Why Oil Shortages May Cause Price Decreases, Rather than Increases

Posted by Gail the Actuary on May 18, 2009 - 9:15am

A lot of people think peak oil is no longer a problem because prices are no longer in the stratosphere. It seems to me that standard economic models start breaking down when production for a commodity like oil starts becoming difficult to expand and there are no good substitutes. We have been taught:

and

As long as production of oil can be expanded easily, relationship (1) holds. But once oil production can no longer be easily expanded, the relationship doesn't work. Relationship (2) would work, if there were a good, cheap, easily expanded substitute for oil, but there really isn't, so it doesn't hold either.

When these relationships don't hold, there are several other relationships that become more important. It seems to me that these relationships help explain our current price situation.

Once the price of oil started going up, one type of feedback loop looked like this:

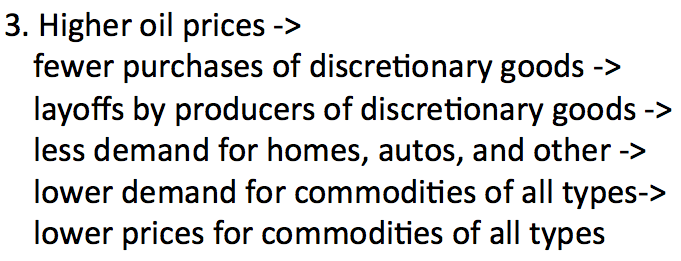

Another looked like this:

Steve from Virginia pointed out, through his analysis of the minutes of the Federal Reserve Open Market Committee, that there was also a feedback loop that looked like this:

All of these feedback loops led to reductions in demand for commodities of all types, including oil. With lower demand, prices dropped, not only for oil, but for natural gas, coal, uranium, and most metals.

Feedback loops 4 and 5 led to damage to the lending system. One problem was that banks were less able to lend because of reduction in capital because of defaults and because of fear that new loans would default as well. Another was that structured securities became much more difficult to sell, because it became clear that the system was not set up to handle large numbers of defaults. These changes popped the "debt bubble".

As a result, the total amount of credit began to fall--not just bank issued debt, but credit from other sources as well:

Change in capital markets between 2007 and 2008 from report issued by Security Industry and Financial Markets Association

Once the credit markets were damaged, there was a very significant impact on demand for oil, because credit is used at many points in building new products. Manufacturers often use credit to expand their factories; suppliers need credit to buy their raw materials; and purchasers of end products (like homes and automobiles) often use credit. A reduction in available credit could therefore result in a steep drop in demand.

It was not difficult to damage the capacity of credit markets, because the amount of debt had been expanding completely out of proportion to the amount of underlying assets (fed by cheap credit, aimed at keeping this expansion up, so no one would notice the lack of real growth). Also, credit markets needed economic growth in order for default rates to stay low. Once oil production flattened, default rates rose because of slower economic growth and higher oil prices. Without growth in oil production, economic growth couldn't continue, default rates rose, and the unwinding debt cycle took on a life of its own. The feedback loop looked something like this:

Note that with this feed-back loop, there is no longer a need for high oil prices to drive the credit unwind. The credit wind is now self-reinforcing, and it seems to me that it is the driving force behind the current reduction in demand for oil and other commodities. The debt unwind has been hidden for a while now by all of the bailout activity, but will soon back from hiding, as it becomes impossible to cover up the extent of the continuing defaults. I expect the impact of the debt unwind on oil prices will continue to be generally negative for quite some time as the unwind continues.

Besides the debt unwind, there are other factors that can be expected to have an impact on the price of oil. One is how well the purchasing power of the dollar holds up. If the purchasing value of the dollar drops, the price of oil could rise, whether or not demand rises.

Availability of storage for oil is another factor that may affect oil prices in the future. Rune Lickvern wrote a post about the possibility of inadequate storage capacity suddenly causing a drop in oil prices.

We cannot know precisely what path oil prices will take in the future, but one past example that is somewhat similar showed widely fluctuating prices. When whale oil (used for lamps) became scarce at the end of the 19th century, its prices fluctuated widely. The average price was higher than prior to the peak in production, but there was considerable variation:

Figure by Ugo Bardi, modified by graywulffe, showing whale oil production and prices, after the peak in whale oil production. Prices are at 2003 price levels.

Oil prices are likely to follow path that is somewhat different from those of whale oil, because the circumstances are different now (no available substitute, widespread economic impact). The whale oil model gives further evidence, though, that the price path isn't just upward. Other feedback loops besides those postulated by classical economists can also be important.

theoildrum.com |