Grid-scale

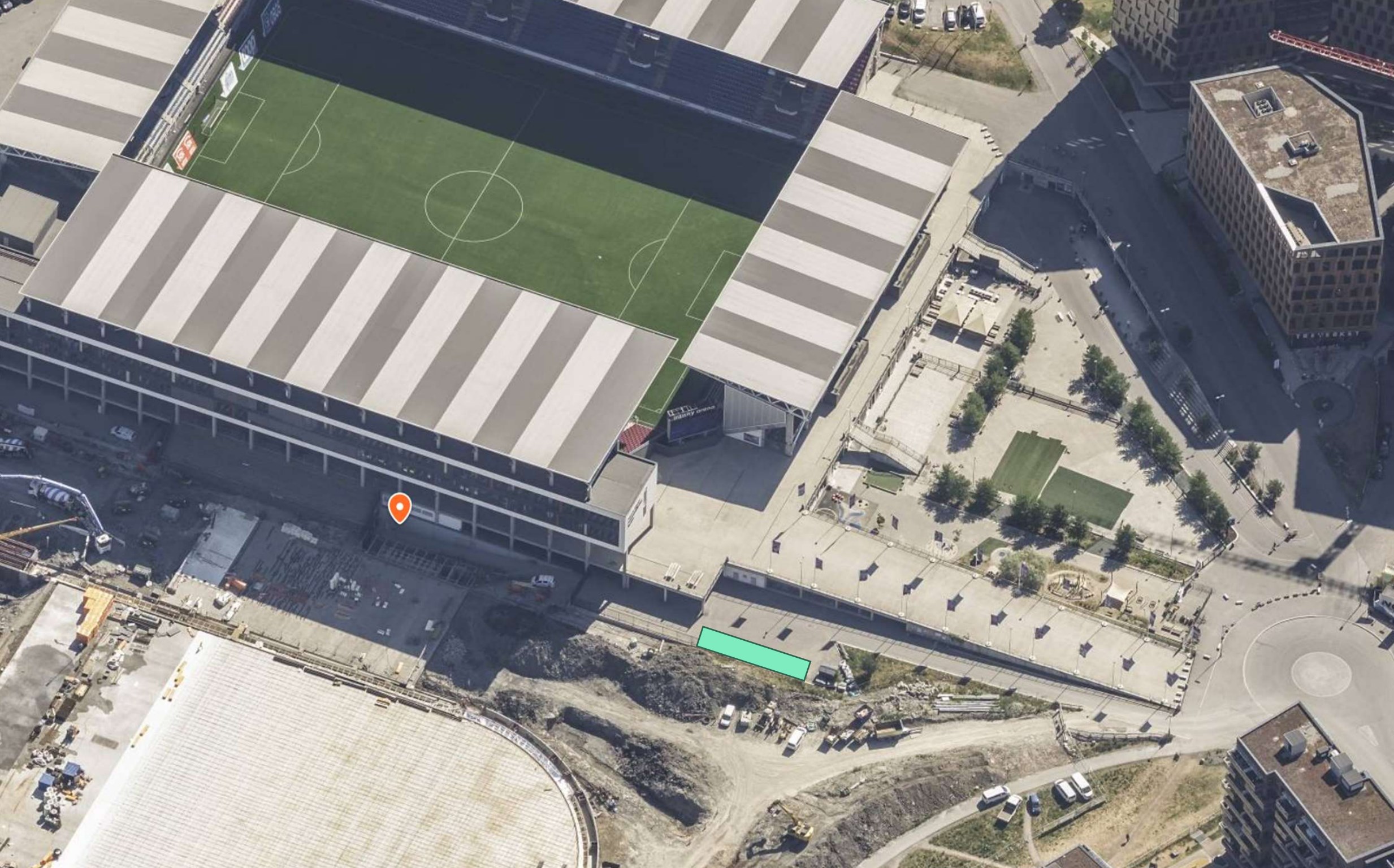

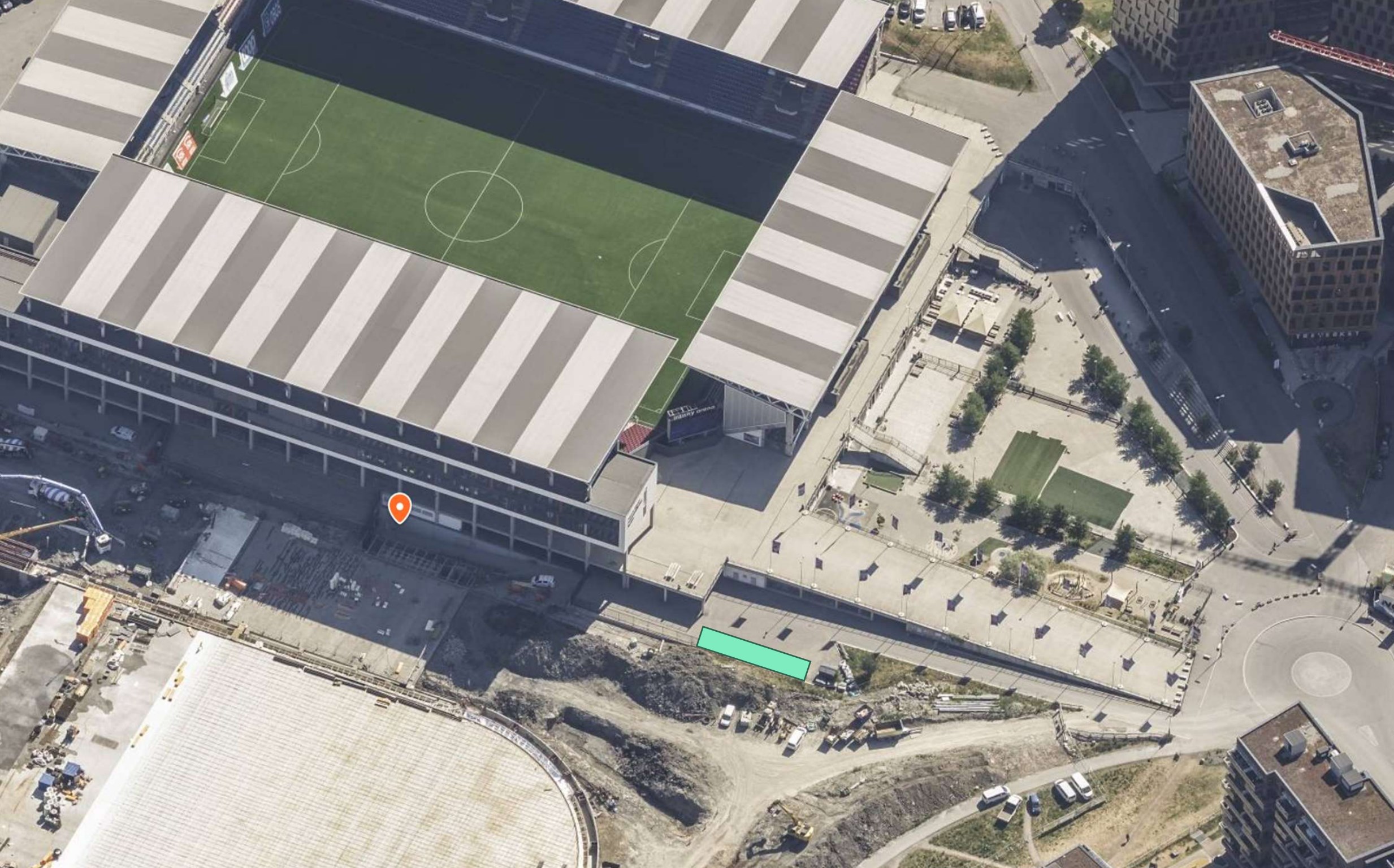

Kick off in Oslo’s Intility Arena: Battery flattens matchday peaks, earns revenue for startup

Norwegian startup Peak Shaper has commissioned a 1.2 MW battery system at Intility Arena, utilizing an “Energy as a Service” model without capital costs for those that want a battery. Torfinn Årdalsbakke, a project developer at Peak Shaper, tells ESS News more.

By

Tristan Rayner

Dec 22, 2025

Finance

Grid-scale

Projects & Applications

Revenue streams

Image: Peak Shaper

Like many football stadiums around the world, on a typical weekday, the Intility Arena in Oslo, Norway, has a modest energy footprint. But when the home team has a matchday – Oslo’s Vålerenga Fotball club – the load profile changes aggressively. At the ground, as floodlights, stadium lighting, and television broadcast trucks power up, consumption spikes from a baseload of 250 kW to peaks exceeding 1 MW for the active window: pre-game, the match itself, and post-game.

To manage these surges and ensure broadcast continuity as stipulated by TV contracts, the stadium previously relied on the grid, supplemented by rented diesel generators, which were transported in and out each game.

Now, a 1.2 MW / 2.2 MWh battery energy storage system (BESS) from Peak Shaper, a new startup part of municipally owned energy company Eidsiva Vekst, has taken over the duties, which is supported by a local 740 kWp solar array.

The BESS was supplied by CATL using LFP batteries, with Hitachi Energy supplying the inverters. Norwegian company TGN Energy then provided the battery management system (BMS) which gives Peak Shaper the ability to control the battery for the specific requirements of match days, and then offers flexibility to support the grid and generate revenues.

Shaving the match day peak

Interestingly, the primary operational goal of the new system is to provide backup power for the TV contracts. However, a close second is managing the intense energy demands of match day. Accordingly, the BESS is programmed to charge fully in the hours leading up to kickoff.

“A couple of hours before the match starts, the battery needs to be full,” Torfinn Årdalsbakke, project developer at Peak Shaper, told ESS News.

Once the floodlights activate, the battery starts to discharge to handle the surge. According to Årdalsbakke, a typical match consumes around 1,350 kWh during the high-load window. By servicing this load from the battery rather than the grid, the system works to peak shave, cutting down on the load and peak demand charges.

