₪ David Pescod's Late Edition 8/11-8/15/08

To receive the Late Edition and be on our daily circulation simply e-mail Debbie at Debbie_lewis@canaccord.com and give your address, phone number and e-mail and we’ll have you on the list tonight.

_____________________________________________________________________________________________________________________________________

David Pescod's Late Edition August 11, 2008

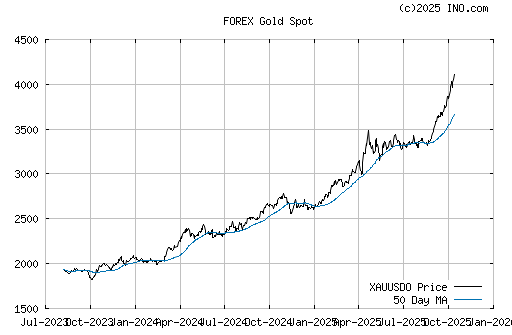

GOLD $829.80 -35.00

CRUDE OIL $114.45 -0.75

To many of us who have participated in the commodities

rally over the last few years, Don Coxe of BMO fame

and editor of the much looked-forward to Basic Points is

probably the high priest of that belief (which I guess

means that Josef Schachter would be the high priestess).

While Schachter was saying last week and the week

before that it was time to start loading up on oil stocks

again, his suggestion looked more than a little early and

on a day like this where oil is down almost $1.00, but oil

stocks are acting as if they were down $20.00, one wonders

if panic is hitting the commodities market particularly

on the mining side where gold today is down thirty some

bucks and a chart on gold looks absolutely bleek.

For those who received Coxe’s Basic Points late last

week and had time to review it over the weekend, you

might have been feeling hopeful for this week’s activity.

Certainly not today…

As far as his investment recommendations for looking

ahead, he writes:

1. This is not the end of the commodity bull market.

Bear Stearns, F&F and other crisis will one day seem

trivial. The new global middle class that is repricing

commodities never will.

2. Remain underweight the banks and financial stocks

(which we note today, aren’t paying attention to him

and are actually doing quite well).

As a new recommendation he suggests, “Clients begin

taking preliminary positions in companies which stand to

benefit most from the possible onset of realism in US energy

policies. When—if not—offshore drilling finally gets

the nod, the majors and service companies should benefit

enormously.”

He makes an interesting comment on natural gas and

notice how natural gas prices have gone off a cliff over

the last while. He writes, “Natural gas supplies have exceeded

expectations because of the Barnett Shale and

coal bed methane booms, and because this summer has

not been as hot as had been feared. We recommend the

natural gas-oriented producers with above-average reserve

life indices.”

Natural gas is very much dependent on weather.

For those bullish on natural gas, you hope for hot

summers which would see air-conditioning increase

demand for electricity, cold winter which would increase

demand for electricity for heating and of course

hurricanes, which would shut down production facilities

in the Gulf of Mexico. It hasn’t happened.

As far as other recommendations, Coxe takes a

look at the fertilizer companies and suggests they

“have delivered the most impressive earnings gains of

any other commodity group. Nevertheless, their share

prices have fallen in recent weeks along with other

commodity groups on days when traders have been

buying banks and dumping commodities. They probably

have the most predictable earnings of all the major

commodity sectors.”

Coxe also remains a believer in gold and writes,

“Gold remains the asset that offers unique risk reduction

features in equity and balanced portfolios. As to

investment strategies, the ETF outperforms during

gold bullion selloffs, but the stocks outperform when

bullion rallies. We believe investors should have exposure

to both kinds of asset, but leave the weighting

to be resolved on individual portfolio risk/reward considerations.”

He adds, “We keep reading forecasts predicting

falling inflation and gold prices because of a US recession,

but insisting that the recession will be neither

deep nor long. Recession actually proved to be an

aphrodisiac for gold lovers in the Seventies.”

We have seen a huge and painful correction in commodity

and stock prices, bigger than we would have

thought possible. Here’s hoping the economies of

China, India and Asia keep chugging and can rescue

those commodity prices and ourselves.

