whenever I visit China and use cash, more and more the folks look at me strange, just as in Europe when one, typically travellers, pull out a large denomination (500) as if a criminal tax cheat,

w/o WeChat / Ali payment on cellphone brookings.edu ,

difficult to navigate the subway system in China. Same w/ other public transport systems and convenience stores and and and.

Credit card? ancient technology.

am guessing that the current virus episode shall expedite cashless migration, and would stick

dress-rehearsals reveal much of what needs doing per script.

I do not like cellphone based payment systems, but may have to succumb to social norm. In HK we use an 'Octopus' card, and I keep it in the cellphone cover. It can be used to pay for all public transport, pay parking meters and tolls, by conveniences, and and and octopus.com.hk

the card can be 'charged' at all sorts of locations, and using it involves no contact w/ another person, just a tap on a sensor w/ the card encased in whatever non-metallic container

daxueconsulting.com

Payment methods in China: How China became a mobile-first nation

Daxue Consulting

Paying with your phone in China has become a daily gesture. According to a survey, 92% of people in China’s largest cities use Wechat Pay or Alipay as their main means of payment. And the phenomenon is the same in rural China: 47% of the rural population is reported to use mobile payments very regularly.

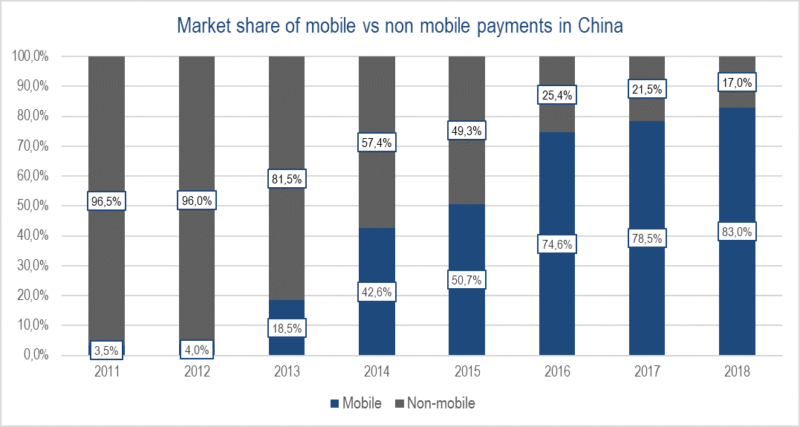

In 2018, around 83% of all payments were made via mobile payment modes.

Read the French version here

[ Mobile payment in China – Source: Walk The Chat, Ipsos, chart by Daxue Consulting]

China has developed differently in terms of payment methods: while all countries have switched from cash to credit cards and are now switching to mobile phones, China has skipped a step. The use of the credit card in China is sporadic, if not non-existent.

And even though mobile payment is overgrowing across the continent, Chinese people are using phone payments more often than their neighbors in Asia.

[Payment methods in Asia, China massively use mobile payment – Source: eMarketer, chart by Daxue Consulting]

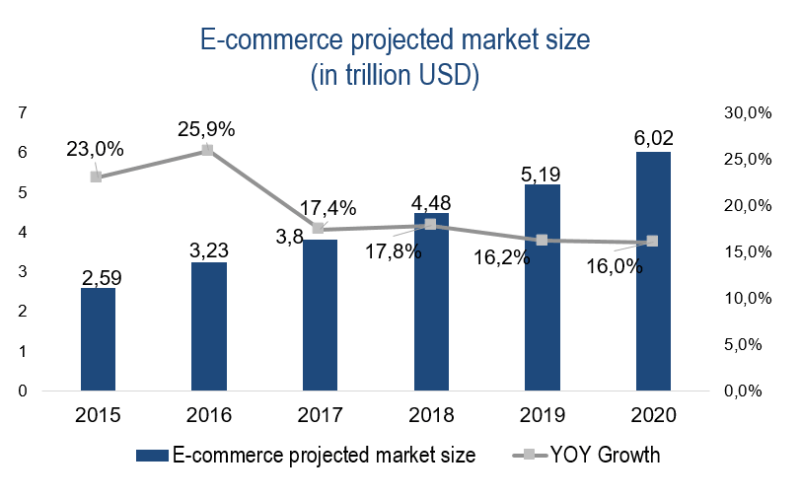

Why and how do mobile payments in China work?This increase in the use of smartphone payments in China is linked to the growth of e-commerce and m-commerce. Indeed, if the share of online sales may still seem relatively low, it is increasing very quickly.

[E-commerce and M-commerce in China – Source: Daxue Consulting]

Experts even estimate that mobile commerce in China will reach about $1.5 trillion in sales in 2019, representing a quarter of the country’s overall retail market.

