interesting vector-movement, and as BTW, am limited to buy AND sell 10 pieces of 1-troy oz coins per day, iow, the main retail dealing centre in HK is not keen to play, and the bid/ask gap is ~US$ 50 per piece, rather wide

in the meantime, lapping it up ... suspect gold and silver mis-priced and ought to be re-rated as opposed to de-rated

Team Japan is ZUGSWANG situation, as are the Euro lapdog / Chihuahua states

bloomberg.com

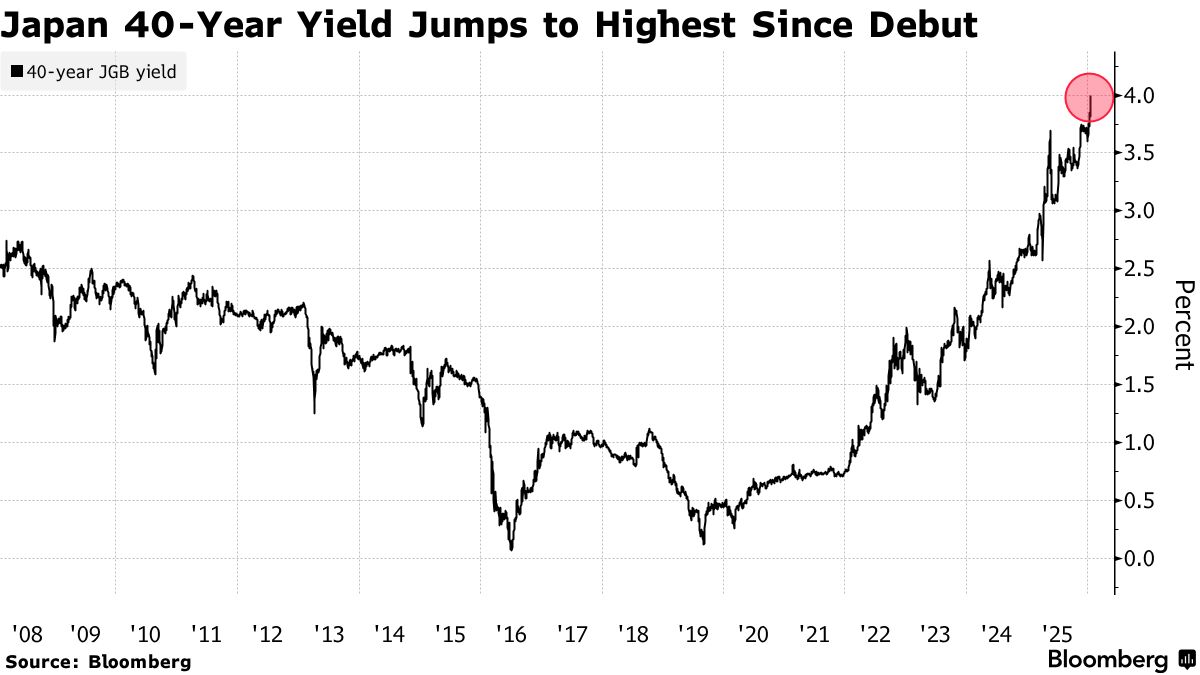

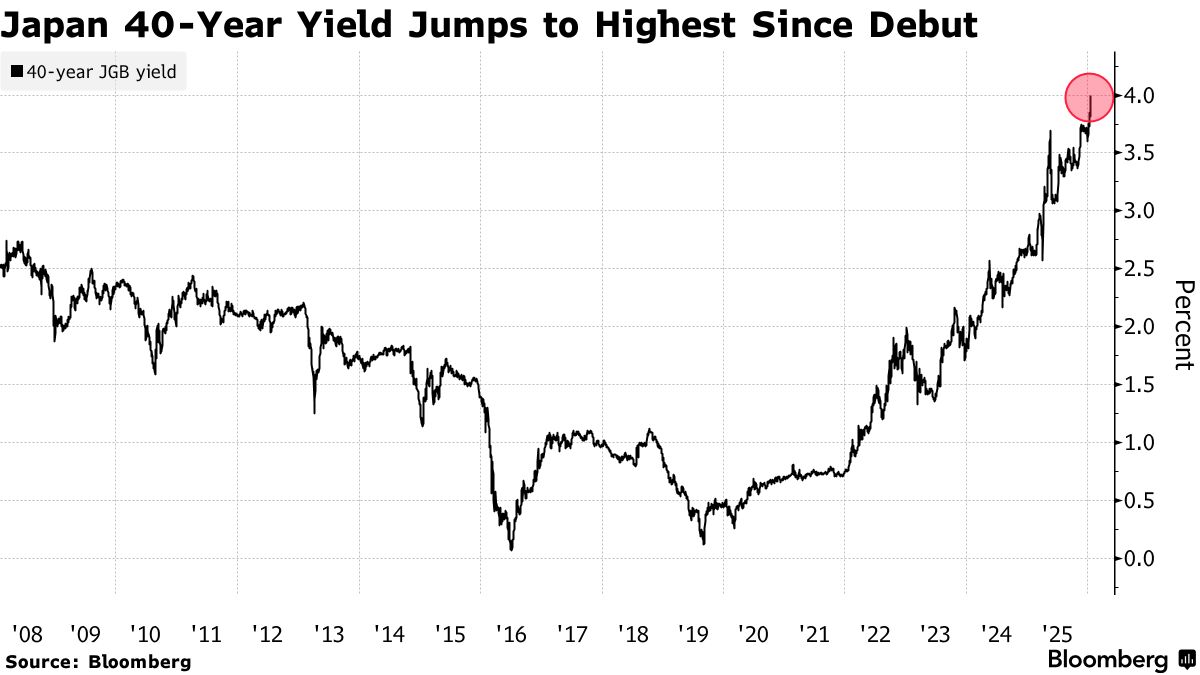

Japan 40-Year Bond Yield Hits 4% for First Time Since 2007 Debut

By Mia Glass

January 20, 2026 at 8:30 AM GMT+8

Updated on

January 20, 2026 at 8:39 AM GMT+8

Japan’s 40-year bond yield rose to 4%, the highest since its debut in 2007 and a first for any maturity of the nation’s sovereign debt in more than three decades.

The 40—year rate jumped 5.5 basis points, marking the first time Japanese government bond yields have reached the 4% level since the 20-year yield did in December 1995.

The gain underscores a wider selloff in Japanese bonds that’s accelerated on concern the government’s plan to cut the sales tax on food will leave a hole in the country’s finances. The Centrist Reform Alliance, a merger between Japan’s largest opposition party and a former ruling coalition partner, also aims to generate the financing needed to cut the sales tax on food to 0% through the management of a new government-related fund.

The surge marks a shift in Japan’s bond market, where years of ultra-low interest rates had kept yields well below those of global peers. The nation’s 30-year bond yield has surpassed Germany’s rate of that tenor, which sits at around 3.5%

Read: Japan’s Takaichi Calls Feb. 8 Election, Vows to Cut Sales Tax

Japanese Prime Minister Sanae Takaichi officially called a Feb. 8 election during a briefing on Monday, betting that her ruling Liberal Democratic Party can strengthen its slim majority in parliament. Investors are also cautious ahead of a 20-year government bond auction on Tuesday. |