Jeffrey Gundlach's Doubleline Capital - Emerging Market Debt And The Three Cs

May 25, 2016 4:26 AM ET

|

Includes: ADRE, CHN, CN, CXSE, DBEM, EDBI, EDC, EDZ, EEM, EEME, EET, EEV, EMCR, EMF, EMFT, EMLB, EMSA, EUM, EWEM, FCA, FEM, FXI, FXP, GCH, GMM, GXC, HEEM, IEMG, JFC, KEMP, KLEM, LLEM, MCHI, MSF, PGJ, ROAM, SCHE, TDF, VWO, XPP, XSOE, YANG, YAO, YINN, YXI

ValueWalk

?Follow(1,192 followers)

Contrarian

Send Message

|

ValueWalk

By VW Staff

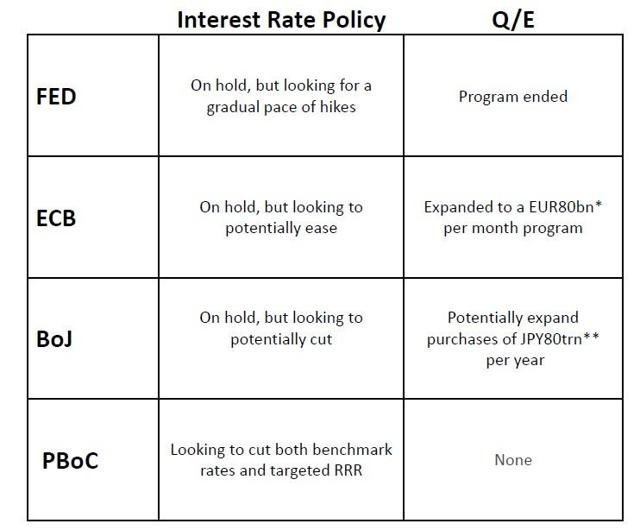

Three Cs: Central Banks

Source: DoubleLine, Bloomberg

*Approximately 92 billion U.S. dollars as of April 30, 2016, **Approximately 752 million U.S. dollars as of April 30, 2016

FED: Federal Reserve, ECB: European Central Bank, BoJ: Bank of Japan

Q/E: Quantitative Easing

EUR: Euros, JPY: Yen

PBoC: People's Bank of China

Fed Fund Futures implied probability of a June hike

Source: DoubleLine, Bloomberg, Data as of 01/02/2015 to 05/19/2016

FOMC = Federal Open Market Committee, which consists of twelve members. Probability of the Federal Reserve raising the target range for the Federal Funds rate at the June 15, 2016 meeting, as implied by Fed Fund futures

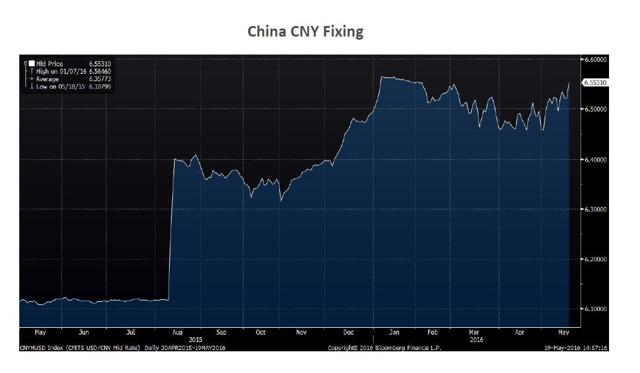

Emerging Markets - Three Cs: China

Source: DoubleLine, Bloomberg

Dates: 04/30/2015 to 05/19/2016

CNY = Chinese Yuan Renminbi

USD/CNY Mid Rate or the CNYMUSD Index is the daily CNY fixing price released by the China Foreign Exchange Trading System

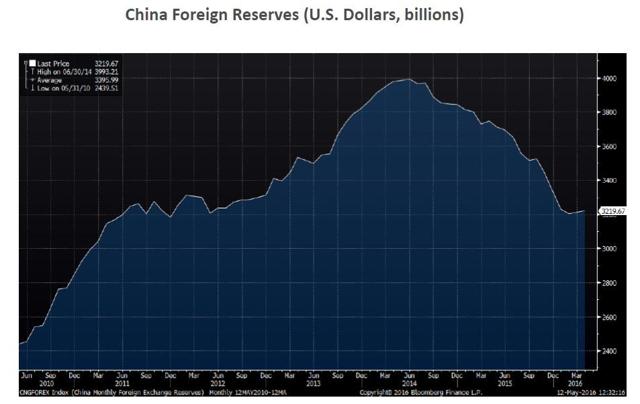

Source: DoubleLine, Bloomberg

Dates: 05/31/2010 to 04/30/2016

China Foreign Reserves or the CNGFOREX Index: This ticker calculates Foreign exchange reserves comprise securities at market value, currencies and deposits with other national central banks, BIS and IMF, such as financial derivatives.

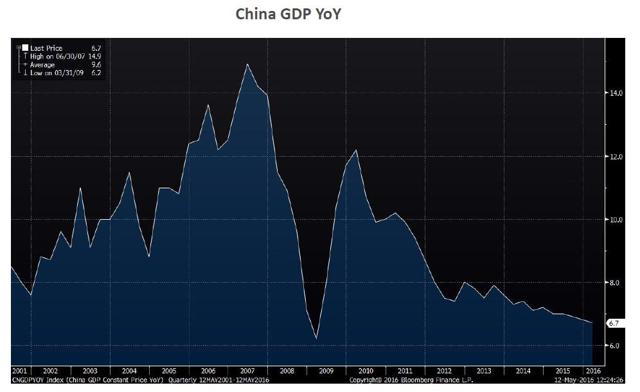

Source: DoubleLine, Bloomberg

Dates: 06/30/2001 to 03/31/2016

YoY = Year over Year

China GDP or the CNGDYOY Index is China's Gross Domestic Product

Source: DoubleLine, Bloomberg

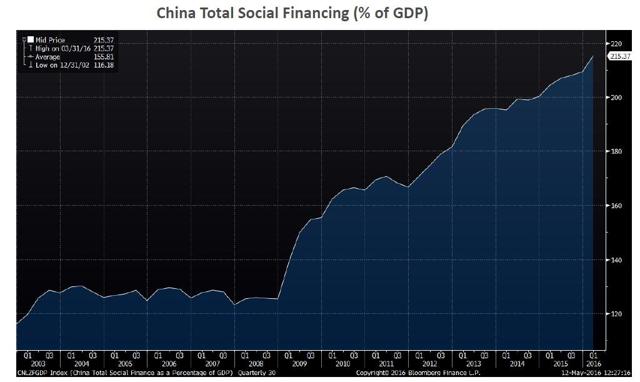

Dates: 12/31/2002 to 03/31/2016

China Total Social Financing or the CNLZFGDP Index: This ticker calculates total outstanding corporate and household borrowing in China as a percentage of GDP. To calculate outstanding corporate and household debt, it takes outstanding bank loans at end 2002 as a starting point and adds net growth in total social finance in every month since. Funds raised through equity issuance, which are included in total social finance, are netted out.

---------------------------------------------------------------

The Chinese and Japanese have managed to burn through a few trillion of USD currency reserves that they had 2 years ago.

2

CHina's currency is on the lows of the year in it's value.....and the offshore rate is expanding showing even further weakening.

3

china's FX reserves peaked in June 2014 and have been in draw down mode.

4

The official GDP number continues to trend lower.

5

The spending on social financing as a % of GDP is on a real tear and creating more on more debt at an almost parabolic fashion.

6

seekingalpha.com

impressive slide show imbedded in the above link........ |