Going back to 2008, CREE was a stock like many others in the semi area that bottomed out in price in the Nov/Dec area at around $13 dollars a share. The stock than began a rise that topped out in Apr 2010 at over $83 dollars a share. That was a long 16/17 month rise in pretty much of a straight line. Since Apr 2010, the stock has been in a downtrend and is now today selling in the $33 area, at the bottom(off 3.5%) of the 30 stock SOX index. Even at this level, next year's PE is by far the highest in the SOXM collection of stocks.

Message 27442442

So why did CREE fly so high for awhile and is now in a downtrend with maybe more to go? I will try to set the stage a little and then anyone interested can look for more details.

First, this is an article from IBD when the stock was selling for about $60 a share dated in Jan 2010.

<<LEDs Light Up Cree As Chipmaker's Q2 Handily Beats Views

By JAMES DETAR, INVESTOR'S BUSINESS DAILY

Posted 01/19/2010 07:14 PM ET

Hailing a "revolution" in light-bulb technology, chipmaker Cree beat analysts' second-quarter sales and profit forecasts Tuesday after hours, thanks to surging demand and stable prices for its light-emitting diode chips.

Shares of the Durham, N.C., firm soared nearly 10% after it said it earned 38 cents per share for the quarter that ended Dec. 27, crushing the 30-cent estimate from analysts polled by Thomson Reuters.

Revenue rose 35% to $199.5 million, topping views for $186.8 million. Cree (CREE) said its operating income jumped 23% to $46 million.

"The LED lighting revolution continues to gain momentum," said Chief Executive Chuck Swoboda, in a conference call with analysts and reporters after the company put out its numbers.

LEDs are emerging as a popular lighting option because they use a fraction of the energy used in today's incandescent light bulbs and last up to 10 times longer. They're also considered environmentally safer than florescent lights, which contain mercury.

In addition to LED chips, Cree also makes LED bulbs and the modules that make up the main part in LED lighting fixtures.

Swoboda credited the results to a combination of factors, including a faster-than-expected production ramp-up of its newest LED product. In addition, prices remained stable, and the firm's yield — the number of good chips and modules in a given production batch — was better than forecast.

Those factors helped boost Cree's profit margin to 47.5% from 39% a year earlier, beating its own target of 44%.

The company snagged a major deal in November when Wal-Mart (WMT) said it'll install Cree's products in 650 stores. Swoboda called the deal "one of the most important milestones to date."For the current quarter, which ends March 31, Cree expects profit of 41 cents to 44 cents on sales in the range of $215 million to $225 million. That would easily top analysts' forecasts of a 28-cent profit on revenue of $189 million.

Merriman Curhan Ford analyst Bill Ong said LED is taking off in the outdoor lighting market, and Cree's results reflect that expected growth.

"That will benefit them for the next couple of years. I'm bullish," Ong said.

Swoboda said the next big challenge for the company is to bring LED lighting into homes.

Looking forward, Swoboda said Cree will strongly focus on the general outdoor lighting market. Asia is a big sales driver, as are newer flat-screen TVs that use LED backlighting.

"We are benefiting from the fact that both markets are growing," Swoboda said, adding that revenue growth is limited only by how fast the company can bring on new factory capacity.

Last quarter, Cree purchased a manufacturing facility in Huizhou, China, to expand into that market.

"There is probably some upside if we could execute a little better," Swoboda said. "But I think our targets are built around what we can execute in the next quarter.">>

