AAWP on Nokia's Q2 ...

... including CC Notes. It's the best summary of the earnings results and the CC i've seen so far:

>> Nokia Q2 2012 Results - Continued Losses, Cash Position Better Than Expected

Rafe Blandford

All About Windows Phone (AAWP)

July 19th 2012

allaboutwindowsphone.com

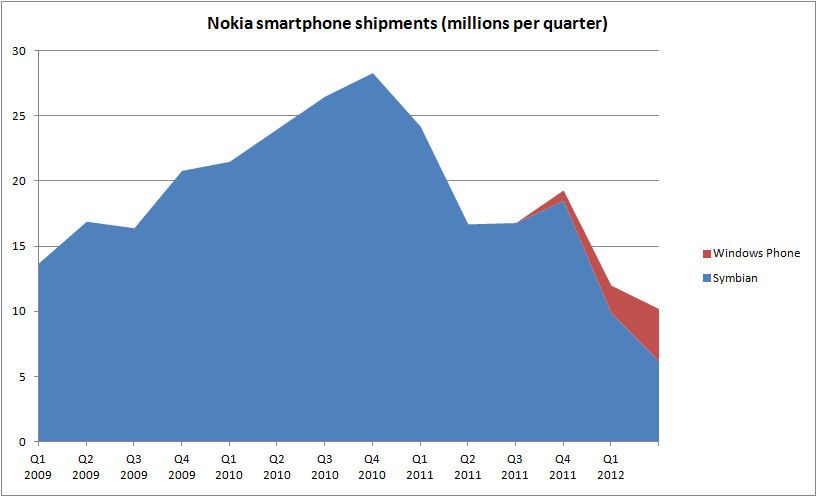

Nokia has released its Q2 2012 results, reporting an operating loss of €826 million, with net sales of €9.275 billion (down 19% YoY). Nokia's Devices and Services division's losses were €471 million. Margins in devices and services were -11.8% (down from -4% in Q2 2011 and down from -5.2% in Q1 2012). Total smartphone device sales were 10.2 million (4 million Lumia), compared with 16.7 million units in Q2 2011 (down 39% YoY) and 11.9 million units in Q1 2011 (down 14%, QoQ).

Nokia's overall results were below market expectations (expected operating loss of €641 million), though sales were ahead of expectations (€7.32 billion expected). However, the company reported a stronger than expected cash position (net cash of €4.2 billion, against expectations of €3.7 billion). Nokia's net cash position was lower on a quarter-by quarter basis due to a €742 million dividend payment to shareholders, but the cash position from operating activities in Q2 2012 was positive €102 million, primarily due to €400 pre-payments from existing IPR (patent) licensees.

Nokia's cash position is an important measure because it dictates how long the company can continue to lose money while completing its strategy change. Today's results indicate that Nokia's position is more stable than some analysts feared. While the overall results are, as anticipated, grim, the Nokia leadership team continues to do a good job of controlling costs and cash levels in the context of the company's current situation. This is reflected in a 15% rise in Nokia's share price today.

The headline loss of €826 million is a big number, but a significant component of it is a write down in value as a result of restructuring costs. This can be seen more clearly in Nokia's non-IFRS figures. Nokia's Non-IFRS operating loss was €327 million, with Devices and Services non-IFRS loss at €365 million, and margins at -9.1%. Non-IFRS results exclude special items for all periods and can be seen as measures of underlying performance. In Q2 2012 the non-IFRS results exclude €499 million of charges, related to restructuring charges and intangible asset amortization. Similar charges are likely in Q3 and Q4 2012 as a result of recently announced cost cutting and job losses.

Stephen Elop said:

"Nokia is taking action to manage through this transition period. While Q2 was a difficult quarter, Nokia employees are demonstrating their determination to strengthen our competitiveness, improve our operating model and carefully manage our financial resources.

We shipped four million Lumia Smartphones in Q2, and we plan to provide updates to current Lumia products over time, well beyond the launch of Windows Phone 8. We believe the Windows Phone 8 launch will be an important catalyst for Lumia. During the quarter, we demonstrated stability in our feature phone business, and enhanced our competitiveness with the introduction of our first full touch Asha devices. In Location & Commerce, our business with auto-industry customers continued to grow, and we made good progress establishing our location-based platform with businesses like Yahoo!, Flickr, and Bing. We continued to strengthen our patent portfolio and filed more patents in the first half of 2012 than any previous six month period since 2007. And, we are encouraged that Nokia Siemens Networks returned to underlying operating profitability through strong execution of its focused strategy.

We are executing with urgency on our restructuring program. We are disposing of non-core assets like Vertu. We are taking the necessary steps to restructure the operations of the company, which included the announcement of a new program on June 14. Faster than anticipated, we have already negotiated the closure of the Ulm, Germany R&D site, and the negotiations about the planned closure of our factory in Salo, Finland are proceeding in a collaborative spirit.

We held our net cash resources at a steady level after adjusting for the annual dividend payment to our shareholders. While Q3 will remain difficult, it is a critical priority to return our Devices & Services business to positive operating cash flow as quickly as possible."