_____________________________________________________________________________________________________________________________________

David Pescod's Late Edition August 12, 2008

PETROLIFERA PETROLEUM (T-PDP) $5.34 -0.09

SOLANA RESOURCES (V-SOR) $4.44 -0.29

We are in some resource markets, the likes of which we haven’t seen in a long, long time. Uranium prices have been clobbered and uranium stocks have been annihilated. Same thing for lead/zinc stocks. Now all of a sudden, you’ve got a huge correction in gold prices and oil prices and many stocks seem to be having no bottoms in sight.

One story we have been following for a while with hopes for it down the road is Petrolifera Petroleum. A subsidiary of Connacher Oil, Petrolifera has some decent production in Argentina that always threatens to get close to 10,000 barrels a day, but never seems to stay there. However, that’s the good news. The bad news is that it’s in Argentina and there’s many reasons why Argentina has had its government bond ratings reduced yet again.

Countries like Haiti and the likes have similar ratings as Argentina finds a different way to do everything. For instance, if you are an oil producer in Argentina such as Petrolifera, you don’t get world prices for your oil, you get what Argentina wants to pay you, which in this case, is a paltry $47 a barrel. It makes no sense, but then in Argentina where they have to import a lot of natural gas, they are now paying three and four times as much to import gas from Bolivia as they are paying their domestic producers.

Why and when are they going to increase resource prices to world levels? Well, that’s a good question, but gossip is that sometime soon, Argentina will be raising prices to make sure domestic producers actually go out and find some more stuff.

In the meantime, there is some decent news for Petrolifera today as they announce that a heli-transportable drilling rig has finally been located for their La Pinta prospect in Colombia which is expected now to spud before September 30th. The company expects to drill the Brillante prospect on the same license thereafter, writes Jason Bouvier of RBC Securities.

One thing about Colombia is that several companies such as Solana Resources (SOR), Pacific Rubiales (PEG) and others have had great success in Colombia and the country seems to be a great place to explore in with a wellrun royalty scheme.

Meanwhile, the big play for Petrolifera probably still remains in Peru which the newly acquired rig will be able to spud sometime in the spring of 2009.

Petrolifera is run by Gary Wine who spent many years working for the Peruvian government in the natural resources department and one would assume has lined up some of the best possible prospects when the Peruvians made those leases available for public bidding. Gossip is that the targets are believed to be enormous, but then you always have that exploration risk.

Jason Bouvier of RBC writes, “At the current share price, it is our view that no exploration upside is priced into the stock and that any material commercial discovery would provide a share price catalyst.” Bouvier has a target price on Petrolifera of $11.00.

We note that in the last few days, several analysts have changed their expectations as GMP Securities has lowered their target from $17.00 to $14.00 and Octagon Securities has thumped their target as well, dropping it from $25.00 to $14.00.

Given the current price of the stock that we have been holding all the way down, we would love the see the bleedings stop at any one of those targets. It would certainly make us happy.

Petrolifera Petroleum

Solana Resources

CGX ENERGY (V-OYL) $1.43 +0.01

The theory is simple enough—that when markets are beaten up and all the news in the newspapers is bad to ugly, that’s the time when stocks are dirt-cheap and that’s the time you are supposed to load up on them. In the real world it doesn’t always work like that as it takes a little bit of nerve to step up to the plate when you hear about major banks and brokerage houses in trouble, the economy softening, commodities falling out of bed and the like.

So sometimes that means mutual funds and the like have their own problems about raising money as they face redemptions in times like this.

A few days ago, CGX’s stock got hit when a mutual fund decided to sell its holdings of over 1.2 million shares and you can imagine when a junior stock with only so much liquidity faces one sale order such as that. But it’s happening these days.

The chart shows you what a success story CGX was last year, but now it’s in the quiet times and we assume that we will see some significant joint venture announcements over the course of this year and finally some drilling probably late next year on an awesome combination of almost a dozen targets over 100 million barrels.

