Roxmark completes acquisition of three Gold mining properties -

along strike from -

The Northern Empire Gold Mine -

TORONTO, Nov. 8 /CNW Telbec/ -

Roxmark Mines Limited -

(TSXV - RMK) (CNQ - RMKL) announces that it has issued an

aggregate of 115,940 shares in satisfaction of payments

due under three option agreements (the "Agreements")

to acquire the Amede Gold Properties -

totalling $26,666.67.

The securities issued are subject to a hold period expiring on

March 7, 2008.

The Agreements were previously announced in the Company's

July 12, 2007 news release....

Roxmark acquires Gold properties

16:26:26 GMT, 13 July, 2007

Gold exploration company Roxmark Mines has acquired a number of

gold-bearing properties in Summers Township near Beardmore,

it has been revealed.

According to Roxmark, the Amede Properties contain several

gold deposits historically yielding grab sample results

of up to 43.89 grammes per tonne (g/t) of gold.

Roxmark reports that the mineralisation occurs along strike

of the gold veins of

the Northern Empire Gold Mine,

where the company is carrying out a

26-hole surface drilling programme.

"We are pleased to have acquired these properties because

initial evaluations indicate both extensions to

gold-bearing structures we are currently drilling on

the Northern Empire Mine property and new prospective zones,

one of which is considerably wider than those we have

encountered to date," said Monir Younan,

president of Roxmark.

In 1999, resource grading of 15g/t of gold was determined

by Peter Bevan, a consulting geologist.

Drilling is continuing on the remaining holes and results

to date confirm the previous resource assessment.

"These are early days in the drilling programme, however,

we are pleased that results appear to confirm

the historical information," Mr Younan noted.

An exploration surface program is being carried out simultaneously

on two properties by Roxmark crew under the supervision of

Peter Bevan, Consulting Geologist.

Work includes stripping, trenching, sampling and geological

mapping of these gold-bearing structures.

Historically, the Northern Empire Mine

produced 149,053 ounces of gold from 425,866 tons with a recovery

of 0.35 oz. in gold per ton.

The mine was serviced by a shaft to 2,460 feet -

with development above and below a major flat diabase sill.

Existing infrastructure on the property,

including an upgraded and fully permitted 200 tpd mill

(expandable to 500 tpd),

as well as the mine's non-remote location,

will reduce the cost of future development.

About Roxmark Mines

Roxmark Mines Limited -

is the leader in gold and molybdenum exploration and development

in the historically significant Geraldton-Beardmore area of

Northwest Ontario.

In the last two years, Roxmark has generated cash flow from

bulk-sampled gold and molybdenum processed at its fully-permitted

mill and has the advantage of infrastructure from six formerly

highly productive gold mines located on its properties.

These mines previously produced nearly two million ounces

of gold from high grade ore but were closed primarily

due to dramatically lower gold prices at the time

and to boundary issues, since eliminated.

Roxmark Mines -

vs. comparison to -

Ex..dd..

The Empire Gold Mine, made Newmont NEM very rich -

just south of Grass Valley, made more money than any other

in California.

It operated from 1850 until 1956 and produced 5.8 million ounces --

sadly, most at $35 an ounce rather than today's $300+ -- of gold

as well as over 367 miles of tunnels, to 6000' down -

the mine operated on a 750 acre property and was

the US largest Gold producer.

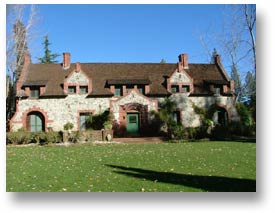

Empire Mine Headframe 1872 (Original painting on canvas)

As one of the only decent jobs available during the depression,

it's fondly remembered by the old hard rock types who gather

once a year on Miner's Day -

The mine still owned by NEM but surface owned by the California

Park board -

Compare this largest Gold Mine in US history -

mined on 750 acres with ex..dd....

Roxmarks have a huge land holdings of today -

the Gold values and richness increases often by depth and

its only narrow veins at the top but the rich wide veins

are wider and richer the deeper we mine -

Philip F. Cunningham is Chairman Roxmark Mines Ltd;

Philip F. Cunningham;

Chairman of the Roxmark Mines since May 2005,

and been a director of the Roxmark Mines since August 2004.

Mr. Cunningham is the chairman of Mackenzie Financial Services Inc.

and executive vice president of

Mackenzie Financial Corporation.

He joined the Mackenzie organization in 1982.

RE:

Q. - several posters have mentioned that they are in this stock

because of cunningham.

Can anyone explain why that is a plus.

Who is he? what is hew? and why is anything he is in is a plus?

Mr. Cunningham,

is a very knowledgeable, honest, reliable and

a good man for Canadian future mining industry -

Btw.

Mr. Cunningham is executive vice president of -

Mackenzie Financial Corporation -

and chairman of Mackenzie Financial Services Inc. -

He joined the Mackenzie organization in 1982 -

mackenziefinancial.com

Mackenzie -

offers more than 100 investment funds in Canada -

and the United States

and Mackenzie - manages more than $45 billion -

for over 1,000,000 investors and their financial advisors...

as major shareholder for RMK/RMKMF -

roxmark.com

Philip will get the old Roxmark's great Canadian Gold Mines -

back UP Re-commissioned Gold production lots of Gold again -

well, we all aquired RMKL share for a firesale price -

we can do the same now - or you can wait and get

on the bandwagon to pay a few fiatz$$bucks later? -

its up to you -

I have been in Goldcorp from its beginning -

and haven't sold one share of it -

and the same goes for RMK -

been in it for more than 20yrs -

only buying more -

haven't found any mines with more Au treasures -

RMK - is a strategic fire sale -

btw..fys....better than gold -

The Mission is to help people to gain great Golden Health -

and Wellness - from God's Herb Garden -

welcome to join me -

it will be your best Christmas gift -

holyteaclub.com

God Bless All

at Roxmark forum dd.... below -

siliconinvestor.com

Subject 56863

Imo. Tia.

