Japan Might Be A Bomb Ready To Explode-- Why You Should Care

ugurhan/iStock via Getty Images

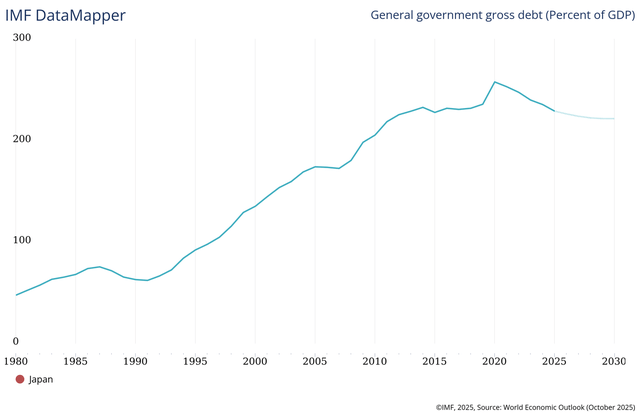

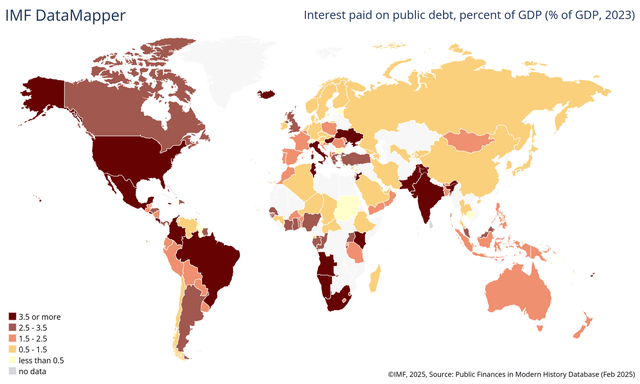

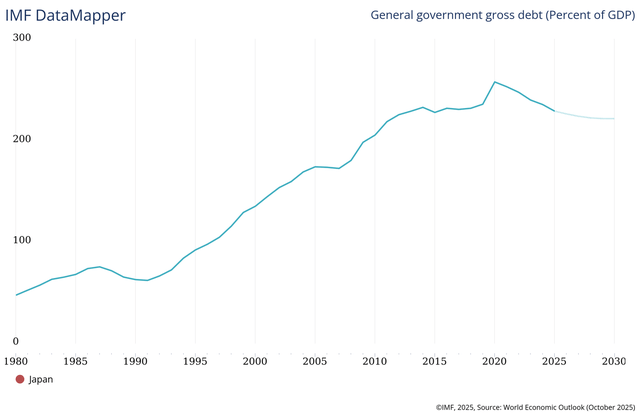

While all the media attention is focused on the US debt sustainability, on the other side of the globe there might be a bomb ready to explode. To be precise, a 229% Debt to GDP bomb that might affect all the major economies.

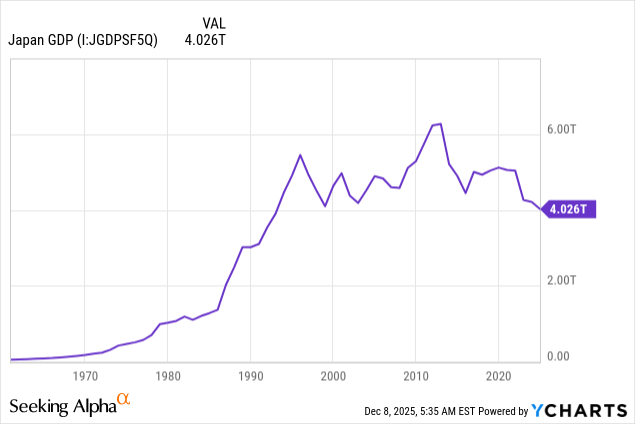

The significant shift in the Japanese economyOver the last decades, Japan has implemented its own monetary policy, which was totally disconnected from what we studied in economic textbook. The reasons for such a divergent approach stemmed in two major crises that affected the country: the early ’90 real estate bubble burst and the Great Financial Crisis (2008).

