| | | Are Wall Street Analysts Predicting Caterpillar Stock Will Climb or Sink?

Sohini Mondal - Barchart - 1 hour ago Columnist

Share

/Caterpillar%20Inc_%20sign%20on%20building-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Caterpillar Inc_ sign on building-by Jonathan Weiss via Shutterstock

With a market cap. of $347.3 billion, Caterpillar Inc. ( CAT) manufactures and sells construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives in the United States and internationally.

Shares of the Irving, Texas-based company have outperformed in the broader market over the past year. CAT stock has surged 105% over this time frame, while the broader S&P 500 Index ( $SPX) has returned 14.9%. Moreover, shares of the company are up 30% on a YTD basis, compared to SPX’s 1.9% gain.

Focusing more closely, shares of the construction equipment company has also outpaced the State Street Industrial Select Sector SPDR ETF’s ( XLI) 26% return over the past 52 weeks.

www.barchart.com Shares of Caterpillar rose 3.4% on Jan. 29 after the company reported Q4 2025 adjusted EPS of $5.16 and revenue of $19.13 billion, both exceeding expectations. Investor optimism was fueled by strong demand tied to AI-driven data-center spending, with sales in the power and energy segment jumping more than 20% and becoming Caterpillar’s largest business by revenue. www.barchart.com Shares of Caterpillar rose 3.4% on Jan. 29 after the company reported Q4 2025 adjusted EPS of $5.16 and revenue of $19.13 billion, both exceeding expectations. Investor optimism was fueled by strong demand tied to AI-driven data-center spending, with sales in the power and energy segment jumping more than 20% and becoming Caterpillar’s largest business by revenue.

For the fiscal year ending in December 2026, analysts expect CAT’s adjusted EPS to rise 18.6% year-over-year to $22.60. The company’s earnings surprise history is mixed. It surpassed the consensus estimate in two of the last four quarters while missing on two other occasions.

