I did my first DSM assisted CEF partial-rotation today (see Example 1: PCN >> PDO). I was PCN heavy and PDO light. It's a Tier-3 Rotation in the context of other rotation options given to me, to reduce my portfolio's distribution fragility and NAV decay exposure, while improving future trim optinality (PDO is easier to trim later).

If interested, please read the details below (it may give you ideas on how to do a similar type of rotation in your own portfolio, that is if you desire):

What Tier-3 Rotation Actually Means?

You are not exiting CEFs.

You are exchanging fragile income for better-structured income.

Key rules:

- Same asset class (or close)

- Lower leverage / better coverage

- Income loss per swap typically = 10–20%, often recovered via stability

Example 1 — PCN > PDO (Classic PIMCO Risk Compression)

Why this matters

- PCN = older structure, higher NAV decay risk

- PDO = newer mandate, better credit mix, more resilient distribution

Current snapshot (approximate)

Partial rotation example Partial rotation example - Sell $25,000 PCN

- Buy $25,000 PDO

- Income preserved

- NAV volatility reduced

- Sponsor quality unchanged

DSM verdict:

This is a near-perfect Tier-3 rotation — same sponsor, similar yield, lower structural risk.

Example 2 — RQI > UTF (REIT beta > Infrastructure ballast)

Why this matters

- RQI = leveraged REIT exposure (rates + property risk)

- UTF = infrastructure with regulated utilities, transport, pipelines

Current snapshot

Partial rotation example - Sell $20,000 RQI

- Buy $20,000 UTF

Immediate income dip ˜ $120/year

Volatility reduction is material

DSM framing:

You’re trading rate-sensitive equity leverage for regulated cash flow.

This is exactly how you de-risk REIT CEF exposure without abandoning yield.

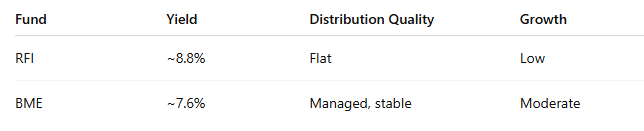

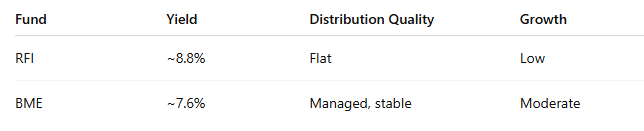

Example 3 — RFI > BME (Defensive rotation inside income sleeve)

Why this matters

- RFI = REIT income, limited growth, rate exposed

- BME = healthcare equity CEF with option overlay + distribution discipline

Snapshot

Partial rotation example Partial rotation example - Sell $15,000 RFI

- Buy $15,000 BME

- Short-term income gap ˜ $180

- Long-term NAV + distribution sustainability improves significantly

DSM note:

This trade raises portfolio quality, not just safety.

Summary Table — Tier-3 Rotations at a Glance

Bottom Line (Most Important)

Tier-3 rotations allow you to:

- Stay in CEFs

- Preserve most income

- Reduce leverage + NAV decay risk

- Buy time for dividend growth elsewhere to offset gaps

This is income engineering, not yield chasing.

Post rotation (PCN > PDO) DSM Risk & Quality Improvement:

|