Job gains cooled in December, capping year of weak hiring

Story by Harriet Torry

• 2h

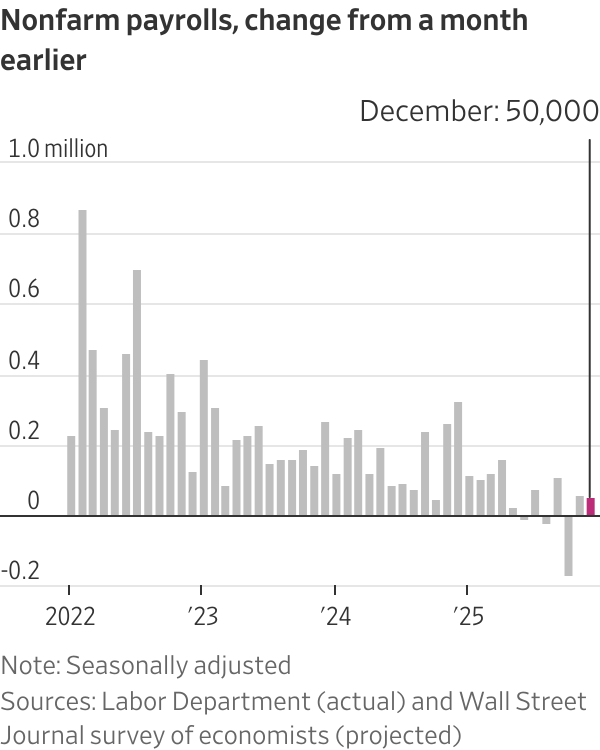

Nonfarm payrolls, change from a month earlier

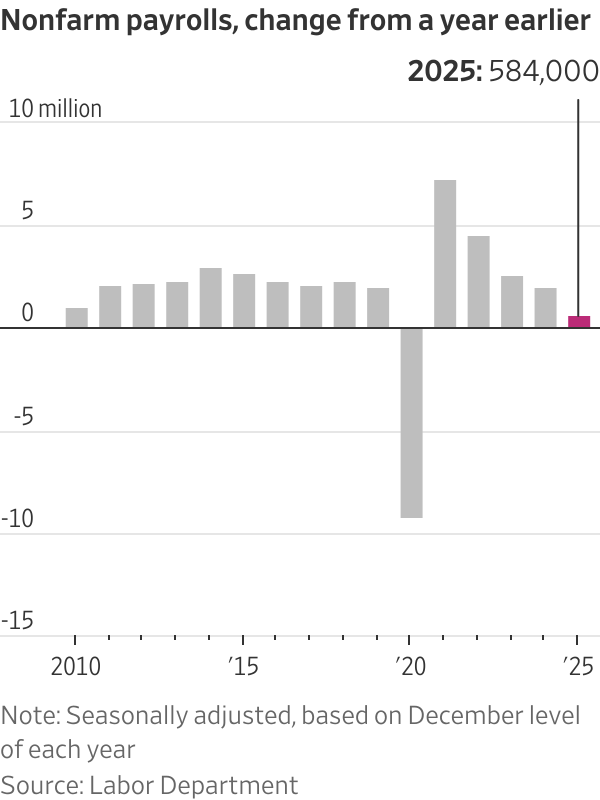

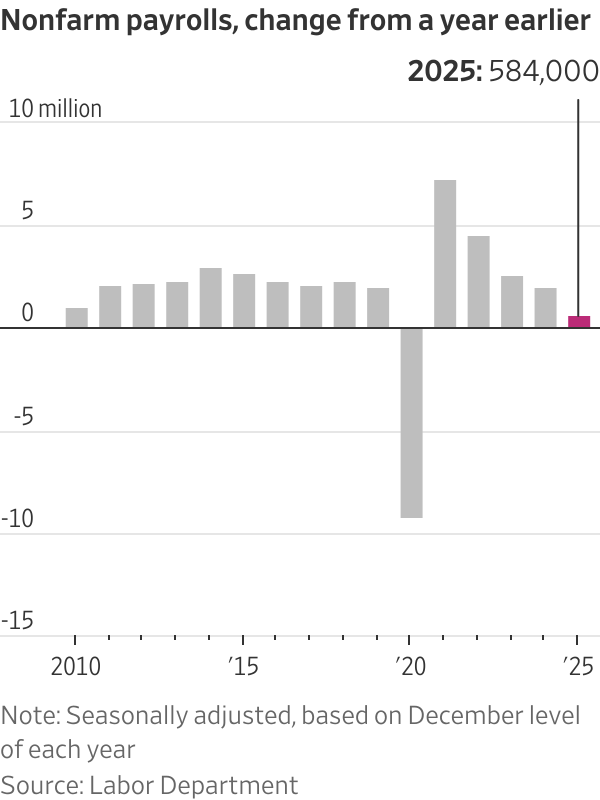

American employers added jobs at a subdued pace in December, capping a year in which the U.S. labor market lost considerable momentum. Outside of the two most recent recessions, 2025 saw the lowest pace of average monthly job growth since 2003.

