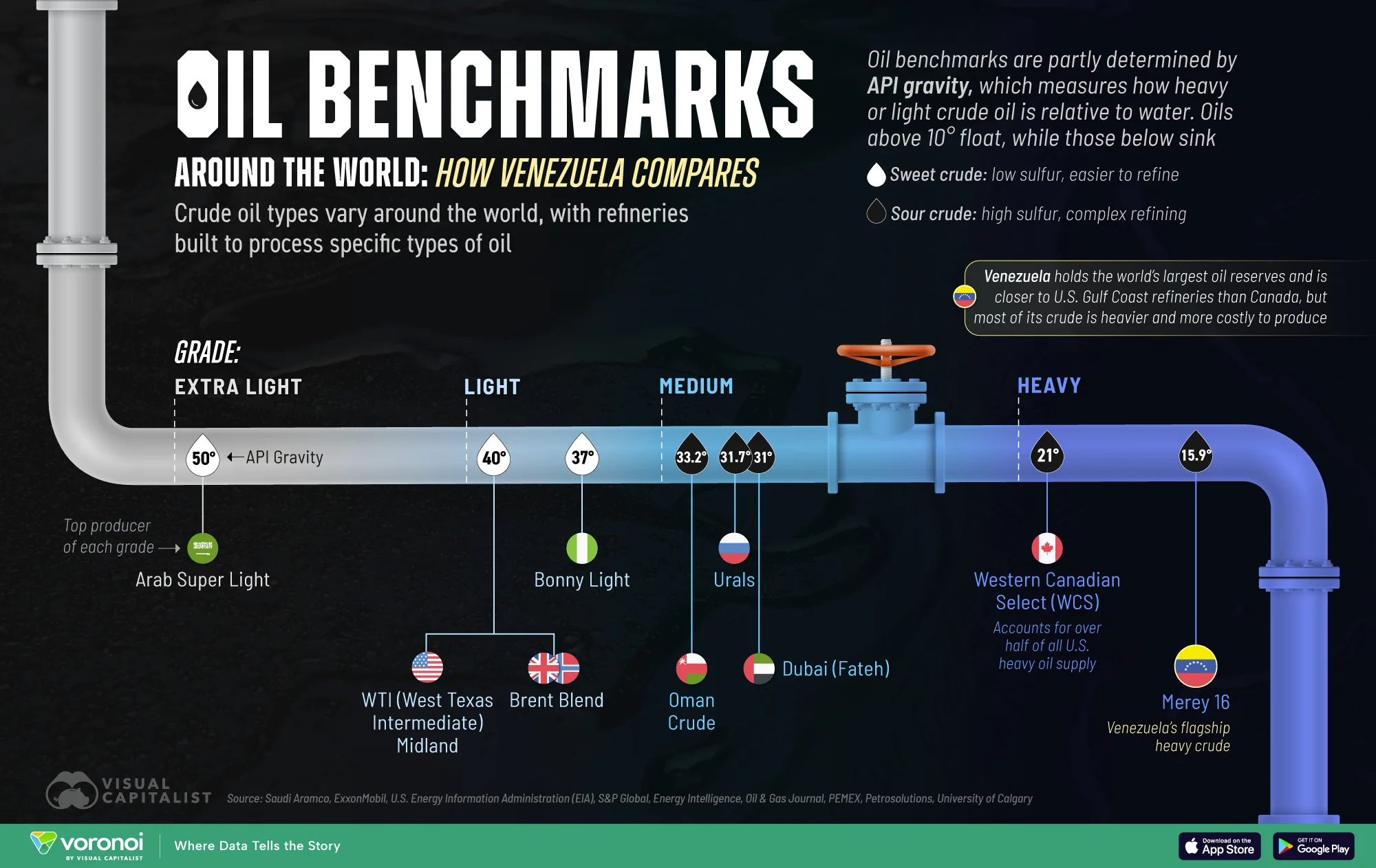

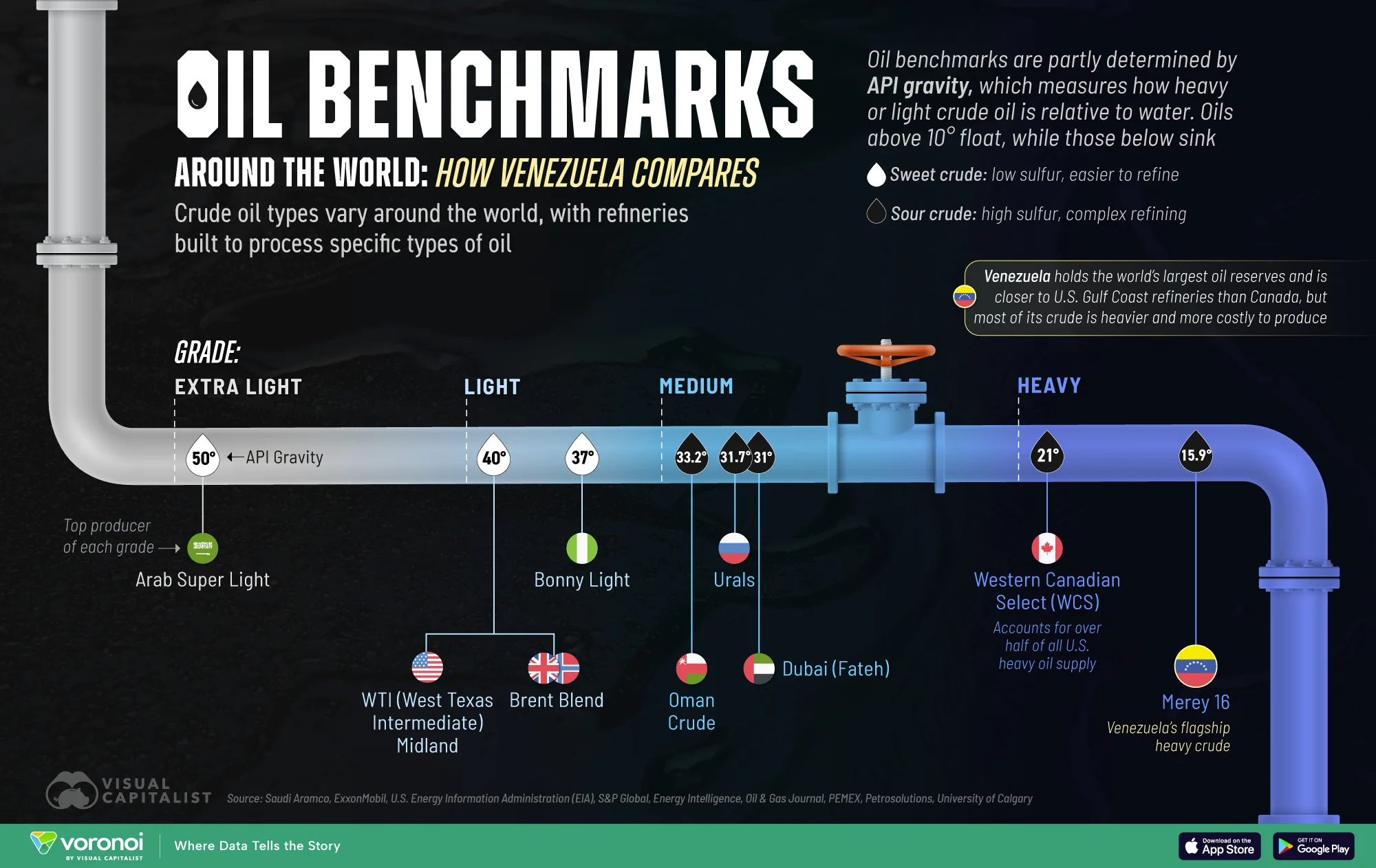

Oil Benchmarks Around the World: How Venezuela Compares

January 10, 2026

By Bruno Venditti

Graphics/Design:

See more visuals like this on the Voronoi app.

Click to view this graphic in a higher-resolution.

Oil Benchmarks Around the World: How Venezuela ComparesSee visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways- Venezuela holds the world’s largest oil reserves, but most of its crude is heavy and sour.

- Global benchmark crudes tend to be lighter and sweeter, making them easier and cheaper to refine.

- U.S. refinery capacity is designed to process heavy crude oils, like Canadian or Venezuelan crude.

Crude oil is not a uniform product. Its quality varies widely by region, shaping everything from refinery design to global trade flows.

This visualization compares Venezuela’s oil with the world’s most traded crude blends.

