More background on Masayoshi Son: -- he is the CEO of Japan's Softbank, SoftBank is the Japanese company who Saudi Deputy Crown Prince Mohammed bin Salman gave $100 Billion dollars of Saudi Arabia's Sovereign wealth fund to Invest primarily in American next generation technology companies, that are working on machine learning, Artificial Intelligence, Autonomous driving, advances in Medical technology and medicines, P E Unicorns such as UBER, Solar technologies and more efficient powerful batteries etc.

---------------------------------------------

As the dot.com bubble burst, he reportedly lost $70 billion in one day. He admits that 99% of his net worth was wiped out in 2000

The 'crazy' Japanese billionaire who met Donald Trump has a 300-year plan

by Sherisse Pham @Sherisse

CNN Money

December 7, 2016: 10:52 AM ET

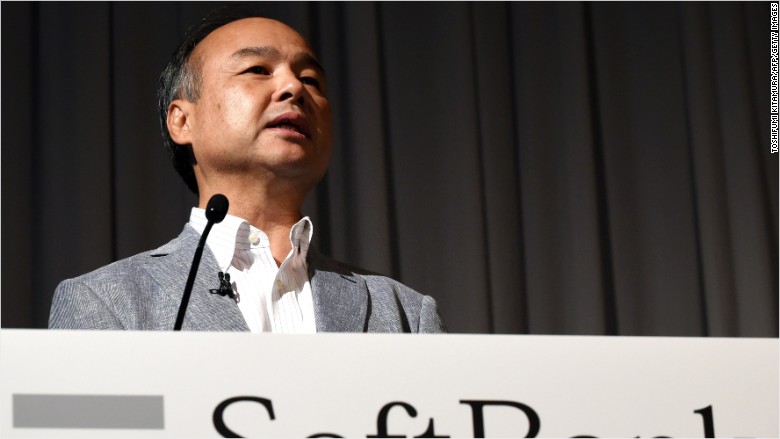

Masayoshi Son is not a household name in America. Yet. But the billionaire founder and CEO of Japan's SoftBank ( SFTBF) loves to make a splash and is rapidly gaining a global profile thanks to a series of big deals.

He met with Donald Trump in New York on Tuesday, after which the president-elect tweeted that "Masa" had agreed to invest $50 billion in the U.S. Son said he would pump the money into startups.

Son is obsessed with the future. During an earnings call last month, he said he wanted to be tech's Warren Buffett, and he has a 300-year plan for SoftBank ( SFTBF). Yes, 300 years.

(editorial observation by JJP: if a blizzard of almost 1000 developing cryptocurrencies, which are taking your hard earned Dollars, Yen, Euro's, Swiss Francs, GBP, AUD, CAD..... your gold, silver and platinum and letting you use them to "Invest in an ENDLESS AND INFINITE OCEAN OF CRYPTOCURRENCIES is not setting alarm bells off in any investors heads that they might just be a few 20 Trillion or so dollars of

Quantitative easing and very cheap and Oceanic Liquidity out there in the world..... maybe the idea

that there are this generation's Go-Go builders ---- movers and shakers, coming up with 300 YEAR PLAN's

when the SINGULARITY is going to be here in 30!!!!! and people have the HUBRIS to be speaking of 300

year plans...... Yup it's 1719. 1999...... 2008...... i honestly don't know what it is....and possibly DJT's

ability to eliminate Excess Regulation and free the US to really compete agressively in the global market place remains to be seen.... It does seem as if It's the point in the story where we have to haul

out the vintage line by Richard Dreyfuss in the Movie "Jaws"...... YOU ARE GOING TO NEED A BIGGER BOAT......... JJP )

He wants his company to help break down language barriers and allow people to communicate telepathically.

It may seem odd that a billionaire who wants to make silent communication a reality, just met with a billionaire known for loudly expressing his views at massive rallies. But not for Son.

He has a track record of meeting directly with world leaders to talk business. Last week, he chatted with Prime Minister Narendra Modi about SoftBank's $10 billion investment in India's technology sector.

In September, he called on President Park Geun-hye to talk about investing in South Korea.

Despite his ability to open doors, he hasn't always had things easy in the U.S. SoftBank paid more than $20 billion to take control of Sprint ( S) in 2012, but regulators blocked his attempt to merge the struggling mobile carrier with T-Mobile ( TMUS) in 2014.

After Tuesday's meeting, Son said he decided to back American startups because Trump had made deregulation part of his platform.

Son invented a pocket translator when he was 20. He sold it to Sharp Corporation for $1 million.

