UK Calls in “Nuclear Golden Age” with 17GW pipeline. The Hoot this week: 2nd - 6th February

Ocean Wall Feb 06, 2026

KAP FY25 Results: More Than Meets The Eye

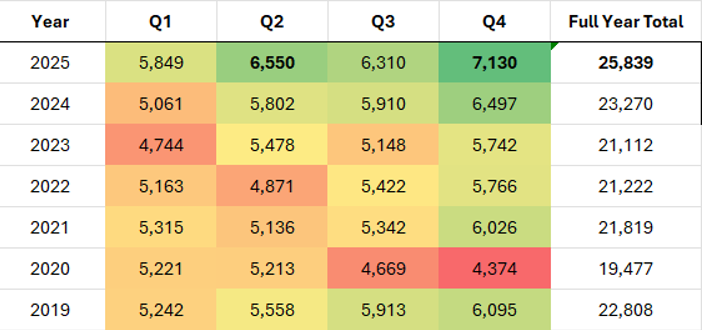

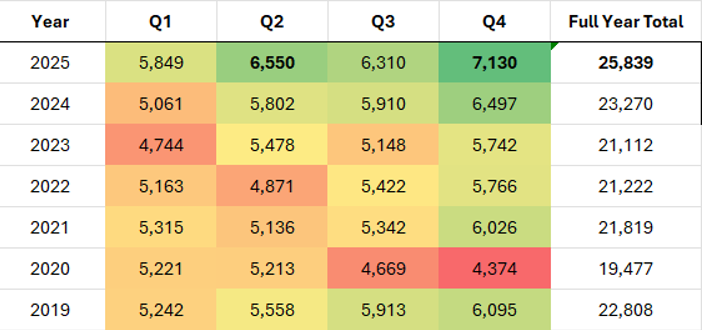

Kazatomprom (KAP) reported its Q4 and full-year results on Monday, delivering its highest-ever quarterly production of 7,130 tU, representing a 9% increase above the previous all-time high. This drove full year 2025 production to 25,839 tU (67 Mlbs), landing comfortably within the Company’s guidance range of 25,000 to 26,500 tU.

In our preview, we noted that quarterly production would likely be materially higher due to the MET hike that was implemented from January 1st 2026. In addition, KAP had to have a strong quarter if they were to meet the lower end of their guidance range. As you can see below, KAP had their strongest quarter ever in terms of group production.

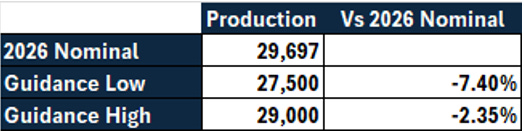

The Company also issued its 2026 production guidance, targeting 27,500 to 29,000 tU on a 100% basis (71.5 to 75.4 Mlbs), subject to availability of sulfuric acid. This implies a 2.4% to 7.4% discount to its revised 2026 nominal production level. Notably, that nominal level had already been structurally reduced in August 2025 from 32,777 tU (85.2 Mlbs) to 29,697 (77 Mlbs) – reflecting 5% of global supply. As a result, today’s guidance represents up to 9.8 – 13.7 Mlbs of production below that nominal reset.

Sales volumes increased 11% year on year, with an average realised group price of $65.10/lb, versus an average month end spot price of $73.54/lb over the period.

Our View: No new production for the West

In our Friday preview of KAP’s results we noted: “We believe KAP will have a record, or close to a record quarter in terms of sales and production given our view that they have been incentivised to step up deliveries into year end prior to the MET hike.” The Q4 update supports this view.

The Company also clarified that the year-on-year increase in production is primarily driven by the planned ramp up at JV Budenovskoye. However, KAP reiterated that 100% of Budenovskoye’s output for 2024 to 2026 is fully reserved for Russia, meaning incremental volumes from this asset are unlikely to be available to Western buyers.