Also, mobile payments have been so successful in China because they are fast and straightforward. And this speed is possible thanks to the QR codes. In China QR Codes are everywhere; even street musicians have a QR Code to collect money.

There are two ways to pay via QR Codes in China: The customer scans the seller’s QR code, which is very often printed and visible at the checkout, on restaurant tables and even on products in some stores. The customer then chooses the amount and can send the money directly to the seller.The customer shows the QR code displayed on his smartphone, and the seller scans it. This method is even simpler and faster because the customer has nothing to do; it is up to the seller to select the amount that will then be deducted from his mobile wallet.China has therefore quickly adopted mobile payment, and this is mainly because it is very easy for sellers. Unlike Apple Pay, where sellers have to buy technology to receive a payment, in China, a simple piece of paper printed with the QR code is enough.

Mobile payment methods in China in 2019

[Payment methods in Asia, China massively use mobile payment – Source: eMarketer, chart by Daxue Consulting]

Tenpay (including WeChat Pay and QQ Wallet)

Tenpay has the biggest market share by penetration rate in China, with 84,3% in 2018. Enveloped by Tencent Company, which owns the most popular social media in China, Wechat (Weixin), Tenpay has developed the most used mobile payment solution in China: WeChat Pay.

WeChat, the Chinese giant, sees 1.08 billion monthly active users in 2018 and more than 900 million users on a monthly basis. We could barely compare this to Apple Pay which has only reached 127 million monthly active users in the world.

Today Wechat pay strategy in China is to extend its services to various financial products – from investment funds to insurance, allowing users to pay for it directly within the app.

Wechat pay transaction fees of 0.1% start at withdrawals over 10,000 RMB as well as overseas transactions such as in case of cross border commerce. The app currently supports 9 currencies, against 18 for AliPay. Cross-border transactions can still be complicated, but WeChat has recently partnered with Adyen, an international payment technology company to facilitate access to China for foreign companies.

Alipay

Alipay is the only online payment system used on Taobao, which is the leading shopping website in China, owned by Alibaba.

Alipay has the second biggest market share in China with over 900 million users worldwide at the end of 2018 and 700 million active users. Many major websites use Alipay as an e-commerce payment method, such as Taobao, Amazon, JD.com and AirAsia, and other 40 million small shops and sellers in China.

Considering low trust in China’s online payment system, they introduced escrow (the payment is made by the buyer before the product is shipped and the payment is released when the product is received) and immediate payment (used to pay for hotel room bookings, flight bookings or other items that do not need to be shipped) to solve the trust issue and to expand the market.

CONTACT US NOW TO ANSWER YOUR QUESTIONS ABOUT BUSINESS IN CHINA

As a foreign company to set up on this platform, you need to pay USD 1,000. Transaction fees are 2.5 – 3.0% depending on your annual transaction volume.

For Chinese companies there is no setup fee, they need only pay 0.7-1.2% as transaction fees. You can communicate with Nanjing Marketing Group for the information on setting up your account. Alipay has arrangements with over 60 Chinese banks, Visa and Mastercard.

China Union Pay

Union Pay is the world’s largest payment card issuer with approximately 30% of cards worldwide being a China UnionPay card (CUP). China Union Pay is the only domestic bank card organization in China, linking the ATMs of 14 major banks and many smaller banks throughout mainland China. It is also an Electronic Funds Transfer at Point of Sale (EFTPOS).

With China Payment Services, international merchants do not need a physical presence in China, nor do they need a Chinese bank account.

The “push payment” principle is a different process that Westerners may not be accustomed to, whereby users are directed to their personal bank account to authorize the payment.

Many sizeable international eCommerce merchants in China are choosing to offer liberal return policies for card payments, rather than provide a Cash on Delivery option, making UnionPay card payments an excellent China online payment method for any international merchant. In 2019, Union Pay is planning to enter the European market in a move that could cause serious competition for Visa and Mastercard.

Paypal

Paypal entered into China in 2005 with services specifically designed for the Chinese population, including Chinese entrepreneurs.

But the Chinese market of mobile payment methods is very difficult to conquer for Paypal, especially against the competition. In 2017, an agreement was reached with Baidu Wallet that allows Chinese companies to have better access to the international market and vice versa. PayPal and China UnionPay have also agreed to work together.

How do consumers pay in China?Cash on Delivery (COD)Cash on delivery makes up the largest percentage of online payment methods in China. Famous websites such as Dangdang, Amazon, JD.com are conducting methods like this as one option. COD is a payment method in which it is the carrier who ensures the collection of the payment in return for part of the goods and who takes care of the return of the amount to the seller.

There are many reasons for the preference for this payment method in China. Firstly, goods can be quality assured by the receiver before payment. Secondly, if people don’t have an account for online payment (for example a senior or someone from a rural area who is not good at using a computer), they tend to choose this method. COD payment can be made by cash (uncommon) certified check or money order.