As to a little hand holding, we ask President Kerry Sully what his expectations are for oil prices and when forced to open his crystal ball, he suggests $100 this Christmas and $120 next Christmas. He reminds us that at those prices, oil companies make a swack of dough.

_____________________________________________________________________________________________________________________________________

David Pescod's Late Edition August 13, 2008

CAMECO CORP. (T-CCO) $32.89 -1.16

DENISON MINES (T-DML) $6.16 +0.86

URANIUM ONE (T-UUU) $3.73 +0.43

URANIUM PARTICIPATION (T-U) $8.50 +0.85

To say we are in the glue in the resource sector is now truly an understatement. It started with uranium as uranium prices ran over the last few years from roughly $10.00 to almost $135.00, but since then they’ve crashed to as low as $55.00. Currently it sits at $65.00 for cash and $80.00 for long-term uranium contracts. Lead and zinc have also done the same dive and now we’ve even got the same kind of activity happening in oil and gas. It’s ugly out there.

But what changes things is little events that came out of left field like the curve ball at the uranium market today. Cameco Corp. is one of the free world’s biggest producers of uranium in the nice, safe area of Saskatchewan, not too far from Saskatoon where Cigar Lake is one of the world’s biggest producers. Which is the good news.

Today the bad news is that one some of their work to increase Cigar Lake and its production, they’ve run into water problems and all of a sudden, those water problems have become huge.

Today Cameco announces remediation and dewatering of the No. 1 shaft had been progressing smoothly up to this point," said Tim Gitzel, Cameco's chief operating officer. "An inflow at this rate is disappointing but our remediation plan, as approved by our joint venture partners, recognized the risk and included specific actions to be taken at various levels of inflow."

Work has now stopped as the inflow of water is hampering operations and now they have to plan what to do next. There are those following this story that suggest the water problem is so big, it will never be handled. If that’s the case or is perceived to be case, uranium prices are going to start going the other way for a change.

Benefiting today were uranium stocks as almost every one of them had a bump.

Cameco Corp.

Denison Mines

Uranium One

Uranium Participation

CANADIAN SUPERIOR ENERGY (T-SNG) $4.92 +0.74

We’ve written about Canadian Superior Energy over the years and traded the stock as well because following renegade oil and gas guy Greg Noval over the years has always been of interest. He was amongst the first in the industry to try several new areas of the world. First offshore Nova Scotia (which didn’t turn out) and now offshore Trinidad, which looks like it’s becoming a huge victory for the oil and gas companies that are there.

Today Canadian Superior announces just an enormous well about 60 miles east of the Trinidad coast which could potentially produce about 200 million cubic feet a day.

The press release today suggested “the so-called Bounty discovery is a large high-quality natural-gas reservoir that, in combination with 3-D seismic data, appears to exceed 7,000 acres in size. The well is expected to have a potential of as much as 2.6 trillion cubic feet of natural gas ...” “Initial production of as much as 200 million cubic feet a day” which they suggest is “33% higher than the production rate at each of the two wells in the nearest analogous field called Dolphin Deep.” Which of course is the good news.

The bad news is that this is offshore Trinidad and getting production facilities in place and if the company does go ahead with plans to build LNG facilities in the eastern coast of the United States, tells you that this is going to be very expensive, very time consuming, but still worth following because Noval will undoubtedly come up with some surprises along the way.

Having said all this, we’ve taken our profits.

Canadian Superior Energy

_____________________________________________________________________________________________________________________________________

David Pescod's Late Edition August 14, 2008

TALISMAN ENERGY (T-TLM) $18.04 -0.38

CONNACHER OIL & GAS (T-CLL) $3.82 -0.11

PACIFIC ENERGY RES. (T-PFE) $0.90 +0.02

CORRIDOR RESOURCES (T-CDH) $6.30 -0.37

Ah...the good old days of a year or two ago when oil and gas guy Andy Gustajtis talked about stocks in his sector, they always seemed to double or do extremely well. Oh, the good old days! What we are experiencing in the markets these days is something else and whereas we suspected Andy Gustajtis of walking on water a while ago, these days his favorite stories (some of them) trade at a fraction of where they used to be. He tells us he has just been able to keep his head above water!

