Ten Good Pieces of Economic Data From All Around the World

There's a lot of positive news out there.

by Sid Verma

December 1, 2016 — 2:18 PM EST

It's been a big week for bullish economic data across the globe, from South Korean exports to European manufacturing figures.

The most important number of the week comes tomorrow: November's U.S. jobs report. The data is expected to highlight a robust labor market that will pave the way for the Federal Reserve to hike rates this month. According to a Bloomberg survey, employers are expected to have added 180,000 workers, compared with 161,000 in October, and the unemployment rate will hold at an eight-year low of 4.9 percent. If these predictions come to pass, it will cap off a good week for the global economy, just as President-elect Donald Trump prepares to usher in a new regime for global financial markets,

Here is a review of some of the positive data released so far:

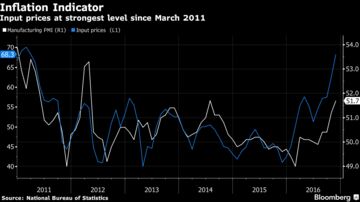

China's manufacturing purchasing managers index rose to 51.7 in November, above market expectations. The index, which is the official gauge of factory output in Asia's largest economy, matched a post-2012 high, driven by monetary and fiscal stimulus.

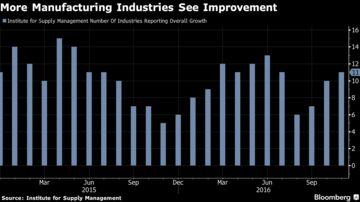

Manufacturing in the U.S. expanded in November at the fastest pace in five months, underscoring the healthy outlook for domestic consumer demand.

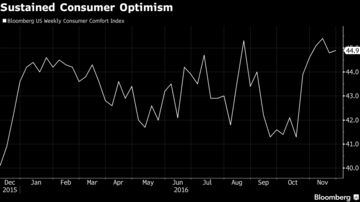

Sentiment among U.S. consumers has held close to the highest level of the year, a boon for spending prospects, according to the weekly Bloomberg Consumer Comfort Index, which ticked up very slightly in the week that ended Nov. 27, to 44.9 from 44.8 the week earlier.

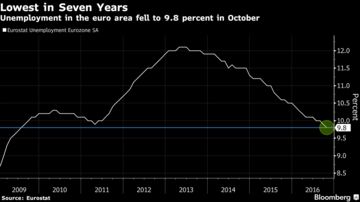

In the euro-area, joblessness fell to 9.8 percent in October from a revised 9.9 percent the month prior, the lowest level since July 2009, fueling hopes that an improving labor market in the single-currency bloc will incent consumer spending in the coming months.

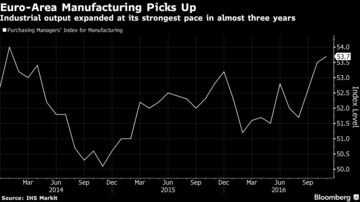

Meanwhile, industrial output in the euro-zone accelerated at its strongest pace in almost three years last month, suggesting a weaker euro is stimulating production and export volumes.

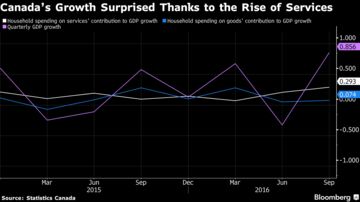

In Canada, third-quarter growth surprised to the upside at 3.5 percent. The best quarterly growth rate in two years was driven by household spending on services.

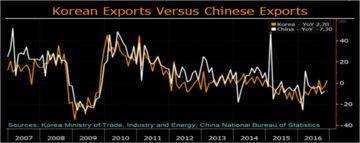

In South Korea, exports rose 2.7 percent year-on-year in November, after a 3.2 percent decline in October. That figure underscores resilient global demand and bolsters the case that external aggregate demand, a weaker yuan, and strong consumer spending in the U.S. will all buoy Chinese exports in the coming months, given the correlation between Asia's integrated supply chains.

Bloomberg Intelligence

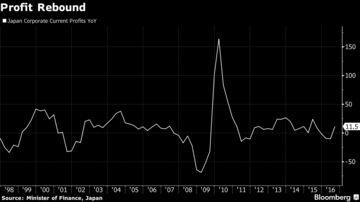

In Japan, corporate profits have rebounded by over 11 percent year-on-year, underscoring "a broad pattern around the world (U.S., China, other countries as well) that has seen the 'earnings recession' driven by higher dollar and lower oil/commodities start to roll off without an economic recession," according to a note by Bespoke Investment Group.

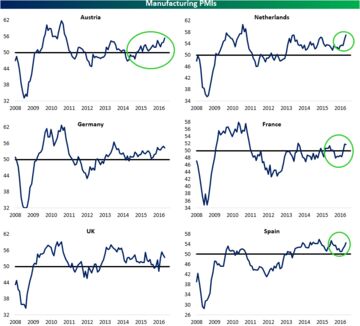

What's more, soft manufacturing data this week highlighted a broad-based positive story. As Bespoke points out, PMI readings by IHS Markit for Austria, the Netherlands, and Russia are both at the highest levels since the financial crisis. Meanwhile, purchasing managers indexes for Spain, Italy, France, and Germany are slowly, though, unevenly improving

Bespoke Investment Group, IHS Markit

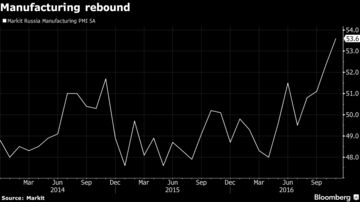

That's good news for Russia, where manufacturing has staged a contraction of 1 percent in the first 10 months of the year, according to Bloomberg Intelligence, citing the national statistics agency. However, a rebound may be nigh: In the third quarter, the manufacturing PMI rose above the 50 threshold for the first time since 2014, and the latest seasonally-adjusted reading stands at a healthy 53.6, suggesting improving prospects for industrial production and the corporate cycle, more generally.

(editorial note: Yes there is a caveat of economic numbers being rear view oriented numbers of where we have been... In the US we actually had increased topline revenue growth this Quarter for the first time in something like 8 Quarters, and the US bond market is absolutely telling us something, as a the explosive moves in commodities such as copper, the milk and meats markets are picking up in price; The Trump administration does have a window to pull back regulatory overreach by the government and to streamline the tax code, I believe that Paul Ryan has some very detailed fiscal and tax policies that he has had over 4 years to develop and it would be inspiring for the US as a country to see pro growth policies put into place...

One additional aspect that does not seem to get enough intellectual discussion, the world has many questions and conflicting information regarding carbon emissions and global warming.

In the treaties that have been created regarding developed countries and are targets do not sufficiently address the almost 3 Billion people and the key countries of China, India, Brazil, Indonesia and a few others that are growing their pollution output at near exponential rates over the past 20 years.... global solutions that ignore this reality strike me as discussions that are lacking a certain intellectual gravitas and honesty.....JJP)

JJP)

|