The U.S. economy added a seasonally adjusted 50,000 jobs in December, the Labor Department said Friday. That was a slight slowdown from November’s 56,000 gain and undershot economists’ expectations for a 73,000 increase.

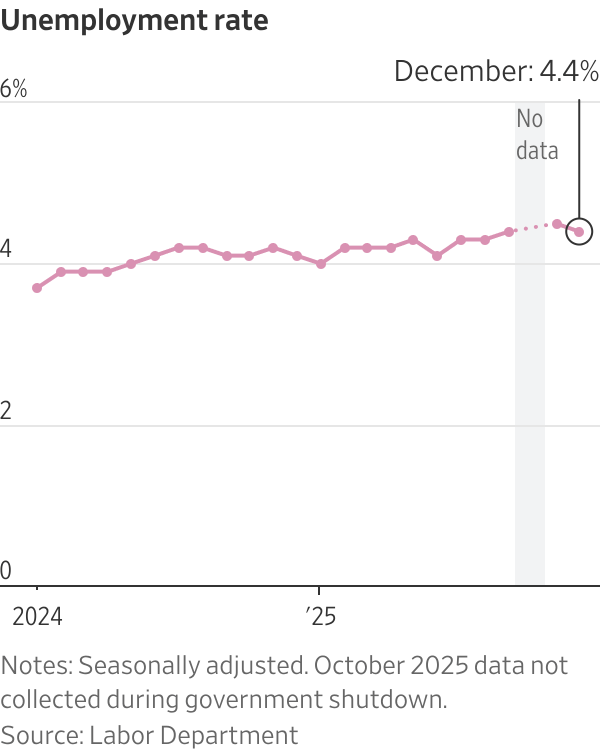

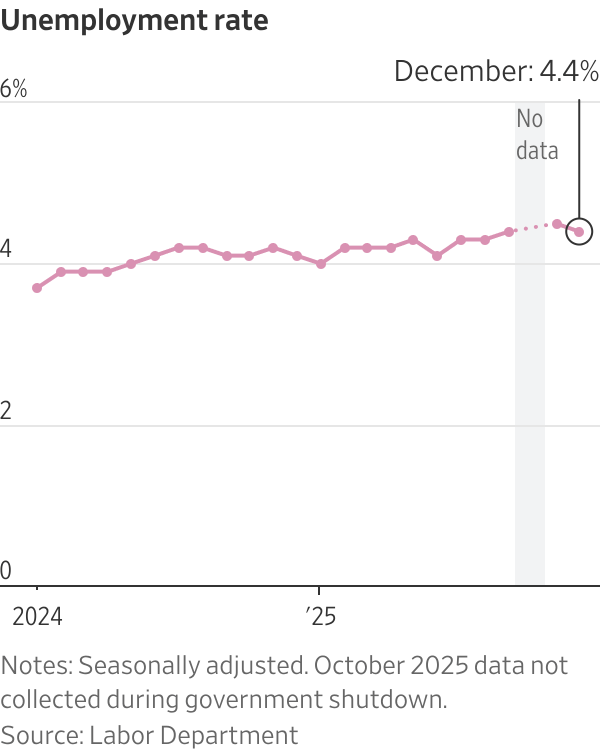

The unemployment rate ticked down to 4.4% last month, although it has drifted up from 4% last January.

