Partisan Statistic Alert

Posted by Glen Whitman at 10:08 AM

Some people are touting the statistics reported here, which show that the national debt has increased by a smaller percentage under Obama than the four previous presidents.

Reagan - 189% Bush - 55% Clinton - 37% Bush - 86% Obama - 35% I double-checked the numbers, and they are technically correct. But they’re also meaningless.

First, these figures compare presidents instead of presidential terms. It shouldn’t be surprising that a two-term president will tend to rack up more debt than a one-term president.

Second, this is one of those instances where percentages are completely misleading. Each administration inherits the debt built up by all previous administrations, and that inherited debt provides the denominator for calculating the percentage increase. As a result, the percentage is automatically pulled downward for later presidents simply because they are later.

(For comparison, imagine if the entire $14.9 trillion in debt accumulated since 1980 had been added in equal-sized chunks by all eight presidential terms. That would be $1.87 trillion per term. Yet the percentages wouldn’t be equal at all. They would decline in every single year, from a high of 201% for Reagan 1 to a low of 13% for Obama.)

So what happens when we correct for both errors? Correcting the term problem first, and also adjusting dollars for inflation (something else I don’t think the original source did), here are the percentage increases by presidential term:

Now Obama’s record isn’t the best. He has the third highest percentage increase, and he hasn’t even finished his term yet. (I used the most recent national debt figures, which you can find here. For pre-1993 figures, see here.)

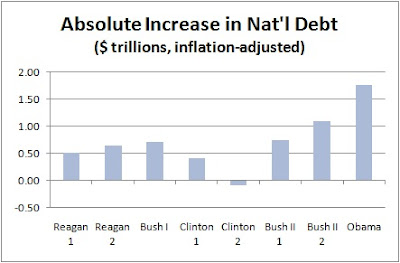

But again, the percentage is misleading. It would be better to look at the absolute dollar increase (again, adjusted for inflation). Here’s what you get:

Now it becomes clear: Compared to the previous seven presidential terms, Obama has presided over the largest increase in the national debt. And again, his term isn’t over yet.

Obviously, Obama’s defenders will say his actions were justified. He inherited a terrible economy, a large stimulus was necessary to boost performance, some expenditure increases were outside Obama’s control, etc. Those arguments might even be right, and they’re free to make them… but only after admitting that the national debt did, in fact, increase dramatically during Obama’s term.

One final addendum: these numbers could, of course, be adjusted in many other ways as well. You could adjust for the size of GDP or population. You could change the start-and-end dates to reflect who passed the relevant budgets, or to reflect that a presidential term doesn’t start until about a month after the election; doing so would shift some of Obama’s debt into Bush II’s second term (as well as shorten Obama’s effective time in office). In truth, there’s something inherently silly about trying to attribute changes in the national debt to specific presidents at all, since additional debt results from a complex interplay of policies created by multiple presidents and congresses over time. All I’m really trying to correct here is two very obvious errors that the creators of these particular statistics should have seen instantly, and probably would have seen if they didn’t have partisan blinders on.

agoraphilia.blogspot.com

Glen Whitman said... Ran, the short answer is YES, I do think absolute change is the right measure. And I don't think this is ideological.

I agree that it might make sense to adjust for GDP or population and interest. (I'm too lazy to do the calculations right now, but feel free.) But once you've adjusted for those factors, I can't think of any justification for setting a baseline of proportional growth instead of absolute growth. Even if you're a progressive liberal who wants to increase the size of the state, it doesn't follow that you'd want to do it via debt instead of taxes.

And furthermore, even if you do accept a normative baseline of proportional growth, looking at percentage change is the wrong way to get at it. Percentage change always measures the president's performance relative to the accumulated debt from previous presidents -- which obviously differs from president to president, and therefore means you're not comparing apples to apples. If you really do believe in proportional growth as the correct baseline, you still have to account for some presidents deviating from your chosen baseline and thus throwing off your measurement of subsequent presidents.

Here's a simple example. Suppose President A leaves the country with $1 of debt, when it previously had $0. President B adds another dollar, leaving the country with $2 debt. President C runs wild, blowing money on booze and hookers, and leaving the country with $102 debt. President D only blows money on booze (no hookers) and leaves the country with $153 debt. Their respective percentage increases are: A - infinity, B - 100%, C - 5000%, and D - 50%. Does it make any sense to rank president D as the best because he has the lowest percentage increase? Or would it be more reasonable to say D looks good only because he followed C? And does it make sense to say A is the worst because he has an infinite percentage increase? Or would it make more sense to say he looks bad only because the previous president left the country with zero debt?

July 10, 2012 11:00 PM http://agoraphilia.blogspot.com/2012/07/partisan-statistic-alert.html?showComment=1341986405110#c4400437521153245164

Note the blog post was over a year ago, the data was from over two years ago (posted in August 2011, the data would presumably be older still). Obama's total amounts and percentages would be higher now. |