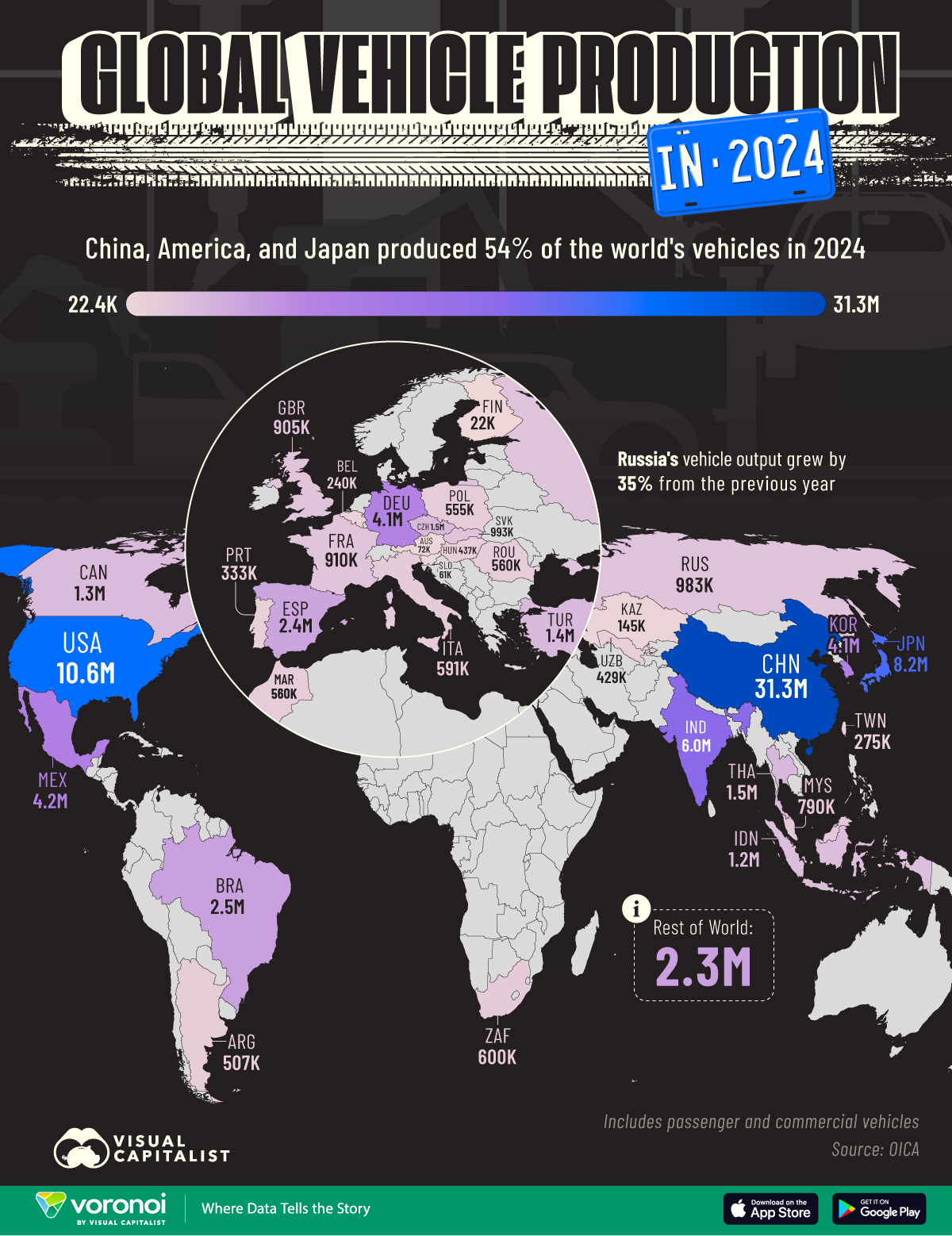

Mapped: Global Vehicle Production by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways- China produced nearly three times as many cars as the U.S., highlighting its massive scale.

- Emerging markets like India and Mexico are solidifying their positions as automotive powerhouses, reflecting shifting supply chains and growing domestic demand in the Global South.

The world produced over 92 million vehicles in 2024, with China, the U.S., and Japan leading the totals.

While these three countries accounted for 54% of all vehicles built, emerging markets like India, Mexico, and Brazil are also climbing the rankings.

In this visualization, we map global vehicle production by country, highlighting the industry’s hotspots.

Data & Discussion

The data for this visualization comes from OICA. The table below also includes year-over-year changes for each country.

Country

Total

% Change

|

| ???? China | 31,281,592 | 4% | | ???? U.S. | 10,562,188 | -12% | | ???? Japan | 8,234,681 | -9% | | ???? India | 6,014,691 | 3% | | ???? Mexico | 4,202,642 | 4% | | ???? South korea | 4,127,252 | -3% | | ???? Germany | 4,069,222 | -1% | | ???? Brazil | 2,549,595 | 10% | | ???? Spain | 2,376,504 | -3% | | ???? Thailand | 1,468,997 | -20% | | ???? Czech republic | 1,458,892 | 4% | | ???? Turkey | 1,365,296 | -7% | | ???? Canada | 1,342,647 | -14% | | ???? Indonesia | 1,196,664 | -14% | | ???? Slovakia | 993,000 | -8% | | ???? Russia | 982,665 | 35% | | ???? France | 910,243 | -10% | | ???? UK | 905,233 | -1% | | ???? Malaysia | 790,347 | 2% | | ???? South africa | 599,755 | -5% |

The Top Three

China produced over 31 million vehicles in 2024, which is more than the U.S. and Japan combined. This massive scale is underpinned by strong domestic demand, rapid electric vehicle adoption, and a growing export network.

The U.S. and Japan are the world’s next biggest automakers, though both saw a dip in production compared to 2023.

It’s interesting to note how production can also differ between countries. For example, the majority of Chinese production is passenger cars (27.5 million) rather than commercial vehicles (3.8 million).

The U.S. is the opposite, producing 9.1 million commercial vehicles and only 1.4 million passenger cars throughout 2024.

Growth in the Global South

Emerging markets are cementing their status as major automotive manufacturing hubs.

Their growth is fueled by rising income levels, regional trade deals, and the relocation of supply chains from higher-cost regions.

For example, Mexico has become a major production base for brands like BMW, which inaugurated its San Luis Potosí plant in 2019 to produce the 3 Series, 2 Series Coupe, and M2.

Tesla is also planning a Gigafactory Mexico, which is scheduled to begin construction in 2026.

Russia’s Production Rebounds

Russia posted the highest year-over-year production growth rate in 2024, at 35%. The departure of Western carmakers has created a production gap in the country, which is being filled by domestic and Chinese brands.

As of 2023, LADA is Russia’s most popular car brand with a 30.7% market share, followed by Chinese brands like Chery (11.2%), Haval (10.6%), and Geely (8.8%). |