2026 Energy Sector Outlook: Brace For Growing Oil Oversupply

Dec. 22, 2025 10:26 AM ET

KM Capital

7.52K Followers

Summary- Energy Select Sector SPDR Fund (XLE) is rated 'Sell' for 2026 due to anticipated sector underperformance.

- XLE's heavy upstream exposure ties its performance closely to crude oil prices, which face major structural headwinds.

- Slowing GDP growth in the U.S. and China, combined with rising global oil supply, is expected to pressure oil prices downward.

- While geopolitical risks could disrupt supply, structural oversupply and weak demand should drive continued XLE underperformance.

georgeclerk/E+ via Getty Images

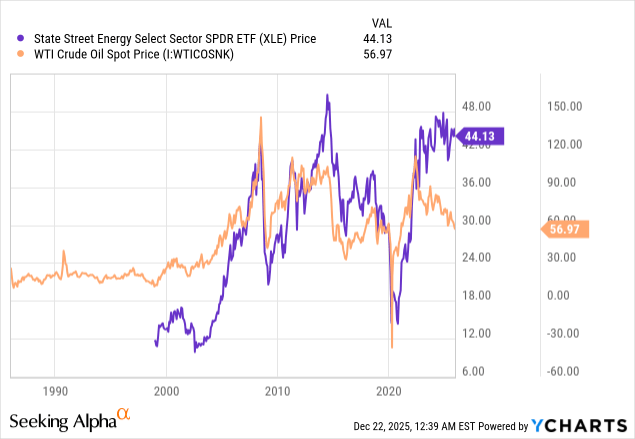

Energy Sector in 2025: substantial underperformanceWe still have ten days in 2025, but I am highly confident that the Energy Sector ( XLE) will finish this year among the three worst-performing sectors out of the total 11 sectors of the U.S. economy. At the moment I am writing this thesis, XLE's year-to-date performance is +3%. This is significantly weaker performance compared to the leading Information Technology sector ( XLK) and to the broader market ( SPX).

State Street Investment Management State Street Investment Management

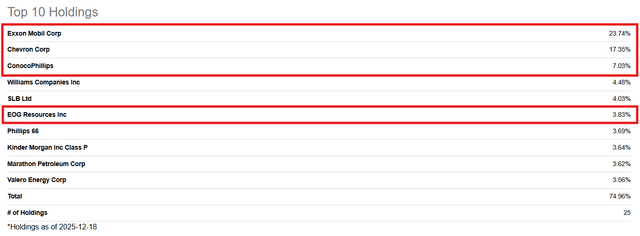

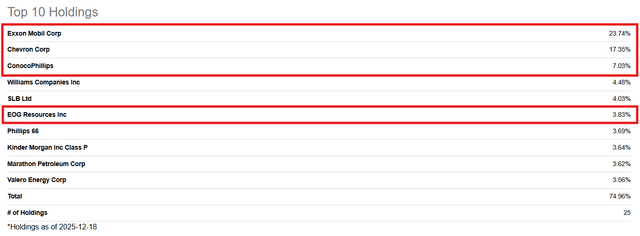

To understand the reasons behind any sector's performance, it is first vital to delve into its structure. If we look at XLE's top 10 holdings, there are four companies with substantial upstream exposure: Exxon Mobil ( XOM), Chevron ( CVX), ConocoPhillips ( COP), and EOG Resources ( EOG). Just these four companies represent more than 50% of the sector. Readers can get the detailed list of all XLE holdings here and check me, but it is safe to say that 60%+ of the holdings are companies with significant upstream exposure.

