Unfortunately all this spending has not weaned us off of the fossil fuels that the belligerent Russian and radical muslim dictatorship countries, that want to enslave us, provide.

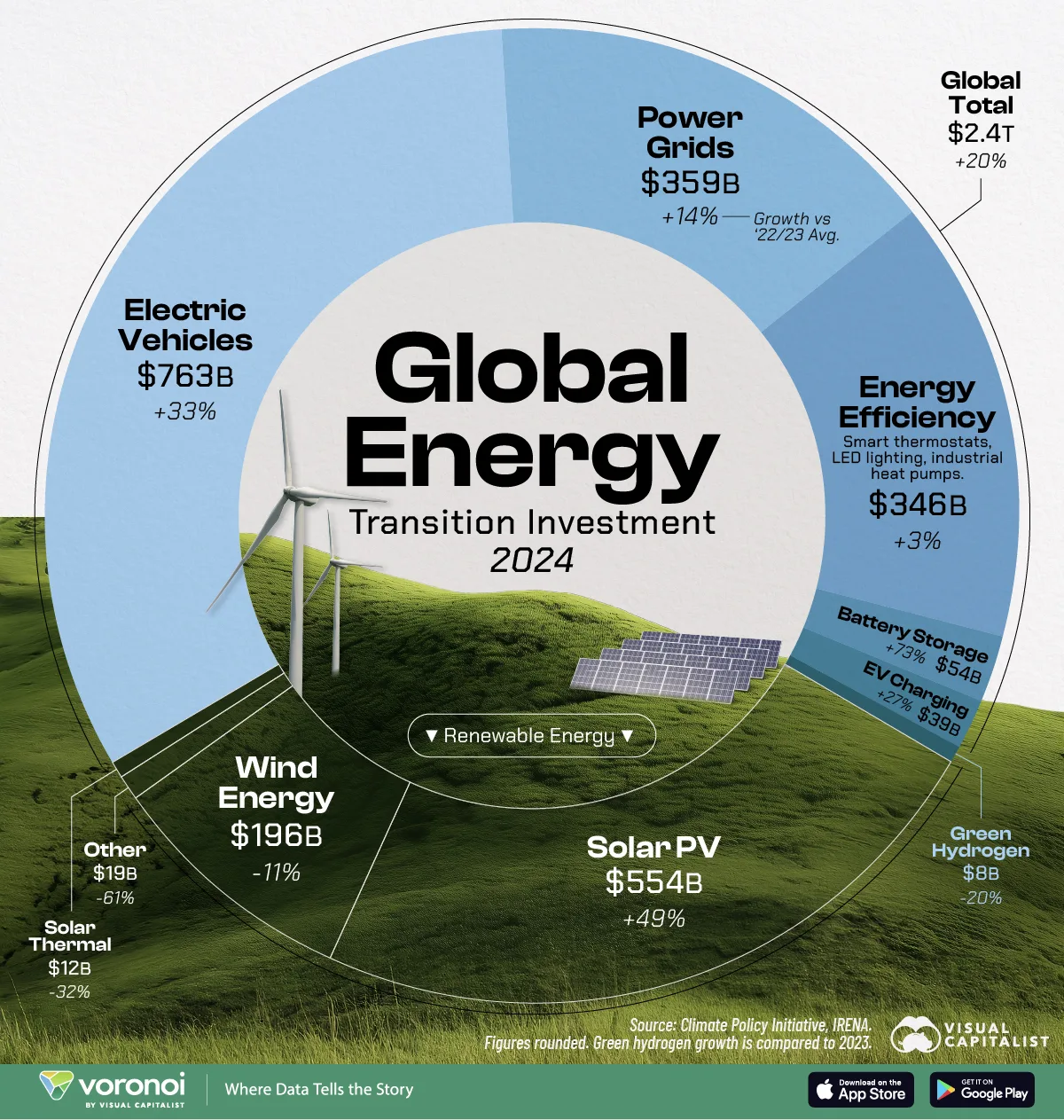

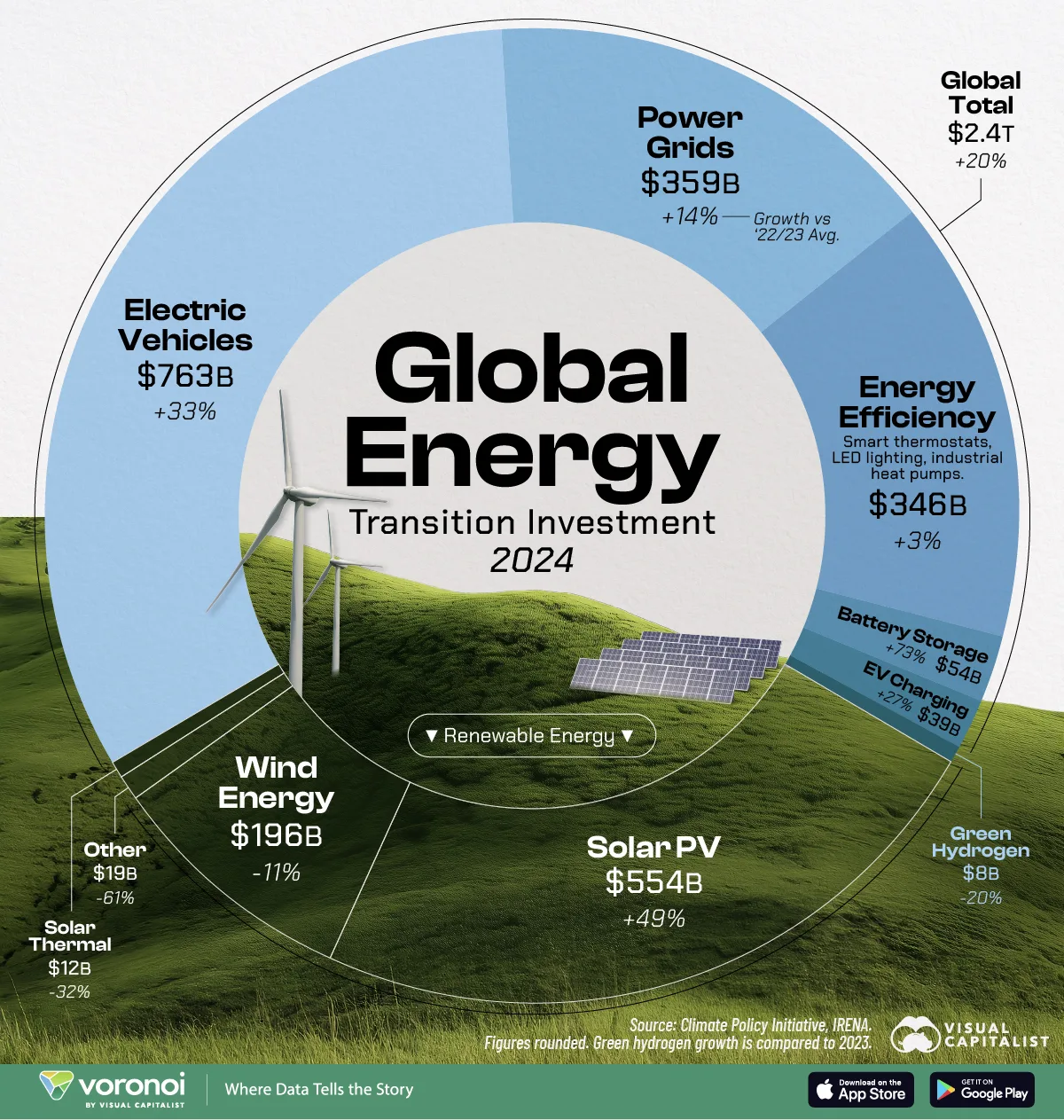

Charted: $2.4 Trillion in Energy Transition Spending, by Category

December 16, 2025

By Dorothy Neufeld

Graphics/Design:

See more visualizations like this on the Voronoi app.

Use This Visualization

Visualizing $2.4 Trillion in Energy Transition SpendingSee visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways- Global energy transition investment hit a record $2.4 trillion in 2024, up 20% from 2022-2023 average spending levels.

- Electric vehicle investment surged 33% to reach $763 billion, while solar power climbed 49% versus the previous benchmark.

Energy transition spending is booming worldwide, as EVs and renewable power expand their market share.

While average global spending in renewable energy was $662 billion between 2022 and 2023, it grew to $807 billion in 2024. Not only that, 92% of new U.S. electricity additions will be powered by clean sources this year and next.

This graphic shows global energy transition investment in 2024, based on data from the Climate Policy Institute and IRENA.

Global Energy Transition Investment by Category

Below, we show investment across key categories in the energy transition, from wind energy and power grids to battery storage:

Category Global Investment 2024

(USD) Growth vs 2022/2023

AverageGlobal Total$2.4T20%|

| Solar PV | $554B | 49% | | Solar Thermal | $12B | -32% | | Wind Energy | $196B | -11% | | Other Renewables | $19B | -61% | | Electric Vehicles | $763B | 33% | | EV Charging Infrastructure | $39B | 27% | | Power Grids | $359B | 14% | | Energy Efficiency | $346B | 3% | | Battery Storage | $54B | 73% | | Green Hydrogen | $8B | -20% | |

Overall, EVs and solar power were the two largest categories, driving 55% of the total last year.

China accounted for 49% global investment in battery EVs in 2024, supported by government policies. At the same time, nearly 1.8 million EV charging points were built, more than the rest of the world combined.

Meanwhile, investment in battery storage was the fastest-growing segment, rising 73% in 2024 versus the 2022-2023 average. What’s more, investment was 11 times higher than 2019-2020 levels given lower costs and efficiency improvements.

Investment in power grids also saw meaningful growth, rising 14% to reach $359 billion. Globally, spending is forecast to continue rising to support EVs and renewable energy generation.

In contrast, wind energy spending declined to $196 billion given permitting timelines and rising financing costs, particularly for offshore wind. As a result, many offshore wind projects were canceled in the U.S., and are expected to continue looking ahead. |