Tuesday's announcement wasn't the first deal Son has struck after a huge political shift. SoftBank bought Britain's ARM Holdings in a record $32 billion deal less than a month after the U.K. voted to leave the European Union.

" Brexit did not effect my decision," Son told reporters at the time. "I was waiting to have the cash on hand."

Early investor in Yahoo and Alibaba

But the timing of the deal meant Softbank bought a prized asset on the cheap, when the pound was down more than 27% against the yen.

SoftBank has invested in some highly-valued tech startups across the world. Among them: personal finance firm SoFi and Uber competitors Ola in India, Grab in southeast Asia and Didi Chuxing in China, according to PitchBook.

Son was one of the earliest investors in Yahoo ( YHOO, Tech30), from which he made a fortune. He also got in early on Chinese e-commerce giant Alibaba ( BABA, Tech30), taking a 32% stake in the company.

Dot.com bust nearly wiped him out

SoftBank recently took a hit from its Sprint acquisition. But Son has lost big before. As the dot.com bubble burst, he reportedly lost $70 billion in one day. He admits that 99% of his net worth was wiped out in 2000.

His latest big venture is a $100 billion fund launched by SoftBank and the government of Saudi Arabia in October. "Life's too short" to do anything small, Son said recently in India.

An avid Tweeter

Like Trump, Son has a huge following on Twitter, and has used it to post thought provoking questions.

In 2010, Son asked his Twitter followers: "What would be the saddest thing in your life?" The most common answers were death, loneliness and despair, according to SoftBank.

In response, the company added a lofty goal to its corporate philosophy: ensuring no one is left alone. SoftBank partnered with Foxconn to make Pepper, a robot pal that learns to love people.

Son also wants to build computers that invent machines to help raise life expectancy to 200 years.

Ethnically Korean, Son was born in Kyusu, Japan. He went to college in the U.S., graduating from the University of California at Berkeley in 1980 with a degree in economics. When he was 20, he invented a pocket translator he sold to Sharp Corporation for $1 million.

Son founded SoftBank in Japan in 1981 with two part-time workers and a small office. Today, he's worth $18.7 billion, according to Forbes.

When the 59-year-old dies -- a few years from now or when he's 200 -- he has said he wants to be remembered as "a crazy guy who bet on the future."

CNNMoney (Hong Kong) First published December 7, 2016: 8:03 AM ET

money.cnn.com

--------------------------------------

SoftBank and Saudi Arabia Team Up for $100 Billion Tech Fund

Partnership combines deep pockets with one of the world’s most ambitious tech investors

A man exits a SoftBank Group Corp. store in Tokyo. The internet and telecommunications conglomerate is launching a fund to invest in the technology sector. PHOTO: BLOOMBERG NEWS

By Alexander Martin in Tokyo, Alec Macfarlane in Hong Kong and Margherita Stancati in Dubai

Biography

@margheritamvs

margherita.stancati@wsj.com

Updated Oct. 14, 2016 6:32 a.m. ET

Japanese internet and telecommunications giant SoftBank Group Corp. 9984 +0.26% is teaming up with a Saudi sovereign-wealth fund to create a multibillion-dollar technology-investment fund, in a partnership that combines deep pockets with one of the world’s most ambitious tech investors.

SoftBank, led by chief executive Masayoshi Son, is known for its bold and wide-ranging bets, ranging from Chinese e-commerce giant Alibaba Group Holding Ltd. and U.S. mobile carrier Sprint Corp . to U.K. chip designer ARM Holdings PLC, which it bought last month for $32 billion. On Friday, it announced plans to invest at least $25 billion over the next five years through a fund dubbed the SoftBank Vision Fund.

Saudi Arabia’s Public Investment Fund may contribute an additional $45 billion over the next five years as the fund’s lead partner, SoftBank said. SoftBank said in a statement that the company was in talks with “a few large global investors” who could eventually push the new fund up to $100 billion to become the world’s “biggest investor” in technology over the next decade.

The ambitious plan lands as tech investors continue to plow record amounts of money into firms like Uber Technologies Inc., the world’s most valuable startup at $68 billion, despite soaring valuations that have led many to worry that the sector is overheating.

SoftBank has also been stepping up its deal pace, pouring more than $45 billion into technology investments alongside co-investors over the past two years and putting its overseas investment operations into a separate unit earlier this year. Recent investments include participation in a $4.5 billion fundraising round for Chinese ride-hailing champion Didi Chuxing Technology Co. and $1 billion into South Korea’s largest mobile commerce company Coupang.

