B2Gold: Gold Is Up 24%, BTG Is Up 3.5%-Navigating The Divergence

Dec. 30, 2025 5:09 AM ET B2Gold Corp. (BTG) Stock, BTO:CA Stock

Dmytro Lebid

1.1K Followers

Follow

Summary- I maintain my rating on B2Gold while paying closer attention to its risk profile.

- This article explores the reasons why BTG shares have failed to keep pace with rising gold prices.

- A combination of growth catalysts and fundamental barriers supports a strong outlook for the stock's performance in 2026.

- The primary driver for interest in gold equities remains the forecast of gold reaching $5,000.

Hans Wismeijer/iStock via Getty Images

Investment ThesisStarting on September 13, 2025, the last time I studied the fundamental valuation of B2Gold ( BTG), the price of gold rose by 23.7%, whereas the share price rose by 3.5%. The question then arises: why, with such a positive continuation of the bull market in gold, are BTG's shares not showing more impressive growth (after all, the sensitivity of the shares of similar companies to the price of gold is mainly between 2.0x and 2.5x)? I believe there are logical explanations for this, based on an analysis not only of the fundamental value of the company and its projects, as well as how it is affected by negative external factors. This article aims to provide a rational assessment of BTG's investment attractiveness and identify the fundamental factors driving strategic growth and the barriers hindering the implementation of the company's strategy. If there are stop factors hindering the growth of B2Gold's share price, what is the potential for their further impact?

My Previous Thesis My previous article's main thesis was that the company could significantly increase its gold production by exploiting the Gramalote and Goose Mine deposits. The implementation of these projects has only recently begun and is likely to have a more positive economic impact towards the end of 2025. Furthermore, a historic bullish trend continues in the gold market, helping to sustain the share prices of gold mining companies. Nevertheless, BTG's market capitalization is sensitive to gold prices, rendering its shares highly volatile.

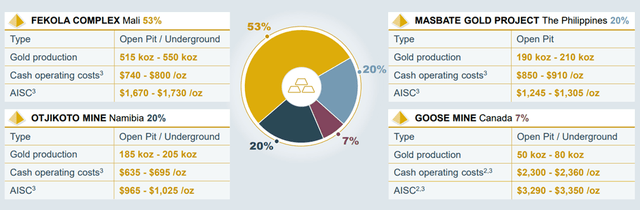

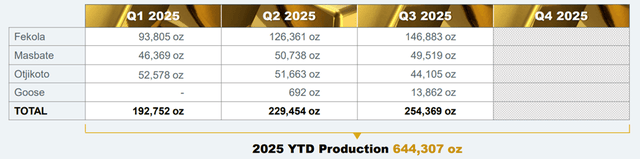

Fundamental Factors for B2Gold's Strategic GrowthCanada-based B2Gold is a gold mining company with operations spread across four continents. It is therefore an international producer with geographically diversified production. This creates an advantage in that the company is able to supply gold to different parts of the world. But on the other hand, the fact that its mines are in countries like Mali and Namibia is definitely a risk because of the unstable political situation in those places. And sooner or later, the same mine in Mali could slip out of the company's control. Currently, the BTG stock price clearly reflects this event with a discount. According to the results of Q3 2025, the Mali deposit showed an 87% increase in production compared to the previous period (146,883 ounces). This was made possible by an 81% improvement in the gold content of the ore and a slight 4% increase in the volume of ore processed.

The Goose Mine is one of the most important projects in BTG's next phase of strategic growth. It was originally planned to operate for nine years, and average annual gold production is expected to be 310,000 ounces. Estimated mineral resources at this mine are estimated at 2,440,000 ounces of gold (10.1 million tonnes with a gold content of 7.54 g/t). On the basis of updated information on the mineral resources of the Goose project, in conjunction with the prospects for exploration work in the Back River gold deposit area, BTG has begun a study to analyze the possibility of increasing the plant's capacity from 4,000 tpd to 6,000 tpd. The average annual production at these mines over a 9-year operating period will be 270,000 ounces.

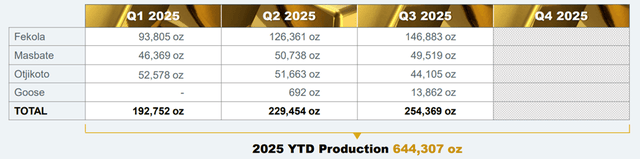

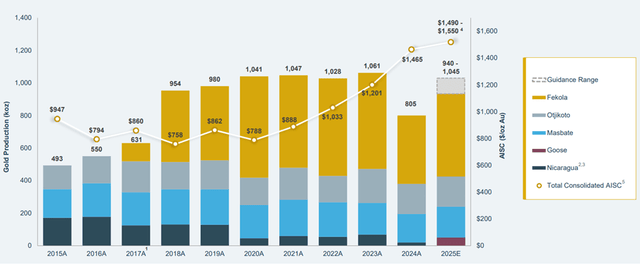

Gold Production, Cash Operating Costs & All-In Sustaining Costs Gold Production, Cash Operating Costs & All-In Sustaining Costs

