The ‘Santa Claus rally’ is here, now prepare for the ‘January effect’ – analyst

Dec. 22, 2025 2:12 PM ET

By: Monica L. Correa, SA News Editor

The “Santa Claus rally” period from Dec. 24 through Jan. 5 has historically delivered remarkable returns for investors, averaging a 1.6% gain for the S&P 500 ( SP500) since 1928.

The index has also traded higher 77% of the time — in 75 out of 97 years — during this specific seven-day window. This performance stands in stark contrast to any typical seven-day period, which has averaged just a 0.2% gain with a 57% positive hit-rate, according to Ari H. Wald, head of technical analysis at Oppenheimer.

However, when the Santa Claus rally fails to materialize, performance in the subsequent one to two quarters tends to be below average.

“Since 1928, the S&P 500 ( SP500) has averaged a 1% loss in the subsequent three months following a negative [Santa Claus rally] vs. an average 2.6% gain following a positive [one],” Wald said, adding the old Wall Street saying: “If Santa should fail to call, bears may come to Broad & Wall.”

Looking ahead to January, Oppenheimer analysts found encouraging signals based on the index’s position relative to its 200-day moving average. Since 1950, the S&P 500 ( SP500) has averaged a 1.2% gain and traded higher 64% of the time when starting January above its smoothed trend, compared to a 0.7% gain and 50% positive hit-rate when starting below it. The index currently sits above this key technical level.

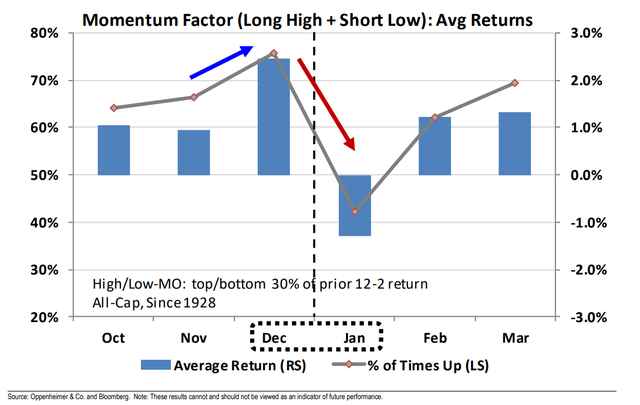

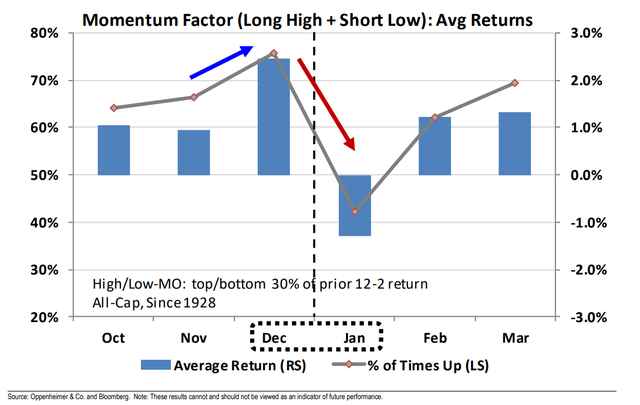

In addition, January has been the worst performing month of the year for the momentum factor ( SPMO), which tracks the performance of market leaders versus laggards over a prior 12-month basis. December outperformance often reflects tax loss harvesting, where investors sell losing stocks to offset capital gains tax liability, making January the worst month for momentum strategies as “the prior year’s ‘losers’ are subsequently bought back” in what’s known as the January Effect.

Momentum Factor (Long High + Short Low): Avg Returns (Oppenheimer & Co. and Bloomberg) Momentum Factor (Long High + Short Low): Avg Returns (Oppenheimer & Co. and Bloomberg) |

Momentum Factor (Long High + Short Low): Avg Returns (Oppenheimer & Co. and Bloomberg)

Momentum Factor (Long High + Short Low): Avg Returns (Oppenheimer & Co. and Bloomberg)