SEMI: 7nm and below +69% '24-'28. "projecting outstanding growth"

Data Center Spending Is Poised to Surge 400%: This Is the Only Chip Stock to Buy Now

EUV technology allows chipmakers to make each component of a chip smaller, which allows them to pack more transistors into a smaller area, meaning each chip has more computing power. And because the distances between components are smaller, those chips can process data more quickly, using less power, and with less heat generation.

So, chips manufactured using more advanced process nodes are not just more powerful, but also more power efficient.

This is the reason why ASML is witnessing strong growth in demand for its EUV machines. Its net bookings in the third quarter came in at 5.4 billion euros. Of that total, 2.1 billion euros were for its EUV systems.

Meanwhile, that Q3 total was more than double the 2.6 billion euros in bookings it received in Q3 last year.

Its sales should keep growing in the long run thanks to the rising demand for advanced AI chips, and data center operators' strong interest in keeping their power consumption in check to whatever degree they can. Not surprisingly, industry association SEMI is projecting outstanding growth in the production of advanced chip wafers over the next three years.

The association forecasts that advanced chips (those manufactured using process nodes of 7-nanometers or less) will witness a 69% increase in output by 2028 as compared to 2024 levels. This will require increased sales of the equipment required to produce such chips. This bodes well for ASML.

SEMI also predicts that the annual spending on advanced chipmaking equipment is likely to jump from $26 billion last year to $50 billion in 2028. ASML delivered 28.2 billion euros in revenue in 2024, which translates into just under $32.5 billion at the current exchange rate. So, there should be ample incremental revenue opportunities for ASML to tap into over the next three years.

It won't be surprising to see that number head higher by the end of the decade, considering the potential growth in data center capex, which will create the need for more advanced chips, and eventually help ASML sustain impressive growth levels.

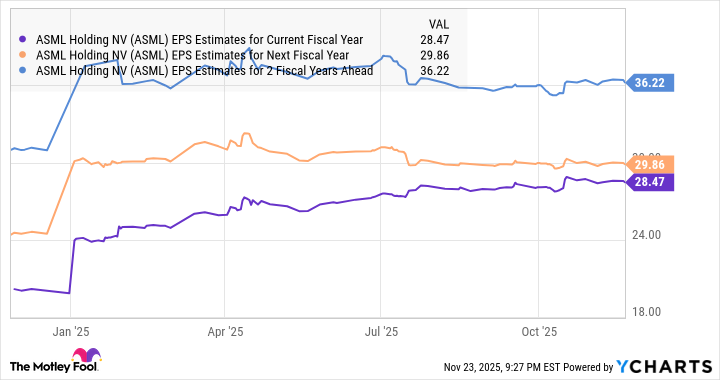

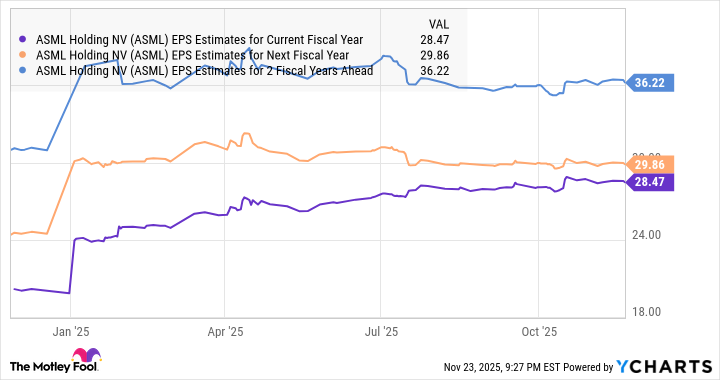

The stock can jump substantially over the next five yearsAnalysts are expecting a 28% spike in ASML's earnings in 2025, followed by a jump of 5% in 2026. Importantly, consensus estimates are projecting a much bigger increase in 2027.

That could help ASML deliver stronger earnings growth next year. But even if its earnings grow in line with consensus expectations and it maintains a 20% bottom-line growth rate in 2028, 2029, and 2030 (in line with its estimated earnings growth in 2027), its bottom line could jump to $62.90 per share by the end of the decade (using its estimated 2027 earnings as the base).

The tech-laden Nasdaq-100 index currently trades at a forward earnings multiple of 26. Applying that multiple to ASML's 2030 earnings would give the stock a price of $1,635. That would be a jump of 69% from where it trades today. So investors looking for a solid AI stock to buy as a bet on growing data center capex may want to take a look at ASML now. |