The "bidding wars" begin.

It has only just begun.

The race is on!

For more solar and storage.

Eric

Amazon outbids WA utility for one of nation’s largest solar projects

Feb. 5, 2026 at 6:00 am Updated Feb. 5, 2026 at 6:00 am

Solar panels in Tucson, Arizona. (Rebecca Noble / Bloomberg)

By

Greg Kim

Seattle Times staff reporter

Climate Lab is a Seattle Times initiative that explores the effects of climate change in the Pacific Northwest and beyond. The project is funded in part by The Bullitt Foundation, CO2 Foundation, Jim and Birte Falconer, Mike and Becky Hughes, Henry M. Jackson Foundation, Martin-Fabert Foundation, Craig McKibben and Sarah Merner, Mary Snapp and Spencer Frazer, University of Washington and Walker Family Foundation, and its fiscal sponsor is the Seattle Foundation.

Amazon outbid Puget Sound Energy last month in an auction for a massive solar farm project in Oregon, leaving the utility concerned about a larger competition for resources with energy-hungry artificial intelligence companies.

Amazon will pay $83 million for the proposed project, which could become one of the largest solar farms in the United States once completed, with 1.2 gigawatts of solar generation capacity and an equal amount of battery storage. It’s approved to take up 9,442 acres, about the size of West Seattle, with the capacity to power several hundred thousand homes. PSE’s final bid was $82 million.

“We are used to being kind of the only buyers for these things as utilities, and now there are other buyers who are a little bigger than we are,” said Matt Steuerwalt, senior vice president of external affairs at PSE.

Amazon and PSE both jumped at the rare opportunity to acquire a shovel-ready renewable energy project when Pine Gate Renewables filed for bankruptcy in November and put its Sunstone solar project up for auction. Sunstone is valuable not only for its size but for how far along in the regulatory process it is. It has land agreements, state siting approval and is queued up to connect to utility grids, all of which can save years when standing up a clean-energy project.

And Amazon and PSE are pressed for time.

Amazon is racing to build datacenters that power artificial intelligence and its cloud services, investing tens of billions each year. But company leaders say a shortage of readily available electricity to power the energy-hungry chips inside them is slowing them down.

