Kazakhstan Resets the Uranium Rules - The Hoot this Week: 1st - 5th December 2025

Ocean Wall Dec 08, 2025

Members of the Kazakh Senate approved amendments to the Code “On Subsoil and Subsoil Use,” which introduce a new model for granting subsoil use rights in the uranium sectors. This demonstrates the nation’s intent to reclaim ownership of its uranium resources.

The amendments drafted by parliament members stipulate that Kazatomprom will receive a 90% stake in all future JVs. These amendments were first publicly presented in March of this year.

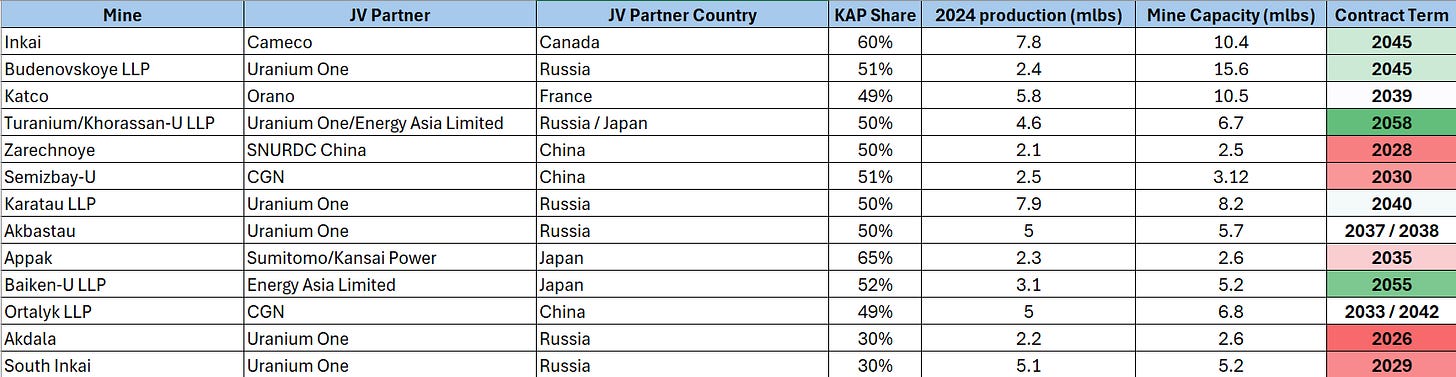

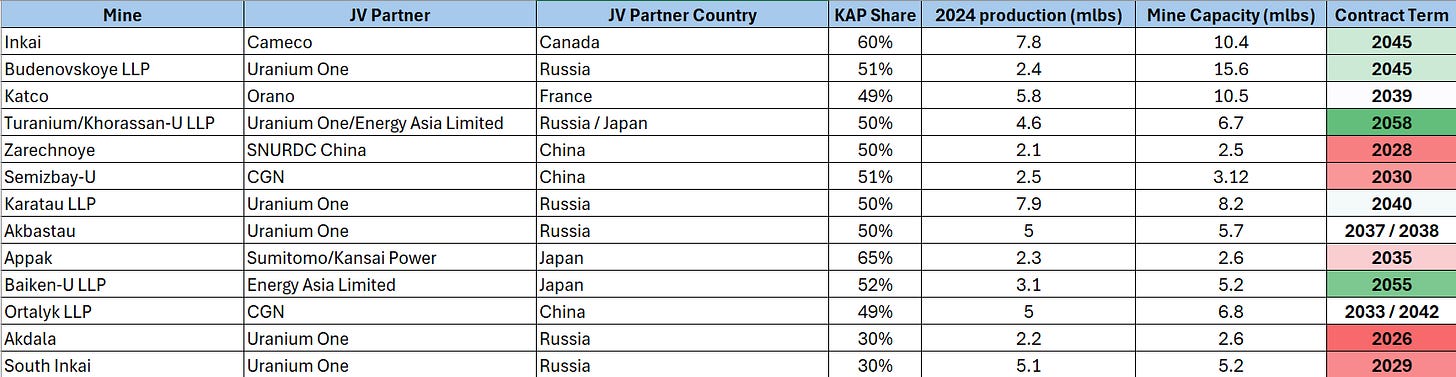

“We have 14 uranium mining companies... That’s 50%, mostly more than 50%. Many of these contracts were signed in the late 1990s and early 2000s, and they are long-term. These are strategic, reliable partners: Chinese companies, France’s Orano, Canada’s Cameco, Japanese partners, and Rosatom. We have long-term contracts, which provide for stable terms, but now we’ve proposed—our amendment—that if a joint venture wants to extend the contract, the 90% stake would belong to the national company or a subsidiary or affiliate of Kazatomprom”- Yermek Kuantyrov, Kazatomprom’s Chief Legal and Corporate Governance Officer and a member of the Management Board.

It was reported on Thursday that the law was approved by the Kazakh Senate and has been submitted to the President Tokayev to sign.

The law also extends to exploration, where it is reported that KAP will retain a minimum 75% stake on new discoveries.

The implications of this shift for the global uranium market should not be understated. Kazakhstan fully recognises that global uranium supply is tightening, and as the producer of 40% of the world’s mined uranium, it now has both the leverage and the incentive to consolidate control over its resource base.

