Obamacare raises spending, thus repealing it would lower the deficit.

--------------------------

The Net Costs of “ObamaCare”

Thursday March 15th, 2012 • Posted by Craig Eyermann at 9:44am PDT

How much will the Patient Protection and Affordable Care Act (a.k.a. “ObamaCare”) really cost over a 10 year long period?

According to the Congressional Budget Office, far more than the Obama administration has previously been willing to acknowledge. The Washington Examiner’s Philip Klein reports:

President Obama’s national health care law will cost $1.76 trillion over a decade, according to a new projection released today by the Congressional Budget Office, rather than the $940 billion forecast when it was signed into law.

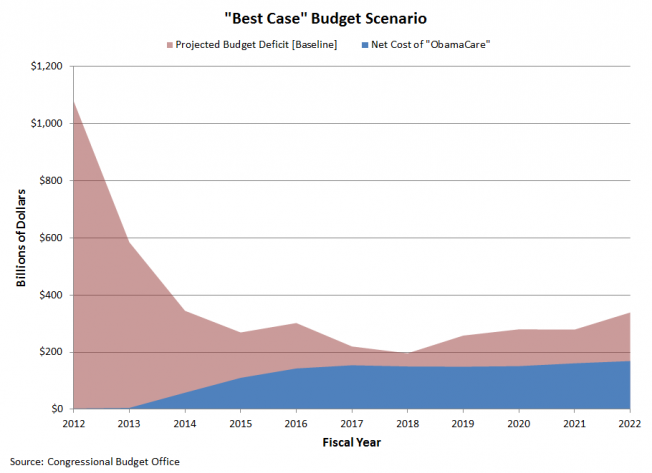

We thought it might be interesting to put those values into the context of the best possible scenario of the annual U.S. government budget deficit for the years from 2012 through 2022, as represented by the Congressional Budget Office’s most recent extended baseline budget scenario.

(Note: What makes the CBO’s extended baseline budget scenario so optimistic is that is assumes that today’s politicians will follow current law to the letter and not act to prevent a number of popular tax cuts and massive spending cuts from happening and that other likely spending increases will not occur.)

Our results are graphically presented below:

In our chart, what find is that under this most optimistic scenario for federal tax collections and spending, the dominant driver of the budget deficit will be President Obama’s health care law, which would grow beginning in 2013 to account for anywhere from 50 to 72% of the budget deficit, and the corresponding increase in the U.S. national debt, in any given year.

That’s the optimistic view. The Atlanta Journal and Constitution’s Kyle Wingfield explains why the critics of Obamacare were right to point out the President’s flawed estimates for the cost of the program:

The only way in which Obamacare critics were wrong in our protests that the law would cost far more than advertised was that we underestimated the damage, by about $40 billion from 2014-2023 if the cost figure continues to grow at the minimum 6 percent annually CBO is now using. That would make it $2.04 trillion during those 10 years.

This is in part because, as Obamacare opponents explained at length at the time, congressional Democrats had rigged the score by beginning the tax increases before the spending kicked in. That made the 10-year figures both for the gross cost and the deficit “savings” look better than they would have if we considered 10 years of Obamacare fully implemented.

But it’s also because, as I’ve explained here recently, the estimates were faulty. Take three years in which there’s an overlap between the two estimates: 2017-2019. The new estimate for the total costs during that time span is now $147 billion, or 30 percent, higher than the original estimate just two years ago. The new estimate for “savings” has fallen by $314 billion, or 63 percent.

The result is that the effect on the federal budget from 2017-2019 has gone from a projected “savings” of $8 billion to an increased deficit of $453 billion.

And it’s only going to get worse in future years, if the new projections hold. That’s because they see the revenue portions holding steady while the expenses keep going up, up, up.

Oh — and this fiscal worsening is taking place while the projected increase in the number of people who are insured by 2019 thanks to Obamacare has fallen by 1 million.

If you’ve had any illusions that the spending needed to support “ObamaCare” was sustainable, the direct role of that spending program will have in jacking up the national debt throughout its miserable existence will hopefully help dispel them.

mygovcost.org

----------------

CBO’s Estimates of Obamacare, Revisited

James Capretta

March 21, 2012 at 2:45 pm

6 Comments

Some apologists for Obamacare are trying to tout recent analyses from the Congressional Budget Office (CBO) as confirming once again that the health law will cut projected future budget deficits.

