The End of the Road for Japan

Japan's latest fiscal stimulus is sending the Yen into a new devaluation spiral

Robin J Brooks

Nov 21, 2025

Japan’s new prime minister - Sanae Takaichi - is planning a large fiscal stimulus that includes energy subsidies and cash handouts for households. At this point, the exact size of what’s coming is uncertain because parliament still needs to sign off, but - no matter what happens - it’s clear there’ll be more debt-financed stimulus, which is how Japan ended up with government debt at 240 percent of GDP in the first place.

Here’s the problem.

As I’ve flagged for many months, we’re in the early stages of a global debt crisis. Longer-term bond yields are rising as markets grow increasingly fearful that high debt levels will be inflated away. A desperate search for safe havens is underway, which is what the “debasement trade” is all about. That’s what’s driven precious metals prices through the roof and is why countries with low government debt (Switzerland, Sweden, Denmark) are suddenly in vogue. In other words, patience is running out for governments whose only solution to a debt overhang is to spend more. That just doesn’t cut it. Japan is reaching the end of the road on this.

Why has Japan reached the end of the road on fiscal stimulus?

The reason is that the Bank of Japan (BoJ) remains a big buyer of government debt as the chart above shows. This means Japanese yields are being kept artificially low by the BoJ and would be much higher without this intervention.

That would plunge Japan into a debt crisis, which the current and past governments are unwilling to confront. Instead, it’s more convenient to use the BoJ to artificially cap yields. The problem is that this doesn’t fix the underlying problem, which is over-indebtedness. It just transmogrifies what would be a crisis in the bond market into a currency crisis.

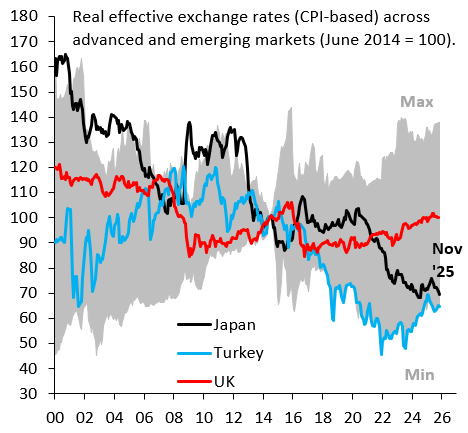

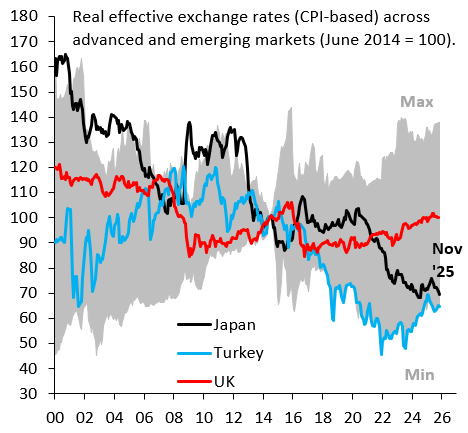

It’s gone under the radar, but if you look at the Japanese Yen in real effective terms, which means factoring in how it stands against all currencies around the world taking into account inflation differentials, the Yen is almost as weak as Turkish Lira, which is the single worst performing currency globally after President Erdogan eviscerated his central bank. The black line in the chart above is the Yen in real effective terms, while the Turkish Lira is in blue. For perspective, the British Pound is in red.

More fiscal stimulus means more debt, which - ordinarily - would mean higher yields. But those are already artificially low and more fiscal stimulus means this distortion will only grow as BoJ is forced to ramp up buying to keep a lid on yields. So the Yen is resuming is devaluation spiral and closing in on its all-time low from mid-2024.

If Sanae Takaichi really wants to make Japan stronger, it’s time to make some hard decisions, which means raising taxes, cutting spending and selling Japan’s abundant state assets. Just doing more of the same - yet another stimulus - just doesn’t cut it.

robinjbrooks.substack.com |