Due to the start of operations at the Goose Mine, there has been a gradual improvement in the company's forecasts. For the remainder of 2025, during its Q3 earnings presentation, BTG updated its estimates, expecting total production of 940,000 to 1,045,000 ounces of ore at a production cost of $1,490 to $1,550 per ounce. In comparison with its industry competitors, BTG is one of the most cost-effective gold producers, allowing it to demonstrate more attractive financial results. Based on forecasts, it's important to add that a similar assessment is possible for 2026 and 2027 with improved indicators, because the same Goose Mine may turn out to be more promising than the estimates for the same Q2 2025. Based on the latest reports, the figures for confirmed and estimated mineral resources have improved by 16% and 14%.

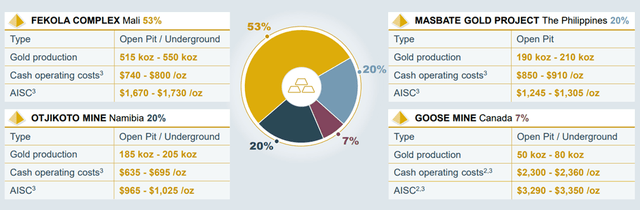

Robust Production Levels Expected in 2025 Robust Production Levels Expected in 2025

It is also implementing a gold mining project at the Gramalote mine in Colombia. Economic feasibility of the project is justified by the fact that the internal rate of return will be 33.5% at spot gold prices of $3,300 per ounce. Considering that gold prices have already reached $4,400 per ounce, the rate of return will be revised upward. At this mine, the company plans to produce 2.3 million ounces of gold over a 13-year operating period. The annual gold production in the first five years will be 227,000 ounces, followed by 177,000 ounces in subsequent years.

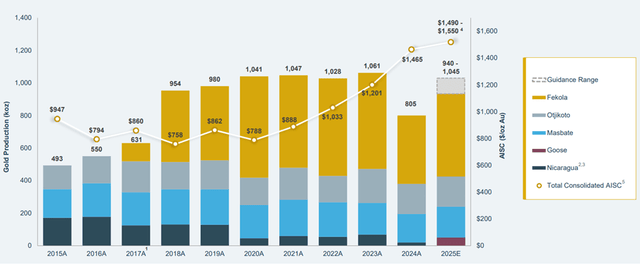

2025 Production & Cost guidance 2025 Production & Cost guidance

Economic conditions in the gold marketIn analyzing the impact of economic conditions on BTG's growth prospects, my primary focus is on the macroeconomic agenda surrounding the outlook for gold prices. Everyone knows that gold is one of the most defensive assets. That is why its main catalyst is various risks to the global economy and financial system. Among them are inflationary risks and geopolitical instability, combined with tariff wars, leading to a significant increase in demand for gold.

It is also important to consider the ongoing easing of monetary policy by the Federal Reserve, because a reduction in the key rate leads to a reduction in interest rates on government bonds (including US bonds). This is one of the main assets in which "safe money" is invested. I am referring to private and institutional investors who do not want to take risks. Since the decline in government bond yields will continue along with the Fed's rate cuts, there is a high probability that this capital will move from the bond market to other assets, primarily gold. Therefore, I predict that gold will reach at least $5,000 per ounce by the end of 2026. It would not surprise me if this growth continues and we see prices rise to $5,500–$6,000.

Reasons for the decline in B2Gold's share priceBTG's case demonstrates a classic situation where, even though the economic outlook for gold is favorable, a company's internal operational risks can offset all the positive effects of fundamental factors. In my opinion, there are three main reasons that explain the decline in the company's share price.

Firstly, there are geopolitical risks at the mine in Mali, a key asset for generating the company's cash flow (53% of the total share). Fighting and attacks by Al-Qaeda create risks that the current government of Mali could be overthrown. As all of BTG's agreements are with the current government, a new government would automatically cancel them. The arrival of terrorist organizations is even less likely to bring about any new agreements. The new mining code also played a significant role. Even though BTG was able to get a permit for underground gold mining at the Fekola mine in July 2025, this permit is still legal. But investors are thinking that this permit might be changed in the future, and taxes or the state's share might go up.

Secondly, the problems that have arisen with the Goose project should be taken into account. Despite the fact that I noted the potential for growth in gold production forecasts for future periods in the growth catalysts (since mineral reserves are larger), details of the first ore extraction turned out to be worse than expected. In this regard, we should note that gold production forecasts for this mine were lowered for Q4 2025 from the initial 80,000-110,000 ounces to 50,000-80,000 ounces. It is also worth considering that production activities at this mine are more technically complex. As a result, the initial costs (AISC) turned out to be higher than expected. Based on data for Q3, they are astronomical, at around $3,300 per ounce.

