| | | THE SILVER COUNTDOWN: 400 Million Ounces Demanded, 100 Million Available — Tick, TockPaper silver’s illusion is cracking as physical demand overwhelms dwindling inventories, lease rates spike, and global vaults drain. The clock is running out on the fiat price lie.

The Silver Academy

Feb 08, 2026

by Niko Moretti

SILVER INVESTORS: YOUR REWARD IS ARRIVING

This is it. The moment we’ve been waiting for—not for months, but for years. The paper games, the gaslighting, the manipulation—they’re running out of runway. The market’s tolerance is gone. The silver paper house of cards is cracking, and what’s coming next makes history look tame.

February 2026 has set the stage. March will be historic.

FACT 1: FEBRUARY DELIVERIES — INSANE.

In the first few days of February alone, COMEX has already seen nearly 19 million ounces taken for physical delivery. That’s almost all of last February’s deliveries—in under a single week.

Let that sink in.

And here’s the shocker: roughly 98% of open interest stood for delivery. Not for cash settlement. Not for rollover paper promises. For metal. Buyers aren’t seeking exposure—they’re demanding ownership.

When investors convert paper to ounces, the illusion of abundance unravels. This is what it looks like when trust breaks and the paper tail can no longer wag the physical dog.

FACT 2: MARCH IS A TINDERBOX.

Look ahead. March 2026 open interest stands around 80,500 contracts—that’s over 400 million ounces claimed on a system with just ~103 million ounces deliverable in COMEX “registered” silver. Do the math.

If even 25–30% of those longs stand for delivery—as we’re seeing this month—there isn’t enough silver. Period.

That’s not a conspiracy theory. That’s arithmetic. The system is levered up roughly four-to-one against its own vaults.

So what happens when buyers call the bluff? When industrial users, bullion funds, and sovereigns all say: “We’ll take it, please—deliver”?

That’s the moment the mask slips. And that moment is coming fast.

FACT 3: THE DRAIN IS GLOBAL.

This isn’t just a COMEX problem. The East-West flow has turned into a drain.

In China, combined SHFE and SGE vaults now show less than 30 million ounces of visible silver remaining—an astonishing collapse considering their pace of industrial demand and solar expansion. They’re absorbing metal aggressively, vacuuming up every spare ounce before the West even has time to quote a new price.

The LBMA estimates the global free float—that’s all physically available silver not already spoken for—to be around 150 million ounces. That’s two months of global industrial consumption. That’s not a buffer—it’s a fuse.

FACT 4: LEASE RATES ARE SCREAMING.

Silver lease rates—the hidden heartbeat of the wholesale market—just spiked above 6%, the highest in years. Banks and bullion houses are suddenly paying up to borrow metal they supposedly had “plenty of.”

High lease rates mean one thing: scarcity.

Scarcity means stress.

Stress means margin pressure.

And margin pressure ends in a short squeeze.

This is the canary in the COMEX coal mine. Historically, this is exactly what happens before a parabolic phase begins—the kind that rewrites price charts and humbles algorithms.

But this time—it’s bigger. The fiat system itself is the counterparty, and the silver stackers are winning.

THE MOMENT OF TRUTH

You survived the ridicule. You lived through the dips. You read the fine print when the pundits sneered. Now the system is blinking.

Mark February 27 — First Notice Day.

That’s when the rubber meets the road. Expect massive short covering, potential cash settlement chaos, maybe even physical default if demand keeps rising.

Because if March follows the 3–4× delivery trend we’ve seen lately, we could watch 200 million ounces demanded—more than the total registered silver on the planet’s largest exchange. That’s not a shortage. That’s game over.

STACKERS: YOUR TIME IS HERE.

Hold your ground. Add ounces if you can. Remember why you stacked—because what’s coming isn’t a 10% trade. It’s a generational transfer.

Supply is in a structural deficit—roughly 800 million ounces mined vs. 1.3 billion used in 2025. Industrial demand keeps rising, especially in solar, EVs, and AI chip fabrication. There is no magic mine that suddenly fills that 500-million-ounce hole.

