Why You Shouldn't Trade Volatility ( Savvy investors could consider shorting EFT's such as UVXY as a income generator......... BUT NOW IS NOT THE TIME TO DO THIS.... )

Apr. 1, 2017 3:32 AM ET|24 comments| Includes: IVOP, SPY, SVXY, TVIX, UVXY, VIIX, VIXY, VMAX, VMIN, VXX, XIV,

Message 30517165

Message 30516091

feeding money to the monster with the endless appetite ..........

Message 31039589

David Fabian

Summary

Trader who is buying volatility futures is losing millions of dollars.

Other investors try to mimic these same results with volatility-linked ETFs.

The odds say that most of us aren’t fast enough or shrewd enough to make these types of trades worth the risk.

One of the top stories on CNBC today is about a trader who is relentlessly buying VIX futures despite millions in realized losses. No one can seem to figure out what the purpose of this play is other than the obvious lottery ticket event of a sharp jump in volatility in the S&P 500 Index.

I would normally read this type of article with the knowledge that this is probably a one-off kamikaze trader with more money than sense. Maybe they are some massive hedge fund with a sophisticated trading algorithm or a family office that is hedging some other unforeseen risk.

The fact is that there are a lot of similar traders and investors that try to mimic these "one in a million" shots all the time. How do I know that? There is $2.6 billion in just the top five volatility-linked ETFs and ETNs alone.

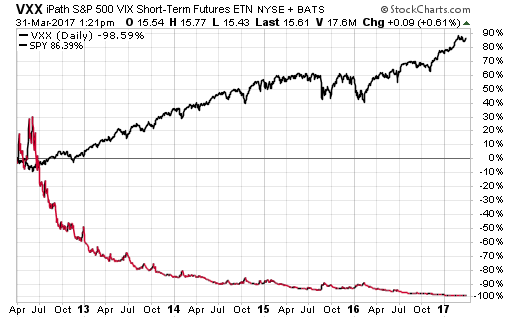

The iPath S&P 500 VIX Short-Term Futures ETN (NYSEARCA: VXX) is the largest and most well-known with $921 million under management. That doesn't count the billions in individual futures contracts, leverage, and options strategies that mimic a similar result.

The returns of VXX over the last five years are -98.58%. Barclays must continually reverse split the fund just to keep it from going to zero. Yet, strangely, it's assets always seem to hover right around a billion dollars. That means investors are continually throwing good money after bad to chase "the big one" even as time, costs, and performance work against them.

Imagine trying to time the next earthquake in California. You know it's going to come. It's virtually a guaranteed certainty. But can you stay solvent long enough to pick the exact day when it materializes? The evidence says no.

Traders with a betting mentality love to wager on fear in the hopes that a huge surge will override the natural inclination of the market to weed out this emotion. Even if the math works against them. Every now and then you can get lucky by being in the right spot at the right time to make some money on a fund like VXX. However, those events are outliers on the investment spectrum. Not the type of consistent returns that it takes to compound your wealth over time.

The best investors think in terms of probabilities that give them the best opportunities for long-term success. Betting against the market via volatility futures, short positions, bear market funds, or other negatively correlated assets have always been a losing proposition for all but the most disciplined and short-term traders.

The odds say that most of us aren't fast enough or shrewd enough to make these types of trades worth the risk.

seekingalpha.com

--------------------------

Comments 24

Add Comment

Franklin123

Comments (1829) | + Follow | Send Message

Yahhh, well, in this case the author is a tad naïve when it comes to the vol thing. Institutional investors use these products by necessity in connection with major portfolio shifts/rebalancing - it's a cost of doing business. Idiots who use them like lottery tickets are the exception - although they do exist.

01 Apr 2017, 03:38 AM Report Abuse Reply2 Like

Insider-Alerts

Comments (4106) | + Follow | Send Message

Here is one of those idiots...

seekingalpha.com

Scroll down to comments by iconstockkilledme:

"Well, the other way is to keep 50% in stocks, 50% in UVXY. When UVXY goes from my 21.30 buy, to about 40, I will sell it and then put proceeds into stocks and be 100% invested in stocks. Kind of an obvious move. UVXY could go lot higher than 40 but that's my sell point"

Comment made 4 weeks ago, when UVXY was 30% higher than today.

Can you imagine putting 50% of your portfolio into UVXY? And as a longer term position? OMG!