Thirdly, a lot of investors locked in their profitable positions after the results of Q3 2025. The company's financial results showed growth, although many drew attention to the quality of the profits themselves. In addition, an additional $200 million was raised, a move that was viewed negatively by many due to the deterioration in liquidity during a period of capital-intensive expansion of the company's business profile. Ultimately, the BTG stock faced a crisis of expectations amid growing expectations for the Goose project. The market players reassessed the company's investment appeal, moving their expectations from rapid production growth in the short term to a more complex process with results in the longer term.

BTG valuationTo determine the target value of BTG shares, I conducted financial modeling using DCF. The model allows us to identify the fair value of the company. Forecasts in the DCF model are based on a five-year period (2026-2030). A key valuation tool is the discount rate. In my calculations, I used a WACC of 10%. Even though B2Gold is a Canadian company, we need to keep in mind the risks linked to the Fekola deposit, so the discount rate is higher than for Canadian mining companies with assets in safe jurisdictions. I expect profits to grow by 6% during the forecast period.

Free cash flow is the main indicator used to assess BTG's fair value using the DCF model. According to analysts' estimates, the median indicator for next year is projected to be $650 million. This is due to the completion of capital investments in Goose and the end of advance gold payments in the middle of the year. Production is also expected to increase significantly due to the expansion of operations at the Goose mine. Below is a table showing the estimated components of BTG's final share price.

| Latest Data

| Forecast 2026

| Forecast 2027

| Forecast 2028

| Forecast 2029

| Forecast 2030

| Cash Flow, in $millions

| 650

| 689

| 730.34

| 774.16

| 820.61

| 869.85

| Discount Factor, in %

| | 0.9091

| 0.8264

| 0.7513

| 0.6830

| 0.6209

| Discounted Cash Flow, in $millions

| | 626.36

| 603.59

| 581.64

| 560.49

| 540.11

|

As a result of the assessment in the table above, the sum of all discounted cash flows of BTG for the period 2026-2030 is determined. This results in a sum of $2.912 billion. Next, we calculate the terminal value of the company. It is the value of cash flows in the post-forecast period. It is worth considering the expected constant growth rate of cash flow in the post-forecast period to be lower than the discount rate. It is proposed to set it at 2%, as this is the forecast for Canada's long-term GDP growth rate. As a result, the terminal value is calculated at $8.287 billion. Ultimately, BTG's fair value according to the DCF model will be: 2.912 + 8.287 = $11.199 billion.

Given that there are 1.339 billion BTG shares in circulation, DCF per share will be $8.36. Considering the current share price ($4.54), its fair value is 84% higher. Are these results objective? Comparing BTG's non-GAAP P/E ratio with its industry competitors, the same imbalance in favor of buying BTG shares can be seen. The ratio for B2Gold is 9.07, whereas the industry average is 17.67. It shows that BTG shares are far from being overbought right now. I think the main reason for this is the country risk associated with the Fekola mine in Mali.

Risks of the Investment ThesisI believe that the main risk is not so much the price volatility of gold as the impact on BTG's production volumes due to the location of its main mines. Risks related to the main mine in Mali will continue to exist. At the same time, there are four main points that are worth paying attention to. Their impact could lead to a sharp decline in the share price.

- The regulatory risk due to the new mining code, the content of which could be revised in favor of the Malian government, thus increasing the state's share in gold mining projects. State ownership has already been increased to 30% + 5% for local investors, whereas the limit was previously 20%. It is not guaranteed that these conditions will not be revised, say, up to 40% or 50%. That automatically reduces the net asset value for BTG.

- Even though the Fekola mine is far from the main fighting (near the border with Senegal), the security risks are still high. Especially for logistics, because attacks on convoys carrying fuel, equipment, and personnel continue.

- This mine in Mali is still super important for operations, as it produces more than half of the gold ore. That's why anything that happens at this site has a big impact on the company's financial stability.

- There may also be tax disputes, because the Malian government's military operations need to be funded by replenishing the budget. The main source of this funding is the mining sector. It is precisely the demands for additional payments or penalties that may lead to a significant increase in the company's expenses at the Fekola mine.

Conclusion

As a result, BTG's fundamental analysis shows that this asset is a pretty attractive investment. My rating is still "Buy," though the risks and threats are pretty significant, so all these factors together slow down the company's strategic growth potential. Were it not for the risks facing BTG today, my recommendation would be to "Strongly Buy" this asset. But until the share of gold production at other mines (especially Goose) is increased, I will remain cautious in my assessment.

seekingalpha.com |