Rooftop solar and batteries on centre stage: Six key graphs from AEMO’s transition roadmap

Installing rooftop solar in Queensland.

Giles Parkinson

Dec 12, 2025

Chart of the day Renewables

The Australian Energy Market Operator has released the long-awaited draft of its 2026 Integrated System Plan, its multi-decade blueprint for the transition of Australia’s main grid from fossil fuels to renewables and storage.

Many articles been written, and we have a whole podcast dedicated to the subject. See: Energy Insiders Podcast: A blueprint to quit coal, and go green and Will the lights go out if we don’t have baseload? “No, absolutely not,” say those whose job it is to keep them on

But for a quick visual take on the main findings, we have published these six graphs to cover the major themes, which basically cover a steady course since the first ISP was produced in 2018 under the Coalition government, because wind, solar and storage remain the lowest cost and most efficient way to replace coal.

There have been some tweaks, and these are highlighted here:

First of al is the prominence of rooftop solar, and the so-called “democratisation” of energy. Homes and businesses will support 87 gigawatts (GW) of rooftop solar by 2050, three times more than they host now – and that of course will have a fundamental change in the way the grid is managed.

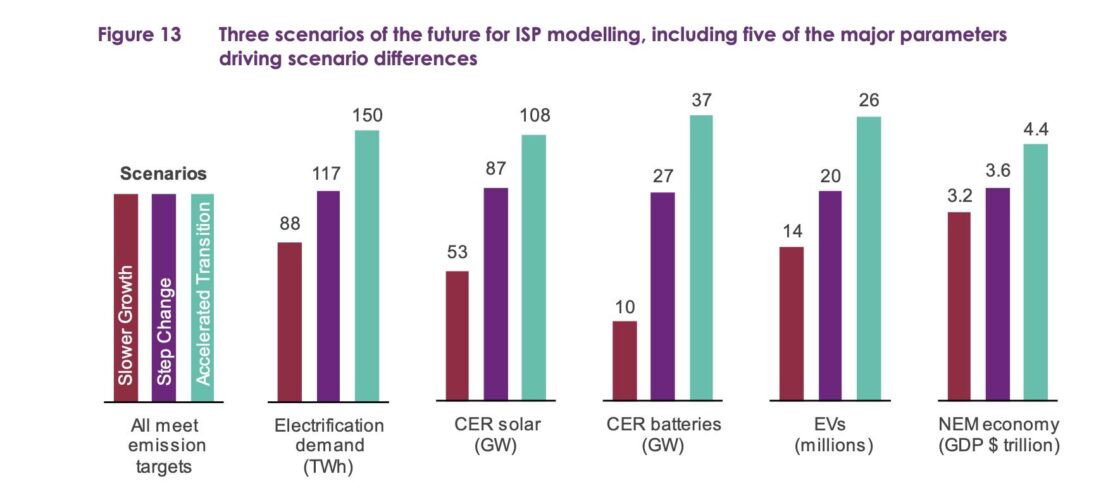

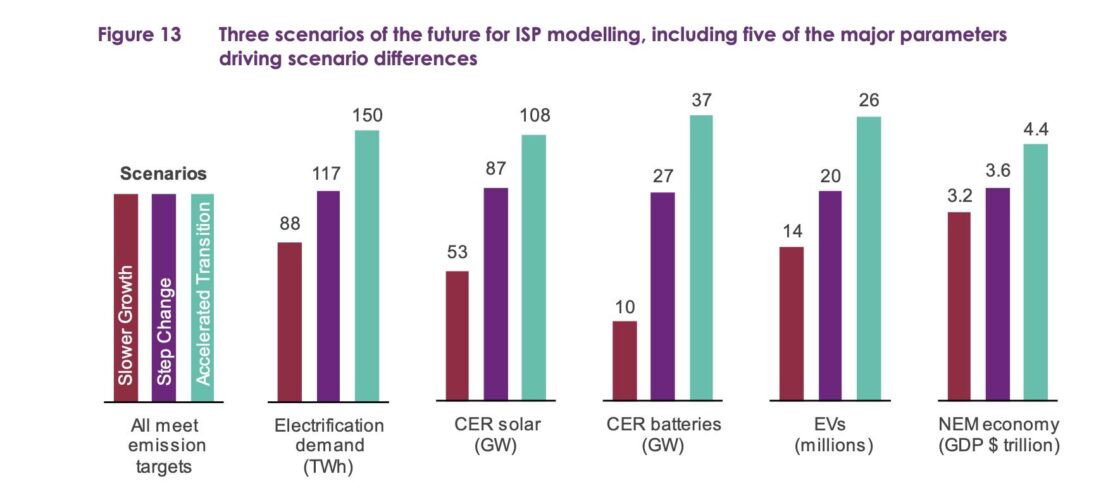

It could be a lot more. The ISP is based on the “step change” scenario that is considered the most likely and is seen as the “optimal development path.” But technology changes quickly and AEMO cannot rule out an “accelerated transition”, considered likely by 27 pct of stakeholders, as many who voted for “slower growth.”