01 Apr 2017, 05:04 AM Report Abuse Reply1 Like

tmdoherty

Comments (1392) | + Follow | Send Message

@Franklin123,

I agree, the article is pretty naive RE the volatility trade. Nobody simply invests in VIX futures. Everbody knows the term structure is contangoed at least 90% of the time. Certainly nobody would consider a long volatility position a long-term investment, but many consider a short volatility position an investment, because the futures can and do remain contangoed for many months or even years in a row---XIV is up over 350% since the low of Feb 2016, and that tremendous run has been interrupted only once when the UK voted for Brexit. That temporarily derailed the rally, but it was a gut-wrenching pullback of over 50% that month.

So if you take short vol positions, you better have some method of getting out when the VIX starts to spike and the futures term structure becomes backwardated.

There are lots of strategies out there...Personally, I know of more than two dozen. Some have been written about here on SA, but this is not something you would ever want to devote a major part of your portfolio to unless you have no sense of prudence or you've got more money than you know what to do with.

TMD

02 Apr 2017, 01:54 AM Report Abuse Reply1 Like

Daniel Goldman, Contributor

Comments (963) | + Follow | Send Message

> Certainly nobody would consider a long volatility position a long-term investment, but many consider a short volatility position an investment...

Except that people are adding it to their portfolios.

02 Apr 2017, 09:29 AM Report Abuse Reply0 Like

fritz68

Comments (385) | + Follow | Send Message

"History shows it doesn´t pay to bet against a decline in volatility" might be a more accurate title.

01 Apr 2017, 04:32 AM Report Abuse Reply2 Like

shaxmatist1

Comments (339) | + Follow | Send Message

People buy volatility futures as a hedge to their long positions. Think of it as insurance.

01 Apr 2017, 04:34 AM Report Abuse Reply2 Like

mirkwood22

Comments (45) | + Follow | Send Message

Normally I wouldn't be too critical, but this article misses about 90% of the ways people use volatility in an overall portfolio strategy. The author only touches on going long volatility over long time period. There are disclosures and warnings plastered all over these things in the prospectus and by my broker and the talking heads on TV will even warn you about them. The author doesn't mention short volatility strategies at all which is another way of "trading volatility". I have actually been moving my portfolio towards a higher and higher percentage of volatility as opposed to stocks and bonds and it has served me very well. Granted, your average investor should not be trading these products, but to flat out say you shouldn't trade volatility and then write an article that only scratches the surface of the topic is a disservice to readers.

01 Apr 2017, 06:09 AM Report Abuse Reply4 Like

escape-from-alcatraz

Comments (308) | + Follow | Send Message

This is poor.

01 Apr 2017, 07:26 AM Report Abuse Reply1 Like

26891393

Comments (3040) | + Follow | Send Message

Through financial disappointment and pain, I have learned much about investing strategy for the past six years, including, twice, being burned trying to time the VIX. Being a novice, I will never again risk precious investment dollars in volatility. BTW, the same goes for commodities, another arena in which I shed financial blood.

Just a forecasting note....I believe there is a strong negative correlation between rising VIX and the need to reduce equity exposure. Likewise, a falling VIX or a low volatility rate, like now, suggests a favorable market environment. Just sayin'.....

01 Apr 2017, 07:59 AM Report Abuse Reply3 Like

Insider-Alerts

Comments (4106) | + Follow | Send Message

"Just a forecasting note...."

In general, very true. However, the point of all of this is to protect against and/or take advantage of a reversal...which is unlikely to be able to be well-timed. There will be the lucky few who are in the right place at the right time. As we both know, they are not investing but rather gambling.

At this stage, I am not willing to gamble. I take and graciously accept whatever the market will give me, whether that be 5% or 10% annually, or any other amount. The market is a vehicle to compound money which I have worked hard in the real world to earn. I have no intent on taking hard earned money and buying lottery tickets. That is irrational.

01 Apr 2017, 08:07 AM Report Abuse Reply1 Like

Toofuzzy

Comments (350) | + Follow | Send Message

I suggest you reverse your stately and sell more while the vix is low ( stocks high) and buy stocks when the vix is high ( stocks low ) . But I wouldn't even bother with that and just gradually trade in and out of what you own based on price, gradually sell as they go up and buy gradually as they go down. This is safest with funds ( mutual or ETF ) as they can't go to zero.

01 Apr 2017, 09:48 AM Report Abuse Reply1 Like

Daniel Goldman, Contributor

Comments (963) | + Follow | Send Message

With the low vol market, the safest way to trade volatility is to short it whenever it spikes, using something like XIV. But F1-F2 contango in the VIX is dropping, so things might be changing a bit.