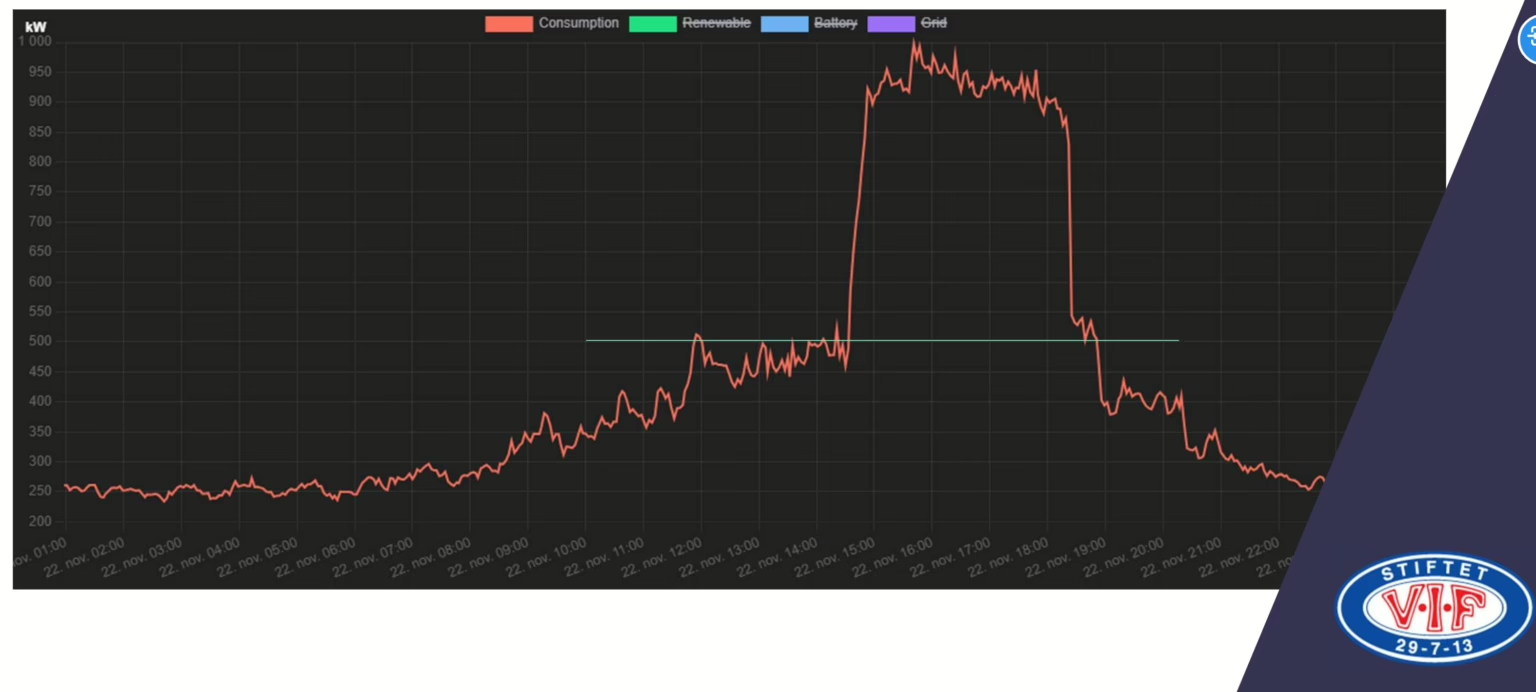

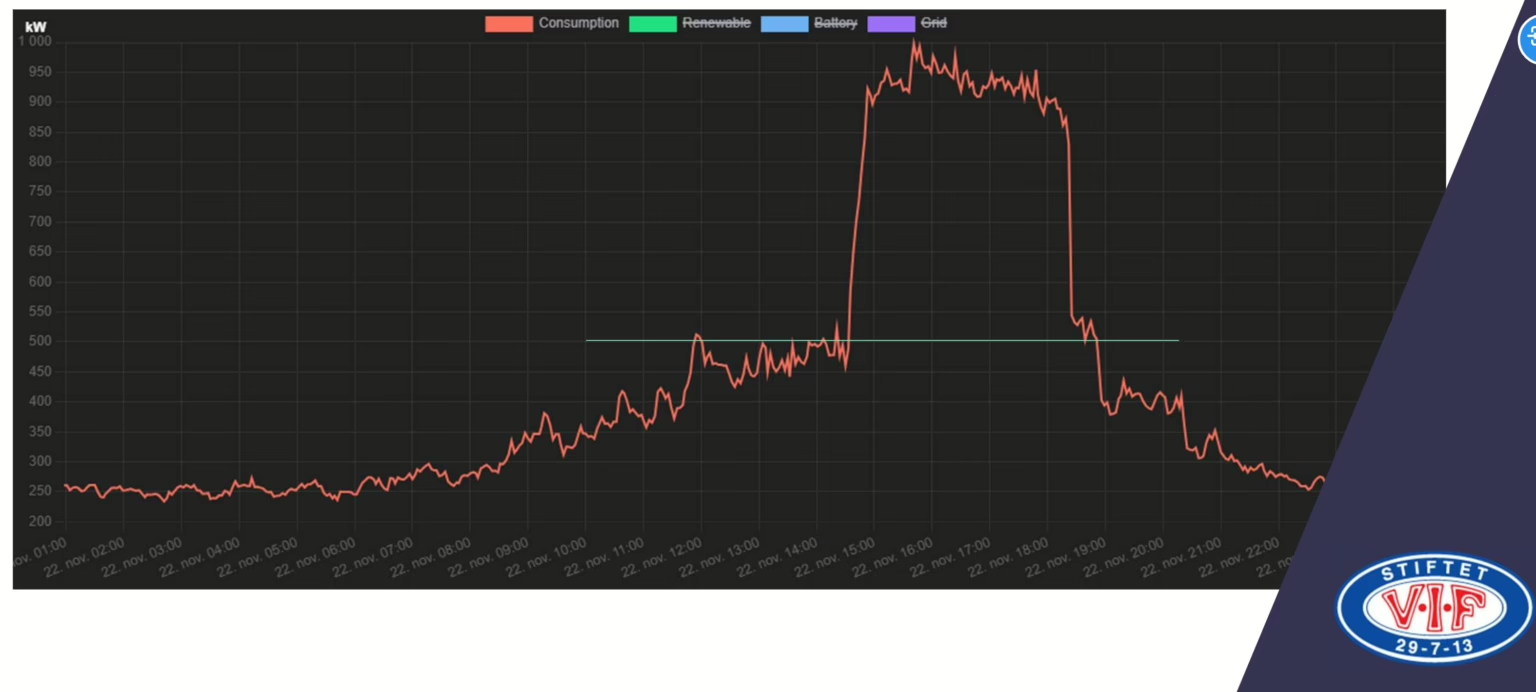

The image below, with the Vålerenga Fotball club’s logo at the bottom right, shows a typical match day consumption, with ramping load and a significant peak for full floodlights. Peak Shaper aims to cap the demand at 500 kW, and supply the rest of the demand via the battery.

A sample matchday chart showing consumption in kW vs time.

Swapping diesel rent for battery

While peak shaving does help to manage grid costs, a key driver of using the BESS came from eliminating the diesel generators that were required as an insurance policy by television broadcasters. To prevent blackouts during live transmissions, the stadium was forced to transport in and set up rented diesel generators for every single match.

“The TV production set the requirements that they need to have this backup power supply,” said Årdalsbakke. “Now the stadium has this cost at every game… even though they’ve never actually had to use it. So they still have to rent it, pay for it, and yet it sits there.”

Under Peak Shaper’s model, the stadium saves on the rental cost of the generators, while paying for the battery at a lower overall cost, and the local grid in Oslo has less of a peak demand issue.

Backup on a budget

The battery’s third role is security. While 1,350 kWh is used for peak shaving, a consistent load for each matchday, the system reserves a buffer of approximately 700 kWh specifically for backup.

“If at some point the power failed, the system is designed to be able to supply the entire stadium load for a full two hours, or the entire game with some buffer,” said Årdalsbakke.

The option for running the backup as a seamless Uninterruptible Power Supply (UPS), responding in 50 ms, was on the table, but the cost from provider Hitachi Energy was high, and in the ballpark of €100,000. Instead, the system utilizes a “blackout recovery” mode. If a grid failure occurs, the stadium goes dark for 20 to 30 seconds before the battery re-energizes the site, including the LED floodlighting. This 30-second gap allowed the project to meet the football governance body UEFA’s requirements for hosting major matches, while avoiding excess costs.