The accelerated transition would see 108 GW of rooftop solar, and 37 GW of consumer batteries, along with 26 million EVs – many contributing to the grid.

Demand, thanks to electrification, will surge, and so too will the economic growth – with GDP estimated to grow to $4.4 trillion in this scenario compared to $3.6 trillion in “step change”. So much for the idea that green energy will kill the economy.

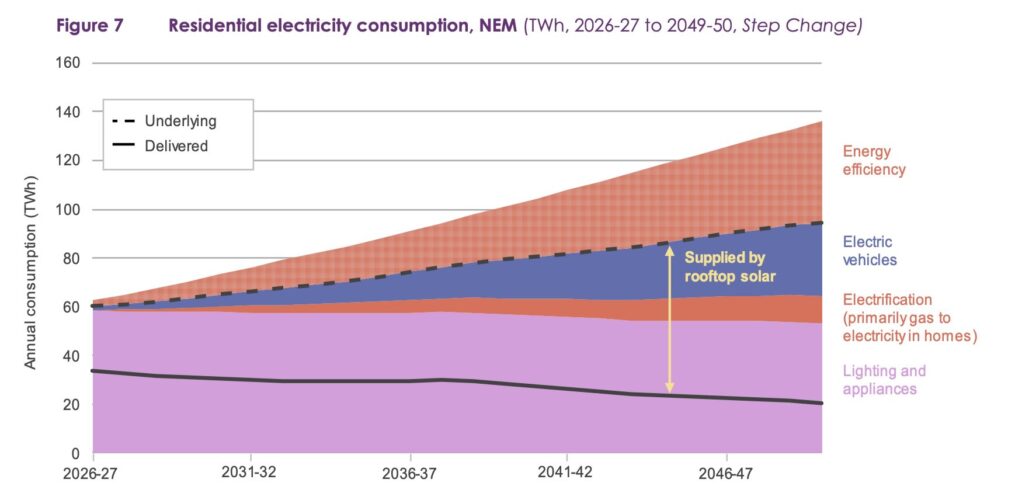

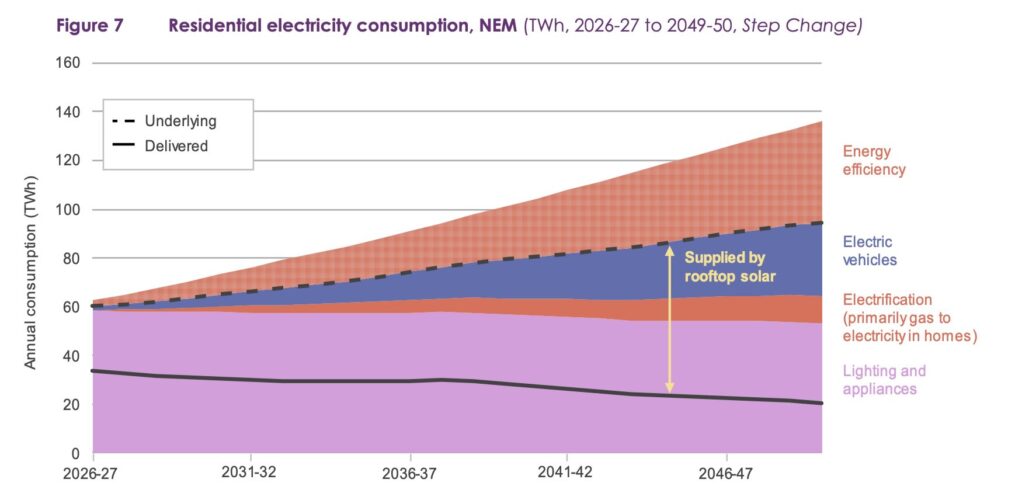

Screenshot Let’s bring this back to households, because with all that rooftop solar and battery storage, and despite or even because of their EVs, their demand will grow but their dependence on the grid will reduce.