At a time like this, it was time for a little hand-holding and Andy admits upfront that he doesn’t remember a time where he’s seen markets as ugly as what we are looking at right now. He suggests there is a “complete disappearance of buyers” in the current marketplace, but he also suggests that he’s never seen a time where there has been so much value in the market.

While we are used to following junior or intermediate-type stocks, he points out that even senior companies like Talisman for example are not immune to the current situation in the market. Talisman announced recently its second quarter with cash flows of $1.7 billion – half a billion higher than expected – and yet the Company’s share price is down almost 30% in the last two months.

We ask him how close to the bottom does he thinks we are and he suggests we are “very, very, very close” and remains convinced that we are in major long term bull market as far as oil prices are concerned. The only event that could kill the current oil market would be 10 million barrels a day of new production over the next two years which would lower oil prices considerably. Or, to put it another way, he suggests kill demand of almost 10 million barrels a day over the next two years. He just doesn’t see either of those cases potentially happening.

As far as other negatives in the market besides 15% correction in oil prices, the concerns are all about financial stocks. He suggests, there have been funds facing redemptions and suspects there are lots of margin calls facing the market as well. But the big concern is the absolute disappearance of the buyers. The state of the market Gustajtis suggests right now is one of “total capitulation” and eventually the selling will have to stop. He re-emphasizes that there is no lack of good value.

He does have some thoughts on the current marketplace though, where some supposedly smart people with money switched from energy into big banks and other financial institutions, many have made the wrong move and may decide to reverse the trade the other way.

Meanwhile, he suggests that over the last decade or two we’ve gone through the Russian currency problem, the Asian flu, the Enron and high-tech bubble and all of them had relatively short life spans of roughly 12 months. Well, we’ve already gone through 12 months of the ugly markets and it would seem to be a time for a bottom.

He reminds us for all of those who have been watching the opening ceremonies at the Beijing Olympics and he asks the question, “How did you feel watching all those war drums at the opening ceremonies?” Is China telling us something – he thinks so!

Meanwhile, if you’ve been watching some of those CBC Specials on Shanghai with its modern suburbs and exceeding efficient infrastructure, you did note that the City of Shanghai has 2,000 new autos a day hitting the street there and he reminds us again that China is a country that is still where much of North America was 30 years ago. They are still in the first inning of a long ball game as far as the commodity cycle goes.

He points out that it’s China and Asia whose economies are probably going to produce the emphasis for commodities down the road, not the beaten up US consumer who is probably close to bankruptcy anyway.

Okay Andy, let’s get to it. If you could only buy three stocks today, what would they be?

Connacher Oil has just announcing their results and Andy points to a NAV of $14.13 a share and production of almost 2,000 barrels a day more than he had expected and just wonders why this stock is so cheap.

Pacific Energy, his second pick, is a company that has been close to his name and his heart for some time as he has played a big role in financing the company over the last two years. He reminds us that PFE has sold 900 barrels a day of production and raised $135 million to retire some of their debt. But the company should be able to add an additional 2,000 barrels a day of production from their offshore facilities in California by Christmas time. This is company with a market capitalization of $160 million and $3 billion of oil reserve in the United States.

Corridor Resources is one story that he has liked, but production was a little bit less than he had expected. On the other hand, they have pre-sold 10 million cubic feet a day of production for this coming winter at $15.00 an mcf and there should be some drilling results of a horizontal nature in the coming weeks that are going to create interest in the company.

Andy Gustajtis is an Officer and Managing Director of D&D Securities Company which is a member of the IIROC and the Canadian Investor Protection Fund. His comments are believed to be reliable but we cannot represent that the information is accurate or complete and it should not be relied on as such. D&D Securities Company, its officers, directors or employees from time to time may hold shares, options or warrants on any issue included in this interview. D&D Securities Company has actively participated in financing of Corridor Resources, Connacher Oil & Gas, and Pacific Energy. Comments made should not be construed as an offer or solicitation to buy or sell and securities.

