EM export surge reveals split in fortunes

Aug 12, 2014 1:00am by James Kynge

EM economies are rebounding from an export malaise that has marred their fortunes since early 2012 and rendered several of them vulnerable to the tapering of US monetary stimulus.

So, is an EM export boom now once again in prospect?

The answer, say analysts, varies sharply according to which side of a stark dichotomy each emerging market falls. Manufacturing-led exporters, particularly in Asia, are riding a wave of resurgent demand from the US and Europe. But commodity-orientated exporters in Latin America and Africa are hurting from the slow expiration of the commodity supercycle.

A sharp divergence in EM export performance

This divergence, says Neil Shearing, chief emerging markets economist at Capital Economics, is set to form a basic template for EM investors for some time. “It is less about the level of (export) growth than the shape of that growth between different emerging economies,” Shearing says.

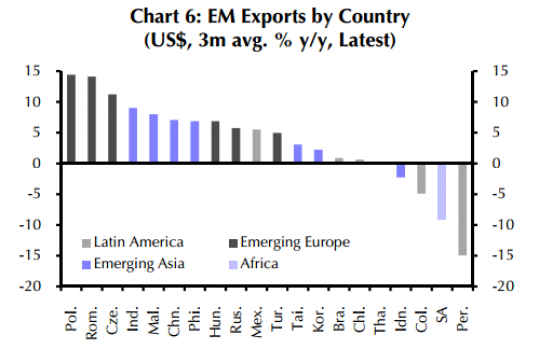

A three-month moving average of export growth from selected EM countries shows the clear division (see chart) between manufacturing-led exporters and those countries that rely on selling commodities, particularly base metals. All of the worst performers – Peru, South Africa, Colombia and Indonesia – are in the commodity-orientated category to some degree.

Source: Capital Economics Source: Capital Economics

By contrast, the best performing countries – Poland, Romania, the Czech Republic, India, Malaysia, China, Philippines, Hungary and Mexico – are to a significant extent the beneficiaries of a manufacturing export surge to Europe and the US.

A rebound, yes, but a boom is less likely

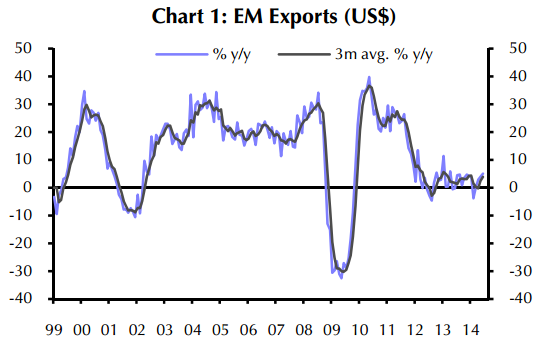

Capital Economics estimates that EM exports rose by 5 per cent year on year in June in US dollar terms, up from 3.9 per cent in May – marking the quickest growth rate since April last year.

Analysts at JP Morgan think it likely that export growth from Asia in July is likely to outpace June’s performance, given the trends visible from Purchasing Manager Index (PMI) readings in key Asian economies. “The good news from the July PMIs is that EM manufacturers appear to be lifting smartly. If the historical correlations hold, this should add to the external demand impulse for the region,” said a JP Morgan report dated August 8.

Nevertheless, it seems unlikely at this stage that EM export growth is set to snap back to pre-crisis levels of 15-20 per cent year on year (see chart).

Source: Capital Economics

There are a few reasons for this. First, the German economy is tiring, potentially hitting demand for intermediate goods from its Central and Eastern European supply base.

Economists polled by Reuters forecast German GDP growth of just 0.1 per cent between April and June, compared with 0.2 per cent in the first three months of the year. Industrial production contracted an annualised rate of 5.8 per cent in the second quarter, according to JP Morgan, which also noted a lacklustre outlook for Italy.

A longer-term constraint on EM export growth, analysts said, is the changing nature of the Chinese economy as the property market remains sluggish and fixed asset investment growth continues to slow.

The China factor is key for commodity-reliant exporters

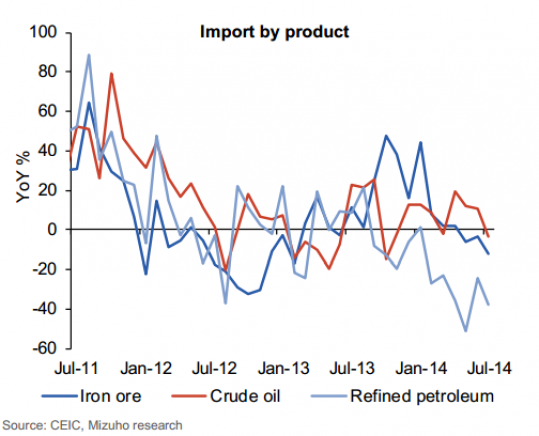

China’s trade surplus rose to a record US$47.3bn in July after exports jumped 14.5 per cent while imports fell 1.6 per cent. The weakness in imports was largely due to lacklustre demand for crude oil, refined petroleum products, iron ore and copper, imports of which fell 3.7 per cent, 38 per cent, 12.1 per cent and 15.6 per cent respectively in July (see chart).

Source: Mizuho Securities Source: Mizuho Securities

Weak demand for such commodities may persist for as long as fixed asset investment growth and the property market remains subdued. In June, newly started floor space under construction fell 16.5 per cent year on year, a slight improvement from the 18.5 per cent decline in May but nevertheless still indicative of a bear market. Land purchased by real estate developers also fell year on year, and unit sales in 42 major cities fell by 25 per cent.

“We expect imports (to China) to stay relatively weak in the months ahead,” said Shen Jianguang, economist at Mizuho Securities in Hong Kong.

Shearing agrees: “We don’t think we are going to see a big rebound in commodities exports to China, especially from Latin America. Demand from China for industrial metals is going to remain subdued.”

So, how vulnerable is EM now to US Fed tapering?

Markets grew jittery in early August partly because of speculation that the US Federal Reserve may raise interest rates earlier than previously expected as the American economy strengthens. Several analysts said that such a rate rise is now likely in the first half of 2015 – though such predictions shift regularly along with the ebb and flow of US growth.

The prospect of rising US interest rates lends extra importance to the export performance of EM countries. Rounds of investor nervousness last year and early in 2014 over the US Fed’s intentions were concentrated primarily on countries beset by large and growing current account deficits as well as hefty short term debts.

Thus, the rebound in EM export growth suggests that EM resilience to Fed tapering may be strengthening, especially in emerging Asia.

“India, in particular, looks less vulnerable than last year, having shrunk its current account deficit and raised interest rates,” said a Capital Economics report. “Thailand and Indonesia stand out as (countries that remain somewhat vulnerable in Asia).”

Latin American economies, however, also appear frail. Brazil’s economic prospects, for instance, are diminishing just as monetary tightening by the US Fed grows more likely. According to this week’s central bank survey of economists, Brazil’s GDP growth this year is likely to reach 0.81 per cent, marking the 11th consecutive week of contraction. The outlook for 2015, which had been unchanged for five weeks at 1.5 per cent, has also come down, to 1.2 per cent. |