RE-GE Era With Plan to Sell Bulb Business

By

Rick Clough

June 8, 2017, 2:23 PM EDT Updated on June 8, 2017, 6:29 PM EDT

Inventor’s 1879 lamp was precursor to the company’s founding

Manufacturer says it’s beginning talks with potential buyers

Thomas Edison is said to have declared that he’d make electric light so cheap that only the rich would burn candles.

More than a century later, General Electric Co., the company rooted in all things Edison, is giving up on the light-bulb business.

The industrial behemoth revealed plans Thursday to sell GE Lighting, its last remaining consumer division after a shift toward jet engines, gas turbines and other big-ticket products. GE said it’s beginning talks with potential buyers and may unload the lighting operation in pieces.

The move will help the Boston-based company “streamline its portfolio and focus on its core digital industrial assets,” according to an emailed statement. GE Chief Executive Officer Jeffrey Immelt has tilted the manufacturer toward heavy-duty equipment and developed a complementary software business in recent years while selling most lending and consumer units.

Immelt is under pressure from activist investor Trian Fund Management to improve operations after several quarters of weak earnings and a falling stock price. GE slid 0.3 percent to $27.59 at the close in New York, extending this year’s decline to 13 percent. The S&P 500 Index has gained 8.7 percent.

Low MarginsGE Lighting, based in East Cleveland, Ohio, has struggled amid government efforts to phase out incandescent bulbs in favor of more energy-efficient options including light-emitting diode technology. GE cited energy regulation in its 2010 decision to close a Winchester, Virginia, factory that was its last U.S. plant making tungsten-filament incandescent bulbs.

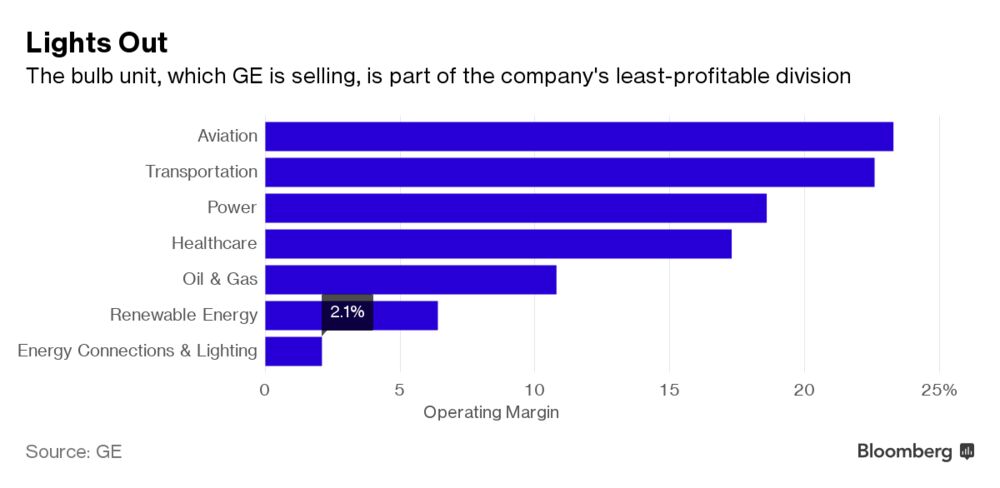

GE in 2015 separated certain energy-related operations, including commercial LEDs, into a new division called Current, while leaving GE Lighting focused on consumer LED bulbs and connected-home products. The Energy Connections & Lighting unit, which includes both GE Lighting and Current, generated a profit margin last year of 2.1 percent, the lowest of GE’s manufacturing divisions.

The company plans to retain professional lighting products and assets in Current, GE said in the statement.

Industry Shift The planned exit comes amid a broader reshuffling in the industry. Competitor Royal Philips NV last year spun off the Philips Lighting business through an initial public offering and in December agreed to sell the Lumileds lighting-components unit. Siemens AG spun off the Osram division in 2013.

The move will also push GE out of the consumer realm after the company last year sold its home-appliances operations to China’s Qingdao Haier Co. The deal allowed the buyer to continue using the GE Appliances name, so the brand hasn’t disappeared from store shelves. GE tried to sell both the appliances and lighting segments in 2008, an effort that was halted by the financial crisis.