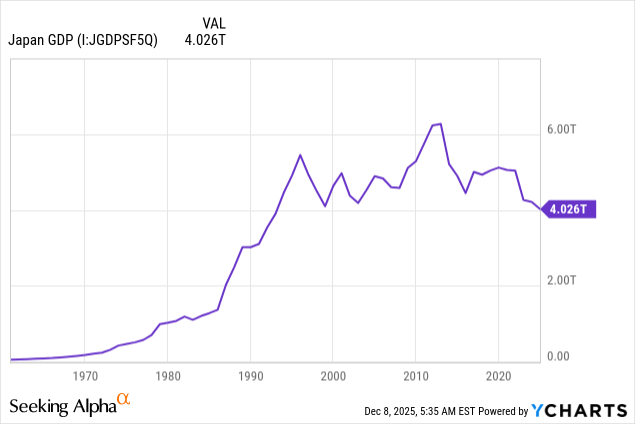

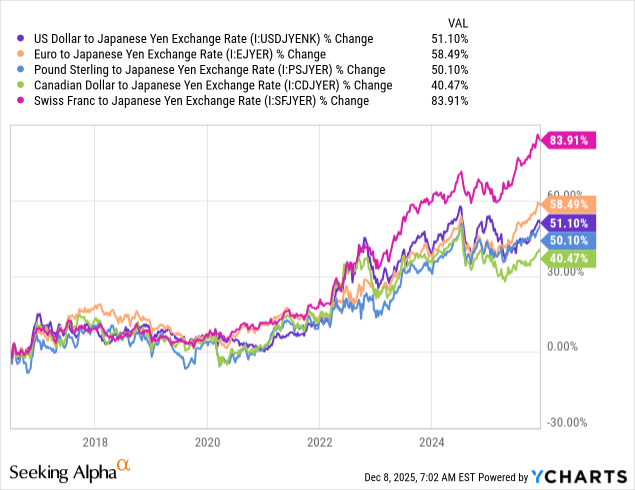

Seeking Alpha, YCHARTS Seeking Alpha, YCHARTS

Japan, never really recovered from these crises, which were both exacerbated by a huge demographic problem: the current population is 120 million, but in 2009 it was 126.60 million. For 16 years in a row, deaths widely exceeded the births, and the working-age population declined to 59%, much lower than the global average of 65%. To put it simply, the two crises, combined with strong demographic headwinds, resulted in a GDP comparable to that of early 90’.

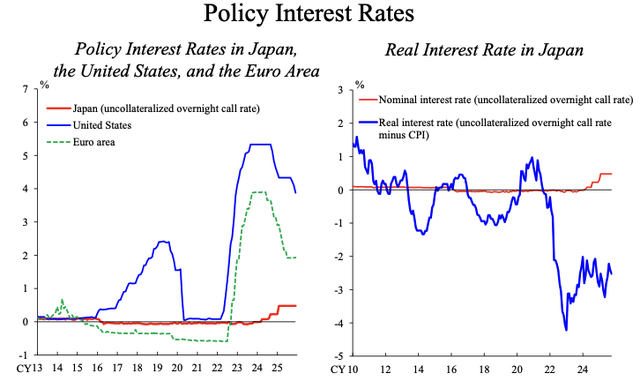

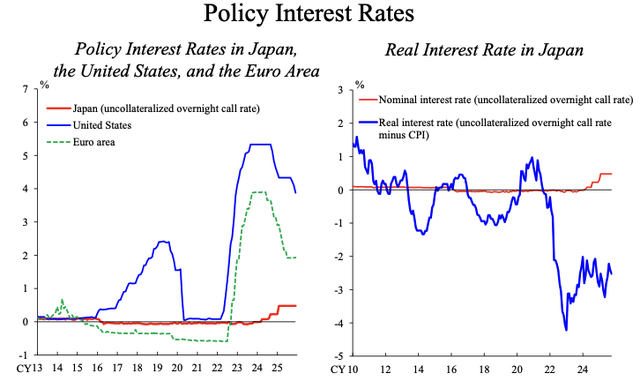

The Bank of Japan has done its best to stimulate the economy, and even set negative interest rates wasn’t enough.

Bank of Japan Bank of Japan

While the major economies also experienced phases where interest rates were high (over 3-4%), Japan didn’t even come close to those levels. And this is exactly why the Japanese economy could survive despite a Debt to GDP of 229%.