SA - XLE top-10 holdings SA - XLE top-10 holdings

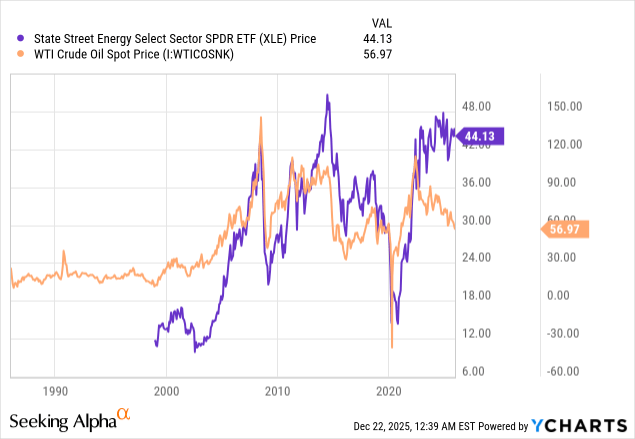

With such a significant upstream exposure, it is apparent that XLE's performance heavily depends on energy commodity prices like crude oil and natural gas. Prices of natural gas have been historically strongly correlated with crude oil prices. The chart below shows that there was almost perfect correlation between oil prices and XLE performance until shocks like the COVID-19 pandemic and the Russia-Ukraine war.

Data by YCharts Data by YCharts

The correlation has weakened over the past couple of years, but I think it is a temporary phenomenon because the world's largest economies demonstrated quite uneven post-pandemic paces of their economies' recovery. Therefore, I think that the correlation will recover over time, and this is why I want my today's outlook to focus on crude oil prices.

Oil prices 2026: major headwindsBefore describing the headwinds, let's briefly recap factors affecting prices. We all know very well that prices depend on the balance between demand and supply. For example, Nvidia is able to charge premium prices for its GPUs because the demand is insane with all these hundreds of billions invested in data centers at the moment, while the capacity to meet the demand (i.e., to supply) is limited because there is only one Nvidia and there is only one Taiwan Semiconductor Manufacturing Company. So, the logic is the same for energy commodity prices. But the difference is that there are by far more consumers and certainly by far more suppliers in the energy commodities market compared to the GPU market.

U.S. Energy Information Administration U.S. Energy Information Administration

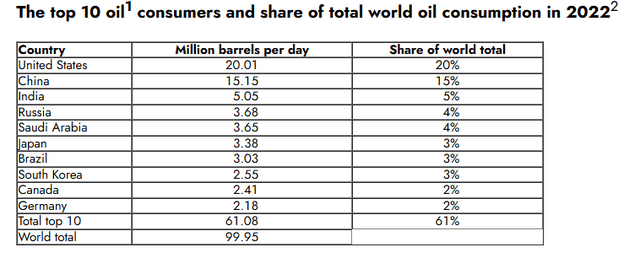

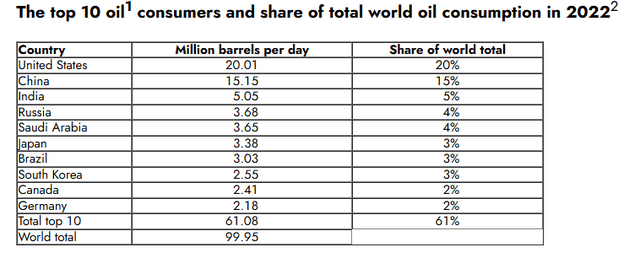

Therefore, to be able to reliably forecast where energy prices are likely to go, we have to understand who the largest players affecting oil supply and demand are. The number one player in the global energy arena is the USA because it is by far the world's largest oil producer, and it consumes the most among all countries even though its population is several times smaller than China's or India's, with their 1.4 billion inhabitants each. According to the U.S. Energy Information Administration, the U.S. produces 22% of the total global oil production and consumes 20% of the total. Besides the U.S., other players significantly affecting crude oil prices are China (15% of the global consumption and significant dependence on imports) and the Organization of the Petroleum Exporting Countries ('OPEC'), which includes 12 countries collectively producing about 35% of the world's crude oil. With all that being said, the global crude oil demand substantially depends on the GDP growth of the United States and China. The global supply even more significantly depends on OPEC and the U.S. once again, as both parties produce more than half of the world's crude oil.

If we look at the economies of the U.S. and China, their peak post-pandemic recovery rates are in the rearview mirror. The U.S. is still demonstrating GDP growth, but it is cooling down. Moreover, the unemployment rate is climbing, and the Fed's recent forecast that there will likely be just one rate cut in 2026 makes the scenario of the U.S. economic growth reaccelerating highly unlikely. Therefore, the U.S. crude oil demand is likely to remain quite stable in 2026 with no sudden spikes. Before this year's tariff war, China's economy had already been facing various structural headwinds like the housing crisis, aging population, and massive youth unemployment rate. In addition to all these problems, there are now increased tariffs from the U.S. It is a significant issue for China's economy because the U.S. is the most important export destination for the country, representing almost 15% of its total exports, or about $500 billion. With all these adverse factors, it is no wonder that China's economic growth is also cooling down. With the world's two largest economies' GDP growth slowing down, big surprises from the crude oil demand perspective are extremely unlikely.