01 Apr 2017, 08:56 AM Report Abuse Reply0 Like

Rand String

Comments (10) | + Follow | Send Message

Yeah, down to less than 3% now. The other part of this is that if VIX is to spike, and it is caused by geopolitical events, it could send short vol ETFs down 30% in short order given this low vol environment. So, you wait 'til the spike finishes, then buy.

01 Apr 2017, 10:13 PM Report Abuse Reply1 Like

Rand String

Comments (10) | + Follow | Send Message

Under normal circumstances, the way to trade volatility is to wait for a big spike, then short. Easy 100% YoY profits there, eh?

01 Apr 2017, 12:00 PM Report Abuse Reply0 Like

Robin Heiderscheit

Comments (3537) | + Follow | Send Message

The headline is the problem . . . the author's specific recommendation not to be long VXX is correct 95% of the time.

But yeah, the author clearly is writing about something he doesn't really understand very well.

Solid click bait though -- he got me!

01 Apr 2017, 12:37 PM Report Abuse Reply0 Like

Rand String

Comments (10) | + Follow | Send Message

I've been thinking about the debate between UVXY puts and SVXY calls, both are at-the-money, and both have the same expiration date. I believe that UVXY puts are good when you don't have confidence that there will be a crash in volatility, and are just gambling on the 2X compounding of UVXY while SVXY calls are better if you use them after a big VIX spike.

01 Apr 2017, 12:41 PM Report Abuse Reply0 Like

Patrick Chu, Contributor

Comments (45) | + Follow | Send Message

In the CNBC article that you referenced, the trader is buying call options on the VIX. However, there are signs (although not as clear) that he could be hedging the position in the VIX futures, since the net outstanding position has recently turned very short. Here's a quote from that article:

"Selling futures "would cover the carry cost of the options, while still maintaining a nice tail hedge in an upside shock to implied volatility," Weinig wrote. "The event where this investor would lose would be in a slow and modest rise in VIX. As we haven't seen this in some while, our 50c friend remains unscathed for the time being."

Since we don't know this person's whole position, we can't really call him "kamikaze". He could even have put options at a different strike prices that you're not seeing, or he's purposely putting in this trade (and hedging it elsewhere) with the purpose of confusing outside observers. We don't know. What is clear is that this guy is running a whole helluva lot more money than we are. To think that he doesn't understand how volatility trades work, or that we know more than him, would be a mistake.

01 Apr 2017, 02:22 PM Report Abuse Reply3 Like

Silent Trader, Contributor

Comments (812) | + Follow | Send Message

"The odds say that most of us aren't fast enough or shrewd enough to make these types of trades worth the risk."

Maybe these are the odds, it does not justify the article. It looks like a typical case of some one lacking the knowledge and understanding of the products he writes about. I agree with 'you shouldn't invest long term in long volatility'. Though even that may be justified based on correlation and pay-off characteristics if done in conjunction with another appropriate trading strategy. Contrary to what the title says, there is however nothing wrong with trading volatility, but indeed, you have to know what you're doing. The attitude of many volatility shorters nowadays, shorting is guaranteed lofty profits is just as dangerous. Loading up on a large short VXX position may (debatable) be profitable in the long run, one has to survive a price explosion that may occur overnight.

In the end it's about risk and reward. A free lunch does not exist. Rewards can be huge, but so are risks, a 50% loss over a couple of days are no exception for short volatility products. It is very well imaginable that short volatility products encounter a 100% loss (doubling VIX futures) event. If, as some shorters believe, short volatility really offers risk adjusted excess returns, over time people should pour in to profit and shift the balance to a more reasonable risk reward ratio. This all however does not change the fact that volatility products offer great opportunities for competent investors and traders.

01 Apr 2017, 03:06 PM Report Abuse Reply0 Like

Rand String

Comments (10) | + Follow | Send Message

Yes, short vol ETFs can indeed go to $0 if the S&P 500 goes down 20% within a day (as in the case of Black Monday). But, as you said, if stock markets had crashed to, say 10X forward P/E and VIX had fallen from the highest point, then, risk/reward would tilt strongly to reward.

If you were to short vol now, however, I would strongly advise against it, as there is evidence of narrowing contango and VIX is so abnormally low...