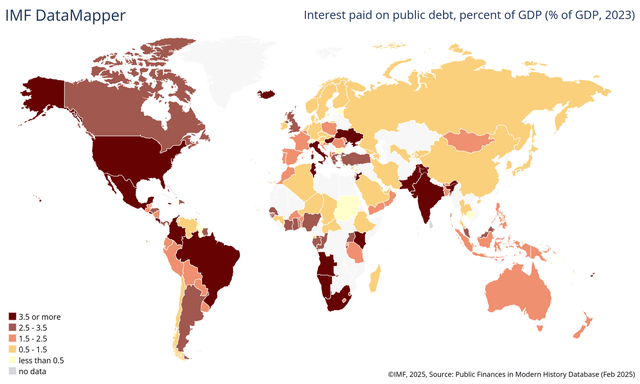

IMF IMF

IMF IMF

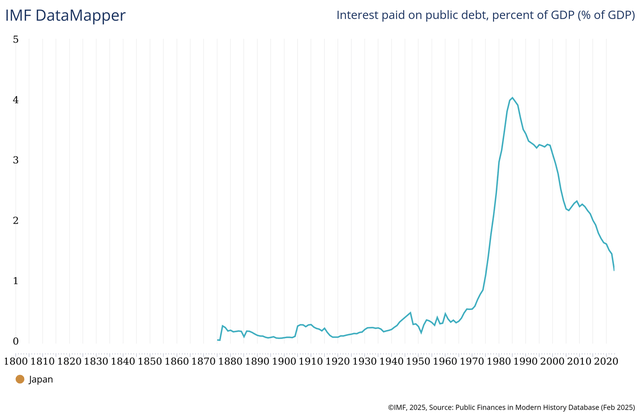

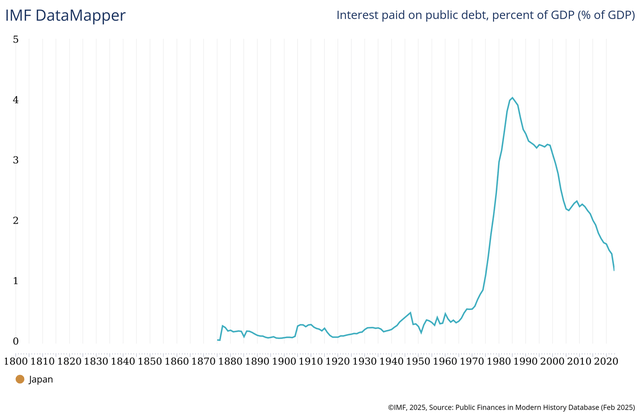

As you can see from these charts provided by IMF, interest paid on public debt as percentage of GDP went in the opposite direction of Debt to GDP ratio. In other words, you can even have a Debt to GDP ratio of 300%, but as long as the interest paid gets lower, the debt burden is much lighter than it should be.

At this point a question arises: how is it possible that a country gets more and more debt but pays lower interests? Doesn’t this mechanism go against the basic financial rules? If you bury yourself in debt and you need a further loan, chances are that the interest rate you are going to pay will be higher as your creditworthiness deteriorated.

Well, to avoid depressing the economy even more, Japan decided to get rid of this basic mechanism by using probably the most expansive monetary policy tool: yield curve control.

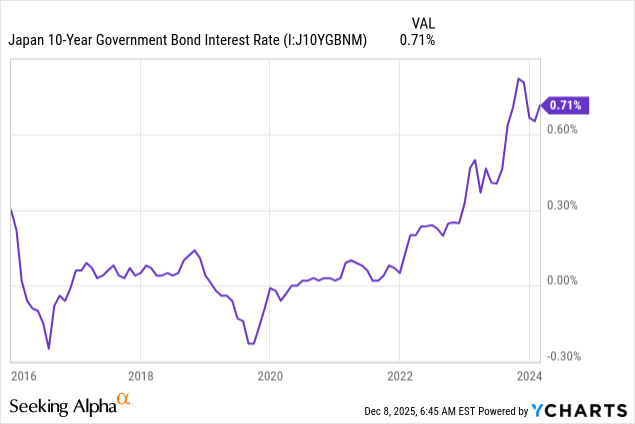

Remember the story that central banks can’t control long-term rates? Japan has reshaped this concept in 2016 when decided to cap the 10Y Bond Yield to 0%. Initially, the tolerance band was at ±0.10%, over the years reached ±0.50%.