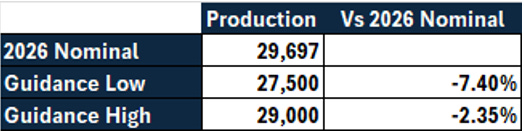

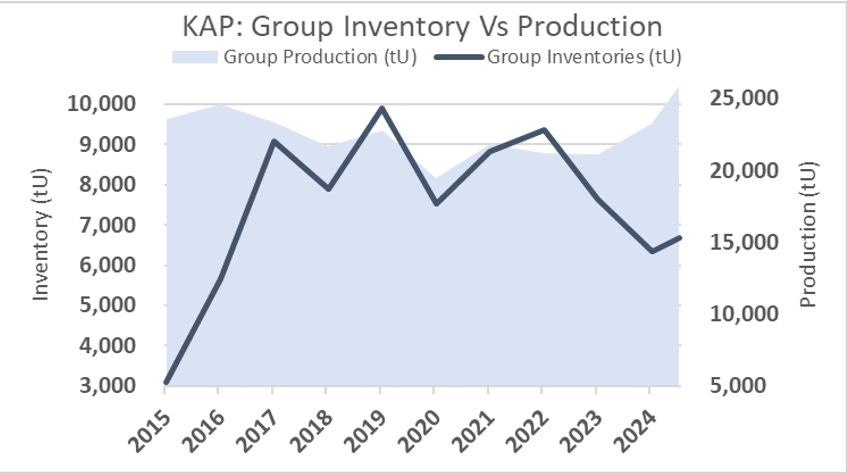

KAP was explicit that the increase in production from its other mines is intended to rebuild and maintain a “comfortable” level of inventories. The Company noted that this strategic approach is designed to ensure uninterrupted fulfilment of contractual obligations, including in the event of potential production constraints, while also allowing it to capture additional value amid a widening gap between supply and demand. This supports the view that the step up in output should be interpreted less as a shift toward volume maximisation and more as a deliberate effort to restore inventory flexibility.

This focus on inventories is notable given stock levels have been near multi year lows. At its peak over the past decade, Kazatomprom held inventories of 9,906 tU, compared with 6,677 tU in H1 2025, which equates to less than one third of annual production. Rebuilding inventories at this stage of the cycle provides meaningful commercial optionality, particularly as the new MET regime starts from January 1, 2026.

Utilities remain uncovered for approximately 3.2 billion lbs, equivalent to roughly 20 years of global annual supply at today’s levels. Against this backdrop, Kazatomprom remains well positioned as scarcity of available pounds becomes increasingly evident.

KAP’s SUA adjustment last year structurally removed around 8 Mlbs, or roughly 5% of global supply. Today’s 2026 guidance sits below the prior nominal benchmark by up to ~9.8 Mlbs, and remains contingent on stable sulphuric acid supply and limited operational disruption.

While we expect near term volatility in commodity prices, financial buyers continue to absorb marginal liquidity in the spot market, further tightening balances. Over the past two years SPUT has raised $1.08 billion, acquiring approximately 11.6 Mlbs of physical uranium. Its new $2 billion shelf provides capacity to meaningfully increase purchases over the next two years, which can provide consistent support for spot pricing.