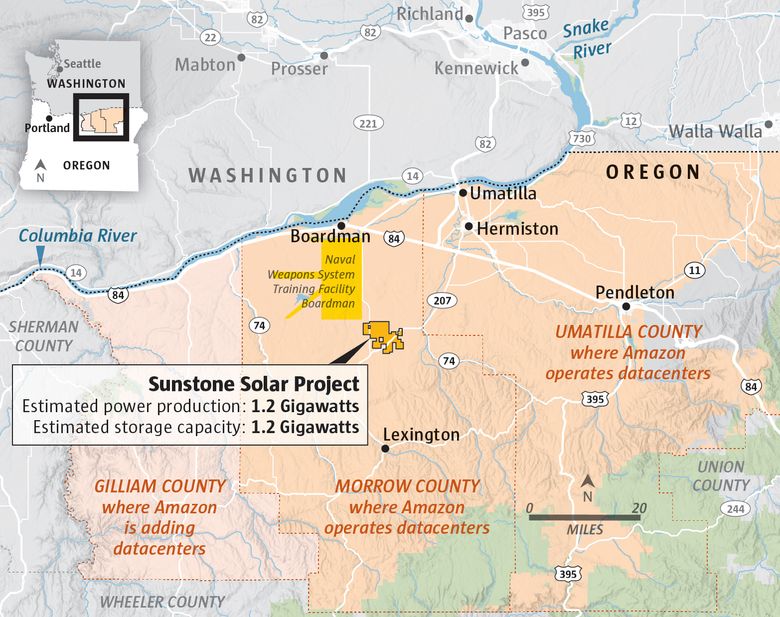

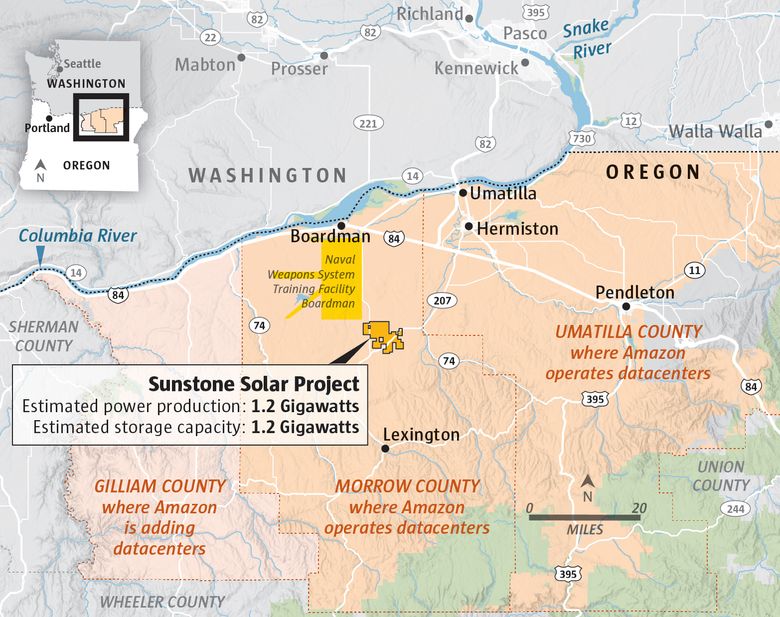

Amazon acquires massive solar farm near its datacenters in Oregon

Amazon’s purchase of Sunstone Solar Project could put 1.2 GW of solar generation and another 1.2 GW of storage capacity near its datacenters in Morrow and Umatilla counties.

Sources: Esri, oregon.gov (Map by Mark Nowlin / The SeattleTimes)

“The single biggest constraint is power,” said Amazon CEO Andy Jassy in the company’s second quarter earnings call last year.

The company says some datacenters near the solar project it purchased are unable to operate properly because they’re not receiving adequate power from the area’s utility.

Amazon filed a complaint last October with the Oregon Public Utility Commission alleging utility Pacific Power failed to deliver adequate electricity to Amazon’s datacenters in Eastern Oregon, saying one campus received no power at all. The tech giant made an unusual request to state regulators asking to remove its datacenters from the utility’s service area and allow other electricity providers to serve them. Regulators have not yet ruled on the complaint.

Plus, Amazon is looking to add more in the area. The tech giant has long operated a major datacenter hub in Umatilla and Morrow counties in Eastern Oregon. Just last year, the company purchased 400 acres of land in Arlington, Ore., to expand its datacenter campuses, according to The Oregonian.

Sunstone could provide Amazon a more secure energy source for its datacenters. Across the country, datacenter operators are exploring “behind the meter” arrangements in which power is generated on-site or nearby rather than relying entirely on a utility. It’s a relatively new strategy to acquire and own power sources directly, but one that’s emerging as Amazon and its peers in the tech world seek to guarantee their datacenter investments can operate.

Before it was sold, construction of the first phase of Sunstone was scheduled to begin in early 2026, with full commercial operation expected by 2030, according to the state of Oregon’s approval of the project in 2024.

Amazon declined to comment on its plans for Sunstone.

PSE, on the other hand, is racing to meet the deadline set by Washington state to phase out fossil fuels. Washington passed the Clean Energy Transformation Act in 2019 which requires utilities to provide carbon-neutral electricity to their customers by 2030 and use 100% renewable or non-carbon emitting electricity by 2045.

PSE said about 57% of its electricity was coming from renewable energy sources in 2025, up more than double from when the state’s law was passed. The Sunstone project would have largely closed the gap for PSE to meet state mandates.

Bidding started at $66 million. Amazon and PSE went back and forth for 16 rounds until the utility eventually folded at $82 million. Steuerwalt said that was the most the utility could justify paying when half of its customers are low-income and its rates are established by state regulators.

Steuerwalt said he didn’t know for sure that the Sunstone auction against Amazon portended an ongoing competition with tech giants for energy resources because it’s not clear they will continue to go after the same ones.

Sunstone was an unusual opportunity to acquire a project already well underway, one that hadn’t been in the utility’s plans until it suddenly became available. And Steuerwalt said nuclear energy which tech companies have been investing heavily into is out of the price range of utilities at this point.

Both PSE and Amazon will be in the market for more renewable energy though, and if they are seeking the same resources, that could be a problem for utilities.

“The fact that we are starting to see competition, as evidenced by that solar project, is a concern,” Steuerwalt said.

Greg Kim: 206-464-2532 or grkim@seattletimes.com. Greg Kim is a reporter for Climate Lab at The Seattle Times who writes about the intersection of climate, energy and business. Previously, he worked on Project Homeless.

seattletimes.com |