Seeking Alpha, YCHARTS Seeking Alpha, YCHARTS

The yield curve control concept is pretty easy: whoever tries to interfere with the central bank policy will end up losing money. If you invested to profit from a 10Y Japanese Bond Yield rise, you couldn’t as the central bank has unlimited firepower and would have bought as many bonds as possible to bring the yield to 0%.

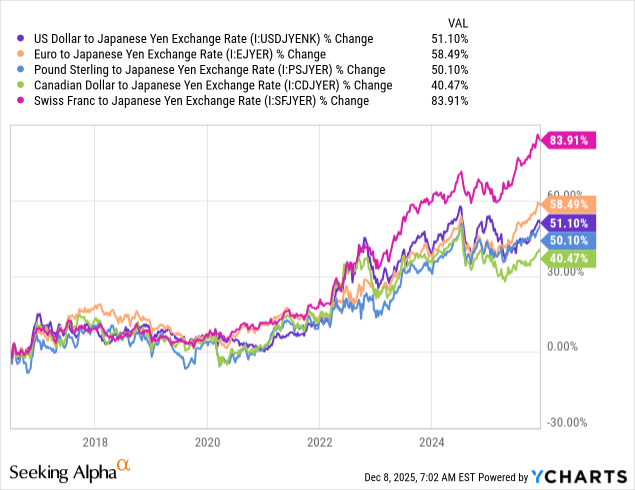

This powerful mechanism is the ultimate tool to stimulate the economy, but it comes with huge costs. The yield curve control will inevitably skyrocket the public debt since the central banks needs to print money to constantly purchasing bonds. That’s why Japan got to such a high Debt to GDP ratio. Second, it leads to a massive currency supply that inevitably hit the currency rates.

Seeking Alpha, YCHARTS Seeking Alpha, YCHARTS

From 2016 on, the yen strongly depreciated against all major currencies and this had a double effect: exports are more convenient but imports are more expensive. And this is a problem since Japan imports a significant amount of food and energy.

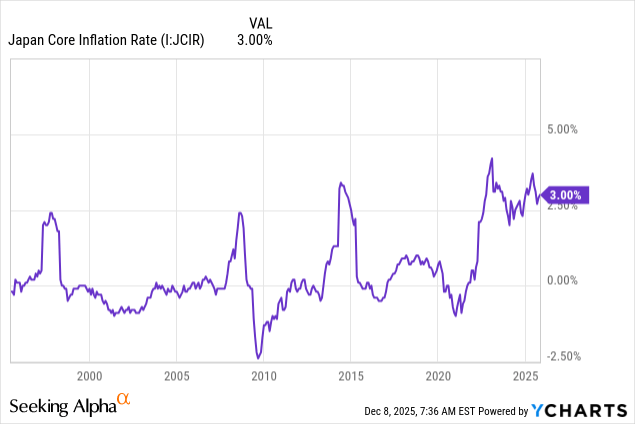

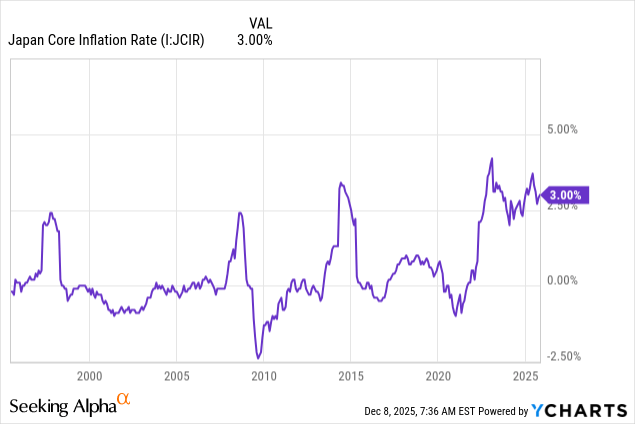

The CPI inflation rate has increased again since then, primarily due to the rise in food prices. One of the causes of the higher inflation is the resumption of the yen's depreciation after having temporarily appreciated sharply in summer 2024. The yen's depreciation has directly led to rises in the price of imported food and other items because the pass-through of higher import prices, after having been weak, has intensified due to the entrenched inflationary trend.