01 Apr 2017, 07:44 PM Report Abuse Reply1 Like

Daniel Goldman, Contributor

Comments (963) | + Follow | Send Message

I've seen F1-F2 go lower, but yeah, there's some funky stuff going on with volatility and related systems.

01 Apr 2017, 07:47 PM Report Abuse Reply0 Like

Silent Trader, Contributor

Comments (812) | + Follow | Send Message

"Yes, short vol ETFs can indeed go to $0 if the S&P 500 goes down 20% within a day (as in the case of Black Monday)."

I don't think such a drama is needed. I think that with Brexit it was very close too but most of the action was outside regular US trading hours.

"But, as you said, if stock markets had crashed to, say 10X forward P/E and VIX had fallen from the highest point, then, risk/reward would tilt strongly to reward."

Correct, but contrary to what many vol shorter claim, there is no guarantee. The term structure can remain in backwardation for quite some time. And VIX may have fallen back, it just means it has room again for another spike. Volatility tends to come in clusters and a couple of spikes in proximity is not rare. But then, after a collapse from the market the market is full of great opportunities for those that have the funds and guts to enter the market. Volatility products are in that respect not really different from other trades.

I agree that the volatility products provide great opportunity, but it's far from risk free. Maybe risk reward is shifted a little into the direction of reward as the products are complex, often misunderstood and relatively new so the market efficiency is possibly not yet maxed out. Market efficiency is further impacted by the fact that vol products are often considered insurance and consequently price sensitivity may be relatively low.

01 Apr 2017, 09:32 PM Report Abuse Reply1 Like

Rand String

Comments (10) | + Follow | Send Message

This, along with the strong rally in the S&P 500 since the election, is why I don't want to be in stocks. You see, since it went to 2400 a month ago, it stagnated and fell...and indeed, Wall Street believes that S&P 500 earnings can go to $131/share in 2017 and uses that to justify SPX 2400, but then, in 2016, it was only $108/share. So, somehow, they think that tax cuts will really make earnings go up 20% while many, many companies pay nowhere near the tax rate imposed by the IRS as they have so much offshore profits.

01 Apr 2017, 10:17 PM Report Abuse Reply0 Like

Rand String

Comments (10) | + Follow | Send Message

There is also the consideration of: "OK, stocks have collapsed, so should I buy ATM SPY calls or ATM SVXY calls"? My calculations appear as though because SVXY is many times more volatile, but the options on them are not nearly as many times expensive than SPY, therefore, SVXY calls have more potential for rewards than SPY calls given that both are at-the-money with the same expiration.

01 Apr 2017, 10:30 PM Report Abuse Reply0 Like

Alexis Tocqueville

Comments (172) | + Follow | Send Message

I concur with 'fritz68' that a more accurate title would be "why you shouldn't go long VIX futures'. I suggest people interested in volatility read "Why are Put Options so Expensive?" by Oleg Bondarenko - a great academic journal paper: bit.ly

01 Apr 2017, 11:17 PM Report Abuse

---------------------------------

A mysterious trader known as '50 Cent' is betting millions on a volatility spike — but why?

Alex Rosenberg | @AcesRose

Friday, 31 Mar 2017 | 8:06 AM ET

A pattern of huge, near-daily trades on the VIX is turning heads in the options market.

What's most notable is that even after losing some $75 million by betting on a volatility spike, the huge options buyer known as "50 Cent" shows no signs of slowing down.

"I would categorize them as someone who doesn't flinch at losing money," commented Pravit Chintawongvanich, head of risk strategy at Macro Risk Advisors, who flagged the activity in a series of research notes.

The money-losing trades in question have been purchases of call options on the CBOE volatility index. These represent bets that market volatility is set to rise, and to a lesser extent, that stocks are set to fall.

Sussing out the actions of an institutional trader based on public information about options trades can be difficult, if not impossible. But this trader made it easier by leaving a clue out in the open.

"They have a very particular pattern of buying options," Chintawongvanich explained Wednesday on CNBC's " Trading Nation." "Basically they come in every day and they buy 50,000 VIX calls worth 50 cents. So in other words, they don't care too much what the strike is; they just pick the option that's worth 50 cents."

On Thursday, for example, 50,000 of the VIX 21-strike calls expiring in May were apparently purchased at a price of 49 cents. These options will expire worthless unless the VIX skyrockets 82 percent in a bit more than a month and a half, and will lose money unless the VIX closes above 21.49 on expiration (the VIX closed Thursday trading a bit below 12).