Credit Cards in China (China UnionPay cards)Online credit card usage in China is less than 5%, not as popular as in Western countries. International cards such as Visa and MasterCard are not common online payment methods due to the low-trust associated with them in China.

Debit Cards (China UnionPay cards)Debit cards are widely used by Chinese consumers for Internet purchases. The funds paid using a debit card are transferred immediately from the bearer’s account through use of a “push payment“ principle. During the online payment process, users are directed to their personal bank account where they physically log in and authorize the transaction.

Although COD makes up the most significant percentage of China online payment methods, the trend towards using debit/credit cards (China UnionPay cards) is continually increasing as more domestic and international online merchants integrate the option of online card payments on their website.

Shipping methods in ChinaMajor shipping companies in China SF Express (Shunfeng Express) ??????It has built an extensive business unit covering research and development, logistics, pickup & delivery network, etc. which spans the nation (including Hong Kong, Macau, and Taiwan). At the same time, its international network has been actively expanding to South Korea, Singapore, Malaysia, Japan, the United States, and Europe.

STO Express ??????Covering Mainland China and Hong Kong, Macau and Taiwan, this shipping company is in service 365 days all year round.

Shanghai YTO Express ??????Yto express is a large famous private shipping company in China. They have set up 4800 branches and have covered more than 1380 cities and 76 airports all over China.

TTK Express ??????They have weixin service as a method to track the package. Their business is mainly in Mainland China and Taiwan.

Yundaex ??????Their business is mainly in Mainland China and Taiwan. For international packages, they work with DHL, UPS, TNT, EMS.

EMS (Worldwide express mail service) ????EMS is one of the major shipping companies in China which owns China Postal Airlines and China Post Logistics. The company has nearly 100,000 employees and 45,000 sales outlets in more than 200 countries and regions. The company possesses the world-acclaimed brand “EMS” and the leading domestic logistics brand “CNPL.”

How can foreign businesses use new mobile payment methods to boost their business in China?Create official accounts to provide special offersThe Alipay and WeChat Pay mobile payment methods offer the possibility to set up individual marketing campaigns. They are not only payment tools, but it goes further: for example, you can attract your customers’ attention by directly offering coupons (one-time discount of product) and promotions that can be used via Wechat Pay or Alipay. These coupons can be placed in applications during critical events such as the Golden Week, Singles Day, the Chinese New Year, etc. For Wechat, it is called the WeChat Voucher solution.

You can also offer your customers a Wechat membership card which is a virtual discount card with the cumulative discount at several levels. Then, you will need to measure these actions, the ROI, to determine the impact on your business but it can attract new consumers and simplify your customer journey.

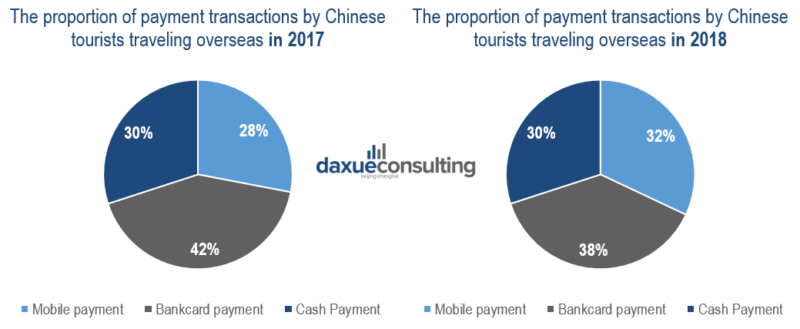

Allow mobile payments for your Chinese clients, out of ChinaAccording to a 2018 survey by Nielsen and Alipay, 91% of Chinese tourists would shop more if overseas merchants had mobile payment options. So if you want to increase your customer base of Chinese tourists, you can develop your payment options.

And that is what many countries are doing: according to Alipay statistics in 2018, the number of mobile payment transactions has increased 75 times in Russia, 12 times in Canada and eight times in Malaysia. The same phenomenon has been observed in New Zealand, Australia, and Finland.

[Mobile payments in China – Source: Nielsen 2018, chart by Daxue Consulting]

Recently, the Galeries Lafayette group in France, whose Chinese customers represent approximately 25% of its €2 billion turnovers, also chose to that implement this strategy.

After opening a store dedicated to Asian customers, the Galeries Lafayette group now accepts payments with Wechat. For the company, this is a logical step in its strategy to conquer the Chinese tourism market.

Want to know more about how you could leverage online payment platforms in China? Daxue Consulting’s Online market research service provides you with in-house service for every step of your research project and can help you to draw a comprehensive digital mapping of your sales funnels in China.

Do not hesitate to reach out our project managers at dx@daxue-consulting.com to get all answers to your questions |