Light bulbs have been central to GE’s identity since the company’s founding. The lighting division traces its roots to 1879, when Edison created the first commercially practical incandescent lamp. The inventor’s business interests around light bulbs and related technologies became the precursors to GE, which was formed in 1892.

bloomberg.com.

Oldie

[Breaking News] GE Lighting to Withdraw from Asia and Latin America Markets

(Author: Judy Lin, Chief Editor, LEDinside)

GE Lighting CEO Bill Lacey announced in an internal memo to employees that it will be withdrawing from Asia and Latin America Markets as of Nov. 30, 2016, reported China Association of Lighting Industry (CALI).

LEDinside confirmed from industry sources that the head of GE Lighting had sent the memo to employees.

In the memo, Lacey stated GE Lighting will be focused on securing its market position in its top three regional markets North America, Europe, Middle East regions instead.

Left: Top U.S. LED lighting brands revenue comparison in 2014-2015. Right: Top brands LED market penetration rates. (Source: LEDinside Silver Report)

The U.S. market is GE Lighting’s top revenue source contributing to 55% of its US $2.86 billion revenue in 2015, followed by Europe (25%), and other regional markets (12%), according to data compiled by LEDinside.

The company’s revenue from Asia contributes to less than 18% of revenue share, in which the China market alone contributed more than a third amounting to 8%.

Broken down by lighting application segments, most of GE Lighting’s revenue in Asia is from LED bulbs, LED tube lights sold through hardware distributuion channels comprise 48%, trailing in second is retail lighting 20%, and industrial lighting’s 13%.

GE Lighting drops less profitable and intensely competitive Asian market

According to LEDinside observations, European and U.S. LED lighting manufacturers’ products are often less price competitive than Chinese counterparts in the Asian market, making it more difficult for Western companies to clinch market shares in this price sensitive market.

In recent years, general LED lighting products profitability have been diluted by large number of Chinese competitors in the Asian market, which has driven down products end retail prices.

For instance, 40W LED bulb prices dropped 2% in China to an average sales price of US $3.4 in July 2016, compared to the global average of US $9.4 during the same period, according to data compiled by LEDinside.

Moreover, Chinese LED lighting imports tariff free status in Southeast Asia following the conclusion of ASEAN–China Free Trade Area talks in 2015, has given Chinese companies further pricing advantages in the fragmented Asian market.

GE Lighting strategy focuses on profitable smart LED lighting

Declining LED lighting product profits over recent years, due to rising market competition urged top LED manufacturers including Philips Lighting, Osram and GE Lighting to turn to more profitable lighting products and direct attention to niche lighting markets.

In the same memo, Lacey stated GE would be setting up a new innovative R&D lab to accelerate LED lighting technology and develop connected lighting products for smart homes.

Under the plan, GE Lighting intends to start testing related products, and develop a new ecosystem by collaborating with different R&D partners to develop a smart and flexible smart lighting solution.

Tumbling market demands for traditional luminaire products including incandescent bulbs, halogen, and CFL bulbs, and the phase out of incandescent in 2007 in U.S. has driven GE Lighting to focus on its more profitable LED lighting business. GE Lighting estimated LEDs will make up half of the company’s revenue in U.S. or 80% of its global revenue by 2020.

In its transition to focus on LED lighting, GE Lighting has shut six traditional bulb manufacturing plants in U.S, including incandescent and halogen bulb plants in August 2016, which is estimated to affect 640 jobs. Many of the plants were operating at below 50% of production capacity, said Alicia Gauer, senior manager of communications for the company.

In addition, tumbling traditional lighting market demands resulted in GE Lighting’s decision to withdraw from CFL sector on Feb. 2 2016.

LED lighting revenue reportedly contributed to US $886 million of GE Lighting’s US $2.86 billion revenue in 2015.

Signs of GE Lighting’s shifting focus to profitable smart lighting and integrated lighting systems can be observed in the spin-off of GE Current which integrates its LEDs, Solar, Energy Storage and Electric Vehicle businesses with its industrial strength Predix platform on October 5, 2015.

LEDinside projects the global smart LED lighting market will become the fastest growing niche lighting market from 2016 to 2020, escalating from US $2.35 billion to US $13.43 billion during this time frame.

GE Lighting’s decision to exit less profitable regional markets is largely driven by its market strategy to focus its resources on more lucrative regional markets, products, and in-line with its smart lighting product development strategies.

ledinside.com

P.S.

|