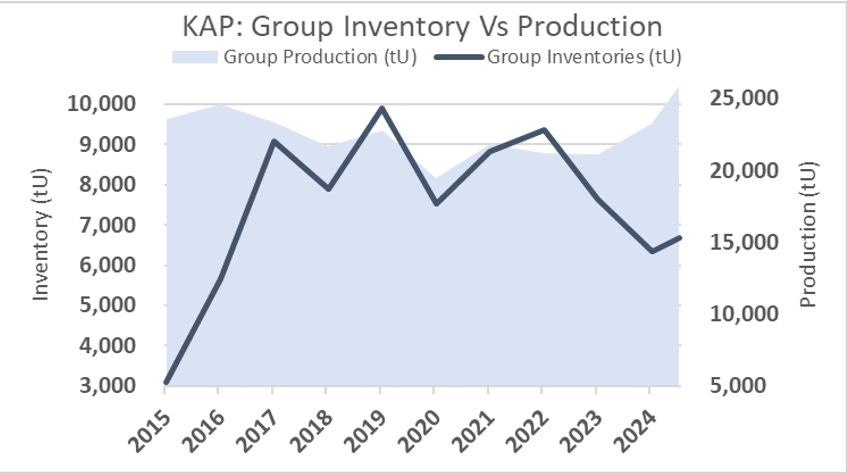

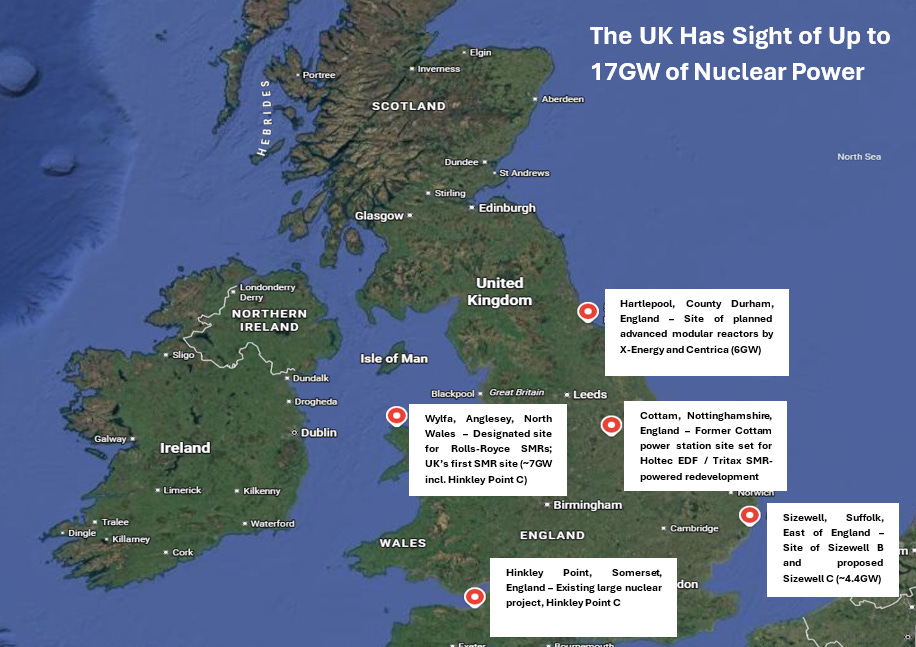

UK Calls in “Nuclear Golden Age” with 17GW pipeline

The UK Government has proposed a new funding framework for advanced nuclear projects, creating a pipeline of credible new nuclear developments designed to help developers attract private investment.

Key points include:

- From March, nuclear developers will be able to submit project proposals under the new Advanced Nuclear Framework.

- Successful applicants will receive in-principle government endorsement, enabling discussions on the level of government support needed to secure private investment in next-generation nuclear technologies.

- Designated projects will also be able to engage with the government-backed National Wealth Fund.

- The government will introduce a “concierge-style” service to guide developers through UK planning requirements, regulation, and fuel supply considerations.

Minister for Nuclear Patrick Vallance said: “We are seizing the opportunity to become a frontrunner in this space as part of our golden age of nuclear, creating the conditions for the industry to flourish.”

The announcement follows recent UK efforts to accelerate privately funded nuclear projects, including major commercial deals between UK and US firms. These include plans for X-Energy and Centrica to build 12 advanced modular reactors in Hartlepool as well as proposals from Holtec, EDF and Tritax to develop SMRs at the former coal-fired power station at Cottam, Nottinghamshire.

In addition, Wylfa in North Wales has been selected to host the UK’s first SMRs as part of wider plans to complement large-scale projects such as Hinkley Point C and Sizewell C with a fleet of new reactors.

The news also comes amid reports that EDF and Centrica are in talks with the government over an £800m investment to extend operations at Sizewell B by 20 years, to 2055.

The announcement follows last year’s government-commissioned Fingleton Review, which argued that overly complex regulation has contributed to a decline in the UK’s global nuclear leadership. The review called for a “radical reset” of nuclear regulation, setting out 47 recommendations to safely accelerate delivery, reduce costs, and unlock a new “golden age” of nuclear innovation.