To help bulk up its war chest, SoftBank has cashed in some winning bets, selling $10 billion of stock in Alibaba, in which it has a 28% stake, and unloading Finnish mobile game-maker Supercell Oy for $8.6 billion. But it has also borrowed heavily to finance many of its investments and its debt currently has a junk rating.

The addition of the Public Investment Fund boosts SoftBank’s investment firepower. The fund is central to Saudi Arabia’s plan to diversify its economy beyond oil. The plunge in crude prices since 2014 has hurt the finances of the kingdom, which depends on oil income for more than two-thirds of government revenue. Last year, Saudi Arabia’s budget deficit was a record $98 billion, or 16% of gross domestic product.

The Saudi government is expanding the scope and size of the PIF, effectively turning it into a war chest for non-oil investments abroad. In June, it invested $3.5 billion in Uber, its largest overseas bet. Riyadh plans to transfer ownership of state-owned oil giant Saudi Arabian Oil Co., or Aramco, to the fund, which Saudi Deputy Crown Prince Mohammed bin Salman estimated will eventually be worth nearly $3 trillion.

“The PIF is preparing for the twilight of the oil,” said John Sfakianakis, a Riyadh-based economist with the Gulf Research Center. “They are looking for another success story like Alibaba.”

SoftBank said its head of strategic finance, Rajeev Misra, will head the new fund, and that it has engaged former Deutsche banker Nizar Al-Bassam and ex-Goldman partner Dalinc Ariburnu for the project.

Investment PivotSoftBank has been shifting investments to the tech sector from telecommunications.

Value of investments

Top three acquisitions

*Year-to-date

Source: Dealogic

SoftBank, established in 1981 by Mr. Son, has a long history of investing in technology and telecommunications ventures. SoftBank was one of the earliest investors in Yahoo Corp. , a bet that proved hugely successful and which the company largely cashed out of by the early 2000s. SoftBank first invested in Alibaba in 2000, when it put $20 million into the then tiny e-commerce company. Since then, Alibaba has become China’s biggest internet shopping mall worth $249 billion, making it Mr. Son’s most successful bet.

During the past few years, Mr. Son has tried to give more order to SoftBank’s investment operations, separating its overseas investments including Sprint from its domestic mobile businesses and putting it under the leadership of former Google executive Nikesh Arora. Mr. Arora abruptly stepped down in June after facing a barrage of criticism from investors.

After Mr. Arora’s departure, Mr. Son has said he intends to invest in fields including smart robots, the “Internet of Things” and artificial intelligence—areas he has said would be a focus for his company over the next 30 years.

Mr. Son has pledged big bucks elsewhere too. Last year, SoftBank formed a joint venture with India’s Bharti Enterprises and Taiwan’s Foxconn Technology Group to invest about $20 billion in renewable energy in India, although it is unclear how far the project has advanced since its inception. Mr. Son has also said he wants to invest as much as $10 billion in Indian tech companies and around $4.5 billion in South Korea’s technology sector over the next decade.

Write to Alexander Martin at alexander.martin@wsj.com, Alec Macfarlane at Alec.Macfarlane@wsj.com and Margherita Stancati at margherita.stancati@wsj.com

Appeared in the October 14, 2016, print edition as 'SoftBank Plans Technology Fund.'

wsj.com

-------------------------------------------------------------------------------------------------------------------

(editorial comment by JJP.... the $100 Billion Dollars that the young Saudi King or minister of Finance .... (The entire country of Saudi Arbia is looking to Modernize rapidly as witnessed by them finally giving the right to female Saudi's to drive today for the first time in history shows how they are playing catch up with a more Western society sensibility. The Sovereign Wealth Fund of Saudi Arabia has been very actively deployed especially the $100 billion dollars they gave to Softbank to invest on their behalf..

They have sunk major 5 Billion dollar chunks into companies such as NVDA, and a number of other top tier US best of breed tech stocks this past year..... it has been an interesting episode to watch unfold. JJP)

-----------------------------------------------------------------------------

Nvidia: Why The Selling?

Sep. 27, 2017 2:40 PM ET|59 comments| About: NVIDIA Corporation (NVDA)

Andrew McElroy

Calling tops in a bull market is generally seen as a mug's game. It certainly hasn't worked with Nvidia ( NVDA) over the last few years. Or at least, it's been a lot easier and profitable to just buy and hold.

But there's a misconception that shorts have been steamrolled and consistently lost money on NVDA. That's simply not true as my articles in Juneand August hopefully demonstrate.