_____________________________________________________________________________________________________________________________________

David Pescod's Late Edition August 15, 2008

ANTRIM ENERGY (T-AEN) $2.60 -0.25

OILEXCO INC. (T-OIL) $13.22 -0.93

ITHACA ENERGY (V-IAE) $1.69 -0.01

BRIDGE RESOURCES (V-BUK) $0.77 -0.07

The good news for those beaten up followers of the oil and gas game came earlier this week when the U.S. Department of Energy updated its petroleum inventories for the week and there were a couple of surprises. First of all, total crude inventories decreased a bit this week and are currently 38 mmb lower than last year. But the surprise came where total gasoline inventories decreased last week by 6.4 million barrels and total distillate inventories decreased by 1.8 million barrels. Both of which were surprised numbers and whenever inventory goes down, it’s good. And oil did pop on the day.

Meanwhile for the week, there was lots out of the North Sea and of a mixed nature. First of all take a look at the two year chart of Antrim Energy, showing just how that stock got so excited when their work started in the North Sea and expectations were so high. We’ve learned over time that if you want ongoing and constant information and the excitement to look forward to, Oilexco is the company for you because they have their own equipment, they have a huge list of inventory of projects and there is always going to be news flow.

For the little guys that’s not the case—where they don’t have their own equipment, are usually lined up to have access to it, there is little news coming out and usually of an irregular nature and the little guys in the North Sea have suffered. For instance take a look at the chart on Antrim. Also, Antrim and others have had to finance over the last while at some of the worst times possible.

This week Antrim announces that it has successfully drilled and completed the Fyne sidetrack appraisal leg at 21/28a-10z. The sidetrack encountered 60 feet of oil pay in the same reservoir section as the previously announced 21/28a-10 well which encountered 32 feet of oil pay. As Fred Kozak reports, the impact is “potentially positive” but points out that the “preliminary results of the sidetrack well are encouraging; however, the flow tests conducted over the next 10 days will determine the well’s potential…. Production is possible from this field as early as 2010.” And that’s important, but because several of the juniors in the North Sea we feel, won’t get recognition until they are closer to cash flow and becoming real oil and gas companies. Which gets us to Ithaca Energy….

Ithaca has been hammered by a recent financing done at a paltry $1.50. Management couldn’t have timed it worse to do their financing and this has had a huge dilutionary effect on the stock.

Again, analyst Fred Kozak who covers the North Sea for Canaccord and as far as the Ithaca closing their $75 million financing, Kozak writes that the impact was “Negative to our valuation. Due the highly dilutive nature of the equity financing, we have adjusted our valuation of the company lower to reflect the 50 million additional common shares.”

If you are looking for positive, Kozak writes, “However, corporately, the company should now have sufficient capital to fund its 2008 and 2009 programs.” Unfortunately with the dilution, he lowers his stock price target from $5.50 to $3.50.

Also Oilexco reported for the quarter and Kozak again writes, “The quarter was marked by a number of production interruptions at Brenda/Nicol due in part to a strike in the UK shutting down the Forties pipeline system, as well as maintenance activities associated with the Brenda/Nicol field and the Balmoral production platform.”

Kozak retains his target on Oilexco, which is one of his favorite stocks at $28.50 (oh, that $19.50 seems a long way away now).

Meanwhile, Bridge Resources came out with bad news at the worst possible time to come out with bad news in an ugly oil and gas market. The Piper field, which is probably one of the biggest targets being drilled in the North Sea over the next while, came up with water instead of oil and their well is being abandoned.

Bridge has a very interesting management team and a big inventory of projects and with their Durango project being put on stream to provide cash flow, the company obviously has a future. We are looking forward to analysts report on this story to see what people are thinking next because they do have a fair chunk of shares out.

If you would like to receive the reports on Oilexco, Antrim or Ithaca, e-mail Debbie at debbie_lewis@canaccord.com. |