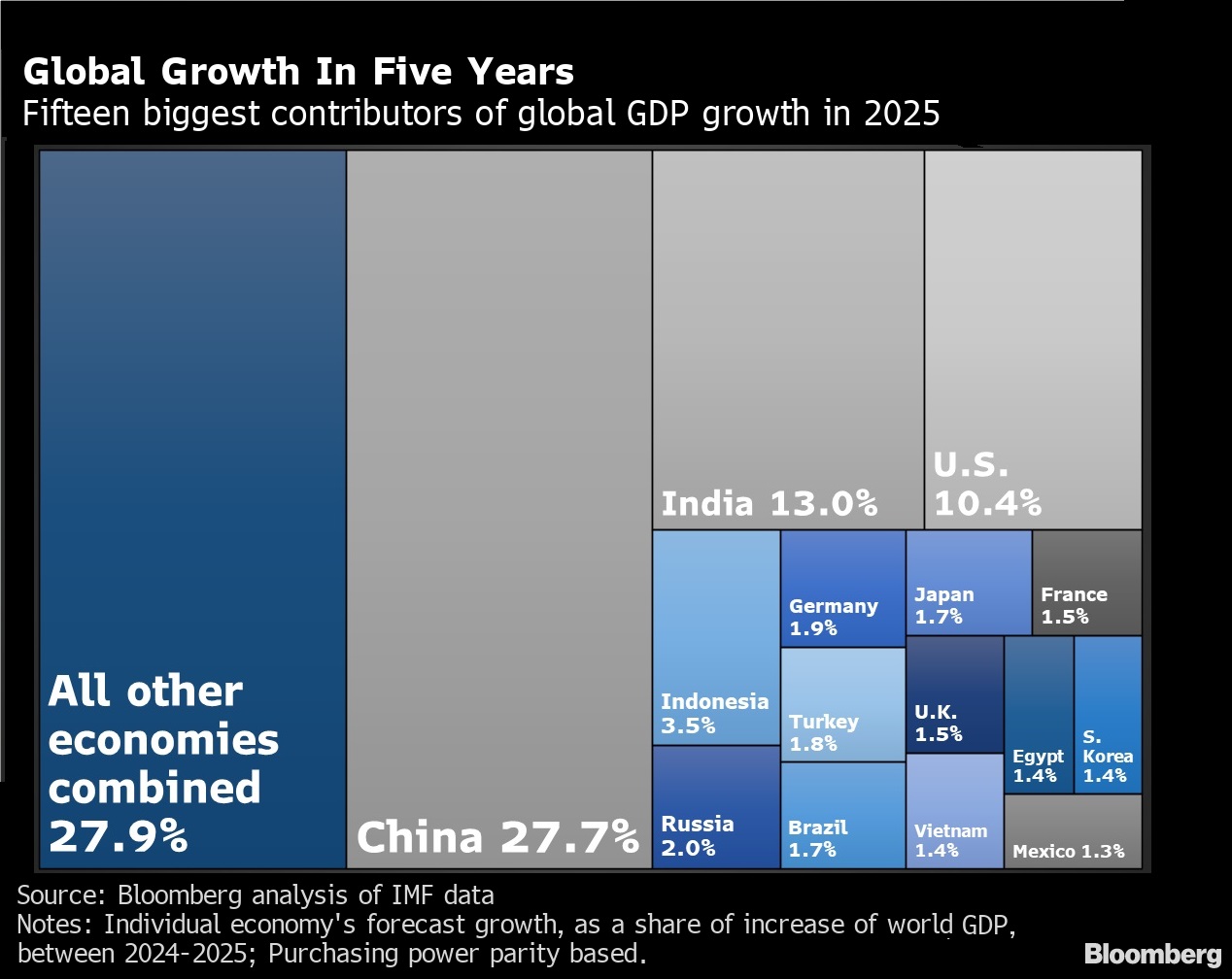

Following up on narrative floated long ago, that Team China shall veer towards 36% of global GDP, by and by, as progressing from TeoTwawKi towards Darkest Interregnum, and onward to new-new paradigm, not so much by arms and legs as some posited, by maybe by arms and legs attached to brains as I reckoned, enabled by reform, helped by stability, and to grow grow grow

as I messaged some pole climber Message 30891856 (circa 2016 December) <<... the next 15 years on this thread should be a lot of fun>>, and so the first 4 has been fun, and better, profitable.

Message 31015412

The <<reform>> is progressing, even as CoVid slowed but did not alter vector, towards <<36% of global GDP>>. The fun is not about arriving, but to do with the journey.

IOW, all seems to be going okay, and better,, for the plan going forward also seems okay, per returning to natural size :0)

bloomberg.com

Xi Says Economy Can Double as China Lays Out Ambitious Plans

Economists surveyed by Bloomberg see the economy expanding by 2.1% this year as a result of the coronavirus pandemic, accelerating to 8.0% in 2021.

Photographer: Yan Cong/Bloomberg

LISTEN TO ARTICLE

Sign up for Next China, a weekly email on where the nation stands now and where it's going next.

Chinese President Xi Jinping said the economy can double in size by 2035 and the country can reach high-income status in the next five years as the Communist Party outlined ambitious plans for the nation’s future.

“It is entirely possible to reach the high-income country status by current standards by the end of the 14th Five-Year Plan, and to double the total economic output or per capita income by 2035,” Xi said in a speech to the party’s Central Committee, according to state media Xinhua.

Read More: China Pledges Quality Growth, Tech Powerhouse in 5-Year Plan

Based on a rough estimate, doubling economic output by 2035 would mean an annual growth rate of nearly 4.7%, said Hong Hao, chief strategist for Bocom International in Hong Kong. “This is ambitious, as the Chinese economy is already of significant size.”

This new target is similar to the current goal to double the country’s gross domestic product and income from 2010’s levels by 2020, as well as building a ‘moderately prosperous society’ by the end of this year.

China will formally announce victory on that target after conducting a systematic assessment in the first half of next year, Xi said, according to Xinhua.

Economists surveyed by Bloomberg see the economy expanding by a mere 2.1% this year as a result of the coronavirus pandemic, accelerating to 8.0% in 2021. The statement didn’t specify on which year the target of doubling the size of the economy would be based.

The Central Committee released a broad framework of its five-year economic plan last week, focusing on self-reliance in technology, boosting domestic consumption and pursuing quality growth over speed.

What Bloomberg Economics Says...“Further steps are needed to encourage innovation, expand domestic demand and enhance economic efficiency.”

-- David Qu, economist

For full report, click here

Xi cited instability and uncertainty in the global environment in coming years, with many risks that could affect the domestic economy, according to Xinhua. The Covid-19 pandemic has had far-reaching effects and the world economy may continue to suffer, the state media agency cited him as saying.

Xinhua also published more detailed proposals from the five-year plan, including:

Promoting yuan internationalization in a “steady and prudent” mannerSupporting Beijing, Shanghai and the Greater Bay area of Guangdong, Hong Kong and Macau as international technology innovation centers Strengthening domestic oil and gas production while also promoting clean energyChina has the world’s second-largest economy, estimated at $14.3 trillion in current dollars by the World Bank. The Washington-based lender categorizes China as an upper middle-income economy with a per-capita income of $10,410. A high-income country is one with gross national income per capita of $12,375 or more.

— With assistance by John Liu, Lin Zhu, and Lucille Liu

(Updates from third paragraph with more details.)

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |