the Heisenberg, much respect to him for going through the Deusche bank files and amplifying our understanding of the freaky high leverage that's been brought into the Chinese Bond market.

once again plunged headlong into the China story over the past several days and after scanning a few headlines on the terminal this morning, I feel compelled to document what amounts to the real-time unraveling of the world's most important emerging market.

A while back, a senior executive in Shenzhen-listed Sealand Securities' bond department named Zhang Yang went rogue. According to reports, Zhang forged the company seal on a proxy holding arrangement with multiple financial institutions. In essence, the arrangement amounts to a repo agreement whereby the lenders (the financial institutions) buy bonds on behalf of the borrower (in this case Zhang) in exchange for a fee. If the price of the bonds rises over the course of the deal the borrower profits. If the price of the underlying falls, well, the borrower loses money.

"Sealand said in a stock exchange filing last week that it had not authorized Mr. Zhang and another employee to sign bond financing contracts on its behalf and that the company seal used on the documents was fake," FT reports, adding that "trading in Sealand's shares has been halted since Thursday pending an internal investigation into the incident."

As you may or may not be aware, China's bond market stumbled last Thursday following the Fed's hawkish outlook on the trajectory of future rate hikes. Between a more aggressive FOMC, reports of continual capital outflows, and the PBoC's efforts to curb speculation by effectively extending the tenor on central bank liquidity ops, yields on 10Y Chinese govies spiked a record 22bps prompting Beijing to halt trading in some futures contracts.

The Sealand debacle didn't help matters.

Now, Mr. Zhang has apparently left the country (probably a good move) and Sealand has indicated that it will (begrudgingly) honor the "forged" contracts. Here's Reuters:

Reports of brokerage Sealand Securities' default on a bond transaction with a bank couldn't have come at a worse time, sowing distrust and wariness in a market that was already stressed. Sealand, which is being investigated by the securities regulator, said on Wednesday it will take responsibility for what it called forged bond agreements.

As bond futures collapsed and banks stopped lending to non-banking firms in the wake of the Sealand news last week, financial magazine Caixin reported the People's Bank of China (PBOC) had directed banks to resume lending.

Zhou Li, President at bond-focused asset manager Rationalstone Investment, worries that unless the Sealand episode is handled properly, the default could "trigger panic, and a breakdown of trust between institutions".

And here's a bit more via Bloomberg:

Company will fulfill the contract obligations even they were stamped with a forged seal in the interest of social responsibility, according to a statement to Shenzhen stock exchange.

Company will pursue responsibility of individuals who forged the seal: statement

Co. is discussing detailed plan with institutions involved in forged seal issue, according to a statement to Shenzhen stock exchange.

Shares to remain halted due to uncertainties of the matter

Meanwhile, as Bloomberg goes on to note, "Chinese regulators are investigating some financial institutions' entrusted bond holdings after [the] incident."

Now as you might have surmised, this is just a microcosm of a system that is pushing the limit when it comes to absurd financial engineering. Let's take a closer look at how Chinese investors can get leveraged exposure to the bond market. Here's Deutsche Bank:

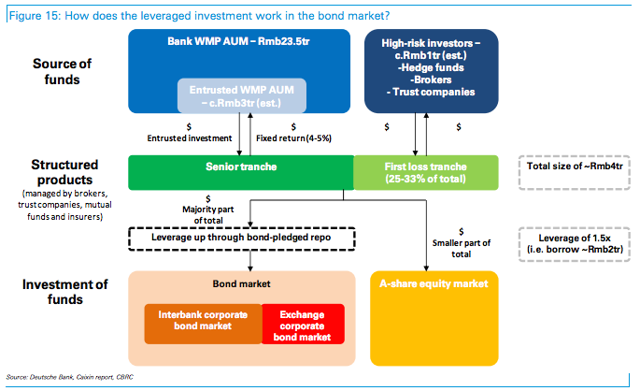

Entrusted investment of banks' WMP funds. Who provide the funds? Commercial banks entrust a certain part of their WMP AUM to third-party asset managers to invest in the senior tranche of the structured products with a fixed return of 4-4.5%. In general, small banks, especially city and rural commercial banks, are more exposed than large banks to such entrusted investments, due to their weak asset management capabilities.

The third-party asset managers include brokers, trust companies, insurance companies and mutual funds.

The funds are mainly invested in the bond market, not only corporate bonds but also government or quasi-government bonds.

