Donald Trump, Would-Be Price Controller

Unfortunately for him, tweets don’t change the law

Paul Krugman

Jan 14, 2026

Donald Trump has no economic principles.

It’s true that he has pushed through classic right-wing policies, cutting taxes on the rich and benefits for the poor and middle class. But there’s no reason to think Trump actually believes in supply-side economics. Unlike Ronald Reagan, he has never articulated a belief that cutting taxes for the rich would raise all boats, resulting in higher incomes for middle and lower income Americans. Rather, if there is one trait that defines Trump’s policy instincts it is that he’s utterly transactional. Cutting taxes for the rich is a reward to his donors and family business partners. As a bonus, he gets to indulge his sympathy for plutocrats and contempt for ordinary Americans.

Similarly, in the past 12 months he has moved to abolish many regulations, especially environmental protections. But not because he is a free market advocate. Again, it’s largely about rewarding donors, but also feeding the right-wing machine – for example, adopting policies pushed by the Federalist Society, which effectively controls judgeships that have given Trump so much unchecked power. And there is an additional perk to disabling regulations like the Clean Air Act: it allows Trump to indulge his visceral dislike for any policy that serves the public good.

So while Trump may sometimes act like an economic conservative, this is just opportunism. Trump doesn’t adhere to any consistent ideology. Instead, it’s all transactional, to serve his interests and indulge his contempt for ordinary Americans. As a result, he’s perfectly willing to issue edicts like a monarch, ordering the private sector around whenever he thinks it might be to his political advantage, as well as acting on personal grudges whenever he meets the slightest resistance.

Rather than resembling the Republicans’ erstwhile icon Ronald Reagan, Trump resembles the Republicans’ erstwhile persona non grata, Richard Nixon. In fact, in some ways 2026 is feeling like the early 1970s, when Nixon pressured the Federal Reserve to cut interest rates despite the risk of overheating the economy, while imposing wage and price controls in an attempt to stop inflation by fiat.

Nixon, however, was a lot smarter than Trump. To achieve his aim of lower interest rates, Nixon wouldn’t have engaged in anything as crude and transparent as Trump’s pressure tactics against the Fed – for example, Trump’s launch of a spurious criminal investigation into Fed Chairman Powell. In fact, Nixon’s price controls, despite being ill-advised, were a serious program supported by enabling legislation. In contrast to Trump, Nixon didn’t govern by making pronouncements and expecting everyone to simply submit.

Which brings me to Trump’s announcement on Friday that he is imposing a 10 percent limit on credit card interest rates, effective January 20 and lasting for a year. Trump’s motives are clearly cynical: as I will discuss below, this is the same man who a few short months ago attempted to disembowel the Consumer Financial Protection Bureau, the federal agency charged with protecting consumers from predatory financial industry practices. His move to limit credit card interest rates is timed to help Republicans in the midterms.

But let’s leave politics to the side for a moment and ask if limiting credit card interest rates makes economic sense. Some economic observers had a knee-jerk negative reaction – according to them, a cap on credit-card interest rates is a price control, and price controls are bad. In addition, according to the banking industry,Trump’s cap will have disastrous effects on the availability of credit to households, particularly to lower income households who must pay higher rates due to their economic situation or bad credit history. But bankers would say that, wouldn’t they?