All told, employers added 584,000 new jobs in 2025—or about 49,000 jobs a month, on average. That is a marked deceleration from 2024, when the economy added two million jobs at a pace of 168,000 a month.

“We are at an inflection point,” said U.S. Bank Chief Economist Beth Ann Bovino. Businesses that staffed up rapidly in the postpandemic years are pulling back on hiring, she noted. Although economic growth has remained strong, with consumers and businesses continuing to spend, “the jobs market is very fragile—the unemployment rate is low, but businesses aren’t hiring.”

Headed into 2026, the labor market appears to have settled into a “low hire, low fire” stasis, where companies aren’t eager to add new workers but also aren’t laying off employees en masse.

The reluctance to staff up reflects a number of factors, including uncertainty over higher costs and President Trump’s back-and-forth tariff announcements. The Trump administration’s large-scale deportations have made it difficult for some businesses to find workers, and some companies are waiting to see if artificial intelligence can handle more of their tasks. And anxious workers are holding on to their jobs, which also allows less room for companies to hire new people.

The federal government swung from a source of job creation in 2024 to job loss in 2025, mostly because of the Trump administration’s cuts to the federal workforce. Since reaching a recent peak last January, federal government employment is down by 277,000 jobs, or more than 9%, the Labor Department said.

Manufacturing employment logged its eighth straight month of declines, meaning the U.S. has steadily lost manufacturing jobs ever since Trump announced “Liberation Day” tariffs.

Unemployment rate

Last year’s job gains were heavily concentrated in healthcare and social assistance, a sector that tends to add jobs no matter how the economy is performing. Bars and restaurants also added jobs at a steady pace, which economists say reflects continued spending by higher-income households buoyed by a strong stock market and other asset gains.

Average weekly hours ticked down in December, and temporary help services shed jobs in nearly every month of 2025. That could be a sign that employers, faced with slowing demand, are reducing their employees’ hours and pulling back from temporary labor to avoid laying off staff.

Those on the sidelines are also struggling. December’s report showed the number of long-term unemployed—those without a job for 27 weeks or more—is up nearly 400,000 from a year ago. The median duration of unemployment also jumped in December, to 11.4 weeks from 9.8 weeks a month earlier. The number of people working part time who would prefer a full-time job has increased by nearly a million since December last year.

Even so, other recent data point to a solid pace of economic growth, highlighting a disconnect between the middling environment for hiring versus other measures of the economy. The U.S. trade deficit shrank dramatically in October to its lowest level since 2009, the Commerce Department said earlier this week. And consumer sentiment ticked up in January, although it remained nearly 25% below last January’s reading, according to the University of Michigan’s monthly survey of consumers out Friday.

The GDPNow tracker published by the Atlanta Fed suggests fourth-quarter GDP growth of 5.1%, a pace not seen since late 2021 when the economy was emerging from Covid-19 shutdowns.

U.S. stocks have been on a tear and traded higher on Friday, with the Dow Jones Industrial Average and the S&P 500 on track for new records.

Nonfarm payrolls, change from a year earlier

December’s jobs report is the first clean look at the labor market in several months, after the record-long government shutdown caused government agencies to cease data collection for six weeks and delayed the release of many major economic indicators.

The drop in the unemployment rate in December cements expectations that the Fed will stand pat at its Jan. 27-28 meeting, though the soft hiring figures ensure that central bankers’ debate over the labor market’s health is far from settled.

A lower jobless rate eases for now the most acute concerns about labor-market deterioration that drove the Fed to cut rates at three consecutive meetings last year—each time with growing opposition from a minority of policymakers who didn’t think cuts were warranted. Wage growth also firmed in December, with year-over-year average hourly earnings ticking up 3.8%.

Economists say lower borrowing costs and tax cuts from the One Big Beautiful Bill Act should help support hiring in 2026, even as employers grapple with continued uncertainties around tariffs and inflation. |