Bank of Japan

Therefore, like a sequence of dominoes, the yield curve control led to a higher core inflation.

Seeking Alpha, YCHARTS Seeking Alpha, YCHARTS

After years of struggling with deflation, now Japan has to face an unexpected enemy that a whole generation never really experienced. The higher inflation was the main cause that ended the yield curve control and it is now heading toward an historic shift in the Japanese monetary policy.

The current benchmark rate is 0.50%, but the market expects a 25 bps increase over the next meeting. If you think about it, once again Japan is acting contrarian. For decades the Japanese economy has been more expansive than major global economies, however, now we are getting through a phase where the opposite is true; ECB and Fed are about to reduce rates, while Japanese monetary policy is turning hawkish.

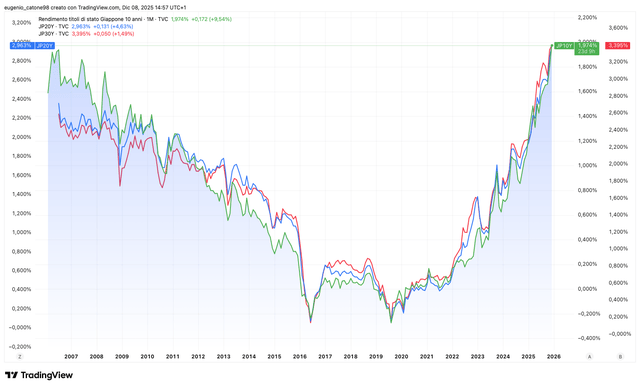

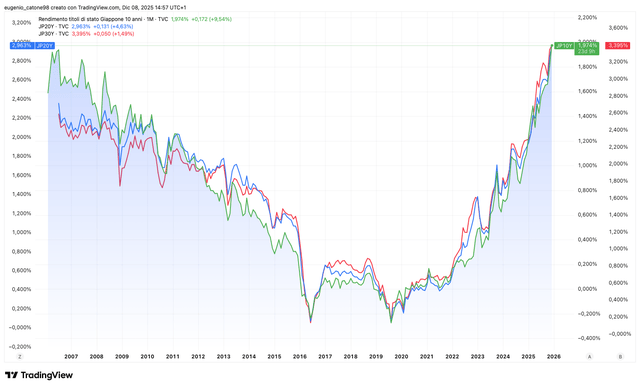

A hawkish Bank of Japan, combined with the end of the yield curve control and new Prime Minister prone to increase fiscal spending, are bringing long-term interest rate up to levels not seen in 25 years.

TradingView TradingView

That’s a big concern since Japan was used to pay just 1% or less on its maturing debt. Needless to say, having a debt that is more than double the GDP does not help either.

You might think that a 10Y yield close to 2% is not a big deal, but it actually is since the debt amounts to $9.80 trillion. We are talking about tens if not hundreds of billions of dollars more in interest payments every time rates rise by 1%, a significant amount even for a country whose GDP was $4.02 trillion in 2024.