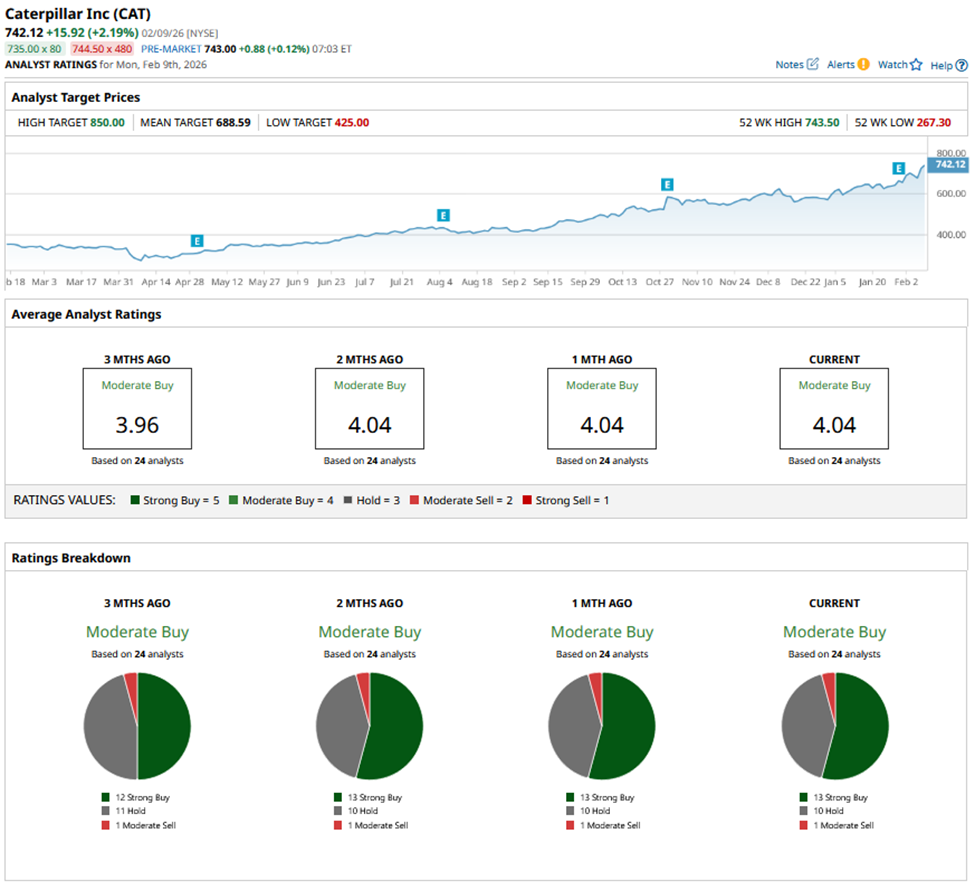

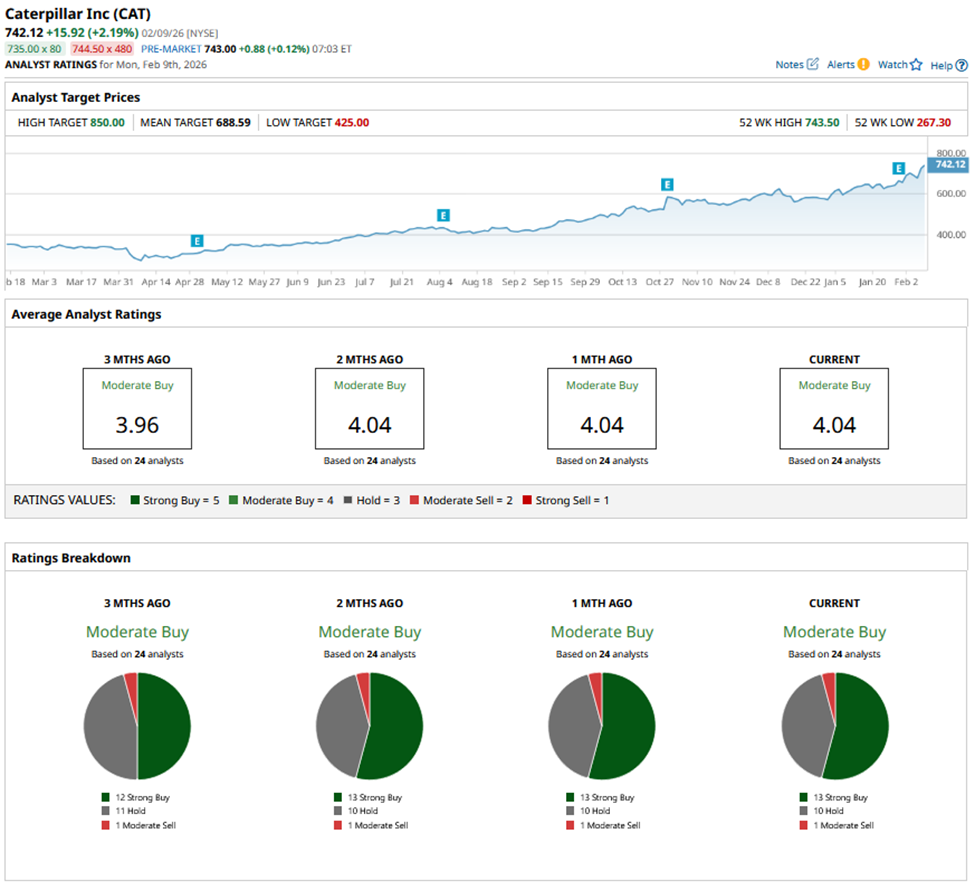

Among the 24 analysts covering CAT stock, the consensus is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, 10 “Holds,” and one “Moderate Sell.”

www.barchart.com On Jan. 30, B of A Securities analyst Michael Feniger maintained its “Buy” rating on Caterpillar stock and raised its price target from $708 to $735. www.barchart.com On Jan. 30, B of A Securities analyst Michael Feniger maintained its “Buy” rating on Caterpillar stock and raised its price target from $708 to $735.

As of writing, the stock is trading above the mean price target of $688.59. The Street-high price target of $850 implies a potential upside of 14.5% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

/Caterpillar%20Inc_%20sign%20on%20building-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)