Of the smart devices volume of 10.2 million, 4 million were Nokia Lumia devices and approximately 6.1 million were Symbian devices. The Lumia devices sales were slightly ahead of an average analyst estimate of 3.75 million units and take total Lumia sales to around 7 million units. The average selling price was €151 (up 7% from 141 in Q2 2011 and up 6% from 143 in Q1 2012). The average selling price of Lumia devices was €186 in Q2, compared to €220 in Q1 2012. Devices & Services margins were negatively effected due to a recognition of a €220 million cost related to excess component inventory and future purchase commitments, an indication of the difficulty Nokia is having in predicting device sales volumes.

In Q2 Mobile Phone volumes were 73.5 million, up 2% from 71.8 million in Q2 2011, and up 4% from 70.8 million in Q1 2012. The results indicated that, thanks to the successful roll out of its Asha range and dual SIM devices, Nokia has been able to successfully defend its position in the mobile phone space, with the increased device volumes an impressive performance in the context of a shrinking overall market (as more feature phone owners switch to smartphones). Nokia did note that the volumes of higher end feature phones were adversely effected by competition from affordable smartphones and full touch feature phone devices.

Nokia's Location & Commerce division reported sales of €283 million, up from €271 million in Q2 2011 and €277 million in Q1 2012. The increase was mainly due to the higher recognition of deferred revenue related to sales of map platform licenses.

Nokia Siemens Networks reported sales of €3.34 billion, down from €3.6 billion in Q2 2011 and up from €2.94 billion in Q1 2012. Operating losses were €227 million, up from a loss of €111 million in Q2 2011, and down from a loss of €1005 million in Q1 2011.

Outlook: Looking forward, Nokia expects its non-IFRS Devices and Services operating margin in Q3 to be similar to that of Q2 (-9.1% with a +/- range of 4%), underlining that Nokia's tough times will continue well into the second half of the year. Q3 2012 will be a very tough period for Nokia as it looks to continue to sell Symbian devices and Windows Phone 7.5 devices, ahead of a Windows Phone 8 launch in the last quarter of the year. As a result, the sales level of the Lumia 610 and low cost Symbian phones are likely to be the major varying factor in Q3 2012.

Nokia's outlook for Q3 2012 is based on a number of factors, including competitive industry dynamics and consumer demand relating to Lumia products. The company expects Q3 "to be a challenging quarter in Smart Devices due to product transitions".

The priority for Nokia is to return the Devices & Services division to profit as quickly as possible. This is unlikely to happen in 2012, but the situation may improve in Q4 2012 and H1 2013 with the release of Windows Phone 8 devices, assuming Nokia can continue to defend its position in the mobile phone (feature phone) business.

Conference Call Notes

• Nokia "sold 4 million Lumia devices in Q2 2012".

• Nokia expects the transition from Windows Phone 7.5/7.8 to Windows Phone 8 to have "some impact on Lumia devices sales". However, Stephen Elop did note that "in the weeks following the announcement of Windows Phone 8 Lumia sales have been flat or up".

• Elop expects that "Windows 8 will have a halo effect for Lumia" and that Nokia will benefit from Microsoft spending on marketing and promotion/ visibility of Metro experience.

• Talking about the Location & Commerce business Stephen Elop noted that Nokia "aims to become the where company, in the same way that Facebook is the who company, and Google is the what company".

• "Lumia 610 and Lumia 900 volumes are increasing, Lumia 710 and Lumia 800 volumes are decreasing", noted Timo Ihamuotila, Nokia's CFO.

• In response to a question about Windows Phone 7.8 Elop noted that updates for existing devices "would continue for quite a while after the launch of Windows Phone 8" and that Nokia would continue to sell Windows Phone 7.5/7.8 devices after the launch of Windows Phone 8 (as is typical for consumer products).

• In response to a question about how Nokia plans to increase margins Elop noted that, "the catalyst for us will be the next wave of Lumia devices" and that the company will be launching "more expensive [Lumia] devices".

• Asked about how Nokia would break through in the sales channels Elop noted that, "there would be further [hardware] product differentiation", noting that with existing Lumia models Nokia had been obliged to adopt the "standard chassis". He suggested that some of the hardware features of early Nokia models would return to the Nokia smartphone portfolio. We can speculate that this means that future Lumia devices may include hardware features such as penta-band radio, NFC and FM transmitter and take different form factors.

• Repeating what he said in June, Elop said that Nokia would put "more resources behind specific sales opportunities", a lesson learnt from the pattern of AT&T (one device on one carrier, with a big marketing push) versus Europe (broader push across multiple operators).

• Nokia will continue to look at the best way to maintain cash balance. That may include selling IPR or real estate assets.

• In response to a question about operators Elop noted that, "operator support for the third ecosystem continues to be an important part of the conversation" and is something that Nokia plans to take advantage of going forward.

• Both Windows Phone 7.5/7.8 and Windows Phone 8 will be used to address the market for cheap Windows Phone device ("you can anticipate both").

• Elop noted that, "we have a very important relationship and dependency with Microsoft" and that Nokia has a "preferred status pwith regards to Windows Phone]". He went on to comment that the Nokia ownership of the location platform [Nokia Where] is an "important dynamic to the health of the relationship with Microsoft". ###

- Eric - |