Based on [a] Caixin report, these structured products involve an average leverage of 4x, i.e., the total product size is four times that of the investment from equity tranche investors.

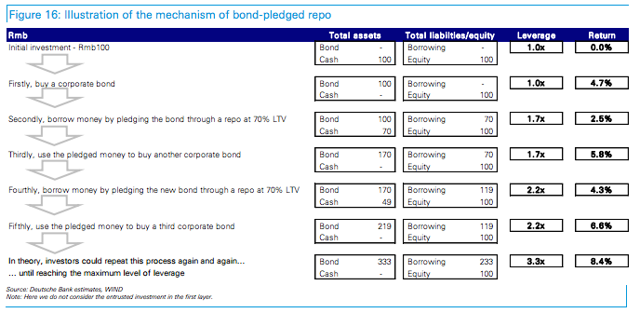

In both the interbank and the exchange bond markets, investors are able to borrow money by pledging their bond positions to counterparts and invest in additional bonds. We illustrate the mechanism of bond-pledged repo in the diagram below. An investor with an initial investment of Rmb100 in theory could lever up its assets by 3.3x times to Rmb300. In contrast to a return of 4.7% in the absence of leverage, the full levered investment could boost the return to 8.4%.

And here's a look at the entire structure:

(Chart: Deutsche Bank)

So how bad would things have to get to wipe out the leveraged investors? Well bad, but not too bad and that's, well, bad. Here's Deutsche Bank again:

We estimate equity tranche positions would be completely wiped out if the corporate bond value dropped by 14% in a base case with 6x overall leverage (first layer: 4x and second layer 1.5x). 14% bond value decline would equivalent to 300bps widening in YTM assuming five-year average duration, which looks remote under current market conditions. However, high leverage in bond investment could trigger a sell-off right after a bond re-rating due to default.

We think the leverage in the bond market exacerbates the liquidity and credit risks, as corrections in bond prices are increasingly likely to trigger further sell-offs by investors and lead to a downward spiral.

See, this is the kind of thing that makes people worry about China. And remember, this is just one of many loose screws. I'd put it in context for you but frankly, it's almost impossible to put anything into context when it comes to the Chinese financial system due to the opacity of the myriad transactions institutions have used to skirt restrictions and flout official efforts to curtail speculative excess.

On Wednesday, Reuters reported that at least one state bank is using reverse repos to inject liquidity into fund management firms:

At least one Chinese state lender provided liquidity support worth several billion yuan to fund management firms via short-term lending tools on Wednesday, two sources with knowledge of the matter said.

The sources, who declined to be named because of the sensitivity of the issue, told Reuters the lender injected the funds via bond repurchase agreements, in a move that signals easier access to funding by non-bank financial institutions such as fund houses and brokerages.

The injection, which comes on the same day Sealand Securities Co promised to honor a problematic bond transaction agreement, in effect avoiding default in a high-profile bond scandal, helped ease fears of a liquidity squeeze in the financial system and boosted bond prices.

Zhou Hao, economist at Commerzbank, said China's market liquidity conditions improved somewhat as Sealand Securities avoided defaults with its counter-parties, but cautioned that "the risk of bond deleveraging won't disappear immediately."

No, it won't. And furthermore, I'm not exactly sure this is the proper time for banks to be loaning out cash against collateral that's in the midst of a rather epic rout (of course one imagines this was probably not a "choice" the bank made, but rather the product of a directive handed down from the Politburo).

At the end of the day, we're witnessing the early stages of an unwind that many observers believe will eventually mushroom into something akin to the collapse of China's equity bubble. It has all the same ingredients.

"We should raise our alert system to the level as high as during the equity market rescue campaign last year, and promptly enact our crisis management plan to fight the currency and financial wars," Wang Hongyuan, co-chairman of First Seafront Fund Management Co told Reuters via email.

Echoing those sentiments is the aforementioned Zhou Li who said the following: "I'm worried that the bond market has witnessed just the first wave of sell-offs."

So you can see that no matter what you might hear from the soothsayers (and given the China-driven sell-offs we saw in January of this year and in August of 2015 I'm frankly not sure how anyone is still in denial about the ripple effects of Chinese meltdowns), there are some very worried people out there.

And with good reason. Markets need a Chinese bond market collapse........ like we need a 10th shot at the end of St Patricks day

JP |