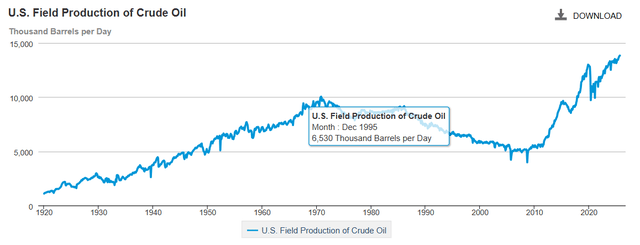

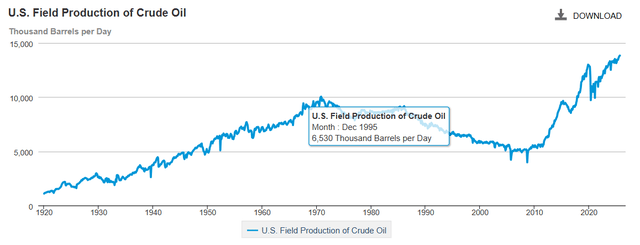

Without aggressive crude oil demand growth, energy prices are unlikely to soar. And there is also the supply side, which will be putting downward pressure on crude oil prices. Of course, OPEC is not interested in lower oil prices because its members are large exporters. However, they are highly unlikely to introduce oil production cuts like they did decades ago, because they will be losing their market share if they do so. It is vital to understand that OPEC's influence has deteriorated significantly compared to 20-30 years ago because the global oil supply market became much more competitive. First and foremost, the U.S. crude oil production has more than doubled over the last thirty years, and the country currently produces more than it consumes. When the world's largest oil consumer becomes independent of oil imports, it is a huge structural headwind for oil prices.

U.S. Energy Information Administration U.S. Energy Information Administration

Besides that, there are many other emerging players in the global oil market, which is another factor diminishing OPEC's influence. South American nations like Brazil, Argentina, and Guyana are all demonstrating an oil production boom. Canada and Norway are also oil-rich states showing increasing crude oil production. Therefore, I tend to agree with some experts saying that we will see the widening crude oil oversupply in 2026, which will inevitably push prices down. Since the performance of XLE heavily depends on crude oil prices, I expect this sector to significantly underperform in 2026 as well.

Mitigating factorsEven though the picture looks quite clear, as there are apparent fundamental factors both from the demand and supply sides, a 'black swan' can come. From the demand side, a 'black swan' event for oil prices will mostly mean a downside and not an upside. For example, the global lockdown during the pandemic was such a 'black swan' event, but it was a big headwind for the demand, not a tailwind.

However, in the current geopolitical environment, there might be a supply-side 'black swan.' Some oil-rich states like Venezuela, Russia, and Iran are already under dozens of sanctions related to their crude oil exports, which creates uncertainty. Moreover, the Russia-Ukraine war is still ongoing. It means that besides administrative factors like sanctions, Russia's oil export facilities are also facing physical damage risks. It is a big potential adverse factor for the global oil supply because Russia is the world's second-largest oil exporter.

Furthermore, some of the pipelines situated in Russia serve not only Russian oil companies. For example, Kazakhstan is another prominent oil exporter, and around 80% of this country's oil is exported via the CPC pipeline. It was recently attacked by Ukraine's drones, meaning that in case these attacks intensify, it might disrupt Kazakhstan's oil exports as well.

Conclusion

Despite some potential 'black swan' events that might disrupt the global oil supply, I think that their effect is likely to be relatively short because there are several structural factors that will inevitably weigh on crude oil prices in 2026. Since there is a historically strong correlation between crude oil prices and XLE performance due to significant upstream exposure, I expect the Energy Sector to underperform significantly compared to the broader market in 2026. Therefore, I think that XLE is a 'Sell' into 2026. |

Data by

Data by