But CBO’s recent analyses—including updated projections of the costs of the new entitlement spending in the so-called exchanges and some simulations on employer dumping scenarios—basically say nothing that wasn’t already said when the agency issued its original cost estimates for the law in March 2010.

It is certainly true that CBO projected in 2010 and again this month that the new law would, at least on paper, reduce the federal government’s budget deficit modestly over its first two decades. But that assessment has always rested on a series of omissions, gimmicks, double-counting of savings, and implausible assumptions that also have not changed since the law was enacted in 2010. When the imaginary “savings” is stripped out of the accounting, Obamacare is exposed as the epic budget buster that it is. That, too, hasn’t changed since March 2010.

The problems start with some “pay-fors” that were doomed from the get-go. Just after enactment, the ridiculous paperwork provision that was going to require all employers to report even the smallest contractual transactions to the IRS caused such an uproar that it was repealed, with scores of Democrats joining in the fun of repeal just months after voting to impose the requirement on businesses. Then the Administration pulled the plug on the ill-begotten CLASS Act, the voluntary long-term care program that hitched a ride on Obamacare because CBO said it would reduce the deficit by $70 billion over a decade. Right there, more than $70 billion of the supposed 10-year deficit reduction of $123 billion from the original cost estimate is already gone.

Next up is double-counting. The law relied heavily on cuts to the Medicare program to pay for the massive entitlement expansions in the legislation. But a large part of the Medicare cuts (and payroll tax increases) is also supposed to pay for future benefits out of the Medicare Hospital Insurance trust fund. In other words, the savings from the cuts and taxes is spent twice—once on Obamacare’s entitlements and then again to fill a hole in the trust fund so that future Medicare claims can be met. The end result is not deficit reduction, as Obamacare’s apologists claim, but a massive increase in deficit spending over the long term.

Then there are the scores of implausible assumptions. The Medicare cuts that are double-counted may not survive long anyway, because they are so indiscriminate and blunt that the chief actuary of the Medicare program has warned multiple times that they cannot be relied on. If they are implemented as written, they will cause severe access problems for seniors, as declining payment rates from Medicare will drive hospitals and other providers to stop taking elderly patients.

Further, even CBO admits that there is great uncertainty surrounding employer and worker responses to the massive entitlement promises in the law. According to CBO’s recent simulations on employer responses, a family of four with income at 200 percent of the poverty line in 2016 would get $11,300 more in government assistance for health care inside the exchanges than from employer-paid health care. That’s a huge amount of money for a family with $50,000 in annual income. And yet CBO’s original cost estimate showed very few of those people migrating form employer plans into the exchanges. In one of the scenarios CBO released last week, it estimates that the cost of the legislation would go up by $36 billion if just 20 percent of low-wage workers migrated into the exchanges from employer plans. But what if 40 percent, 60 percent, or 80 percent migrate? The costs of the legislation will balloon.

Finally, there are the omitted costs. CBO admits that a lot of the costs for administering Obamacare aren’t counted in the original cost estimate. There’s at least $5 billion to $10 billion in Health and Human Services (HHS) spending, and another $5 billion to $10 billion for the IRS. Just this year, HHS asked for an additional $850 million to pay for setting up a federal backup exchange in 2013. None of these costs are counted in the original cost estimate. Further, there’s the $300 billion in physician fees. The Administration scooped up every Medicare cut it could find to pay for Obamacare and then said it wanted to add new physician fee spending to the deficit without any offsets. But just because they tried to keep two sets of books doesn’t mean the deficit won’t go up. It will, as the combined effect of the “doc fix” and Obamacare is unquestionably an increase in the deficit.

Obamacare is the largest entitlement expansion in a generation. It will add tens of millions of Americans to government support programs, with trillions in new spending in coming years. The idea that this will somehow improve the long-term budget outlook has always struck commonsense Americans as a combination of wishful thinking and typical Washington misdirection. They are right.

blog.heritage.org

And it only increases the deficit as "little" as it does because it raises taxes, but raising taxes is not something that can be done indefinitely. Using up some of the possible tax increases would be fiscally irresponsible even if the program actually slightly decreased deficits (and no analysis ever showed it decreasing deficits by a lot, your "Repeal of Obama Care would explode the national debt" idea would be a fantasy even if the poor analysis that showed that it would slightly decrease the deficit was correct. |