Since the multiplier on VIX options is 100, the purchase alone comes to nearly $2.5 million. In terms of the number of contracts, it was the single biggest trade of the day on any index or stock.

And that wasn't all. Also on Thursday, 15,000 May VIX 20-calls were traded at 51 cents, and 10,000 May VIX 21-calls were traded at 47 cents.

In total, the party that has become known as "50 Cent" after its favorite purchase price has spent about $90 million, and has already seen $55 million worth of purchased options expire worthless.

Unsurprisingly, this strategy appears to have a marked effect on the overall market for VIX options. Total VIX call open interest has risen to an all-time high thanks to 50 Cent's purchases, Chintawongvanich said.

A huge share of those calls have 50 Cent's name on them.

Ironically, the huge bets on the VIX could end up dampening volatility.

"50 Cent becomes very well hedged in a risk-off event, and would be in a position to provide liquidity for those scrambling for a hedge," Chintawongvanich wrote. "The presence of '50 Cent' could mean that future volatility spikes are muted."

In fact, Jake Weinig, founding partner at options-centric hedge fund Malachite Capital, commented in an email to CNBC that "the size is probably too big"; the very enormity of the trade "almost makes it a self-fulfilling prophecy that it won't pan out."

Of course, if it does pan out, the rewards could be sweet indeed. In 2008, the VIX closed above 80 on a couple days; looking at Thursday's $2.5 million purchase alone, a close at that level on expiration day would yield a profit of about $300 million.

So is this the case of a huge hedge fund quixotically betting it all on a volatility spike in the near future?

Perhaps, but the story is almost certainly not that simple.

"We think it's highly possible that this is some kind of systematic hedge run by a larger asset manager," such as a government pension fund, Chintawongvanich said. "Even though $90 million is a lot of money to us … in percentage of their total assets, it might be a lot smaller."

He added that "the persistence and the fixation on actual costs" suggests that "someone sat down at the beginning of the year and said, 'OK, we're going to spend this much on hedging our books every day. Go out and do it, and I don't care what you do — just spend this much money.'"

Further, the options trades may simply be one part of a broader hedging strategy.

Weinig theorizes that while buying VIX calls, 50 Cent is also betting against volatility in another form, such as VIX futures — which have indeed seen their share of shorts spike recently.

Selling futures "would cover the carry cost of the options, while still maintaining a nice tail hedge in an upside shock to implied volatility," Weinig wrote. "The event where this investor would lose would be in a slow and modest rise in VIX. As we haven't seen this in some while, our 50c friend remains unscathed for the time being."

In other words, the big purchases of calls may simply be the most dramatic part of a big asset manager's comprehensive plan to cheaply protect itself from a market crisis. Or, a bit more exotically, it may represent part of a fund's outright bet on a particular sort of volatility environment.

It may be impossible to say for sure. At the same time, it's worth noting that tracking down 50 Cent's motives may provide little in the way of useful information.

"After 30 years in the business, I have seen far more money lost than made by speculation on 'other people's positions,'" Dennis Davitt, partner at Harvest Volatility Management, wrote to CNBC. "I find it is hard enough to make money just managing my own positions."

http://www.cnbc.com/2017/03/31/mysterious-trader-known-as-50-cent-bets-millions-on-volatility-spike.html

----------------------------------------

http://www.siliconinvestor.com/readmsg.aspx?msgid=30517165

| To: Davy Crockett who wrote (18046) | 3/25/2016 3:01:44 PM | | From: John P | 1 Recommendation Read Replies (1) of 18933 | | | please keep me informed regarding your UVXY ,,,, I have been watching the june vix futures contract the past few days.. was pondering going long it on Friday.

The UVXY etf appears to have an overall premium erosion component to it and I have been trying to understand the volatility ETF's better.

here is the one year UVXY

here is the two year UVXY notice the massive overall downtrend in the ETF..... which becomes starkly obvious when we look at the ETF Price since it's inception in 2012 which I will show further down.

OK here us the UXVY since it's inception in 2012......... riddle me this batman.....? (camp '60's reference from the Batman series with Adam West) what has been going on with the pricing of this instrument below.....

210,000......down to 21,25 a record low this past Tuesday March 22nd. The way it dropped so precipitously in 2012 into 2013 makes me think they had to re-calibrate the way the UVXY was comprised or valued,

However I do Agree with you very much that implied Volatility has gotten way to low the past few days read the next article that I am posting on Volatility and the UVXY and it's related products.

John |

|