I referenced Stephen Haines, by name, back in 2013 and probably a few times back in the first decade

of this century on the Lab thread......

(read post I am responding to for his name mentioned)

Stephen and I worked very closely when I was on the bond desk at Citi Sydney...... He was a mentor

into the nuances of arbitrage of cash bonds vs. the futures..... especially "off the run" bonds that are

not actively traded, as they are tucked away in Insurance company, pension funds and other bigger

portfolios

Stephen's name came to mind as I connected on Linked In with George H Walker IV... who is running Neuberger Berman

(my good friend Stephen Haines, who ran our bond desk at Citi in Sydney... his dad owned a Melbourne Investment Bank , Portland House...... after I had come back to Manhattan and was trading FX for Chase Manhattan, Stephen Haines came over to NY for a number of months as his dad had

purchased all of the distressed debt of Wheeling Pittsburgh steel from Manny Hannover..... Stephen's office was at Neuberger Berman's midtown headquarters, as they were the "Wall Street" bank facilitating the proceedings.... I was over at his office..... NBerman had one of the finest art collections on

there walls of any financial firm in Manhattan.) ... an except from an email I sent to a couple of friends.

( interesting anecdote.... the debt for Wheeling Pittsburgh was sold for 5% of face value as the NYC money

center banks had to clear the decks and get rid of the dreck... and strengthen their balance sheets in the LDC banking depression of 1982)

----------------------------

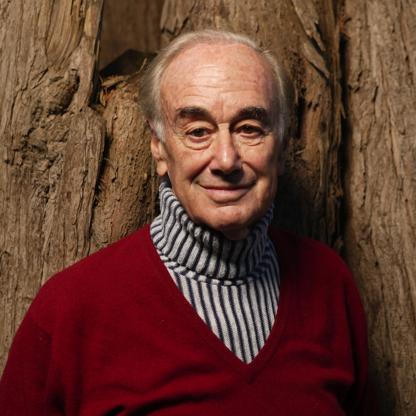

http//www.forbes.com/profile/david-hains/#2f386d644a45

#1157 David Hains

REAL TIME NET WORTH

$2B

as of 8/6/18

David Hains owns hedge fund Portland House Group, which is now managed by three of his sons.Richard oversees managed funds and investment in New York and London; Stephen looks after bond holdings; and Michael is in charge of equities.His daughter, Cathy, breeds racehorses, and his other son, Paul, founded online magazine Aeon in London.A former engineer, Hains stopped working for seven years in the late 1960s to improve his golf game with legendary Australian coach Norman Von Nida.He later became known for restructuring companies such as U.S. steelmaker Wheeling-Pittsburgh.

ON FORBES LISTS

#1157 Billionaires 2018

#19 Australia's 50 Richest 2017

STATS

AGE87

SOURCE OF WEALTHInvestment, Self Made

RESIDENCEMelbourne, Australia

CITIZENSHIPAustralia

MARITAL STATUSWidowed

CHILDREN5

EDUCATIONBachelor of Science in Engineering, University of Melbourne

DID YOU KNOW

He bred the 1990 Melbourne Cup winner racehorse Kingston Rule.

-----------------------------------------------------------

One day I will tell the story of the Day that John D Rockefeller and his brother William met and got to

know Prescott Bush's father who needed to take over the active management of a Railroad company

that "blacksheep brother" Frank Rockefeller was unsuccessfully endeavoring to manage........

story title "The Day the Bush's met the Rockefeller's" ....... mystically wondrous things occur to those

whom have favorable interactions with the Rockefeller over the past 150 years.

---------------------------------------------------------------

George Herbert Walker IV

From Wikipedia, the free encyclopedia

Jump to navigation Jump to search

For other people named George Herbert Walker, see George Herbert Walker (disambiguation).

George Herbert Walker IV (born April 1969) is the chairman and CEO of Neuberger Berman, one of the largest independent, employee-owned investment management firms. During Walker's tenure, the firm survived the implosion of its corporate parent, Lehman Brothers, was repurchased by the employees and has been amongst the industry's best performers. [1] Its growth has been most significant in global equity and fixed income strategies, alternative investments and amongst the largest institutional investors. [2] The firm's broad capabilities have enabled it to win numerous public strategic partnership mandates, most notably from Teacher Retirement System of Texas and the National Social Security Fund of China. [3] Its community service programs, NB Impacts, have also been a hallmark. [4] [5] [6] [7]

Neuberger Berman has been named the #1 Best Place to Work in asset management, amongst firms with 1,000 or more employees by Pensions & Investments. [8] The firm has been ranked amongst industry leaders as an employer over time. [9] [10] [11]

Contents

1Family 2Education 3Career 4References

Family[ edit]Walker comes from a successful family of industrialists and financiers, originally from St. Louis, Missouri. Walker's great-grandfather, George Herbert Walker, was the founder of G. H. Walker & Co., a securities firm, which eventually became part of Merrill Lynch. An avid golfer, he was also the namesake of amateur golf's Walker Cup. His grandfather, George Herbert Walker Jr., was a co-founder of the NY Mets and his father, George Herbert Walker III, was U. S. ambassador to Hungary. Walker was raised in St. Louis, Missouri and has a younger sister, Carter. Walker's grand-aunt, Dorothy, married Senator Prescott Bush, father of U.S. President George Herbert Walker Bush and grandfather of U.S. President George Walker Bush. He is thus the first cousin once removed of former President George H. W. Bush, and the second cousin of former President George W. Bush.

He is married to the former Nancy Dorn.

Education[ edit]Walker went to the University of Pennsylvania where he received the Harry S. Truman Scholarship [12] and was a Benjamin Franklin Scholar, graduated Phi Beta Kappa and received a dual degree — a B.S. and a B.A., both summa cum laude. He also received his MBA as a Palmer Scholar from the Wharton School of the University of Pennsylvania [13] after completing the 5 year MBA program. He was a member of the St. Anthony Hall fraternity.

Career[ edit]Walker began his career on Wall Street when he joined Goldman Sachs in the Merger Department in 1992. Six years later, in 1998, Walker became one of the youngest partners in the firm's history. [13] He held several senior positions at Goldman, including co-head of the firm's Wealth Management business, and head of Alternative Investment Strategies. Walker was recruited to a rival investment bank, Lehman Brothers, to head its Investment Management Division, of which Neuberger was a part. Following Lehman's bankruptcy and the announcement of the sale of Neuberger, Walker assumed his present position. [14] [15] |