Årdalsbakke told ESS News he enjoyed the challenge of the project, which balanced the requirements of regulations made for both television and fans, while solving several potential technical issues through his previous experience in the marine industry, including how to manage long cable runs where voltage drops occur.

Torfinn Årdalsbakke Torfinn Årdalsbakke

Energy as a Service: Zero CapEx

Perhaps most attractive to the client was the financial structure. Intility Arena paid no upfront capital costs for the battery or local infrastructure, though it did make some necessary upgrades to its electrical system to incorporate the battery.

The result is that Peak Shaper continues to own and operate the system, taking on the investment risk and operating costs. But it also has freedom to use the battery outside of game days: for approximately 98% of the time the stadium isn’t hosting a match, the company monetizes the battery in flexibility and balancing markets, and can charge the battery from the solar system on the rooftop of the stadium

“We own and operate, and the stadium pays an amount per year to us. That is less than the rental cost of the generators, while also a little bit less than what we expect to save behind the meter,” said Årdalsbakke. Then, local energy markets and optimized use of the battery determine revenues.

In terms of the return on investment (ROI), Peak Shaper invested heavily in the project as a strategic place to prove its Energy as a Service model, and on paper, accepted a longer operational horizon for its return.

“We accepted a longer ROI to learn the market,” said Årdalsbakke. However, while the initial outlook suggested the system would complete the ROI over its 15-year lifetime, real-world use and optimization have improved the outlook. “Now we’re looking at actually a better return, at around 10 years,” added the project developer.

ess-news.com |

Torfinn Årdalsbakke

Torfinn Årdalsbakke