| | | Re: Legacy Portfolio ...

Today I started a new position in SWK. I'm looking at post earnings which came out last month. Here is the takeaway from the conference call.

>> Final Takeaway ... Stanley Black & Decker's third quarter call highlighted steady progress on cost reduction and supply chain transformation, with an explicit path toward 35% adjusted gross margin by Q4 2026. The company's proactive pricing strategies, operational efficiencies, and brand-focused growth initiatives are expected to support margin expansion and long-term shareholder value, despite ongoing macroeconomic and tariff-related headwinds. Management reiterated confidence in executing its strategic priorities and maintaining a resilient balance sheet while actively mitigating external risks. <<

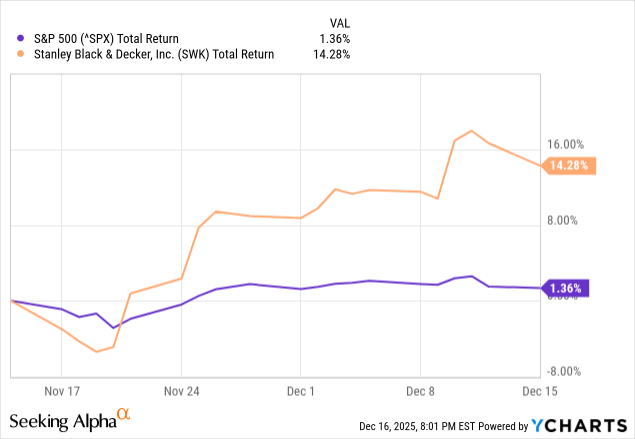

1 Month Chart: (as I said, I'm looking at the response to the earnings call)

On the Valuation front, according to Alpha Spread, the intrinsic value of one SWK stock under the Base Case scenario is 141.4 USD. Compared to the current market price of 74.45 USD, Stanley Black & Decker Inc is ... Undervalued by 47%.

SWK is actually selling at deep discount with a 4.39% yield. Looking at a Worst case scenario, according to Alpha Spread, the intrinsic value of one SWK stock under the Worst Case scenario is 95.17 USD. Compared to the current market price of 74.46 USD, Stanley Black & Decker Inc is ... Undervalued by 22%.

In my opinion, buying at a deep discount might work out with this company. |

|