RR thanks for the info....

I agree, Roxmark Mines management,

with Cunningham at helm will get all of

the RMK old great Canadian Gold Mines into

new great Gold production at a strategic time;

stockhouse.com

RE: Like Nobel1 said,

kxl 55m is a peanut compare to Philip's RMK Au inventory -

RMK definately is undervalued as a .50 cent

share price is just a fiatz$75 million M/C..

.. got more today

and I think we are very near our lows.

Gold T fyi. Roxmark is not just undervalued,

it may has been systematically held down by constant -

negative bashers who been on RMK forums for a long time -

maybee done by a group who want to keep and hold RMK

shareprice down - to buy for less fiatz$?

or is it nss naked short sellers?

RE:

they are going to have to come up with a lot more money

to get RMK!

For years short selling have bashed Roxmark constant

with negativity -

RE: It's WAY UNDERVALUED -

Ex....

RMK Gold Mines - should be $29.50/sh -

it would be a 100% more fair market value -

with the richest old Gold Mine in Canada +

more than 10 more -

Great old Gold Mines in Canada -

compared to -

a grassroot exploration company in the area -

without a mine -

only some surface trenches and few cores -

trades at about 4 times higher market value? -

what a hyped up public market? -

IMHO!

Gold – Beardmore

1. Northern Empire

In 1996, Roxmark acquired a 100% interest in

the Northern Empire property

from Pancontinental Mining (Canada) Ltd.

and Ateba Mines Inc.

The property consists of 72 patented and leased claims

covering 2,644 acres in McComber and Summers Townships,

and includes a permitted mill complex.

The mill currently has a capacity of 200 tons-per-day,

but has been designed for expansion to 500 TPD.

It has been upgraded and readied to process bulk gold

and molybdenum samples from

Roxmark’s Nortoba-Tyson properties

and could also process samples from

the Sand River/Leitch

and

East Leitch properties,

if and when extracted in the future.

Historically, the Northern Empire property

produced 149,053 ounces of gold from 425,866 tons

with a recovery of 0.35 oz. in gold per ton.

It is serviced with a shaft to 2,460 feet with development

above and below a major flat diabase sill.

The mine was inactive since 1988.

Historical resources were estimated by J. C. Fagan

and associates on March 1, 1999 covering the Power

and Contact zones for total resources of 70,545 tons

grading 0.48 oz. of gold per ton.

This estimate is not in compliance with NI 43-101.

2. Sand River Mine Property

In 2000, Roxmark acquired a 100% interest from

Rio Fortuna Exploration Corp. in

the Sand River Property,

37 contiguous mining leases

covering 1,692 acres in Eva Township.

The Sand River-Leitch discovery

was made on the Sand River Mine in 1934

and the vein system was extended to the northeast onto

the Leitch Mine in 1935.

Servicing was by a three-compartment shaft to 2,656' depth.

Sand River Resources

processed 157,870 tons with a recovery grade

of 0.32 oz. of gold per ton yielding 50,065 oz. gold.

3. Leitch Property

In 2003, Roxmark acquired from

Teck Cominco Limited an approximate 63% interest in

the Leitch property,

consisting of 10 patented claims covering 1,276 acres

in Eva and Summers Townships.

The property is governed by a Joint Venture agreement

dated June 30, 1987 between

Teck and San Paulo Exploration Inc.,

now AdvanteXCEL.com Communications Corp.,

as amended April 30, 1990 and October 30, 1990.

The other Joint Venture party holds the balance of

approximately 37%.

Roxmark is the operator.

The Leitch Mine

was serviced by a three-compartment shaft to 3,006',

with a winze from the 19th or 2,875' level to

the 30th or 4,525' level.

It operated continuously from 1937 to 1965,

processing 906,395 tons with a recovery of 0.92 oz. of gold

per ton yielding 860,648 oz. gold at US$35/oz.

4. East Leitch Property

In 2003, Roxmark acquired from Kinross Mines a 55.25% interest in

the East Leitch Property

covering 20 claims held under a 21-year lease on 832 acres

in Summers Township.

The property is governed by a Joint Venture Agreement

dated September 1987 between Falconbridge Limited (now Kinross)

and Minerals Anodor Inc. (now Afri-Can Marine Mineral Corporation).

In January 2005,

Roxmark acquired the remaining 29.75% interest from African Marine.

roxmark.com

Roxmark Gold Mines - RMK -

Gold POG Last trade $846.0 Change +$22.6 (+2.73%)

RMK Gold Mines - $31.-/sh -

should be a 100% more fair market value -

with the richest old Gold Mine in Canada +

more than 10 more -

Great old Gold Mines in Canada -

compared to -

a grasroot exploration company in the area -

without a mine -

only some surface trenches and few cores -

trades at about 4 times higher market value? -

welcome to join Roxmark's US forums -

stockhouse.com

Subject 56863

Subject 57091

siliconinvestor.com

Imo. Tia.

God Bless America

Amen

by Nobel on another forum |