Traders such as myself who can't bring themselves to invest for the long term at these prices can still make money playing both sides.

And although shorts have been hard work, I think things could get a lot easier.

Drivers of a declineFundamentally Nvidia looks in great shape. It leads the way in high-end GPU and GPGPUs. Earnings are fantastic. There is huge potential for growth. How could it ever fall?

Well clearly after a 680% gain since the start of 2016, much of the fundamental positives are already priced in. The PE ratio has jumped from just over 20 to 48. Nvidia has a lot to live up to.

And while the company is likely to continue doing very well, there are some possible catalysts for why it may find it hard to live up to the lofty expectations.

Competition from Advance Micro Devices (NASDAQ: AMD) could weigh on the gaming revenue. The data center business could also come under pressure from competition. Perhaps the Bitcoin ( COIN) bubble bursts and causes headwinds.

However, the eventual catalyst for a drop is probably one few people are talking about now. In fact, it could be completely unrelated to Nvidia the company. Nvidia moves in line with the broader market and related sectors such as Technology ( XLK). Here is a how a beta adjusted portfolio of long NVDA versus long XLK looks.

Software developed by Arbitrage Trader

The middle left chart clearly shows the portfolios move in line; NVDA is in red, XLK in blue. The correlation over the last 150 days is as high as 0.94. NVDA is essentially a leveraged position on XLK.

So while you may feel a warm glow looking at Nvidia's current balance sheet, a market correction will cause a drop around three times a large in the stock. And that is regardless of earnings, growth or any stock specific catalyst.

In other words, if there are signs of selling and a top, it may be related to macro factors. And a warning could come from other high flying tech stocks such as Apple ( AAPL), Amazon ( AMZN), Alphabet (NASDAQ: GOOG) ( GOOGL), and Tesla ( TSLA), all of which have recently reversed and possibly topped. They haven't all suddenly had bad company specific news.

One factor may be the Fed's policy of balance sheet reduction which was first properly aired in late May. While this didn't cause an immediate reaction, Tech stocks have generally struggled to rally since then. It signaled the Fed is determined to tighten financial conditions, and there are theories this is less to do with controlling inflation (consider there have been four hikes and inflation is still below the Fed's target rate) and more to do with equity bubble prevention (or even giving the Fed room to act if the bubble pops).

I think this quote from Paul Tudor Jones is apt,

"By watching [my first boss and mentor] Eli [Tullis], I learned that even though markets look their very best when they are setting new highs, that is often the best time to sell. He instilled to me the idea that, to some extent, to be a good trader, you have to be a contrarian."

Source: 25iq

The path to a topThis article isn't intended to merely point out there are risks for Nvidia longs. All stocks have risks, at all times. But the patterns on the charts are quite clearly suggesting the big money is trying to get out. I don't know exactly why yet, but no doubt it will become clear in time.

The path to a top has been playing out quite predictably. Rallies since June have struggled to hold new highs, strength has been sold, and the pullbacks are getting deeper. I posted this chart in the comments section of my August article projecting a final rally.

The projection was based on the below pattern, and ending diagonal, which is created by slowing momentum and selling at each new high.

The move to new highs came on good news as Evercore raised its price target to $250. Markets tend to top on euphoria and good news, allowing the large players to exit positions. It seems they did exactly that and prices began to fall two days later. The reversal tells us the gap higher on the 18th September was indeed an exhaustion gap.

It's interesting Intel ( INTC) topped with the same pattern at the height of the last tech bubble in 2000.

Strangely enough, Intel's PE ratio peaked at 55 in the year 2000, the exact same figure NVDA topped at earlier this year.

Sentiment, positioning and faith in the future are all comparable in these two stocks and periods. So is the Fed's hawkish stance and the concern about equity bubbles. I think this is one reversal pattern we shouldn't ignore.

ConclusionsNvidia is a great company, but is priced for perfection. There are signs the trend is reversing and the smart money is leaving. Why?

At the moment we can only speculate on the reasons. There are potential headwinds for the company, but similar reversals are happening in related stocks and it seems the catalyst is affecting the broader market. I think it relates to the Fed's concern with elevated equities and their hawkish stance. Either way, I would take note of the price action and what it tells us.

If Nvidia does manage to recover I would expect any new highs to be brief and an opportunity exit longs or short.

seekingalpha.com

----------------------------------------------------

John Pitera has sent you a SharpChart snapshot from StockCharts.com:

Comments from John Pitera:see attached

You can access the 'live' version of this chart here:

stockcharts.com

(some advanced features and settings may not be available to non-members or basic members). |