AEMO suspects that grid demand from homes will fall by 40 per cent to just 20 terrawatt hours by 2050, while overall demand will nearly double to nearly 400 TWh. That’s a big change for consumers and for the energy retailer that serve them.

Screenshot

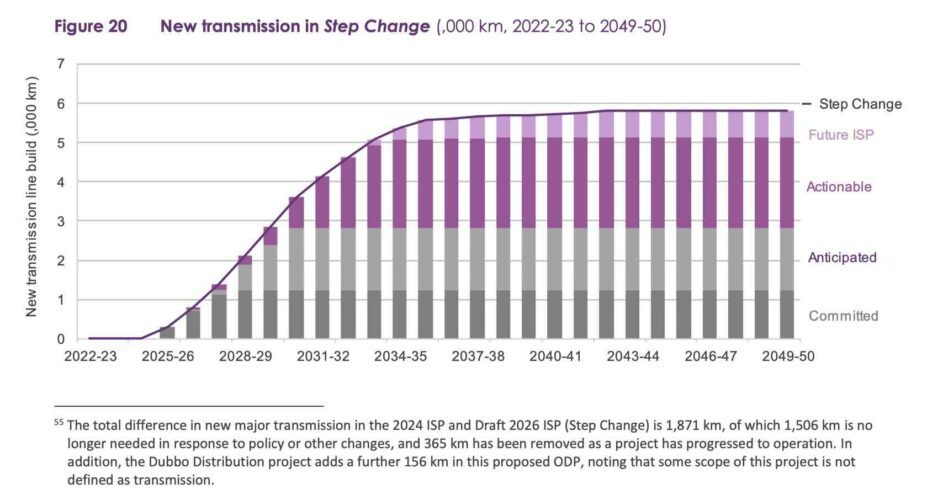

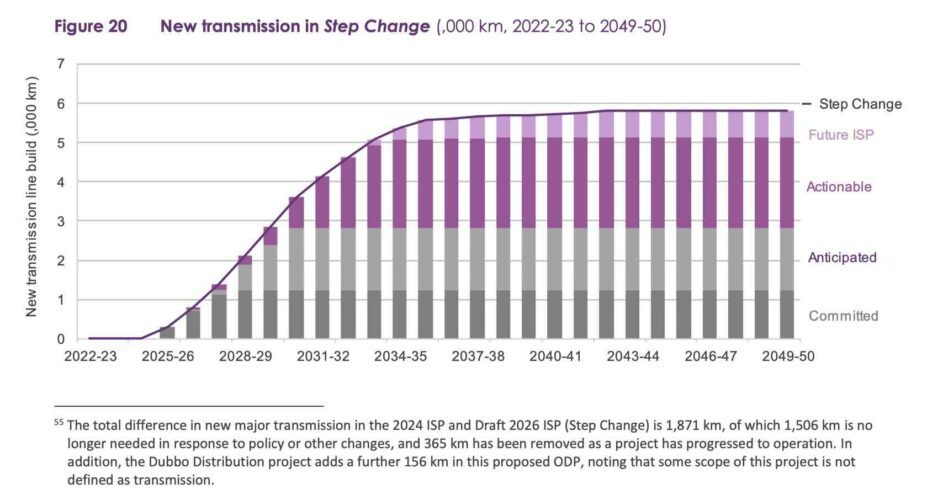

And let’s be absolutely clear about transmission. Nearly every day we hear the Coalition, Murdoch media or some other renewable critic complain about 28,000 kms of extra transmission lines that will criss-cross the country.

That is not true – the central scenario canvasses less than 6,000 kms, with 365 kms already completed and another 1,506 kms no longer needed because of policy or technology changes.

The biggest change in the ISP is the continuation of coal in Queensland, where the ruling LNP state government has scrapped renewable targets, and vowed to keep coal running until 2049.

AEMO is not sure how they can do that, given that ageing coal fired power stations are the biggest threat to grid reliability, and suggest if coal fired power stations are still operating, they will likely have to shut down for days, weeks, months or even seasons at a time.

The decades old concept of “baseload” will effectively be dead, but it won’t mean that the lights will go out.

Screenshot

Finally, that gets us back to emissions, and the biggest drop occurs in the next five years as the grid makes a big leap from around 40 per cent renewables towards the government target of 82 per cent renewables by 2030.

The draft ISP canvasses a “constrained” scenario where the share of renewables reaches 75 per cent, but it will still result in a significant drop in emissions, which in turn will pave the way for further emission cuts in the rest of the economy as transport and industry electrifies and is powered by renewables and storage rather than coal and gas.

reneweconomy.com.au |