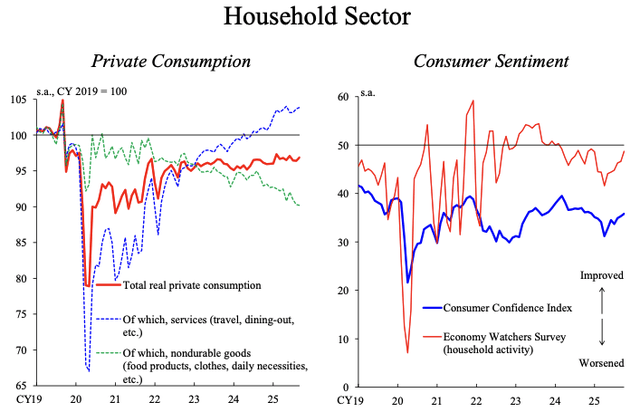

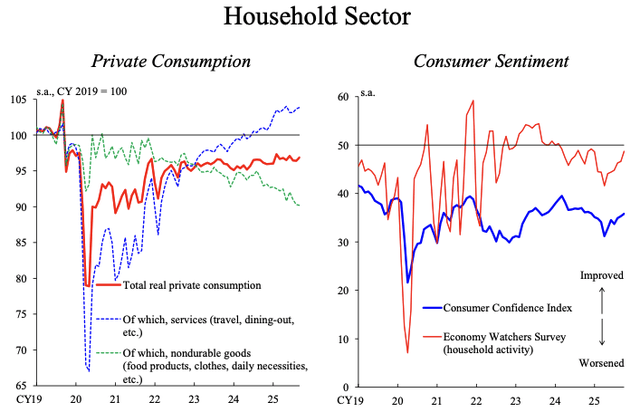

By the way, to add fuel to the fire, today it was released the Q3 2025 GDP data. The estimates were an annualized 1.80% contraction, the actual result was an annualized contraction of 2.30%. Tariffs had a major role in this contraction, so part of it will be offset in the next quarter, however, we are certainly not talking about a thriving economy: Japanese household sentiment remains depressed.

Bank of Japan Bank of Japan

The consequences for the US economyThe main world economies are all interconnected, which is why it would be naive to think that nobody would be affected by a Japanese crash. The debt spiral is silently annihilating Japan, and the final blow would be a 10Y Bond Yield that won’t stop rising. What would be the most relevant consequences over the US economy? I found three of them.

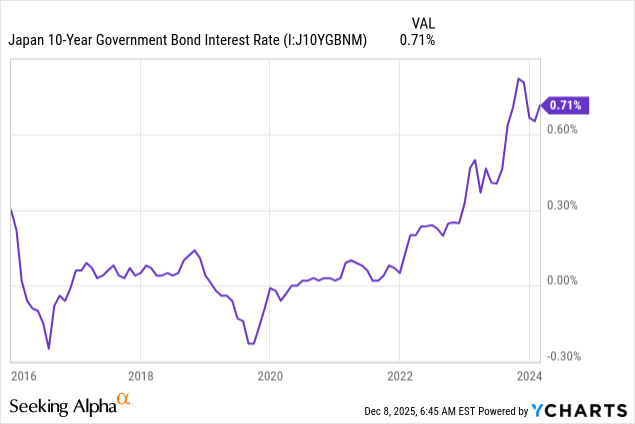

The first one doesn’t relate to just US but to all the countries that significantly increased their debt levels. If the fourth largest economy can no longer sustain its debt due to higher interest rates, the whole government bond market would be flooded by a wave of pessimism.

IMF IMF

We know that interest payments are becoming a primary issue for most developed economies, so Japan could be seen as the first of a longer list. In general, the whole fiat monetary system could be questioned.

The second consequence of a Japan crisis would be the end of JPY/USD carry trade. If Japanese rates rise, the spread with US rates narrows, and this would limit the profitability of the carry trade investment. For Japanese, it wouldn’t be so beneficial to borrow in JPY and invest this capital in USD assets. Therefore, this implies lower Japanese inflows in the US stock market.

Third, Japan is the foreign country with the largest holding of US Treasury: $1.18 trillion. If the Yen depreciates too much against USD, the central bank could gradually sell US Treasury and purchase Japanese bonds to support the national currency. Consequently, the US Treasury Bond yield would face an upward pressure that might eventually hurt US consumers (higher interest rates on long term loan).

ConclusionAfter decades of low interest rates, Japan is currently facing a major change in its economy. The country forgot how it feels like to bear a 3% inflation, and with the yield curve control no longer possible, bond vigilantes are punishing the Japanese fiscal policy and high Debt/GDP ratio.

Long term interest rates don’t appear to stop climbing, and this is widening the cracks within the financial system. Japan needs to invert the fiscal policy direction, but Prime Minister Takaichi has a strong conviction in flooding the country with new fiscal stimulus, after all, the GDP growth is very underwhelming.

We will see how this debt dilemma will end up, but Japan currently looks like a colossus with feet of clay.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

seekingalpha.com |

Seeking Alpha, YCHARTS

Seeking Alpha, YCHARTS

Seeking Alpha, YCHARTS

Seeking Alpha, YCHARTS Seeking Alpha, YCHARTS

Seeking Alpha, YCHARTS Seeking Alpha, YCHARTS

Seeking Alpha, YCHARTS