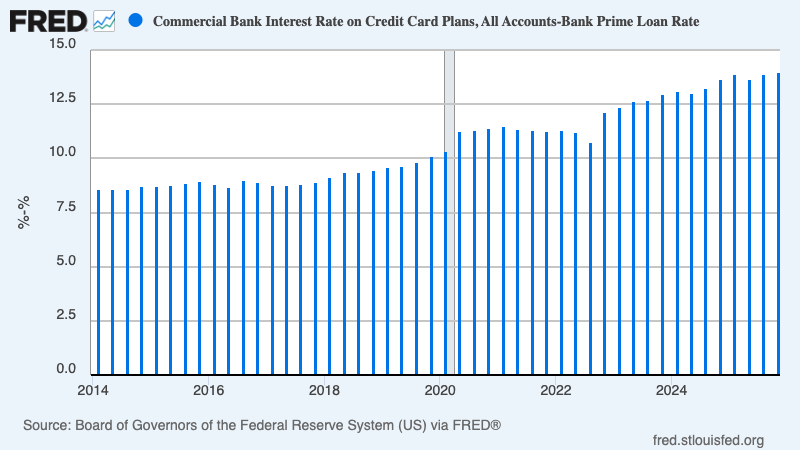

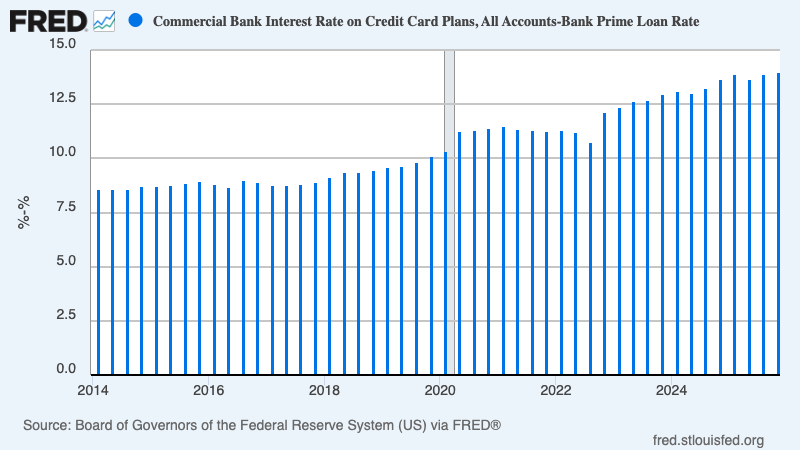

The truth is that the spread between credit card interest rates and other lending rates, such as the prime lending rate, has soared since 2019, and is now extremely high by historical standards:

Sky-high credit card interest rates do not reflect supply and demand. Instead, they mostly reflect business practices that victimize consumers. As research reported by the Federal Reserve Bank of New York documents, credit card companies spend vast sums on marketing. Once they have pulled customers in, they then use their market power to charge exorbitant interest rates. This arrangement is deeply unfair: The losers are vulnerable individuals and families who don’t have access to better sources of credit. It’s also wasteful, because marketing doesn’t provide useful information or make the nation richer. It’s simply a way of attracting the uninformed and credulous.

So in straight economic terms there is a valid case for government intervention to protect consumers by reducing credit card interest rates. There is also a valid case for action to end other abusive credit card practices, such as exorbitant late fees.

But until a few days ago the Trump administration was very much on the side of the bankers and against consumers.

As I mentioned above, we have a federal agency, the Consumer Financial Protection Bureau — the brainchild of Senator Elizabeth Warren — whose mission is precisely to protect consumers from predatory financial institutions. As late as December 2024, just before Trump took office, the CFPB forced a group of “credit repair” companies that charged illegal fees and engaged in bait-and-switch advertising to refund $1.8 billion to consumers. But one of the Trump administration’s first major actions was an attempt to shut down the CFPB.In February 2025 Russell Vought, who ran Project 2025 then became Trump’s budget director, informed CFPB staff that the bureau was closed and that they should not “ perform any work tasks.”

The CFPB was created by Congress, and the courts have found that the CFPB cannot be closed by presidential edict. Nonetheless, the administration has been engaged in a running legal battle over the CFPB, with Vought trying to ensure that consumers are not, in fact, protected.

Now, facing likely electoral defeat in November, Trump has suddenly announced that he is imposing a credit card interest rate cap. Yet unlike Nixon, Trump isn’t working with Congress to pass legislation that is, in effect, a price control. In fact, he has shown no interest in doing anything substantive. Whatever Trump may imagine, posts on Truth Social do not have the force of law.

Nor is there any realistic prospect that he can get Republicans in Congress to support the legislation he would need to turn his pronouncements into reality. They will do almost anything for Trump, but they won’t do that.

And what about the Democrats? Trump called Senator Warren Monday to talk about the credit card issue. Warren’s statement afterwards revealed little about what Trump wanted, but we can infer that he was seeking some kind of support and affirmation from a leading progressive Democrat.

Here’s a bit of unsolicited advice to the Democrats: He shouldn’t get any help unless he is prepared to offer something substantive he can actually deliver.

And it’s obvious what that “something substantive” is: End the effort to kill the Consumer Financial Protection Bureau, restore its funding, and let it get back to doing its job. This would immediately help Americans with credit card debt, and many other struggling American families as well. No legislation would be required, since the CFPB was established by law — law Trump has been trying to defy. If Trump really wants to cap credit card interest rates, he should reach across the aisle and get legislation passed with Democratic support.

However, I don’t expect any of this to happen. Trump has repeatedly shown a visceral dislike for policies that serve the public good. He really hates bipartisanship because it won’t allow him to flaunt his dominance and act like America’s Supreme Leader. As with his performative claim that he would bring down grocery prices on “Day One”, Trump somehow believes that his bluster and antics will solve his political problems. Well, voters are in no mood to get fooled again. And the Democrats should make sure that they don’t abet another Trumpian charade.

paulkrugman.substack.com |