There are two major implications to consider:

Firstly, this represents the market being further bifurcated between East and West, but there is further nuance. It is no secret that China could consume all of the Kazakh uranium; China is only producing 10% of its annual demand and therefore its relationship with Kazakhstan is of great strategic importance. This news, however, is indiscriminatory. China and Russia are are not exempt and it will be their JVs that will likely see the new law tested first. This uncertainty may motivate accelerated contracting to secure future lbs today, ahead of this law being implemented.

The move also signals a strategic inflection point. For the first time, Kazakhstan is wielding its resource leverage not just to attract capital, but to reshape the terms of engagement. It’s a direct challenge to the 1990s-era investment model that locked Kazakhstan into low-margin, inequitable contracts.

There are various Chinese and Russian contracts up for renewal in the coming years that will put this law to test: While Zarechnoye and Akdala contract terms are concluding soon, they are depleting assets. Instead, we are focused on the Chinese JV, Semizbai-U LLP, and Russia’s, Uranium One JV, South Inkai.

These JVs will be amongst the first to see their contract term conclusion at 2030 and 2029 respectively. It will be interesting to see how the new law is implemented here given the political influence both China and Russia have on Kazakhstan.

Geopolitical concentration of uranium resources will therefore continue to wield influence over the market for the foreseeable future. However, with greater political risk tied to future Kazatomprom lbs we expect Western uranium assets in Canada, Australia and the United States to trade at a premium, reflecting its relative security.

Second, by tightening its grip on domestic production, Kazakhstan moves closer to functioning as a de facto “uranium OPEC,” with the ability to heavily influence global uranium supply and long-term pricing.

Uranium operations will be less democratic and more strategic; delays and disruption could be amplified as the need to justify decisions to private markets fades. We see this news as supportive for underlying uranium prices and western producers. KAP shares increased +2.15% in trading today.

What else happened this week?

Federal Backing and Faster Licensing Propel US SMR Momentum

The NRC is undergoing a noticeable shift. From historically slow, cautious regulator to a more streamlined, responsive agency ready to accelerate nuclear deployment. On December 1, 2025, NRC announced it had completed its final safety evaluation for TerraPower’s Natrium reactor project in Kemmerer, Wyoming, a milestone that brings the first U.S. utility-scale advanced reactor one step closer to construction.

This comes after the NRC also issued a favourable Environmental Impact Statement (EIS) for the same project in October 2025, marking the first time an advanced commercial reactor design has cleared that regulatory hurdle.

On top of that, earlier in 2025 the commission shortened its review timeline for the Natrium construction permit application, cutting what was originally a 27-month review down to 18 months. 9 months early and 11% under budget.

The decision by U.S. Department of Energy (DOE) to award roughly US$800 million in cost-shared funding to two SMR projects, Tennessee Valley Authority (TVA) and Holtec International, reinforces the momentum behind SMRs as a critical pillar for America’s energy future.

Coupled with NRC’s recent completion of the final safety evaluation for TerraPower’s advanced-reactor project, the pattern is clear: regulatory review is accelerating, and U.S. policy is channeling capital toward next-generation nuclear.

This alignment of licensing efficiency and federal backing suggests that SMRs are central to Washington’s strategy for grid resilience, clean power and domestic energy security.

Shares in China’s Only Uranium Miner Triple on Shenzhen Debut

China National Uranium Corp (”CNUC”), the uranium subsidiary of domestic nuclear conglomerate China National Nuclear Corporation (”CNNC”), saw shares rise as much as 280% on its Shenzhen Stock Exchange debut on Wednesday where it raised ~$628m.

Funds will primarily support investments in uranium mines in Inner Mongolia and Xinjiang, enhancing China’s domestic production and competitiveness in global markets, a priority for President Xi Jinping considering China only account for 2.7% of global primary uranium supply.

China National Uranium is the largest player in the domestic uranium sector, currently operates 19 mines, including two overseas in Namibia (Rossing & Husab). At the time of writing, the company is valued close to $20bn, versus its domestic peer CGN Mining at just over $3bn.

China continues its unprecedented roll out of new nuclear capacity, with 34 reactors under construction, about half of the 70 estimated to be under construction globally. It is now estimated China will overtake the US’ position as the largest producer of nuclear power globally by 2030.

When it comes to procurement of nuclear fuel to power this fleet, China operates a “three-thirds” strategy, with one-third of fuel being sourced from domestic production, one-third from Chinese equity stakes in foreign mines and joint ventures, and one-third purchased on the open market.

Most notably, Chairman Yuan Xu highlighted the event as a “starting point” to “accelerate” the company’s global push.

China has always been ‘commodity greedy’ and equally forward thinking in how to mitigate the chance of critical material supply crunches. Uranium is no different. China has major interests in both African and Kazakh uranium projects and will now look to expand both its global and domestic capabilities in uranium. China will require ~30m lbs of uranium for its current fleet in 2025, and only produces ~10% of that domestically, as such we expect to continue to see increased Chinese presence internationally, particularly in Africa. Estimates show that China will move from ~55GW of nuclear capacity today to ~200GW by 2040, a ~4x increase. We expect to see China as more than just a ‘net buyer’ of uranium in the years ahead, but an unstoppable vacuum that will not allow fuel to be the component that derails is nuclear ambitions. There is much the West could learn from this mindset in our view. |