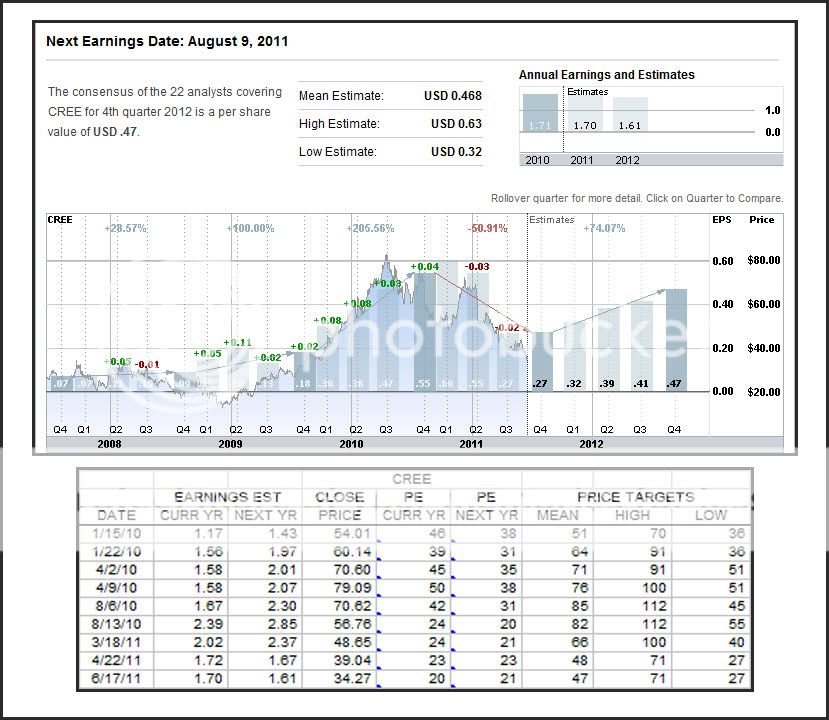

Shown below is an earnings and price history for CREE dating back to 2007 with estimated earnings going out through FY 2010. CREE has a FY ending in June, so the report for the 4th quarter and Current Year earnings will be out in about 6 weeks.

Below the chart is a small table that I put together from archived data showing some interesting data during the recent rise and fall of CREE. The 1st 2 entries are a week apart, before and after the quarterly earnings report. The PE's were already high on 1/15 expecting a good report and the market was not disappointed. Earnings estimates "skyrocketed" and the price jumped $6 in 1 week. The same thing happened in the Apr area, the price jumped almost $9 dollars in 1 week. PEs continued to climb in consonance with very strong growth expectations. Next, the yearly earnings report in Aug again exceeded expectations and earnings estimates jumped again, but by now the bloom was off the rose. The price had gone from 80+ in April to 56.76, down about $25 a share from April. In Mar earnings estimates and the stock price were trending downward.

In April a big change took place, Current year earnings were reduced a lot, and next year earnings were reduced even more to now be less than current year earnings. That is where the situation stands today as we wait for the 4th quarter and year end results for CREE in about 6 weeks. Even today with the price around 33/34 a share, the PEs are much greater than the other SOXM stocks. The chart shows rising quarterly earnings in the future. Perhaps CREE will be at, or finding a bottom soon if the market believes the estimates.

I'll close this post with the latest article on CREE available from IBD.

<<Aixtron, FEI, Ultratech Resilient After Cree Warning

By ALAN R. ELLIOTT, INVESTOR'S BUSINESS DAILY

Posted 03/23/2011 06:43 PM ET

Lowered third-quarter guidance from chipmaker Cree (CREE) sent a tremor through LED-related chip stocks Wednesday. Three of the more resilient plays, Aixtron (AIXG), FEI (FEIC) and thinly traded Ultra-tech (UTEK), are included in the Stock Spotlight.

Cree plummeted as much as 12.7% after revising its revenue and margin guidance below consensus expectations. The company said demand for light-emitting diodes or LEDs — semiconductor chips that produce light — was improving, but more slowly than expected. Prices were also below expectations.

Aixtron dropped as much as 5% following the news, then trimmed the loss. It is in the sixth week of a possible flat base.

Based in Germany, the company makes equipment used to deposit circuit patterns on LED chips. The stock holds best-possible Composite and EPS ratings of 99 from IBD.

Oregon-based FEI slipped as much as 1.4% before recovering. Its tools help chipmakers analyze defects and speed product development.

FEI is gently testing support at its 10-week moving average in the third week of a pullback. The stock carries a Composite Rating of 96. Its EPS growth jumped to triple digits in Q4. Analysts expect more of the same through the first half of this year.

Sales growth has lagged, advancing from single digits to 20% in Q4. Forecasts see 25% and 27% growth in Q1 and Q2, respectively.

The thinly traded Ultratech dropped 2% in early trade, then reversed. Ultratech makes lithography equipment, used to chemically etch circuit patterns onto LEDs and other chips.

The stock is back at its 10-week line after a failed rebound attempt in early March.

Rubicon Technology (RBCN) dove sharply. Veeco Instruments (VECO) crumbled as much as 6%, and then reversed.>> |