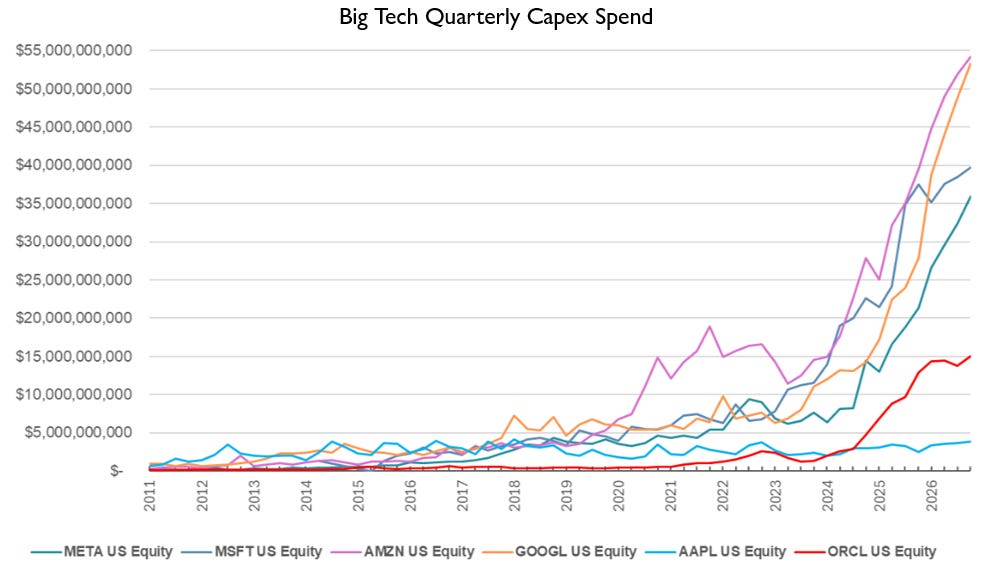

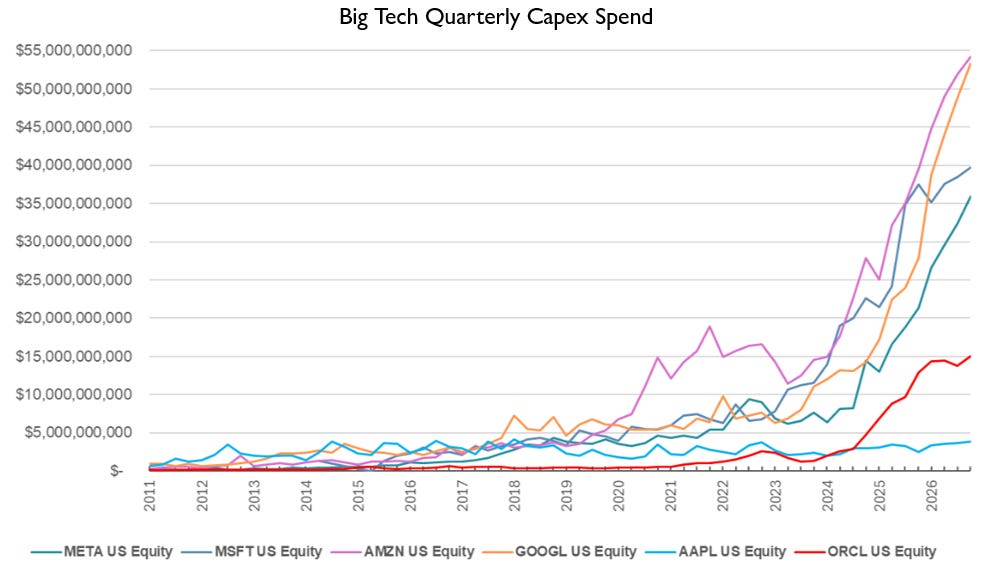

Big tech’s capex points to more silicon, more compute…and a lot more power.

Alphabet and Amazon’s 2026 capex plans, $175–185bn and ~$200bn respectively, underscore how aggressively Big Tech is scaling AI infrastructure, with spend concentrated in data centres, silicon and compute. While the near-term beneficiaries are semiconductors and equipment suppliers, the binding constraint is increasingly power, not capital: data centre build times are lengthening and semiconductor capacity is effectively sold out into 2026, but reliable, scalable electricity supply is now the key limiter. Supporting AI at this scale will require large volumes of new generation capacity, and nuclear remains uniquely positioned as a carbon-free, 24/7 baseload solution that can support dense, power-hungry compute infrastructure in a way intermittent sources cannot. |