The data for this visualization comes from a combination of sources, including Saudi Aramco, ExxonMobil, the U.S. Energy Information Administration (EIA), S&P Global, PEMEX, and the Canada Energy Regulator. It compares major global crude grades using API gravity, crude type, and sulfur content to show how oil quality differs around the world.

Venezuelan Oil: Heavy and Sour

API gravity measures how heavy or light crude oil is compared to water. Oils above 10° API are lighter and float, while those below 10° API are heavier and sink. In general, lighter crudes are easier to refine into fuels like gasoline and diesel. Heavy crude oils typically produce more residual products, such as asphalt.

Venezuela holds the world’s largest proven oil reserves, but most of its production consists of heavy and extra-heavy crude.

The country’s flagship blend Merey 16 has API gravity well below 20°. The oil is also sour, meaning it contains high sulfur levels.

Top ProducerGradeAPI GravityCrude TypeSweet / Sour|

| ???? Saudi Arabia | Arab Super Light | 50° | Extra Light | Sweet | | ???? Malaysia | Tapis | 45.8° | Extra Light | Sweet | | ???? U.S. | Eagle Ford | 45° | Extra Light | Sweet | | ???? Algeria | Saharan Blend | 43.2° | Extra Light | Sweet | | ???? U.S. | WTI | 40° | Light | Sweet | | ???? UK, ???? Norway | Brent Blend | 40° | Light | Sweet | | ???? Nigeria | Bonny Light | 37° | Light | Sweet | | ???? Oman | Oman Crude | 33.2° | Medium | Sour | | ???? Russia | Urals | 31.7° | Medium | Sour | | ???? UAE, ???? Oman | Dubai (Fateh) | 31° | Medium | Sour | | ???? U.S. | Mars Blend | 28.5° | Medium | Sour | | ???? Venezuela | Mesa 30 | 29.1° | Medium | Sour | | ???? Mexico | Maya | 21° | Heavy | Sour | | ???? Canada | Western Canadian Select | 21° | Heavy | Sour | | ???? Colombia | Castilla | 18.8° | Heavy | Sour | | ???? Venezuela | Hamaca | 17° | Heavy | Sour | | ???? Venezuela | Merey 16 | 15.9° | Heavy | Sour | | ???? Venezuela | Boscan | 10.1° | Extra Heavy | Sour | | ???? Canada | Athabasca Bitumen | 8° | Extra Heavy | Sour |

Because of these characteristics, Venezuelan crude requires complex and expensive refining processes. Only a limited number of refineries globally are equipped to handle such heavy feedstocks efficiently.

Why Light and Sweet Crudes Dominate Global Trade

Many of the world’s most traded crude oils—such as Brent, WTI, and Arab Light—are light and sweet. With API gravities near or above 40° and low sulfur content (sweet), these crudes are cheaper to process and yield higher proportions of valuable fuels. This makes them attractive benchmarks for global pricing.

Extra-light crudes like Arab Super Light and Tapis sit at the top of the quality spectrum. Their high API gravity and low sulfur content allow refiners to maximize output with minimal processing complexity.

Despite its challenges, heavy crude still plays an important role in global markets. U.S. Gulf Coast refineries, for example, were specifically configured with cokers and other complex units to process high-sulfur, low-API crude crude oils from countries like Venezuela, Mexico, and Canada.

Venezuela is geographically closer to U.S. Gulf Coast refineries than Canada, but most of its crude is heavy and costly to produce. Historically, U.S. refiners purchased significant volumes of Venezuelan heavy crude before sanctions reduced those flows, and Canadian heavy crude has since become the largest foreign heavy crude supply to the U.S. market.

Venezuela’s Rise, Fall, and Changing Role in Global Oil

At its peak in the 1970s, Venezuela produced around 3.5 million barrels per day, representing more than 7% of global oil output at the time.

Since then, production has declined sharply due to underinvestment, infrastructure decay, and geopolitical pressures, including sanctions.

Today, Venezuela’s output averages around 1 million barrels per day, or about 1 % of global supply.

Despite the collapse in production, Chevron continues to operate in Venezuela through joint ventures, maintaining a presence that few other U.S. oil majors have preserved amid sanctions and nationalizations.

Venezuela was also a founding member of OPEC in 1960, alongside Iran, Iraq, Kuwait, and Saudi Arabia. However, its influence within the group has diminished as production declined and its ability to meet export commitments weakened. |