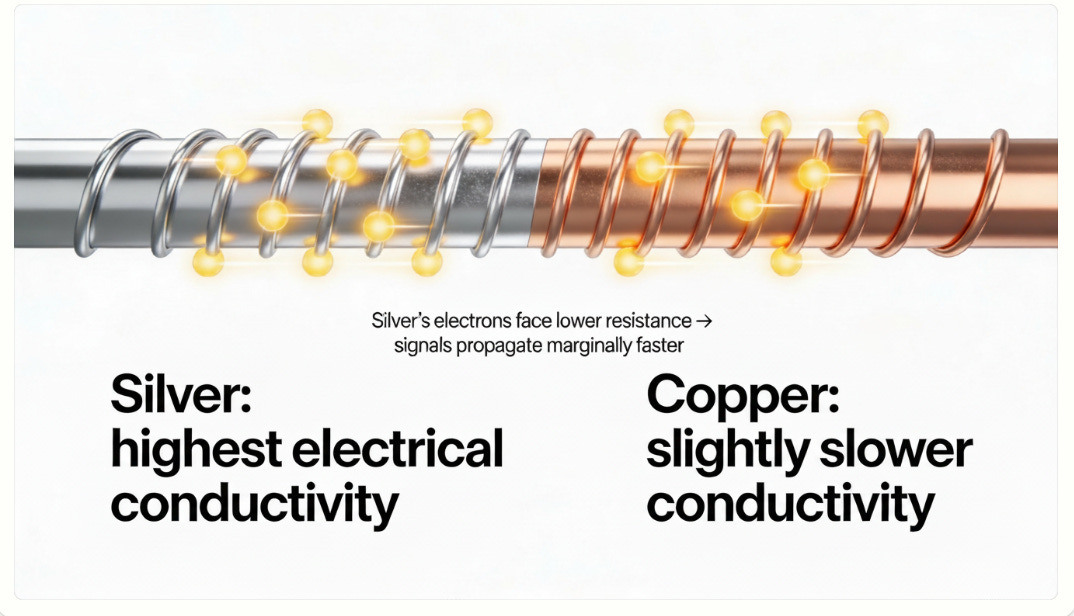

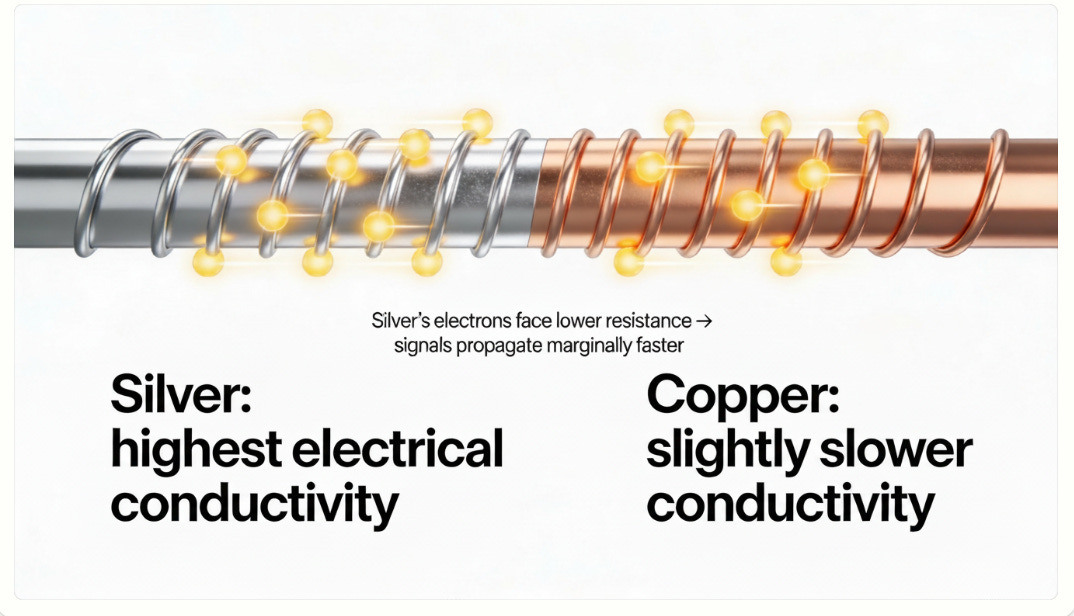

Silver isn’t just a precious metal. It’s the metal that powers the future: the fastest conductor on Earth, with 5–7% higher conductivity than copper. The electrons move faster. The signals transmit cleaner. The efficiency drives everything from EV acceleration to AI computation.

And in a world where speed is power, silver is the ultimate energy metal.

THE NEW MONETARY CLARITY

When the paper system collapses, truth returns to metal. Every ounce you hold now becomes the antidote to decades of deceit. Every bar is a vote of no confidence in financial fiction. Every round is a declaration: we choose hard money over hollow promises.

The countdown has begun. The cracks are showing. The vaults are depleting. The truth is surfacing.

Stackers—your reward is arriving. |

|